From February 2021, the Federal Tax Service has the right to demand clarification of the VAT return not only during a desk audit, but also during any tax control activities. The VAT return is the subject of our article today, from which you will learn how to correctly fill out a VAT return, what changes have been made to it since 2021, what codes to indicate in it, when it must be submitted and in what form.

According to the Federal Tax Service, tax collection is growing in Russia every year, for example, in 2021 the increase was 23% compared to the previous year. Both the taxes themselves, such as VAT, and the persistence with which these taxes are collected are growing. The fiscal system is being modernized, automated, etc. Each taxpayer with his contributions becomes transparent, and his reporting becomes “under a magnifying glass.” This is why it is so important to fill out reports taking into account all the rules, especially if the reporting is not the simplest, such as the VAT return. Moreover, this year the Federal Tax Service is increasing its attention to this form of reporting.

If inconsistencies are detected in the VAT return or if the specified information in the return does not correspond with the data of the tax authorities, the Federal Tax Service has the right to demand an explanation from the company. If previously such a requirement could only be made during a desk audit of the taxpayer, now they can demand clarification on the VAT return during any tax control activities

. These changes are stated in the letter of the Federal Tax Service dated February 13, 2021 No. EA-4-15 / [email protected] The changes apply from February 17, 2021.

The VAT declaration is submitted by legal entities and individual entrepreneurs who:

- are recognized as VAT payers (including Unified Agricultural Tax payers),

- are tax agents for VAT,

- those who have issued an invoice with the allocation of VAT are special regimes and persons exempt from paying tax,

Who is required by law to submit VAT reports?

The tax office expects a VAT return for the 4th quarter of 2021 from:

The VAT payer must submit a return, even if there is nothing to reflect in it for the tax period. In this case, the report will be zero .

VAT defaulters do not submit .

What does an invoice contain and what is it for?

The invoice document contains all the necessary information about the cost of the product - with and without tax. It is provided by the supplier and must be attached to the log book.

It requires special attention , since if the paper is filled out incorrectly, the tax inspector checking it will see a discrepancy in the data, which may lead to the cancellation of all deductions and an increase in the amount of value added tax.

Now we have learned what a value added tax return is. As you can see, there is nothing complicated in it, you just need to understand the details. If you have any additional questions, you can always contact the inspector . It is better to spend more time filling it out than to receive a significantly increased tax amount later.

Read our article about what an invoice is and when this document is used.

Methods for filing a VAT return

The VAT return is a special , since it can only be submitted electronically, regardless of the number of employees of the organization or individual entrepreneur. This rule applies to both zero declarations and single cases of VAT reporting.

tax agents can file a VAT return

Results

Individual entrepreneurs working for OSNO are VAT payers and are required to submit quarterly reports for this tax, even if there is no data to fill out its main sections.

There is no special form or special rules for filling it out for entrepreneurs. There are some peculiarities in displaying information about the individual entrepreneur in the report, but they are related only to the fact that this data always differs from that available to the legal entity. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Innovations in the VAT return form from the 4th quarter of 2021

In 2021, the VAT report has undergone adjustments.

Important

Changes to the VAT return were made by order of the Federal Tax Service of Russia dated August 19, 2020 No. ED-7-3/591

.

Below we summarize what should be taken into account when filling out a VAT return starting from the 4th quarter of 2021.

We described in detail about the changes to the VAT return, including explanations on the SZPK, in the article “New form of the VAT return for the 4th quarter of 2021: overview of changes.”

Tax agent - in what cases?

You may have encountered situations where a taxpayer, for some reason, could not pay tax on us himself, and another person did it for him (we will look at these cases below).

This is the tax agent who will deduct the required amount from income in advance and then send it to the state budget. Thus, this person or enterprise acts as a link between the state and this taxpayer.

According to the Tax Code, a tax agent for VAT is the one who:

- purchases products or services from foreign entities that are not registered with the Russian tax authorities (the purchase is made in Russia);

- rents or buys state property, property of constituent entities of the Russian Federation;

- sells confiscated goods, purchased valuables or buys the property of a bankrupt person.

