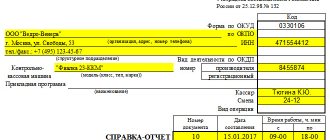

Shift closing report is a fiscal document that must be generated at the cash register when closing a shift. Based on this report, a cash receipt order is issued and an entry is made in the cash book.

It is important that the shift closure report will inform you if any checks or other fiscal documents were not transferred to the fiscal data operator (FDO) and at what time this happened. From the moment the first document is not received by the OFD, you will have up to 30 days and no more to correct the situation. If, after this period, untransferred checks remain at the cash register, the cash register will be blocked and stop working.

In addition, the shift closing report will notify you that it is time to change the fiscal drive - if there are less than 30 days left until the end of the drive's validity period or if its memory is 99% full.

Regulatory regulation of the use of online cash registers

| Federal Law of May 22, 2003 N 54-FZ | use of cash registers |

| Directive of the Bank of Russia dated March 11, 2014 N 3210-U | procedure for conducting cash transactions |

| approved Ministry of Finance of the Russian Federation 08/30/1993 N 104 | operating rules for cash registers |

| Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132 | forms of primary documentation for accounting calculations |

| Letter of the Ministry of Finance of the Russian Federation dated January 25, 2017 N 03-01-15/3482 | is not subject to mandatory use of primary forms |

Results

The Z-report is a report from cash desks equipped with ECLZ that are almost a thing of the past. The online cash register provides an analogue of this report - on the closure of a shift, the set of tasks for which has been adjusted in accordance with changes in the technical characteristics of cash registers. One of the important new functions of the shift closure report is its prompt sending to the controlling Inspectorate of the Federal Tax Service.

Sources

- https://www.cleverence.ru/articles/elektronnaya-kommertsiya/z-otchet-chto-eto-takoe-kak-vyglyadit-i-kak-snyat-po-kasse/

- https://astral.ru/articles/ofd/11958/

- https://www.cleverence.ru/articles/z-otchet-chto-eto-takoe-kak-vyglyadit-i-kak-snyat-po-kasse/

- https://spb-kassa.ru/z-%D0%BE%D1%82%D1%87%D0%B5%D1%82.html

- https://webcatcher.ru/finances/1072-xiz-otchet-chto-takoe-kak-vyglyadyat-i-chem-otlichayutsya.html

- https://nalog-nalog.ru/kkt_kkm_kassa/nuzhen_li_zotchet_pri_ispolzovanii_onlajnkassy/

- https://assistentus.ru/kassa/z-otchyot/

- https://onlinekassa.guru/zakonodatelstvo/z-otchet.html

- https://biznes-prost.ru/otchetnost-po-onlajn-kassam-v-year-godu.html

- https://nalog-nalog.ru/kkt_kkm_kassa/kak_proizvoditsya_hranenie_chekov_kkm/

- https://online-buhuchet.ru/nuzhno-li-xranit-z-otchety-onlajn-kassy/

Z-reports of online cash register

The use of cash register systems implies the movement of cash of an organization or individual entrepreneur. The Z-report implied closing and resetting the cash register once a day, and the proceeds were handed over to the administrator (senior cashier) for further collection. Based on the Z-report, the cashier generated: a cashier’s certificate-report and a cashier-operator’s journal. These documents reflected the movement of money through the cash register for the shift and were transferred to the accounting department.

The document was displayed once a day (at the end of each shift), that is, it is necessary to prepare a report for each shift. Generating a Z-report seems to be a simple operation depending on the specific cash register.

However, there were the following restrictions:

- on weekends there was no need to reset the cash register

- on weekdays, in the absence of cash transactions, the Z-report was taken with zero indicators, and cashier reports were also compiled on its basis.

Z-reports, which were supposed to be stored for 5 years, lost their essence when using an online cash register.

Important! After switching to an online cash register, organizations and individual entrepreneurs received the right to abandon the document flow of old cash registers or retain it. And these old documents that are optional for use can be filled out in any form.

What is a z-report

Z-report ( “Z-report” , also known as a cancellation report ) is the final cash receipt, which must be printed within 24 hours. It means completing the cash register shift, handing over the proceeds and resetting the cash register RAM. All data from the previous moment of cancellation remains in the fiscal memory of the cash register and on the EKLZ tape.

