The buyer - a VAT payer - has the right to take advantage of the deduction of the tax presented to him on goods, works, services, property rights if the requirements prescribed in Art. 171 and 172 of the Tax Code of the Russian Federation conditions: the purchase is intended for a transaction subject to VAT and is registered, the buyer has an invoice issued accordingly.

A “late” invoice results in an adjustment to the VAT return. And its inclusion in the deductions is already “reimbursement”. What to do?

Define period

In accordance with paragraph 1 of paragraph 1 of Article 172 of the Tax Code, tax deductions provided for in Article 171 of the Tax Code are made on the basis of invoices issued by sellers when the company purchases goods (works, services), property rights, documents confirming the actual payment of tax amounts when importing goods to the territory of the Russian Federation and other territories under its jurisdiction, papers confirming the payment of VAT amounts withheld by agents.

Money can be accepted for deduction only after the products are reflected in the company’s accounting, and if the relevant primary documents are available (paragraph 2, paragraph 1, article 172 of the Tax Code of the Russian Federation). Another mandatory condition is the use of purchased goods (works, services), property rights in the activities of the organization (clause 2 of Article 171 of the Tax Code of the Russian Federation).

On a note

VAT first appeared in 1958 in France. Currently, value added tax exists in more than 100 countries around the world. However, some states have abandoned it, for example, in the USA it is absent; instead of VAT, the buyer pays, and the seller transfers sales tax to the budget.

As for the period in which these amounts can be declared for deduction, in accordance with paragraph 1.1 of Article 172 of the Tax Code, this is allowed within three years after the registration of goods (works, services), property rights acquired by the company in the territory of the Russian Federation (Letter of the Ministry of Finance dated February 12, 2015 No. 03-07-11/6141).

Based on the provisions of Article 163 of the Tax Code, the VAT tax period is equal to a quarter. For example, an organization purchased and registered goods in May 2015. Therefore, the three-year period must be counted from the moment at which the company acquired the right to apply the deduction, that is, from the next day after June 30.

Therefore, the three-year period in which a company can take advantage of the VAT deduction expires on June 30, 2021. In other words, an organization has the right to declare a deduction in one of the tax periods starting from the third quarter of 2015 and ending with the second quarter of 2018.

What does this look like in practice?

What is the procedure for an accountant if it is necessary to declare a VAT deduction in parts in different periods? Let's look at an example.

In the second quarter of 2015, Ajax LLC purchased a passenger car from Avtotrade LLC at a price of 944,000 rubles, including VAT of 144,000 rubles. The purpose of buying a car is further resale. The buyer's accountant decided to claim VAT deduction in equal installments until the end of the current year. Thus, a deduction in the amount of 48,000 rubles (1/3 of 144,000) will be declared in the II, III and IV quarters of 2015.

At the time of purchase, that is, in the second quarter of 2015, the following transactions are made:

| Wiring | Amount (RUB) | Operation description |

| Dt 08 Kt 60 | 800000 | car price excluding VAT |

| Dt 19 Kt 60 | 144000 | VAT amount |

| Dt 68 Kt 19 | 48000 | first part of VAT deduction |

In the same period, an invoice from Autotrade LLC in the amount of 48,000 rubles is registered in the Purchase Book of Ajax LLC.

In the following quarters of 2015, the accountant must repeat the last entry:

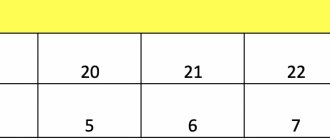

| Quarter 2015 | Wiring | Amount (RUB) | Operation description |

| III | Dt 68 Kt 19 | 48000 | second part of the VAT deduction |

| IV | Dt 68 Kt 19 | 48000 | third part of VAT deduction |

In each of these periods, you should also register an invoice from Autotrade LLC in the amount of 48,000 rubles. Thus, the invoice will appear in the Purchase Book not once indicating the full amount of VAT of 144,000 rubles, but three times for 48,000 rubles.

You can enter the second and third parts of the tax into the Purchase Book on any day of the corresponding period. For example, it is quite convenient to do this on the first day of the quarter.

