Buying land: what tax breaks are possible

In accordance with Art.

220 of the Tax Code of the Russian Federation, the buyer of land for the construction of housing, land with an already built house or a share in these objects can take advantage of a property deduction for personal income tax. IMPORTANT! The purchase of land for another purpose does not provide a deduction.

In this case, the buyer must have in hand papers indicating ownership of the house or confirming the intended use of the land for the construction of a residential building.

NOTE! Until 01/01/2010 Art. 220 was in effect in a different version - expenses for the purchase of land were not mentioned as deductions. Therefore, only those who registered housing on the site after the specified date will receive a tax deduction on the land plot.

Basic value

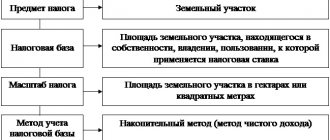

Many, of course, are interested in who approves the base rate of land tax, which then appears in the Tax Code of the Russian Federation. So: the value under consideration appears at the suggestion of the Government of the Russian Federation, as well as relevant ministries and departments. It depends on:

- cadastral characteristics of the site;

- its area;

- other features of the earth.

Typically the base rate applies:

- for lands located outside populated areas;

- when the local administration does not approve its rate.

Who and how can claim a deduction when purchasing land?

Only residents of the Russian Federation have the right to a tax deduction if they have income taxed at a rate of 13% (except for income in the form of dividends). At the same time, they must purchase land at their own expense and register it or the house on it (a share in the said property) in the name of themselves, their minor children (including adopted children) or wards under the age of 18.

The deduction will not be processed if:

- The purchase and sale of land, housing or shares was carried out between interdependent persons, for example close relatives.

- Expenses for land, housing or shares were paid at the expense of employers, maternal capital, and funds from the state subsidy program.

The taxpayer is given a deduction:

- by the tax inspectorate at the end of the year after filing and checking the declaration and other documents by returning income tax to the applicant’s bank account;

- by the employer on the basis of a notification from the tax authority by reducing the tax base for the tax by the amount of the claimed deduction.

The taxpayer decides independently how it is more convenient to receive the deduction.

Who installs

Now about who sets the land tax rates. Local authorities have the right to regulate their size. The size can be minimum, average and maximum allowed by the Tax Code of the Russian Federation. At the same time, officials always take into account the characteristics of the area.

Basic land tax rates are established by the Tax Code. And on its basis - the legislation of Moscow, St. Petersburg, Sevastopol, as well as representative bodies of municipalities. The rules and terms of payment are also regulated by local administrations and the authorities of federal cities.

What is the amount of tax deduction when purchasing land?

The amount of tax deduction when purchasing a land plot is determined by the amount of acquisition costs, but is limited to 2 million rubles. and you can only get it once. But the distribution of the deduction for objects depends on the year in which the person first claimed the right to it.

- If the ownership right was registered after January 1, 2014, then in case of incomplete use of the deduction for the first object, the balance can be transferred to the next one and so on until the limit of 2 million rubles is completely exhausted.

Example 1: In February 2014, V.V. Petrov bought and registered land for construction for 1 million rubles, and in 2015 received a tax deduction on land in the specified amount. In February 2015, he expanded the plot by purchasing neighboring land for 700 thousand rubles. At the end of 2015, he will be able to claim a deduction in the amount of 700 thousand rubles. The balance is 300 thousand rubles. can be used on the next object.

- If the ownership of the property was registered in 2013 or earlier, then in this case, transfer of the deduction when it is not fully used is not allowed in accordance with the version of the Tax Code in force at that time.

Example 2: Petrov V.V. from example 1 registered a land plot in December 2013. In 2014, he will be able to receive a deduction of 1 million rubles, but the deduction will not apply to the plot purchased later (subparagraph 3, paragraph 1, article 220 of the Tax Code, letter of the Ministry of Finance dated June 23, 2015 No. 03-04-05/36283) .

Receiving algorithm

What documents will be needed?

A citizen should prepare certain documents. First of all, this is a Tax Return in Form 3-NDFL (you can fill it out yourself). You will also need the original certificate from the 2NDFL accounting department. You should also ensure that you have a copy of the document that confirms the citizen’s ownership of the land.

It is necessary to prepare a copy of the land purchase and sale agreement , a copy of the land transfer act, if any, a copy of the document on the ownership of residential premises already built on the site or purchased at the same time. If spouses acquired a plot of land during a registered marriage, they must bring a copy of the marriage certificate.

If the taxpayer has children under 18 years of age, and a standard deduction was provided for them at the citizen’s place of work, then a copy of their birth certificate must be provided. You will also need taxpayer account details, a loan agreement if the plot was purchased on credit, and a copy of the passport of a citizen of the Russian Federation (completed pages).

Applications must be submitted along with the following documents:

- to provide a tax deduction;

- to transfer the tax refund amount.

These applications are required to be submitted.

An application for distribution of deductions between spouses may also be required. This is an optional document; it is filled out only when the taxpayer is officially married (relevant for purchases made before January 1, 2014).

