Tax legislation provides for the right to apply the deduction of VAT amounts on acquired assets, i.e. reduce the amount of accrued tax by tax deduction. The deductible tax amount is formed under the conditions when goods or services are accepted for accounting, are used in transactions subject to VAT, and the transaction is confirmed by an invoice. Moreover, you can exercise the right to apply a deduction in later periods than in the quarter in which goods or services were accepted for accounting, by declaring the deduction in the declaration within 3 years from the moment the assets were accepted for accounting.

The tax period for VAT calculations is a quarter, and upon completion of each, an enterprise or entrepreneur must submit a corresponding declaration to the Federal Tax Service. If in the quarter there were many acquisitions of assets for significant amounts, then the deductions for them will be very significant, and their one-time presentation can significantly reduce the amount of tax payable, or completely eliminate it, reflecting only a VAT refund from the budget.

Such a situation is undesirable for an enterprise, since the Federal Tax Service will not ignore it, initiating a desk and often on-site inspection of the company. Therefore, before submitting a VAT return, a company should ask what part of the tax can be deducted, while avoiding an inspection by the Federal Tax Service.

How to calculate the share of VAT deductions in 2021

The share of tax deductions for VAT is an indicator of assessing the state of affairs in the organization. Organizations that do not wish to provide information to the inspectorate about the reason for reducing the tax burden risk being included in the list of those who received notification of the appointment of an on-site inspection. If an organization, when compiling information on the tax burden at an enterprise, finds itself at risk according to this criterion, it is recommended to submit an explanation to the tax office about the reasons for the current situation, without waiting for requirements from the inspectorate. Calculation of the share of deductions and comparison with the threshold value approved for 2021 for the region in which the organization operates will help to assess the risks. This indicator represents the percentage of VAT deductions in the amount of accrued VAT. For the calculation, only two values from the declaration are required:

- Line 190 “VAT deductible”;

- Line 110 “VAT accrued”.

We calculate the indicator: VAT deductible / VAT accrued * 100%. An indicator in dynamics is informative, that is, a change in the values of the indicator over two or three reporting periods. Having carried out the necessary calculations, we will find out what percentage of the accrued VAT the organization deducts. This value is compared by tax authorities with a threshold value in order to identify the degree of VAT tax risks in the organization. Organizations with a threshold value higher than that approved in the region in which the organization is registered immediately come under the close attention of inspectors. An example of calculating the share of VAT deductions for an organization (Moscow) According to information from the declaration for the 1st quarter, VAT was charged in the amount of 1,000,000 rubles. The tax deduction for the 1st quarter amounted to 900,000 rubles. The share of VAT deductions = 900,000 / 1,000,000 * 100% = 90% Let us turn to the background information of the internal reporting of the Federal Tax Service of Russia (report on form No. 1-VAT). For the date we are interested in, we establish that the share of tax deductions for VAT in 2021 (Moscow) is 89.9%. In our case, the share of VAT deductions exceeds 89%, explanations for the tax office in this case will be useful, since this is more than the threshold value for Moscow, which means the organization faces a call to the tax office to give explanations. If the share of tax deductions for VAT exceeds 89%, what should I answer to the tax office?

Operations included in expenses when distributing input VAT

In order to distribute the input tax, the cost of shipped goods (work, services) must include goods (work, services) sold on the territory of the Russian Federation and abroad (determination of the Supreme Arbitration Court of the Russian Federation dated June 30, 2008 No. 6529/08).

General business expenses for non-taxable operations on the territory of the Russian Federation must be taken into account in the cost of goods (work, services) that form these expenses. These amounts are not accepted for deduction (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 1407/11).

The use of another, different from the regulated clause 4.1 of Art. 170 of the Tax Code of the Russian Federation, the methodology for drawing up the proportion is illegal (resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2009 No. A33-7683/08-F02-959/09).

High share of tax deductions for VAT. Response to the tax office

After submitting your VAT return, did the tax office receive a request to provide an explanation for the high share of VAT deductions? An example of an explanation is easy to find in open sources, but it is not worth wasting time because explanatory documentation can be provided in any form. It is recommended to indicate that:

- the indicators indicated in the declaration are correct, re-checked and approved in the previous values;

- the organization did not make errors or incompletely reflect information, and clarification is not required;

- The organization has taken measures to increase these indicators in the next reporting period and reduce the share of VAT tax deductions.