FOR YOUR INFORMATION! In the cash register there is a control tape (EKLZ - “electronic control tape protected”), on which all indicators from the meters are recorded. In cases where information on reports is lost for some reason, EKLZ is the only way to restore it.

From this document you can track:

- money counter data at the beginning and end of the shift;

- the total amount of proceeds until cancellation;

- the amount of refunds, if any;

- the amount of discounts provided;

- amount for canceled checks.

Cash documents used in online cash registers

When using an online cash register, the machines must be equipped with fiscal drives, which are an analogue of a secure electronic control tape (ECT), but the essence of an online cash register is that all information on transactions performed is encrypted and cannot be corrected. And one of the documents stored in the financial storage is the shift closing report (a modern analogue of the Z-report). Based on this document, you can also generate cashier reports (upon delivery). But the online cash register itself sends all the required reports to the Federal Tax Service.

It is allowed to capitalize the proceeds the next day after the fiscal report is issued, for example, when the operating hours of the company (from 12.00 to 24.00) and the administration (from 10.00 to 19.00) do not coincide.

Expert of the Legal Consulting Service GARANT, professional accountant

I. Bashkirova

How to store acquiring checks: legal norms and bank requirements

In this article we will look at how to properly store acquiring receipts. Let's find out what slip checks are needed for and how long they need to be stored, according to the law. We have prepared step-by-step instructions for you on how to transfer checks to the bank and have collected recommendations on how to properly store slips.

Is a check required for acquiring?

Disputes about whether a fiscal receipt is needed when paying online, as well as whether it is necessary to save it, have been going on since 2003.

At this time, Law No. 54-FZ was adopted, which defines the use of cash registers (KKM) when paying for goods or services with a bank card or cash.

But this act did not take into account the improvement of technology and the emergence of the possibility of online payment. Until July 2021, this law could be interpreted as follows:

Today this opinion is not correct. Federal Law No. 290, issued on July 3, 2021, clearly states that a fiscal document is required for any payment method, including:

- sale of goods and services;

- payment of winnings from lottery tickets;

- electronic payments (for example, to a mobile phone account or for housing and communal services through the application);

- receiving paid content (applications, games, books, software, etc.);

- and others.

Therefore, the answer to the question of whether checks are needed for acquiring is clear: yes, they are needed. However, they must be stored for a certain period of time. Let's look at how long you need to save receipts in 2018.

How long to store acquiring checks

All documents that fall into the category of primary cash registers must be retained by law for 5 years. This rule was approved by Decree of the Government of the Russian Federation No. 470 of June 23, 2007.

However, the law provides an exception for copies of sales receipts and used cash receipts. The storage period for these two documents is 10 days. The storage of acquiring receipts and other similar documents is carried out by the financially responsible person. At the same time, Z-reports from cash registers (including from POS terminals) refer to primary documents, the shelf life of which is 5 years.

As a rule, the acquiring agreement provides for a period of storage of checks and other documents confirming the fact of a transaction or expenses. It is equal to three years. In this case, checks (slips) are transferred to the bank no later than within three days from the date of receipt of the request from the bank.

Now let’s look at why and how to store receipts.

Why do you need to save receipts?

First of all, the presence of saved receipts is due to the need for the enterprise itself:

- To avoid a fine from the tax office (for example, if a Z-report is lost) and for correct accounting (different sections of the cash register are allocated for cash and non-cash payments, which avoids double taxation).

- To resolve disputes with clients.

- For a refund.

- In some cases, to check the payment status.

In addition to these cases, the bank with which the acquiring agreement is concluded has the right to demand that all slips for a certain period or a specific date be sent to its office. If checks are stored correctly, providing the required information will take less time than the three days established by the contract.

Let's figure out how to properly store acquiring receipts. Modern cash registers print receipts, usually on thermal tape. The data printed on such a tape fades completely over time. No special storage conditions can affect this process. But receipts from acquiring companies must be kept for a certain period of time. But how to do this if in a few months all the information disappears?