How to make an application correctly?

The taxpayer requests a deduction in the amount of the actual costs incurred by him for the purchase of a plot of land. Of course, it may happen that during the reporting year the taxpayer’s salary does not reach 2 million rubles. In this situation, the application must indicate the amount that the citizen actually received during the reporting period .

In the application for a deduction, it is necessary to indicate the personal data of the taxpayer (full name, address, tax identification number), the amount of the deduction, the address of the residential building located on the land plot, as well as a list of attached documents. The tax office at the taxpayer’s place of residence may adjust the content of the application by asking to include some additional information, for example, passport details and the taxpayer’s contact phone number.

In the application for the transfer of the tax refund amount, the citizen indicates his own bank details . Refunds are made after a desk audit.

In the application for a refund, instead of the deduction amount, the overpayment tax, a document confirming the overpayment, bank details, and the employer's OKATO are indicated.

The sample can be downloaded here.

Where can I get the 3rd personal income tax declaration?

Filling out this declaration is carried out on the basis of certificate 2-NDFL for the reporting year (take it from the accounting department).

The document can be filled out in two versions. It is allowed to be filled out manually on a paper form from the order of the Federal Tax Service of Russia. However, the filling process can be significantly simplified if you use a ready-made program. You can view it and download it on the official website of the Federal Tax Service. The taxpayer will need to enter the relevant individual data. Ultimately, he will receive the declaration in electronic form.

You can find the program at www.nalog.ru. You should pay attention to the fact that a separate program is developed for each reporting year.

The specified program contains three files. The InsD2014.exe file is required directly for operation.

The structure of the document includes a number of required elements . The first of these is the title page. This is followed by Section 1. It must contain the amounts of income tax that will be subject to payment or additional payment to the budget or upon return from the budget. Section 2 is also filled in. It calculates the tax base and the amount of tax. Next are sheets A-I. They are filled out by the taxpayer selectively, taking into account whether he had income and expenses for the relevant items.

Filling out the 3-NDFL declaration is carried out in a special manner. First, it is advisable to fill out sheets A through I. Then, based on the data received, the taxpayer must enter the required information in the second and first sections.

After completing the necessary sheets, the tax base and personal income tax amounts are calculated. Our experts will tell you in this article how personal income tax is calculated from the sale of a land plot.

Where to submit?

A package of documents for obtaining a tax deduction is submitted to the tax office at the citizen’s place of registration.

There is an option to receive a deduction through your employer in the form of a 13% addition to your salary. But you still can’t do without a visit to the tax office.

Deadlines

The legislation establishes the deadlines during which the tax inspector must check the package of documents that the citizen provided to receive a tax refund. This period is three months. If the issue regarding the application is resolved positively, the taxpayer will have to write a statement.

It is necessary to make a decision on returning to the citizen the excessively collected funds from the tax inspectorate within two weeks. And the period for returning this amount of money is one month from the date of application .

When is a property tax deduction applicable when selling a land plot?

Not only the purchase of housing is accompanied by a deduction for personal income tax. When selling a plot of land, an income tax deduction is also provided, but in a slightly different form. After all, if upon purchase submitting a declaration and receiving a deduction is a voluntary matter, then when selling property, submitting a declaration (if the maximum period of ownership of such property of 3 or 5 years has not been exceeded) with the calculated tax payable is the responsibility of an individual.

The amount of the deduction is provided in the amount of documented expenses that an individual incurred to purchase the property being sold. If there are no supporting documents, then the value is 1 million rubles. - the maximum for reducing the taxpayer’s income received from the sale of his own housing (houses, apartments, rooms), dachas, garden houses, land plots and shares in all listed property.

IT SHOULD BE NOTED! When selling other property, such as motor vehicles, the deduction is limited to 250 thousand rubles.

Increased odds

In some situations, double tax rates are used. These include the purchase of a plot of land in order to build a residential property (not individual housing construction). Then the payer makes contributions at a double rate for 3 years until the registration of rights.

At the same time, a legal entity that has received a site for the construction of any structures on the basis of permanent/indefinite exploitation does not apply to the coefficient of the land tax rate.

Also see “Land Tax Declaration for 2021: Sample Completion”.

Read also

17.08.2017

What is a tax deduction for land tax of 6 acres

The calculation of land tax is carried out by the tax authorities. An individual can only check its correctness and, in case of disagreement, contact the tax authorities with an application and relevant documents for recalculation.

Starting from 2021, when calculating land tax, a tax deduction has been established, reducing it by the cadastral value of 600 square meters. m for one plot of land. This means that if the area of the plot does not exceed 600 sq. m (6 acres), then no tax is charged, but if it exceeds, then the liability will be calculated for the remaining area.

The deduction is applicable to the persons listed in clause 5 of Art. 391 of the Tax Code of the Russian Federation: pensioners, veterans, disabled people, etc.

Who should pay

All individuals and organizations owning plots of land must pay this type of deduction to the budget. The frequency of receipt of funds into the budget from individuals is once a year.