By the same principle, the accountant of Ajax LLC could “split” the VAT deduction not into equal parts, but into arbitrary parts and into any number of periods within a three-year period from the moment the car was registered. Accepting the deduction in parts with “jumping” over one or more quarters also does not contradict the Tax Code. For example, if for some reason Ajax LLC had no sales operations in the fourth quarter of 2015, then it would be logical for the accountant to transfer the last part of the deduction to the first or any other quarter of 2016.

So, let’s summarize the main points of splitting the VAT deduction:

- You can claim part of the deduction in any quarter, the main thing is that the entire amount is “spent” within three years from the moment the goods are registered;

- the declared part of the deduction must correspond to an entry in the Purchase Book made in the same quarter and for the same amount;

- one invoice will be recorded in the Purchase Book several times in different quarters for an amount corresponding to the declared part of the deduction;

- when adding the partial deduction amounts, the VAT amount indicated on the invoice should be obtained.

When purchasing an OS

According to paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code, VAT amounts presented when purchasing goods (work, services) on the territory of the Russian Federation are subject to deductions if they are purchased for taxable transactions. You can use this right after the OS has been registered and in the presence of invoices issued by sellers. At the same time, according to the position of the Ministry of Finance, the company has the right to do this after registering fixed assets, equipment for installation and (or) intangible assets in full (Letters dated April 9, 2015 No. 03-07-11/20293, dated May 18, 2015 No. 03-07-RZ/28263).

Deduction of VAT in parts and reconciliation of the Federal Tax Service

As you know, since the beginning of this year, the tax service has been carefully monitoring all VAT payers, processing their electronic reports automatically. At the same time, information from the books of purchases and sales of counterparties is compared, which have now become part of the expanded tax return. For each transaction, the data specified by the seller and the buyer are compared, including the amount of VAT.

However, if the buyer decides to “split” the deduction into several periods, then VAT will be partially reflected in his Purchase Book, which will not correspond to the entry in the supplier’s Sales Book. When conducting a cross-reconciliation at the end of the quarter, the tax office will identify this discrepancy and may require an explanation. Moreover, based on clause 8.1 of Article 88 of the Tax Code of the Russian Federation, the inspectorate will be able to demand the presentation of an invoice and other documents regarding the transaction, because formally the amount of tax in the buyer’s declaration will be underestimated. As a result, some accountants still prefer not to split deductions due to reluctance to communicate with the Federal Tax Service or fear of sanctions.

But according to many experts, it is completely safe to deduct VAT in parts. Of course, there is a risk of receiving a request from the inspectorate to provide explanations. But since by declaring a partial deduction, the buyer does not violate tax laws, he will be able to explain his actions, submit the necessary documents and without any problems “justify” the incomplete amount of VAT.

Deduction from advances

According to paragraph 12 of Article 171 of the Tax Code of the Russian Federation, a company that has transferred the amount of payment, including partial, on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, has the right to deduct the amount of tax presented by the seller. Let us pay attention to the provisions of paragraph 9 of Article 172 of the Tax Code. According to the norm, an organization for this will need invoices issued by sellers upon receipt of payment, partial payment for upcoming deliveries, transfer of property rights, as well as documents confirming the actual transfer of money, an agreement providing for the transfer of these amounts. In this case, the right of companies to claim deductions for three years is not secured in the Tax Code. Therefore, this can be done in the tax period in which the organization fulfilled the conditions provided for in Articles 171 and 172 of the Tax Code (Letter of the Ministry of Finance dated April 9, 2015 No. 03-07-11/20290).

EXAMPLE Accept for deduction of fixed assets An organization acquired a fixed asset on January 10, 2015, put it into operation and registered it as a fixed asset on April 10, 2015. From what point do you count three years for the OS deduction? According to the Ministry of Finance, set out in Letters No. 03-07-11/19 dated January 24, 2013, No. 03-07-11/290 dated October 28, 2011, deductions of VAT amounts presented by sellers to the taxpayer when purchasing fixed assets are made in full volume after registration of OS. However, Chapter 21 of the Tax Code does not connect this point with the reflection of assets on any specific accounting accounts: on account 01 “Fixed assets” or 07 “Equipment for installation” and 08 “Investments in non-current assets”. The courts recognize the legality of deducting VAT after reflecting the asset on account 08. Consequently, the first tax period in which the company has the right to take advantage of the deduction is the second quarter of 2015. Thus, the three-year period must be counted from the moment at which the organization acquired the right to apply a tax deduction, that is, from the next day after March 31, 2015. It expires on March 31, 2021. In other words, an organization has the right to declare a deduction in one of the tax periods starting from the second quarter of 2015 and ending with the first quarter of 2021. However, if we follow the position of the Ministry of Finance, these terms will be different: from the third quarter of this year to the second quarter of 2021.