There is no need to file receipts (slips) with any cash register documents. It is optimal to put them in a certain place, for convenience, separating them with bookmarks by day or month. A low box or lid from a package of photocopier paper is suitable for these purposes.

The question arises: what to do with unclaimed checks? Slips that have expired are either stored in an archive or disposed of.

Transfer of slip checks to the bank

Reconciliation of results from the POS terminal occurs daily. All information on completed transactions goes to the acquiring bank. Evidence of this is the closing report on the terminal. However, sometimes the bank sends a request to provide a slip check and clarify the details of the operation. This is done in many cases, in particular, to prevent fraudulent activities on the part of buyers.

In order to correctly provide the bank with all the necessary information, please read the step-by-step instructions:

| No. | Algorithm of actions |

| 1. | Receiving a request from a bank to provide slip(s) for a certain period. |

| 2. | It is necessary to find checks for the period indicated by the bank. |

| 3. | Slip checks (+ their certified photocopies, if the checks have faded) and the explanations required by the bank are described, i.e., an inventory of documents is compiled. |

| 4. | Documents are packaged in a package or folder. The description is attached to the package. |

| 5. | The documents are sent to the bank by courier (yours or from the bank). You can take the package yourself to the bank office. |

| 6. | A note is placed on the inventory indicating that the documents were accepted by the responsible person (bank employee or courier). |

(1

Source: https://rko-bank.ru/stati/hranenie-chekov-po-ekvajringu.html

Documents filled out based on the shift closing report

Based on the Z-report, the following documents were filled out:

- KM-4

- KM-6

With the start of using online cash registers, the obligation to maintain these documents has been abolished, so organizations and individual entrepreneurs make decisions at their own discretion about maintaining these documents.

Order of the Ministry of Finance of the Russian Federation dated October 17, 2011 N 132n approved the administrative regulations on control by the Federal Tax Service, which reflects documents that may be requested for verification and although the regulations reflect that the required documents depend on the period being checked, they may be requested as part of the documents being checked :

- cashier-operator logs

- certificates and reports from the cashier-operator.

Thus, the optionality of maintaining these documents leads to the fact that it is still advisable to draw them up or refer to the Letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413.

And it's all about him!

What is a Z report?

A Z-report or Daily report with cancellation is a fiscal document that closes a cash register shift, records the accumulated total of broken amounts in the fiscal memory and resets the revenue counter for the shift to zero.

Is it necessary to make a Z-report if there were no sales during a shift?

If we turn to the legislative position, then in accordance with officially valid documents, receiving daily Z-reports, regardless of whether there was revenue or not, is the responsibility of the cashier-operator. The captured Z-report is the basis for entries in the cashier-operator’s journal. This is referred to by the “Instructions for the use and completion of forms of primary accounting documentation for the accounting of cash settlements with the population when carrying out trade operations using cash registers”, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 and “Model rules for the operation of cash registers” machines when making cash payments to the population.”

It is clear that these documents were created at a time when electromechanical cash registers were used, where there were no built-in electronic clocks and fiscal memory. The date on these counters was translated manually, otherwise the date on the check would be incorrect. This is where the requirement for mandatory daily withdrawal of reports originates, regardless of the presence or absence of revenue, and, consequently, the obligation to fill out the cashier-operator’s journal on a daily basis based on Z-reports. The Ministry of Finance of the Russian Federation of June 11, 2009, No. 03-01-15/6-31, adheres to a similar opinion.

Today, these instructions are already outdated from both a moral and technical point of view. And not all cash register models technically have the ability to produce full Z-reports with zero revenue.

In this case, you can go the following ways when preparing the cashier-operator’s journal:

1. We break down the pennies and take out the daily report with cancellation, fill out the cashier-operator’s journal with all the values, as required by the “Model Rules”. The instructions, as they say, are old, but have not been canceled by anyone. And this option will definitely not cause any complaints from tax inspectors.

2. We issue a written order for the enterprise that, due to the specifics of the cash register, which does not take out a daily report with cancellation in the absence of sales, the line “there was no revenue” is written in the cashier-operator’s journal without entering any figures. You can also request a technical opinion from the service center about the specifics of the functioning of your cash register. They can, of course, find fault with the “wrong” keeping of the cash register. But there are no fines for incorrectly maintaining this journal, unless, of course, this affected the posting of revenue and, accordingly, the payment of taxes.