As a general rule, payment at the established tax rate of land tax occurs if 3 conditions are met:

- The real estate is recognized by the Land Code of the Russian Federation.

- The owner has title documents.

- The land is listed in the cadastre.

Of course, payers must comply with payment deadlines that:

- prescribed by law (legal entity);

- indicated in the document from the Federal Tax Service (individual).

Only the owner of this property must pay land tax. There is no need to deduct funds to the budget for temporary use.

Financial obligations to the treasury arise from the moment of registration of land real estate.

Results

Individuals - residents of the Russian Federation, when purchasing a land plot, can take advantage of a property deduction in the amount of expenses incurred, but not more than 2 million rubles. In this case, the acquired plot must be intended for residential construction or a residential building must already be built there.

The sale of land may also be accompanied by a personal income tax deduction: either in the amount of expenses previously incurred when purchasing the land, if supporting documents are available, or in a fixed amount of 1 million rubles.

A deduction for land tax is 6 acres, which are not taxed for the categories of individuals listed above.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legislation

Receiving a tax deduction for the purchase of a land plot is subject to the norms of the tax legislation of the federation.

Subparagraph 3 of paragraph 1 of Article 220 of the Tax Code speaks in detail about the tax deduction for the purchase of land. It describes the conditions and circumstances for providing such a discount on a citizen’s obligations to the state when making a transaction.

And you should also pay attention to the Federal Tax Service document from 2012. It explains what exactly is meant by those assets for which a payment reduction can be applied.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(free call for all regions of Russia)

How to find out the cadastral value?

Data on the cadastral value of land plots can be obtained in two ways:

- Submit a written application to the Rosreestr authorities at the location of the allotment;

- View in a special section of the Rosreestr website.

To obtain information from the site, you must enter the cadastral number of the plot in the format xx:xx:xxxxxxx:xxx (for example, 61:39:0010102:332) in a special field and click the “Find” button. The displayed cadastral value of the plot in rubles is the tax base.

You can find out the cadastral value of buildings and structures located within the boundaries of the plot in the following ways:

- In the multifunctional center (MFC);

- By postal request;

- By request to the cadastral chamber;

- Electronically through the Rosreestr website;

- Courier delivery.

The cost of providing this information for individuals is three hundred rubles. For WWII veterans and disabled people of the first and second groups, the service is provided free of charge.

List of documents required to receive a tax refund

- Application for a deduction

- Certificate of ownership (copy). If the nature of the acquisition of real estate is joint ownership, then when submitting an application this fact should be indicated for the distribution of interest on tax compensation

- Form 3-NDFL (it can be obtained from the tax office or downloaded from the Internet)

- Form 2-NDFL (a certificate is taken from the place of work; it is issued specifically for the year for which the taxpayer plans to receive a deduction)

- Payment and other types of documents that confirm payment for the purchase of real estate

- Passport and TIN (copies)

Disabled people of the third group

A disabled person in this group is a person who is limited in his life activities due to injury, illness or defect from birth. Group 3 disability is established for one year or for life. The individual receives a certificate. It is this that should be considered the basis document for obtaining a tax benefit. This category of citizens is not exempted by federal law from full payment of tax. Only municipalities are vested with this power. And it is possible to reduce the cadastral value of the tax by only 10 thousand rubles.

The procedure for submitting a package of documents to the tax authorities

Copies from the above list can be certified by a notary or certified yourself. If the documents are certified by you, then you need to put a stamp in the organization where you work. On each page, the accountant or manager must sign and write “Copy is correct” indicating the current date.

The application submitted to the Tax Inspectorate is drawn up in any form. But for convenience, you can use the recommendations compiled by tax officials. In any case, your application must be accepted on the same day. Moreover, you must have 2 copies of documents. You transfer one of the packages to the tax office, and keep the other package for yourself. When your documents are accepted by tax officials, you have the right to request a mark on acceptance of the documents. In this case, you must be given a certificate indicating the list of accepted documents signed by the employee. It is also possible to send the necessary materials to obtain a tax deduction by mail. In this case, send a registered letter with notification. To do this, you need to create an inventory of attachments, where you need to describe what you are sending.

In certain cases, situations may arise when tax officials refuse to accept documents from you personally. They may claim that they need to check your documents, and only after that they will supposedly be able to accept them. This is contrary to the rules for accepting applications for tax deductions. In such a situation, you should also send documents to the Tax Inspectorate by mail. Keep your postage receipts and certified mail return receipt in case you have to explain that you already sent the application letter.

If insurmountable circumstances do not allow the taxpayer to independently submit an application to the tax authority, it is possible to draw up a power of attorney, under which the authorized person has the right to represent the interests of the buyer. A person acting on the basis of such a power of attorney can submit documents to the tax authority, as well as sign on behalf of the person who issued the power of attorney.

The legislation of the Russian Federation establishes a period during which a tax inspector must consider an accepted application. This period is 3 months.