Thus, if a company accepted a deduction after the tax period in which the right to it arose, it must submit a “clarification” to the inspectorate. Moreover, on the basis of paragraph 2 of Article 173 of the Tax Code of the Russian Federation, the company has the right to file such a declaration within three years after the quarter in which this right arose (Letters of the Federal Tax Service dated March 30, 2012 No. ED-3-3 / [email protected] , Ministry of Finance dated October 13, 2010 No. 03-07-11/408, dated June 22, 2010 No. 03-07-08/186, Determinations of the Supreme Arbitration Court of the Russian Federation dated February 3, 2010 No. VAS-113/10, dated May 17, 2011 No. VAS-5739/11).

From the explanations of the Plenum of the Supreme Arbitration Court, set out in paragraph 27 of Resolution No. 33 of May 30, 2014, it follows that the positive difference resulting from the excess of the amount of deductions over the amount of tax calculated on taxable transactions is subject to reimbursement from the budget. However, to do this, the organization must submit a declaration before the expiration of the three-year period established by paragraph 2 of Article 173 of the Tax Code. Since this norm does not provide otherwise, deductions can be reflected in the declaration for any of the tax periods included in the corresponding three-year period.

At the same time, the “three-year” rule must also be observed in the case of including deductions in the submitted declaration. In addition, please note that VAT on advances paid may not be deducted at all (Letters of the Ministry of Finance dated April 12, 2013 No. 07-01-06/12203, dated September 1, 2009 No. 03-07-14/92) .

Found an old invoice

Let's say that in September 2021, the accountant discovered an incoming invoice dated August 2021.

But this document was not registered in the purchase book, and no deduction was claimed for it. Carry out automatic reconciliation of invoices with counterparties Connect to the service

Is it possible to correct the situation now, in the third quarter of 2020? Simply put, is it permissible to reflect the specified invoice in the purchase book for the third quarter, and show the deduction in the declaration for the same period?

Another indulgence?

The innovations in Article 172 of the Tax Code of the Russian Federation are yet another concession for business. However, from January 1, 2015, companies that were previously accustomed to using the “transfer” of VAT deductions run the risk of losing in court. The fact is that before this date, the code did not establish a lower limit for the three-year period during which companies could apply the deduction by either filing an amended declaration or reflecting the amount of the deduction in the declaration for the reporting period. Since before January 1, 2015, the start date for calculating this period was not regulated, the Ministry of Finance, the Federal Tax Service and arbitration courts believed that it should be calculated from the moment all conditions for applying the deduction are met. Now, paragraph 1.1 of Article 172 of the Tax Code clearly states that the deductions provided for in paragraph 2 of Article 171 can be claimed within three years after goods (work, services) and property rights are registered. That is, now the date is clearly defined, and there can be no discrepancies.

Irina Razumova

, for the magazine "Calculation"

Help your business grow

Invaluable experience in solving current problems, answers to complex questions, specially selected latest information in the press for accountants and managers. Choose from our catalog >>

If you have a question, ask it here >>

Do not delay deduction until the very last quarter of this three-year period.

The deduction must not only be applied, but also declared. And, as you know, we submit the declaration at the end of the tax period - we are given as many as 25 days for this. The Tax Code does not stipulate whether those same 25 days for filing a return are included in the three-year period during which VAT can be offset or not. The reaction of tax inspectors is expected. There is only one way out - to accept VAT for deduction in the penultimate quarter of the three-year period. Or, as a last resort, submit a declaration on the last day of the last quarter.

@garant_ooo

There is no such point!

And the appeal agreed with this point of view. AS MO did not agree! But why? After all, everything seems to be logical...