It is recommended to decipher and attach to the explanatory note the calculation of the disputed values of the indicators and documentation confirming the information provided in the documentation. To explain why an organization has a high share of VAT tax deductions, an explanation (it is difficult to find a suitable example, because the reasons for each organization are individual) should be provided with the requested documentation attached within five banking days. Without providing written explanations on the issues requested by the inspectors, the entrepreneur is not liable before the law. But a timely response to the tax authorities’ demands on a voluntary basis will save the organization from problems with unreasonable penalties, which inspectors, at their discretion, will impose on the enterprise on controversial issues. Unfortunately, in such situations, controversial issues are resolved not in favor of the organization. Of course, the tax inspectorate evaluates the tax risks of companies based on more than one indicator, so just exceeding the values established on the basis of statistical information will not be the reason for an audit, but it will certainly be the basis for additional demands from inspectors. It is fair to note that, working within the specified indicator, an entrepreneur is not immune from tax audits. So, before submitting the declaration, the leaders of the organization should check such an indicator as the share of tax deductions for VAT, because exceeding the threshold value will provoke a keen interest in the company on the part of the inspection authorities. Although, if the company’s business is legitimate and legal in nature, and the transactions are not related to “fly-by-night companies,” then both the accountant and the director have nothing to fear and have something to provide tax officers with as an objection to the claims. For example, to indicate the objective reasons for the high share of tax deductions for VAT, we will consider a sample explanation.

Consequences of failure to comply with the optimal amount of deductions

Safe percentages of deductions are established for a reason. The state must replenish the budget through taxes in any case, and VAT is the most administered tax, which brings in the majority of revenue. At the same time, one cannot put too much pressure on the business community, as this is fraught with negative consequences. That is why, in the opinion of tax officials, the optimal amount of deductions was chosen, which should suit everyone.

If a company exceeds the safe percentage of deductions, the inspection will first of all require an explanation. In the event that the taxpayer’s explanations seem unconvincing to the tax authority, a decision is usually made to conduct an on-site audit, with all the ensuing consequences.

How to explain the high share of VAT tax deductions

The task of the head of the organization, in the case of high values of the share of VAT deductions, is to reduce the risk of including the enterprise in the on-site inspection plan, and therefore to prove that the reasons for this are objective. In each specific case, the organization provides period-appropriate reasons why the share of tax deductions exceeds the threshold value. How to explain to the tax authorities the high proportion of VAT deductions? Let's consider five reasons, as a sample explanation to the tax office about the high share of tax deductions for VAT. They can explain the occurrence of such a situation in the organization.

Reason 1. The company has just recently been registered

Organizations whose business is just starting do not have a sufficient market, but a “young” company has plenty of expenses. For example, invoices for office and warehouse rent, advance payment for electricity, Internet connection, telephone connection, purchase of goods to a warehouse for subsequent resale, etc. In this situation, the organization has a lot of expenses, but sales have not yet been established and do not generate enough income to cover expenses. In the explanations for the inspector, we indicate the reason for the increase in the indicator: “Due to the start of business activities, the company’s costs exceed its income. To organize the work of the office and warehouse, the necessary equipment and furniture were purchased, and the services of companies providing communication services were paid for. Advance payments have been made to connect the company to electricity and heating. Products have been delivered to the warehouse, the sale of which is planned for the next quarter.” As an appendix, we provide constituent documentation confirming the date of registration of the company, as well as all primary documents confirming the listed costs: invoices, accounting cards, contracts, invoices, acts for the provision of services, etc.

Reason 2. Replenishment of goods for subsequent resale

For example, the head of an organization issued an order to stock the warehouse with products that will become more expensive in the next quarter, so buying goods in advance means acquiring additional profit from the difference in price. As a result, the warehouse will be replenished with goods, and a high proportion of deductions will be reflected in tax accounting. In the explanations we indicate: “replenishment of the warehouse with goods for subsequent sale in a future period.” We attach documents confirming the accuracy of the information provided: accounting cards confirming the receipt and balance of goods in the warehouse, a copy of the agreement for the purchase of products, invoices.

Reason 3. Seasonality of business

Sales volumes of some types of goods depend on seasonality, for example, products for winter fishing or lawn mowers. Sales of such goods practically cease outside the season for which they are intended for use. However, costs, for example, for storage and warehouse maintenance, remain. Therefore, the deductions are high. In the explanations we indicate: “seasonality of the product.” We attach documents confirming the availability of expenses and balances in the warehouse.