Composition of the VAT return

Let's consider what sections the declaration consists of in 2021.

A null declaration includes only title and Section 1.

If the taxpayer does not have data to fill out any section (for example, transactions with a zero VAT rate or non-taxable transactions), then they are not required to be submitted as part of the declaration.

General information about VAT

First, let's figure out what VAT is. Value added tax is a so-called consumption tax . In essence, such a tax is an addition to the price of the product being sold, that is, the buyer pays it when making a purchase. It is the enterprise that sells these products that submits the declaration to the inspectorate.

Various rates

The rate is regulated by Article 164 of the Tax Code of the Russian Federation; it is not fixed and differs for different types of goods.

For example, for most services and products the value added tax is 18%.

An exception is made for certain types of services and goods: children's products, books and periodicals of an educational nature, as well as some medical goods have a reduced rate of 10%. There is also a zero rate for exported goods, some passenger transport and others.

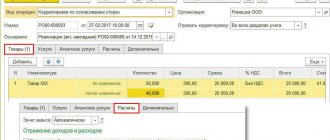

The procedure for entering data into VAT reporting

Like most tax reports, it is more convenient to fill out the VAT return from the end . That is, we first fill out the sheets and sections in which we enter data for calculating the tax, and only then those sections in which results - Section 1 and the title page.

Title page

The title traditionally indicates general information about the business entity submitting the declaration, the reporting period and the tax authority to which the declaration is submitted.

Section 1 and Section 2

The results of the tax calculation are shown here: whether it needs to be paid to the budget or reimbursed, and in what amount.

These sections indicate OKTMO, KBK.

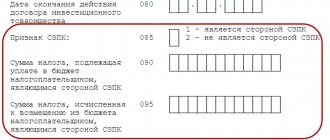

Please note: it is in Section 1 that new fields to indicate:

- participation or non-participation in the SZPK;

- amounts of tax to be paid or reimbursed by SZPK participants.

Section 1 is easy : the formula for calculating the indicator entered in the lines is indicated under the corresponding lines. We remind you that this should be completed last . Section 2 is completed by tax agent . It includes as many sections 2 in the declaration as for how many persons the organization (IP) acts as a tax agent.

Section 3

This section is the main section of the declaration, since it is here that the final tax amounts are calculated.

Here they reflect:

In the appendices to section 3 the following is recorded:

- recoverable tax amounts for previous calendar years;

- the amount of tax of a foreign organization that operates through its representative offices.

Sections 4 – 6

Sections are devoted to those transactions that are subject to a zero VAT rate.

Section 7

not subject to are reflected here - for each such transaction in accordance with the code.

Failure to complete this section does not lead to a distortion of the tax base and the calculated tax. However, it cannot . If you had to fill out the section, but didn’t do it, you may be liable under the Tax Code or the Code of Administrative Offenses of the Russian Federation:

- failure to submit a document – a fine of 200 rubles (for each document) under clause 1 of Art. 126 Tax Code of the Russian Federation;

- administrative fine for an official - from 300 to 500 rubles under Part 1 of Art. 15.6 Code of Administrative Offences.

Sections 8 – 12

Sections - contain information from those registers maintained by VAT taxpayers (and not only) during the reporting period.

For a typical version of filling out a VAT return for the 4th quarter of 2020 (title page, section 1 and section 3) see here:

Deadlines for submitting VAT reports and paying taxes

There are no special rules for individual entrepreneurs regarding the deadlines for filing VAT reports and paying the tax specified therein.

The deadline for filing the declaration is set for the 25th day of the month following the completed reporting quarter (clause 5 of Article 174 of the Tax Code of the Russian Federation). Moreover, tax defaulters are also targeted for the same period, filing a declaration as the need arises and, unlike taxpayers, having the right to submit it in paper form. For the 1st quarter of 2021, the declaration must be submitted by 04/26/2021 (postponement from Sunday, April 25).