Cassation has a different logic.

In accordance with Art. 55 of the Tax Code of the Russian Federation, a tax period is understood as a calendar year or another period of time in relation to individual taxes, at the end of which the tax base is determined and the amount of tax payable is calculated.

The tax period for VAT is a quarter.

Based on clause 9 of Art. 167 of the Tax Code of the Russian Federation, if after 180 calendar days the taxpayer has not submitted the necessary documents, transactions for the sale of goods provided for in paragraphs. 1 and 8 clauses 1 art. 164, are subject to taxation at rates of 10 or 18%. If the taxpayer subsequently submits to the tax authorities the necessary documents to apply the zero tax rate, the paid tax amounts are subject to refund to the taxpayer.

Thus, if the zero rate is not confirmed within the specified period, the taxpayer on the 181st day will experience negative consequences not in the form of a refusal to apply tax deductions, but in the form of the need to calculate VAT on the volume of export shipments at the general rate.

At the same time, the “detection” of documents by the company in the fourth quarter of 2014 is not a basis for increasing the period provided for in paragraph 2 of Art. 173 Tax Code of the Russian Federation.

Thus, the appropriate tax period, after which the three-year period begins, should be considered the month in which the goods were sold under the customs declaration. In this case, the beginning of the three-year period will be the first and second quarters of 2012, which is consistent with paragraph 1 of Art. 167 Tax Code of the Russian Federation.

The specified approach to calculating the period provided for in paragraph 2 of Art. 173 of the Tax Code of the Russian Federation, according to the cassation, was set out in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 19, 2009 No. 17473/08, the rulings of the Supreme Arbitration Court of the Russian Federation dated February 27, 2014 No. VAS-1227/14 and the Supreme Arbitration Court of the Russian Federation dated September 4, 2017 No. 307-KG17-11657 .

It is inappropriate to talk about the existence of grounds for adding 180 days to the three-year period (for the submission of documents confirming the zero rate), identifying the concepts of 180 days and two tax periods, since these periods are not similar within the meaning of the Tax Code of the Russian Federation.

A different interpretation of the law would result in the taxpayer receiving an additional 180-day period to return the tax paid to the established (for all other taxpayers) three-year period, which violates the principle of tax equality.

Deduction for expenses that do not reduce income tax

Situation: is it possible to deduct VAT on expenses that are not taken into account when calculating income tax?

Yes, you can, but provided that the costs are related to operations subject to VAT. True, with this approach, disputes with the tax inspectorate are not excluded.

In private explanations, representatives of regulatory agencies take the following position. For expenses that are not taken into account when calculating income tax, input VAT cannot be deducted. This is due to the fact that the use of the deduction is provided only for expenses that are associated with the performance of operations subject to VAT, including sales. When calculating income tax, expenses not related to production and sales are not taken into account. This follows from paragraph 2 of Article 171 and paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Thus, the presence of expenses not taken into account when calculating income tax means that they are not related to the performance of operations subject to VAT.

There are examples of court decisions that contain similar conclusions (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 5, 2008 No. 6440/08, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated January 24, 2008 No. F03-A51/07-2/6147 , Volga-Vyatka District dated January 10, 2008 No. A43-2450/2007-31-45, Central District dated August 20, 2007 No. A68-AP-104/18-06, dated July 19, 2006 No. A54- 9067/2005-C18).

However, there is an opposite arbitration practice. Many judges believe that the application of the deduction depends on the tax accounting of expenses only in relation to VAT accrued by the organization when performing construction and installation work for its own consumption (paragraph 3, paragraph 6, article 171 of the Tax Code of the Russian Federation).

In other cases, the Tax Code does not contain any restrictions on the use of VAT deductions for expenses that do not reduce taxable profit. The main condition for deducting input tax is the connection of expenses with the performance of operations subject to VAT. This follows from paragraph 2 of Article 171 of the Tax Code of the Russian Federation.