3. In our opinion, the most reasonable approach in today’s realities to the question of whether or not to remove a Z-report in the absence of sales is to issue an internal order for the enterprise that a shift at the cash register opens at the first revenue of the day. Then, you will not have to enter “empty” information into the journal. Again, they may point out the inconsistency of filling out the journal with current standards, but this has nothing to do with the fact that the proceeds were not received, which means there is nothing to fine you for.

If you have a cash register, in which the shift opens automatically when the power is turned on, or a fiscal recorder, where the shift is forced to be opened by the cash register program, then in this case, even if there was no revenue, you will have to withdraw a zero Z-report. Otherwise, after 24 hours, the cash register will generate an error and require you to close the shift. This means that you will have a “zero” Z-report in your hands and you will be required to enter it into the cashier-operator’s journal so that all line entries of the Z-reports are in ascending order without missing their numbers.

Where to store Z-reports?

The practice of storing Z-reports in organizations is very diverse. It is attached to the cashier-operator’s journal, pasted into a notebook, and stored in an envelope. No standard specifically regulates where exactly they should be stored. Therefore, it makes sense to turn to the general requirements for storing primary documents established in section 6 of the “Regulations on Documents and Document Flow”, approved by the USSR Ministry of Finance on July 29, 1983 No. 105.

It is necessary to take into account that on the basis of the Z-report, the cashier-operator’s certificate-report (form KM-6) about the revenue for the shift is filled out, i.e., in fact, the daily report with cancellation is an appendix to this certificate. Therefore, we recommend that these two documents be sealed.

How long should Z-reports be stored?

The storage period for the Z-report, as well as any document related to cash discipline, is established in clause 11 of the “Regulations on the use of cash register machines when making cash settlements with the population” dated July 30, 1993 No. 745 and is no less than 5 years. Responsibility for storing documents rests with the head of the organization. And officials of the Ministry of Finance are adamant on this issue, even if you have several dozen stores and it is expensive to store such a huge volume of paper.

But they also approved the “Standard Rules for the Operation of Cash Registers,” where in clause 6.4. it is written in black and white that “used control tapes are stored in packaged or sealed form in the accounting department of the enterprise for 15 days after the results of the last inventory have been carried out and signed.”

The organization must conduct an inventory of property regularly. Mandatory inventories - before drawing up annual financial statements and planned inventories, the frequency of which is established by the enterprise itself. In trade organizations, as a rule, at least once a month, or at most once a quarter. The inventory results are approved by the head of the enterprise. This means that the storage period of Z-reports can be reduced.

A very important point that must be taken into account is the property of the paper itself on which the Z-report is printed. Modern cash registers using the thermal printing method use heat-sensitive paper, which has a number of storage conditions:

— avoid exposure to sunlight and contact with chemicals;

- do not store images facing each other;

- do not store in plastic bags;

— do not use liquid-based glue for gluing;

- do not hold the paper under pressure.

Depending on the manufacturer and quality of thermal paper, the contrast of information can last up to 5 years. But situations are not uncommon when the details printed on a document fade and the reflected information becomes unreadable. Therefore, auditors recommend making copies of Z-reports certified by the manager with the original Z-report attached.

Using an experimental method, the result was obtained: by heating a faded receipt from the reverse side with a hot hairdryer or lighter, you can obtain a clearly readable negative. The main thing here is not to overdo it and not to burn the document, thereby losing it forever =).

From all of the above, it follows that an enterprise can either preserve Z-reports for all five years, or limit their lifespan to the results of the next inventory. In the latter case, the opinion of the inspectors may not coincide. What threatens the enterprise?

Is it really that scary to lose your Z report?

During the audit, tax inspectors request documents confirming cash settlements with buyers and ask for Z-reports. In case of their absence, they try to prosecute the organization for tax offenses under Art. 120 of the Tax Code for the lack of primary documents and under Art. 126 of the Tax Code for failure to provide information necessary for tax control.

