Notification of the opening of a separate division in the Federal Tax Service

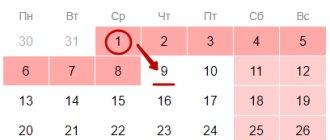

The creation, any changes in previously provided information, or the closure of divisions must be reported to the regulatory authorities. Where to submit a message about opening a separate division? If this is not a branch or representative office, the company must report the creation of a division to the tax office at the location of the organization (not the OP). There is no additional need to report the creation of new branches or representative offices, since information about them must be indicated in the Unified State Register of Legal Entities. A message to the Federal Tax Service about the opening of a separate division must be sent no later than 1 month.

For such a case, there is an approved message form C-09-3-1. The form of notification of the creation of a separate division was approved by order of the Federal Tax Service of Russia No. ММВ-7-6/362 dated June 9, 2011.

Form S-09-3-1. Registration of a separate division. Sample filling.

| Download links: |

| form S-09-3-1 (word) |

| form S-09-3-1 (zip) |

Form S-09-3-1 (KND code 1111053) is required for registering a separate division of a company, as well as making changes to an already open division, such as: changing information about the director, changing the location, changing the name of a separate division.

—> filling out page 1 | —> filling out page 2 |

Filling out the application step by step:

- TIN

- checkpoint

- Tax authority code

- name of the organization or individual entrepreneur

- OGRN of the organization

- number of registered separate divisions

- type of application

- how many pages are in the application

- number of attachments to the document

- who submits the application

- Full name of the person submitting the notification

- TIN of the person submitting the notification

- contact phone number

- document proving identity and authority

- Type of change

- checkpoint

- Name

- Address of the separate division to be opened

- date of creation

- main OKVED

- Full name of the head of the separate division

- TIN of the head of a separate division, if available.

- telephone

- The TIN of the organization is 10 digits, not to be confused with the OGRN.

- Checkpoint - fill out the checkpoint of the main organization (not a separate division, which does not exist yet)

- Code and number of the interdistrict tax inspectorate (MIFTS) to which you are submitting documents. The code and number can be taken from the table.

- Name of the organization. Write the full name of the organization, for example: “Limited Liability Company “Zagrebay””.

- OGRN is the main state registration number, taken from the taxpayer’s registration certificate.

- Each department will need to complete a second page of the form.

- Type of application : 1 - if you are reporting the creation of a separate division; 2 - if you make changes to an already created separate division.

- Number of pages in the application , if one division is opening, then 2 pages. If more, then by the number of divisions plus 1.

- Number of application sheets . The application may be accompanied by a copy of a document confirming the authority of the representative (power of attorney, or order appointing the head of a separate division)

- Who submits the application:

- head of the organization - put “3”

- representative of the organization - put “4”; if this is a representative of the organization by power of attorney, then you will need to submit a power of attorney for the person submitting the notification.

- Last name, first name, patronymic of the person presenting the documents.

- TIN of the individual presenting the documents - 12 digits.

- Contact phone number at the discretion of the applicant

- The passport details of the applicant are filled in in the following format: series, number. Or the number and date of the power of attorney, if this is not the general director.

- Type of change made to an already created separate division. If you are submitting documents to create a separate division, then you do not need to fill out anything.

- Checkpoint of a previously created separate subdivision, if you are making changes to an already registered subdivision. If you are creating a new one, then you do not need to fill out this item.

- The name of the separate unit is whatever you come up with, only without the obscenities and calls to overthrow the existing Putin regime.

- The address is also an address in Africa)))

- Date of creation of a separate division. Just do not write a date earlier than a month before submitting the application, otherwise you may run into a fine.

- The main OKVED of the organization. It is necessary to indicate the BASIC OKVED code - it is listed first in your USRLE) ( Unified State Register of Legal Entities ).

- Last name, first name and patronymic of the head of the separate division; if there is none, then leave the field blank.

- TIN of the head of a separate division, if available.