For example, an organization can give its employee a TV for his birthday. When calculating income tax, expenses for the purchase of a TV are not taken into account. However, such a transfer is recognized as a sale on which the organization must pay VAT. Consequently, the organization can deduct the input VAT presented by the supplier when purchasing a TV. At the same time, there is no need to wait until the gift is given to the employee and VAT is charged to the budget. The Tax Code does not establish a relationship between the period of presentation of VAT for deduction and the period of actual sales, including free of charge. Arbitration practice confirms the legality of this approach (see, for example, Resolution of the FAS Moscow District dated March 12, 2009 No. KA-A40/1726-09).

All this follows from the provisions of paragraph 2 of subparagraph 1 of paragraph 1 of Article 146, paragraph 1 of Article 172 and paragraph 16 of Article 270 of the Tax Code of the Russian Federation.

Thus, as a general rule, if expenses are aimed at performing operations subject to VAT, then, regardless of whether they are taken into account when calculating income tax, input VAT on them can be deducted. The courts also adhere to this position. For example, resolutions of the Federal Antimonopoly Service of the Moscow District dated February 26, 2010 No. KA-A40/978-10, dated July 14, 2009 No. KA-A40/5553-09, dated April 7, 2009 No. KA-A40/2620-09 , Volga District dated September 22, 2008 No. A65-5848/07, dated May 6, 2008 No. A65-12919/07-SA2-22, Ural District dated October 7, 2008 No. F09-7115/08-S3, West Siberian District dated August 23, 2007 No. F04-5630/2007(37318-A46-37), dated December 8, 2008 No. F04-6756/2008(15392-A45-37), Far Eastern District dated August 16, 2007 No. F03-A51/07-2/2293, Central District dated December 16, 2004 No. A36-135/2-04 and Northwestern District dated October 24, 2008 No. A56-46360/2007.

Violation of refund deadlines by the tax inspectorate

First you need to contact the inspector who conducted the inspection and find out from him all the circumstances of the delay. There may have been a technical error and the funds will soon be credited to your current account.

If communication with the inspector does not change the situation, you need to send a letter directly to the head of the tax office. If the answer was unsatisfactory or was not received at all, you should contact a higher tax authority.

The last stage is going to court. In accordance with paragraph 10 of Art. 176 of the Tax Code of the Russian Federation, the taxpayer may receive interest for the period of delay, which is calculated based on the refinancing rate of the Central Bank. It is worth noting that interest is due only if there are no objective reasons for the timing of the transfer.

How VAT refunds from the budget occur: diagram

The Tax Code of the Russian Federation includes two methods of reimbursement from the VAT budget:

- ordinary (general), when VAT refund from the budget (Article 176 of the Tax Code of the Russian Federation) occurs after a desk audit of the submitted tax return;

- declarative, when the VAT refund from the budget is made before the end of the “chamber room” subject to special conditions (Article 176.1 of the Tax Code of the Russian Federation).

Each of these methods contains a certain algorithm of actions, the first step of which is filing a VAT return, since the right to a tax refund does not arise on its own - it must be declared by declaring tax deductions.

How to claim VAT refund

The conditions for accelerated VAT refund are regulated in Art. 176.1 Tax Code of the Russian Federation. In this case, the tax can be refunded until the declaration is verified. This option is acceptable for enterprises :

- operating on the market for at least three years, and having paid taxes of at least 2 billion rubles for the three previous calendar years;

- who submitted a bank guarantee with the declaration, i.e. the bank’s obligation to pay the refunded tax for the company if the decision on refund is cancelled. In this case, the amount of the guarantee must cover the amount of the refundable tax, its validity period must be at least 10 months, and the bank must notify the Federal Tax Service of the existence of such a guarantee within 24 hours from the moment of its issuance;

- companies that are residents of the OSED (advanced social economic development) territories or the free port of Vladivostok and have submitted, along with the declaration, a guarantee agreement for the management company, which provides for the obligation to return excessively refunded VAT amounts by the management company if the taxpayer does not reimburse such amounts himself at the request of the tax authorities.

The guarantor can be a Russian company that has no tax debts and is not in the process of reorganization, bankruptcy or liquidation, and has also paid at least 2 billion rubles for the three years preceding the year the guarantee was issued. taxes. The size of the guarantees should not exceed half the value of the guarantor's net assets as of the last reporting date.