In order to figure out whether the Z-report is a primary document, let us turn to the List of unified forms, approved by Resolutions of the State Statistics Committee of December 25, 1998 N 132 and of August 18, 1998 N 88. There is no Z-report there. Only the cashier-operator's journal has been approved as a form of primary documentation for cash transactions.

Also, a document is primary if it is drawn up in a form from an album of unified forms or contains mandatory details (clause 2 of Article 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”). In the Z-report, as we know, the signature details of the responsible person are not provided.

That is, if there is no reason to classify the Z-report as primary documents, then there is no corpus delicti of a tax offense provided for in Art. 120 NK.

According to Article 126 of the Tax Code, organizations can be held accountable for “failure to submit to the tax authorities documents and (or) other information provided for by the Code and other acts of legislation on taxes and fees.” The fine for this violation is fifty rubles for each document. But here, too, an argument can be made in defense - clause 11 of the “Regulations on the use of cash register machines” No. 745 provides for the use of control tapes and their storage, but this document has nothing to do with the legislation on taxes and fees. And the current legislation on taxes and fees does not establish the taxpayer’s obligation to submit cash register tapes and Z-reports. This means that for the application of liability measures provided for in Art. 126 of the Tax Code, tax inspectors have no legal basis. There is arbitration practice in which judges adhere to precisely this position.

But if it is quite controversial to hold the legal entity itself accountable, then it will be quite possible to punish the manager, since it is he who is responsible for storing accounting documents. A fine may be imposed on an official under Art. 19.4 for disobedience to a lawful order of an official of a body exercising state supervision from 2000 to 4000 rubles, or under Art. 19.7 or 15.6 of the Administrative Code for failure to provide information from 300 to 500 rubles.

At the same time, the statute of limitations for bringing to administrative responsibility is 2 months from the date of its commission.

What to do if the Z-report is lost?

If you lose your Z-report, it is better to immediately document the absence of the document. To do this, write an explanatory note in any form addressed to the head of the organization, in which you indicate the reasons that led to the loss of the Z-report, put a date and signature. The manager must confirm such a statement and indicate the measures taken.

Since all modern cash registers are equipped with an electronic control security tape (ECLZ), it is necessary to obtain a report on the closure of a shift with the help of a central service specialist, which will contain the date, number of the closed shift and the total revenue. This data will confirm your entries in the cashier-operator's book.

What to do if the Z-report was not taken on time?

A Z-report must be taken at the end of each shift. It is on its basis that a certificate-report is drawn up in the KM-6 form, revenue is submitted according to the cash receipt order, and an entry is made in the cashier-operator’s journal precisely on the date indicated on the reports themselves. An untimely Z-report is a violation of cash discipline. Since there is a discrepancy between the data of fiscal reports and the date of receipt of funds. And upon inspection, this may entail penalties: a fine can be imposed either on the enterprise itself from 40,000 to 50,000 rubles, or on an official from 4,000 to 5,000 rubles. (according to Article 15.1 of the Administrative Code).

Fines can be avoided if tax inspectors do not come to you with an inspection within 2 months from the date of the offense, because according to Art. 4.5 of the Code of Administrative Offences, a penalty cannot be imposed after this period.

If, after all, time did not work in your favor, then you can try to prove that the discrepancy between the data of fiscal reports and the data in the cashier-operator’s journal does not mean that cash was not received at the cash desk. The cashier-operator's journal is a control and registration document of cash machine counter readings. All accounting of transactions carried out at the cash desk of the enterprise is reflected in the cash book. This is provided for by the “Procedure for conducting cash transactions in the Russian Federation”. Keeping a cashier-operator's journal is not provided for by this Procedure and, therefore, it has nothing to do with the process of posting money to the cash register! So, differences with the data from the cashier-operator’s journal cannot indicate that the company did not capitalize the cash proceeds received from customers.

What should I do if the receipt tape breaks during the Z-report?

If the tape simply runs out, then you need to insert a new one and the report will be printed. It is allowed to glue two parts of the Z-report. There is no need to draw up any supporting documents.

If it was not possible to finish printing the Z-report due to a break in the receipt tape, then it is necessary to draw up an explanatory note in free form describing the situation and confirm it with the signature of the manager. A report for the shift must be taken from the EKLZ block and, based on the data received, an entry must be made in the cashier-operator’s journal. A ribbon break during printing may indicate a possible malfunction of the cash register. Therefore, we recommend calling a service center specialist.