- telephone number of the head of the detachment, if available.

Sample of filling out a message about the creation of a separate division

So, to inform the tax inspectorate that you have a separate division, you need to use the unified form C-09-3-1. In addition, the tax inspectorate has approved the procedure for filling out the form.

How to fill out form C-09-3-1? Let's figure it out.

In the header of the form, indicate the INN and KPP, you must indicate the code that identifies the tax office to which the message is being submitted.

The following is the main part of statement C-09-3-1. The name must be indicated in full, exactly as indicated in the company’s constituent documents. Next, you need to indicate the OGRN and the number of divisions. Do not be confused: in the field where you need to indicate the number of units, you must indicate the number of units, the creation of which you want to report using form No. C-09-3-1.

If the company wants to inform about the opening of a division, then in the “Informs” field you must put 1. In the “This message is compiled on” field, indicate the number of sheets. If you want to open more than one division, then the number of sheets C-09-3-1 will increase, since a separate sheet is filled out for each division that the company wants to open. The number of sheets is indicated in the following format “2—”. In the field “with a copy of the document attached,” you must write the number of sheets of copies of documents confirming the authority of the representative.

Next, the form is divided into 2 parts; the manager or representative of the company fills out his contact information (phone number, email address, etc.) on the left side.

The second sheet of the message about the opening of a separate division (you will find a sample form below) contains information about the separate division. Enter the TIN and KPP of the organization, page number. The “Checkpoint 3” field is filled in if the inspection is notified of changes.

In the “Name” field, indicate the name of the department, if available. Then provide the full address of the unit's location. Please note how this item is filled out in the sample application C-09-3-1 presented below. If you are filling out information about the address of a separate division for Moscow and St. Petersburg, then you do not need to fill in the “District” and “City” fields. In the “Creation Date” field, enter the date when the separate division was created. The application is signed by a person confirming the accuracy of the information presented.

Filling in the fields

S-09-3-1 is filled out with a black pen or, increasingly, electronically. As in other accounting documents, information is entered in capital letters (printed) - 1 character per cell.

Although the base document is only 2 pages, you can print as many copies of the second page describing the changes as you need.

Let’s say that if an enterprise transfers (changes addresses) three OPs, then the document will increase to 4 pages. And this should be marked in the appropriate cell:

What matters is on whose behalf the form is submitted. If this is the director of the enterprise (code - 3), then in the column “Name of the document confirming authority” we indicate “Passport” and in the line below - the series and number of the passport. If the applicant is a representative of an organization (code - 4), then the name is a power of attorney. These documents must be present when submitted in person to the Federal Tax Service.

Checkpoints should be demarcated. The code of the main legal entity is indicated on the title page, and the subdivisions are indicated in the appendix. Since, by law, not every company has a registration reason code, this field may be left blank. After submitting S-09-3-1, the OP can be assigned a checkpoint, which is noted at the bottom of the form (see appendix).

Adding a new division:

- On page 0001, put 1 in the “Reports” field.

- On page 0002, leave the “Informs the type of change” and checkpoint fields blank.

- Enter the name of the representative office.

- We indicate the address and activity according to OKVED.

- Full name and contact details of management are optional.

How to enter a new OP in form S-09-3-1

Change of name

- On page 0001, put 2 in the “Reports” field.

- On page 0002, check the box in paragraph 1.2.

- We indicate the checkpoint of the existing department.

- We indicate a new name.

- Fill in the existing address fields.

- We indicate the date of renaming in clause 2.4.

- We indicate activities according to OKVED.

How to change the name of the OP in S-09-3-1

Although this information is not displayed in the footnotes, you need to know that the telephone number is not a required field.

Form and sample document

The document form is the same for all organizations, regardless of the nature of the activity (commercial, non-profit), structure, number of staff and other parameters. Form S-09-3-1 looks like this.

An example of filling out form C-09-3-1, which can be used as a sample, is shown below.