To quickly receive a VAT refund, companies that meet the listed criteria must submit an application to the Federal Tax Service within five days after submitting the declaration. The Federal Tax Service has 5 days to review it, after which a decision is made to refund the tax or to refuse it. The tax authorities must notify the taxpayer of the decision made no later than 5 working days. Having made a positive decision, the Federal Tax Service Inspectorate notifies the Treasury about this, instructing it to reimburse the declared amount within 5 days. If the camera did not reveal any violations, then the Federal Tax Service Inspectorate notifies the company about this within 7 days, and the next day informs the guarantor bank or guarantor about the release from the accepted obligations.

For which transactions is VAT deductible?

You can claim VAT as a deduction when performing transactions for which (Article 171 of the Tax Code of the Russian Federation):

- VAT was charged to you by suppliers (contractors, performers) when purchasing goods (work, services) and property rights from them in Russia.

For example, if you bought goods for resale;

- you calculated and paid the tax yourself:

— when importing goods into Russia;

— when performing the duties of a tax agent;

- when performing construction and installation work for your own needs;

- you received or issued an advance payment for future payment for goods (work, services);

- you received a contribution to the authorized capital in the form of property, intangible assets or property rights;

- when compensating for VAT under the tax free system.

Consequences of violating the procedure for accepting VAT for deduction

If you violate the procedure for accepting VAT for deduction, all conditions are not met, or the deadline for deduction is violated, then the inspection may refuse to deduct VAT during the inspection. This will leave you with a tax liability. In this case, the inspection may charge you:

- fine under art. 122 Tax Code of the Russian Federation;

- penalties under Art. 75 of the Tax Code of the Russian Federation for each day of delay.

You will not be able to take into account the VAT accrued based on the results of the audit in your income tax expenses. This follows from the analysis of paragraph 1 of Art. 170, paragraph 19 of Art. 270 Tax Code of the Russian Federation.

There is an elderberry in the garden, and an old man in Kyiv.

So, three courts and two opposing opinions. And only one thing is correct in any case.

Having looked at the decisions of the higher courts referred to in cassation, a neutral observer may be slightly perplexed. Let's take the Determination of the RF Armed Forces No. 307-KG17-11657. Firstly, it talks about a situation where a taxpayer tried to return VAT that he had previously paid on unconfirmed export transactions! Perhaps AS MO sees some kind of connection here, but the author does not see any connection with the situation when the dispute is about the refund of “input” VAT.

In addition, the Supreme Court of the Russian Federation immediately clarified that the taxpayer has the right to claim a refund of the tax declared in the tax return, including an updated one, within three years from the moment determined by the tax period, when all the conditions for the use of deductions are met, the use of which leads to occurrence of the amount of compensation.

Well, the court of first instance and the appeal drew attention to the fact that in the situation under consideration, one of the most important conditions for obtaining the right to deduct “input” VAT is the presentation or failure to provide the tax authorities with documents confirming the right to a zero rate, for which 180 days are allocated.

If we follow the logic of cassation, it turns out that the “input” VAT related to export operations could be claimed for deduction immediately after the export shipment. But this was not so! (Remember that the situation has now changed, as we said above.)

The Determination of the Supreme Arbitration Court of the Russian Federation No. VAS-1227/14 also deals with the situation with VAT overpaid due to the fact that the taxpayer did not have time to collect the necessary list of documents, and when he collected it, the deadline for deduction was overdue.

Somewhat closer to our topic is Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 17473/08. There, indeed, the taxpayer tried to prove that the three-year period for filing a tax return should be calculated from the end of the period, which was the 181st day from the date of sale of services. And the judges refused him.

But even here we were talking about the refund of VAT, which was overpaid due to unconfirmed exports! And even formally, this situation still relates to the reimbursement of the “input” tax, and not the excessively accrued tax...

Therefore, in the author’s opinion, it is unfair to refer to the above court decisions when considering a completely different issue.

In addition, the cassation argument that the exporter may receive some kind of unjustified advantage over other taxpayers is also clearly unfair. What is this advantage? After all, initially the exporter, on the contrary, was placed in worse conditions! He is forced, unlike others, to wait to receive the right to deduct “input” VAT until he has or does not have documents confirming export.