What should I do if the date on the Z-report is incorrect?

Software glitches that sometimes occur at the checkout (for example, during a power surge) can cause the date on the cash register to be lost. And this incident is often not immediately noticed. In this case, it must be taken into account that the Z-report is a criterion for any cash register reporting. And the date of this fiscal document will be perceived as correct. Therefore, any explanations here will help little. In such a situation, it makes more sense to “adjust” the accounting to the date of the Z-report, i.e., make changes to the cashier-operator’s journal, redo the KM-6 certificate-report and the KM-7 summary certificate-report. Naturally, taking into account the cash register limit (here the accounting department also has ways not to break it).

If within 2 months they do not come to you with an inspection, then the statute of limitations for the offense expires.

How many Z-reports can you run?

It is mandatory to take one Z-report per cash register.

Firstly, the technical requirements for fiscal memory state that the duration of a work shift at a cash register should not exceed 24 hours.

Secondly, in paragraph 6.1. The “Model Rules” stipulate that upon completion of work, the cashier must prepare cash receipts and other payment documents and draw up a cash report.

The time and procedure for closing a shift is determined by the internal order of the manager, taking into account the labor specifics of the work and the accounting policy of the enterprise. There are no restrictions in the legislation on the number of Z-reports taken per shift, since Art. 15.1. The Code of Administrative Offenses provides for liability for violations directly named therein, and there is no such violation as repeated withdrawal of a Z-report. Therefore, you set the number of cancellations per day yourself.

To remove financial responsibility from a cashier who has completed a shift of revenue, you can establish a mechanism for transferring cash receipts in the organization either by closing the shift with the removal of a Z-report and drawing up KM-6, or by using a regular X-report and securing it with an order from the manager.

CONCLUSION

The rules for document flow of cash documents must be reflected in the accounting policies of the organization. Also, it makes sense to issue an order for the enterprise “On the loss of cash documents and their restoration,” which prescribes the actions of employees in the event of loss of documents.

These actions will help you either avoid the threat of a fine altogether, or limit yourself to its very minimum amount.

It is possible that the presence of EKLZ in cash registers and the possible receipt from it, upon request, of data by document number, shift, period, will lead to the fact that paper cash documents will become a thing of the past. Still, storing such an electronic analogue is much safer and not so burdensome.

But for now it is better, of course, not to allow such violations and to save your strength and nerves in defending your rights in court, but to organize the procedure for storing and recording cash documents in such a way as to avoid their loss or damage.

Technical Service Center "Shtrikh Elite Service"

Tel.

mailto: [email protected]

Information reflected in the shift closing report

Order of the Federal Tax Service of Russia dated March 21, 2017 N ММВ-7-20/ [email protected] defines the main details that must be indicated in all documents received from the online cash register. Reports can be customized by the software support company that is contracted as the fiscal data operator. This report can be used to organize the organization’s internal document flow if this is reflected in the organization’s local acts.

Letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 canceled cash documents, except for the cash book, if the organization does not intend to use them in accordance with the law, this must be indicated in local acts.

How to withdraw a Z-report at the end of the day

There is a certain set of details that must be reflected in this kind of check, withdrawn after a specific shift. Such a list is established by law; the specifics are contained in the order of the tax authority dated March 21, 2017.

This is the name of a legal entity; it is permissible to provide the owner’s data in some forms of enterprises, address and TIN, as well as information about the employee carrying out the act of removing the document with cancellation. The check itself must contain the number, the number of transactions, the amount of funds accepted, the cash balance at the opening and closing, details of the equipment itself, and the number of discounts taken into account. If there have been returns, they will also be processed. The full date when the procedure was performed is also indicated.

The formation is automatic; the employee does not have to enter any information manually. It is enough to carry out a manipulation consisting of a certain sequence of pressing keys/buttons on the equipment model. Which ones exactly depend on the type of device and manufacturer. There are different options. It is recommended that you read the instructions for use in the attached instructions.

Remember that if the withdrawal was not processed within 24 hours, then this is an automatic violation of current legislation. It will not remain without consequences in any case.