Main purpose

The form is filled out as a message in which the company notifies the tax office that a separate division has been opened. In this case, such a unit must simultaneously meet several requirements:

- this is not a branch;

- This is not representation;

- it has a different address compared to the head office;

- it has stationary workplaces (starting from one), which are fully equipped for employees to perform the relevant duties;

- The expected duration of work is at least a month (continuously).

In this case, the document is drawn up not only as a notice of opening, but also as a notice:

- about its renaming;

- about a change in his address;

- about the simultaneous change of both the address and the name of the unit.

In all cases, the notification must be sent to the local tax office no later than 30 calendar days from the date of establishment of the unit or change in any of its information (name and/or address).

Branch and separate division: similarities and differences

As a rule, medium-sized enterprises use a developed network of their structural elements: along with the central (head) office, there are also several separate units, which, depending on their characteristics, can be called differently: separate divisions, branches, representative offices. A common feature of all these elements is the territorial distance from the main office. That is, this is not a single complex, and certainly not a single building.

However, there are significant differences between them, which are associated not only with physical, but also with legal characteristics. The essence of the differences can be clearly seen in the table.

| compared characteristic | separate division | branch |

| reflection of information about creation in the constituent documentation | are not reflected | reflected |

| the need to appoint a director | absent | There is |

| order of creation | possible without obtaining the approval of the founders | solely with the approval of the founders |

NOTE. The close location of various components of the company to each other does not entail the need to call them branches or representative offices. In such cases, we are talking about structural units - for example, warehouses, production buildings and an administration building, located within the same complex (on the same site).

Instructions for filling

Specific filling requirements are also the same for all cases. The following is a detailed description of the current rules.

Front page

Here the filling rules are quite simple - you need to print (or enter in legible handwriting) the following information about the company:

- The TIN and KPP details are exactly those that were received from the tax office.

- OGRN number.

- Code of the tax office - the one that directly controls the company (this message is also sent there).

- The company name in C-09-3-1 must be indicated in full, exactly as it is written in official documents.

- You need to enter a figure for the number of units to be opened - and it is assumed that they are all registered on the same day. If, for example, one structure is opened, you must enter: “1—”.

- Depending on the type of message, marking with numbers is used - since we are talking about the opening of a unit, the number 1 is put. If you just need to make changes to the message that was submitted to the inspection before, the number 2 is put.

- Line “message compiled on” – here you need to indicate the exact number of pages of the document in the format, for example: “5—”.

- The number of pages from which copies of documents confirming the authority of the relevant person are compiled is similarly indicated.

- The company representative must enter “I confirm” in the proof of confirmation of the accuracy of the information and enter the code “3” if he holds the position of director or “4” if he represents the company but holds a different position.

- The last name, first name and patronymic of the manager are written in capital block letters on 3 lines - each initial has its own line.

- Next, you need to register the manager’s TIN (personal, as a private individual).

- The contact information includes a telephone number and e-mail, followed by a signature (in handwriting) and the date of registration.

- Finally, you must also indicate the name of the document that confirms the authority of the person concerned.

Information about the separate division

When filling out this part, you need to pay special attention to those cases when information is submitted about the opening of several separate divisions at the same time. The design rules are as follows:

- For the TIN and KPP details, the relevant data should be provided, duplicating them on each page (if there are several such pages).

- Using the code in the form, you need to indicate the purpose of the notification: number 1 indicates a change in address, number 2 indicates a change in name, and number 3 indicates a change in address and name at the same time.

- Information about the location - here you need to indicate the full postal address, including the postal code, the code that denotes the region, locality and its district (if any), the full designation of the house (including buildings, letters).

NOTE. In the case of the federal cities of Moscow and St. Petersburg, you must leave the “City” and “District” fields empty.

- By date, you must indicate exactly the date when it was created or the date when changes were officially made to its name and/or address.

Thus, timely and correct completion of the form is a guarantee of the absence of claims from the tax inspectorate and corresponding penalties.