There are several deadlines for making tax payments (clauses 1, 4, Article 174 of the Tax Code of the Russian Federation):

- Taxpayers pay it in three installments during the quarter following the end of the one for which the next report was submitted, doing this monthly no later than the 25th day of each of three months, in an amount equal to 1/3 of the amount accrued in the declaration.

- Non-payers who need to submit a declaration make only one payment - on the due date, the deadline of which expires simultaneously with the deadline for submitting the VAT report.

- Tax agents making payments to foreign counterparties must pay tax simultaneously with the transfer of funds to the counterparty.

- Payment of tax in connection with the import of goods into the territory of the Russian Federation is subject to the rules established by customs legislation.

Thus, if there is only one deadline established for filing a VAT report, the timing of tax payments may be different.

How to fill out the report form

The Ministry of Finance determined exactly how to fill out the report form back in 2007, in order No. 62n. By the way, the declaration form itself was approved by the same order.

Filling out the declaration is very simple; in the vast majority of cases, information is entered only on the first sheet of the form.

| Declaration field | Decoding |

| INN/KPP | In the topmost fields of the form you must enter the TIN and KPP of the company, or only the TIN of the entrepreneur |

| Document type | This implies a mark indicating whether the report is primary or corrective. For a report submitted for the first time, enter code 1, for a corrective report, code 3. For a report with code 3, enter the correction number |

| Year | We indicate the reporting year for which the declaration is being submitted |

| Inspection and its code | We indicate which tax authority the declaration is being submitted to and enter its code |

| Company name, individual entrepreneur | You must enter the full name of the organization or individual entrepreneur |

| Field for indicating the taxes for which the declaration was drawn up | The field consists of 4 columns. In the first, you need to write down what tax the declaration was drawn up for. 3 more columns - to indicate the head of the tax code, reporting period code and quarter number |

| OKTMO, OKVED, phone number, number of sheets | Current data on codes is indicated. It is advisable to provide a contact telephone number to contact the taxpayer. The number of sheets in most cases is 1. |

In the lower left part of the declaration, the name of the manager is written down, his signature is placed and the date of submission of the form to the inspection.

For organizations and entrepreneurs, the procedure for filling out the declaration is similar.

Advantages of submitting reports online via LC

So, this form of submission has several advantages:

- The document submission date is equal to the reporting submission date;

- There is no need to go to the tax office; you can send the necessary documents from anywhere;

- There is no need to be afraid that the format or version of the files will be out of date, since the software constantly updates information about new requirements and standards;

- The entrepreneur is guaranteed to receive a report from tax officials;

- You can ask any question online;

- Fast delivery and feedback;

- There is no room for error as the software checks the document.

Submitting an individual entrepreneur declaration via LC

Is it possible to submit tax reports for individual entrepreneurs through the User’s Personal Account?

The easiest option is to submit it through the Federal Tax Service website (an online reporting service), a special program will help you with this. You will receive your electronic signature and identification number through the Federal Tax Service if you submit an application to the tax office.

If a taxpayer wants to submit a declaration online, then he should go to the special page of the Federal Tax Service - https://service.nalog.ru/nbo/. The operation is performed free of charge.

In order for an individual entrepreneur to submit tax reports via the Internet independently, you need to:

- First, you should install the CA of the Federal Tax Service of Russia, in other words, the root certificate.

- Next, in order to check the receipt and encrypt the report, the individual entrepreneur must download the public key service for the electronic signature of the MI Federal Tax Service of Russia.

- Register a transport container using the “Legal Taxpayer” service. It must be pre-encrypted with a public key. The document must be signed with the electronic signature of the entrepreneur.

- Use the system to transfer encrypted files.

Important! Online registration link – https://service.nalog.ru/static/personal-data.

All services have a single reception point. The convenience is that you can submit reports from anywhere in the world, the main thing is to have access to the Internet.

The system will consider the date of receipt of the report to be the time when the application is received by the service and it approves it. The verification will take into account the electronic signature and format-logical control.