Reason 4. Late receipt of invoices from counterparties

An invoice can be accepted for deduction only upon receipt of it from the counterparty. Upon receipt of the original invoice, the organization records its receipt by mail in a special journal. But, unfortunately, the post office is not always impeccable in the quality of the services provided, and correspondence is “delayed” and sometimes completely lost. It is not surprising that invoices are received by the accounting departments of organizations with a delay. As a result, we accept some invoices for deduction in the tax period following their issue. The law provides for the possibility of submitting an invoice at a later date; it is enough to attach an explanation justifying such actions on your part. In the explanations we indicate: “acceptance for deduction of invoices issued in the previous tax period due to a delay in the receipt of the specified documentation by the organization.” We attach documents confirming the accuracy of the information provided: an extract from the invoice register, a copy of the invoice itself, an extract from the purchase book about the absence of the specified invoices in the previous tax period.

Reason 5. Small trade margin (during resale) or small added value (during production)

The market sets the price level above which the organization cannot set the price of the goods it sells. Therefore, in order to maintain their position in the market, some companies set minimum markups and surcharges on products. During production, a situation may additionally arise when raw materials for production are purchased at a VAT rate of 10%, and sales at 18%. In the explanations we indicate: “a small trade margin in order to maintain the competitiveness of the organization.” We attach documentation confirming the accuracy of the information provided: copies of contracts for the purchase of goods or raw materials, invoices for the purchase and shipment of products. Of course, these are just some of the reasons that will be accepted by the inspector as an explanation to the tax office about the high share of VAT deductions (sample: reason 1).

Rules for drawing up proportions

The proportional distribution of input VAT must be carried out in the tax period in which the purchased goods were accepted for accounting (letter of the Ministry of Finance of Russia dated October 18, 2007 No. 03-07-15/159).

Another requirement of the tax authorities: the amounts taken into account when determining the proportion must be determined in comparable terms. To do this, VAT should be deducted from the cost of shipped goods (letters of the Ministry of Finance of Russia dated August 18, 2009 No. 03-07-11/208, June 26, 2009 No. 03-07-14/61 and June 17, 2009 No. 03-07-11/162) . Similar conclusions are contained in court decisions (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 18, 2008 No. 7185/08, FAS West Siberian District dated November 21, 2012 No. A03-18530/2011, FAS Ural District dated June 23, 2011 No. F09-3021/11- C2, FAS East Siberian District dated 10/08/2010 No. A78-1427/2009).

The opposite point of view was expressed by the judges in the resolution of the Federal Antimonopoly Service of the West Siberian District dated March 4, 2008 No. F04-1298/2008 (1320-A03-29), indicating that in Art. 170 of the Tax Code of the Russian Federation there is no direct indication of the exclusion of the amount of tax from the cost of shipped goods.

For information on how to distribute input VAT if there was no shipment in a given period, see the material “Separate accounting of VAT in non-income periods is carried out according to taxpayer rules”

Special rules for calculating the proportion are provided for by the Tax Code of the Russian Federation in the following cases (paragraph 4, clause 4, article 170 of the Tax Code of the Russian Federation):

- during operations with financial instruments of futures transactions (clause 2, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- for organizations carrying out clearing activities (clause 3, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- when carrying out transactions exempt from VAT:

- providing a loan in cash or securities (clause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation);

See also “Loan Interest Affects Separate Accounting.”

- REPO operations (clause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation);

- sale of securities (clause 5, clause 4.1, article 170 of the Tax Code of the Russian Federation).

See the material “Explained how to calculate the proportion for separate accounting if there was a sale of securities”

VAT and its functional features

The most collected and audited tax in our state is VAT - value added tax. All production enterprises (organizations, firms, companies, etc.) subject to general taxation are required to pay it to the state budget.

To understand the deductions for this tax, you should consider the concept of “VAT” itself. Officially, this tax payment represents some increase in the cost of a product. That is, VAT is nothing more than the difference between the price set for a product (or service) intended for sale and the amount of costs that the manufacturer spent on their production. Thanks to these properties, such a tax has a direct impact not only on pricing in our state, but also performs a regulating function of demand for any goods. The payment of VAT is regulated by state laws, namely the Tax Code.

What to do if the deduction was accepted incorrectly

In the event that a deduction for the total amount of value added tax (from already completed transactions) is accepted erroneously, experts recommend several ways to correct the unpleasant situation:

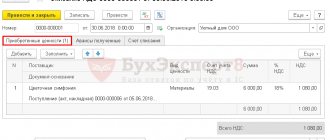

- Use special accounting entries:

- to reflect profit from previous years (Dt 60 Kt 91.1);

- in case of serious errors (Dt 60 Kt 84);

- to restore payment of value added tax to the state budget (Dt 68.2 Kt 19.3).

- Draw up a special accounting certificate in which data on the identified error will be recorded indicating the reporting tax period.

All these operations are carried out independently, without using the 1C accounting program.