What to do after removal

The received check must be submitted in strict form. It is sent directly to the application or the operator’s certificate, and is recorded in the log with a set of related data. These include the date, the total amount of funds before the opening and after the closing of the shift, specific records of expenses and income.

The further path depends on the specific scheme provided at the enterprise. The algorithm may change; there are no strict rules in this regard. The documentation goes to the shift supervisor, goes to the accounting department, is handed over to a manager or administrator, and even into the hands of the head of a branch or the entire company.

The main aspect is that information must be stored for at least five years from the date of receipt. And it is better to strictly observe this aspect; verification may reveal discrepancies.

To avoid fines and sanctions from the Federal Tax Service, and in addition, to simplify the reporting of this area to a minimum, it is most logical to use modern software techniques. The best of them are provided by the Cleverence project, because it:

- I have prepared boxed packages and am ready to provide individually developed systems for personal requirements.

- Focuses on mobile reporting management to simplify the task of control and implementation. An employee with a smartphone is enough to regulate the procedures.

- He knows Russian legislation very well, prepares applications based on current and even future regulations that are at the stage of adoption or approval.

Example of Regulations regarding cash register documents

The procedure for generating and storing documents: (click to expand)

- The documents provided for by Bank of Russia Directive No. 3210-U dated March 11, 2014 are drawn up on paper using a computer and signed in person by the cashier.

- Cash documents must be drawn up by the cashier or a person in accordance with a separate order of the manager.

- Documents are generated on the day the cash transaction is carried out and filed in chronological order.

- Cash register documents must be stored in the accounting department for 5 (five) years from January 1 of the year in which they are issued. The chief accountant is responsible for their safety.

Where and how much to store

The section of the document flow regulations of the Ministry of Finance indicates whether it is necessary to store Z reports of the online cash register - yes, it must be stored in the institution. The reporting is attached to the KM-6 certificate or placed in a separate notebook or envelope.

Clause 11 of the regulations on the use of cash register No. 745 dated July 30, 1993 stipulates how long Z cash register report should be kept - at least 5 years, like all other primary cash register documents. Responsibility for storage lies with the manager or employee appointed by order of the organization.

Filling out the cash book

The cash book (form N KO-4) is approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88.

KO-4 reflects receipts and issues of cash at the cash desk. The procedure for maintaining information indicated in the cash book by hand:

- The cash book must be numbered, laced and sealed on the last page, and also certified with the signatures of the chief accountant and manager.

- Each page of the cash book is represented by two tables carrying the same information and numbered with the same number (the first copies are filed in the cash book, and the second copies are torn off at the end of the day).

- Entries begin with the balance at the beginning of the day. The sheet along the cutting line must be folded, and to keep identical records they are made through carbon paper.

Daily control

“Zetka” is a document of strict financial reporting.

It must be removed after a shift or working day, but at least once every 24 hours. If this is not done, the cash register will be blocked. All cash registers, as required by law, are equipped with an automatic locking system when a 24-hour shift is exceeded. Until the Z-report is removed, the cash desk will not be able to perform any operations.

What if there were no operations?

The SFSU letter dated February 10, 2015 clarified that zero reports do not need to be printed if not a single cash transaction has been completed within 24 hours. However, often internal documents of an enterprise require opening and closing a shift, regardless of the passage through the cash register. In addition, in practice, small money is most often stored in the machine, and this is also finance that must be carried out daily through the cash register (“service deposit”), and this is an operation that will be reflected in the Z-report.

Until legislators have clarified this issue completely, it is better to print the Z-report daily and register it in the cash book, even if it is zero, to avoid troubles.

Cash discipline when using an online cash register

For organizations and individual entrepreneurs, Rules for working with cash registers are formed regarding the movement of funds, their storage and work with cash registers in general.

The order sets a balance limit for organizations, the rest is handed over to the bank (if there is no order, then the limit = 0), the individual entrepreneur can store cash in as much as necessary. Exceeding the limit is allowed on paydays, weekends and holidays.

For cash payments to organizations and individual entrepreneurs, a limit of 100,000 rubles is established; there are no restrictions for individuals.

When introducing online cash registers, the use of forms No. KM-4 and No. KM-6 is not necessary.

What to do if you forgot to take a report

Despite the fact that when using online cash registers, cashiers are not forced to keep journals and take Z-reports, the obligation to hand over the proceeds remains. It is necessary to generate a shift closure document for:

- Monitoring the work of the cashier.

- Quick revenue assessment.

- Transferring the proceeds to collectors.

- Report to the tax authority.

There are many examples from life when cashiers forgot to withdraw a check for closing a shift at the end of the day or did it late. From practice it follows that the tax inspectorate is not biased towards such a violation of discipline if the incident happens once. If violations are repeated systematically, penalties will be imposed.

Important! If the cashier-operator forgot to withdraw the report at the end of the day, he is obliged to draw up a report and an explanatory note.

Documents are kept in case of an audit . Reports on the closure of the shift, generated for the next day, are attached to the cash book.

Responsibility for violating the rules for working with cash register systems

The punishment is regulated by the Code of Administrative Offenses based on the severity of the violation.

| Type of violation | For officials | For legal entities and individual entrepreneurs |

| Calculations and accumulation in excess of established limits | 4000 – 5000 rub. | 40,000 – 50,000 rub. |

| Not using CCP at work | from 1/4 to 1/2 of the settlement amount, from 10,000 rubles. | from 3/4 to 1 size of the settlement amount, from 30,000 rubles. |

| For systematic violation | disqualification from 1 to 2 years | suspension of activities up to 90 days |

| For using a cash register that does not meet the requirements or failure to provide information and documents at the request of the Federal Tax Service | warning or fine from 1500 to 3000 rubles. | warning or fine from 5,000 to 10,000 rubles. |

| For failure to provide a paper or electronic check upon request of the client | warning or fine of 2000 rubles. | warning or administrative fine of 10,000 rubles. |

The Federal Tax Service can check cash discipline without restrictions. The Federal Tax Service creates an inspection plan designed for internal use. Inspections occur no more than once a year, also when a complaint is received and if there have been violations previously, as well as when working with a loss.

Sanctions and fines for violations of the Z-report

Violations of Z-reporting identified by a tax audit are fraught with serious fines for the organization’s management.

The absence of one or more “points” is a violation of Article 19.7 of the Code of Administrative Offenses of the Russian Federation, since in fact this is a failure to provide representatives of government bodies with the information they require.

For this, officials can be fined in the amount of 300 to 500 rubles, and legal entities - tenfold.

If tax authorities consider that unfiled Z-reports constitute disobedience to the requirements of the supervisory authority (Article 19.4 of the Code of Administrative Offenses of the Russian Federation), then a fine can be issued in the amount of 1,000 to 2,000 rubles.

Answers to common questions

Question No. 1: How are shift closure reports stored? (click to expand)

Answer : The fiscal drive of the online cash register provides for the storage of reports on the closure of a shift for a period of 30 calendar days in an uncorrected form.

Question #2 : Will a receipt received by email be legal when returning an item?

Answer : A cash register receipt in electronic form has equal validity as one printed at the online cash register; the information specified in the receipt must be reliable. Thus, a refund is made based on the electronic receipt.

dtpstory.ru

It is called a shift closure report and, essentially, just like the Z-report, it is tied to a time period of 24 hours. The presence of such a restriction follows from the prohibition on the possibility of generating cash register receipts (or BSO) after the expiration of this number of hours from the moment of generating another report - on the opening of a shift (clause.

We recommend reading: Contracts for waste removal individual entrepreneurs

2 tbsp. 4.2 of the Law “On the Application of CCP…” dated May 22, 2003 No. 54-FZ). Federal Law No. 54-FZ dated May 22, 2003, upon completion of settlements using cash register systems (at the end of the day or shift), a shift closure report is generated. In essence, this is a Z-report, which, when using online cash registers, is automatically transmitted to the Federal Tax Service.

With appropriate automation, this information is reflected in the accounting system of the organization and individual entrepreneurs using cash register systems.

The shift closing report, containing summary information about the settlement amounts indicated on cash register receipts (CSR) and correction cash receipts (CSR correction), can also be printed on paper.