Attention! From November 25, 2021, an application for amendments to an LLC must be submitted using a unified form P13014. In a new article, we talked about filling out form P13014 when changing the address.

The Civil Code of the Russian Federation does not give the exact concept of a legal address, but determines that the registration of an organization is carried out at the location of its permanent executive body. This executive body is the director of the LLC, therefore the legal address is the address where the director is located: office or his home address (if the company is registered under the director’s registration).

Law dated 05.05.2014 N 99-FZ separated the concepts of “location of a legal entity” and “address of a legal entity”:

- location is the name of the locality;

- The address of a legal entity is the full address of the LLC indicated in the Unified State Register of Legal Entities.

The unified state register of legal entities must indicate the address of the legal entity within the location of the legal entity (clause 3 of article 54 of the Civil Code of the Russian Federation).

It is necessary to know the difference between these concepts, because changing the address of an LLC within the same locality and changing its location are formalized differently.

Free consultation on business registration

How to fill out the form when changing your legal address? The charter can only indicate a locality (for example, Kazan), so if you move within the same locality, then changes to the charter are not made. In this case, form P13014 is filled out with feature 2 - change of information in the Unified State Register of Legal Entities. If there is a change in the location of the legal entity, i.e. name of the locality (the organization moved from Kazan to Nizhny Novgorod), then sign 1 is indicated in the form - making changes to the constituent document.

How to change legal address? Read our step-by-step instructions for changing the address of a legal entity 2021.

General rule

According to paragraph 1 of Art.

Tax Code, organizations are subject to registration with the tax authorities at the location of the organization and the location of its separate divisions. It clearly follows from this that a change in the location of an organization also entails deregistration at the previous location and tax registration at a new location. This operation is carried out by the tax authorities independently, in the manner prescribed by clause 4 of Art. Tax Code of the Russian Federation. Thus, the tax authority at the old address must, within 5 working days from the date of making the relevant entries in the Unified State Register of Legal Entities, deregister the company and send the documents to the new inspectorate. The tax authority at the new address, having received these documents, must register the organization for tax purposes. In this case, the registration certificate issued to the organization by the tax authority at the previous location is declared invalid and is not submitted to the tax authority at the new location. The date of registration of the organization at the new location is the date of entry into the Unified State Register of Legal Entities about the change in the location of the legal entity (clause 3.6.3 of Appendix No. 1 to the order of the Ministry of Taxes of Russia dated 03.03.2004 No. BG-3-09/178).

The determining factor when moving is the date the new address is reflected in the Unified State Register of Legal Entities: until this date, the company continues to be registered for tax purposes at the old address, and from the date of the change in the Unified State Register of Legal Entities - at the new one. (This rule applies despite the fact that the Tax Code of the Russian Federation allows 5 days for the actual transfer of the case and the taxpayer may not yet have a new certificate).

So the answer to the question about the procedure for paying taxes and submitting reports, as a general rule, depends on whether an entry will be made in the Unified State Register of Legal Entities on the date of payment or submission, respectively, about a change in the location of the legal entity. It is necessary to control the entry using the corresponding extract from the register. Fortunately, it’s now easy to order it without leaving the office.

Order a “fresh” extract from the Unified State Register of Legal Entities

Having decided on the general rule, let's take a closer look at each tax separately, since there are no rules without exceptions.

Who needs to be notified about a change of legal address?

There are several organizations that should be aware of a legal entity's address change:

- Pension Fund and Social Insurance Fund. The IRS will notify them, so you don't need to file anything. After receiving information about the change of legal address, the Pension Fund and the Social Insurance Fund themselves will send documents to the territorial offices of the funds at the future place of registration, and the company will be registered.

- Statistics. There is no need to report, but if you moved to another region, the statistics codes will most likely change. They can be printed from the Rosstat website.

- Bank. Notifying him of a change of legal address is the direct responsibility of the legal entity. The manager writes a letter to the bank and asks to make changes to the company’s bank card. As justification, attaches a sheet of entry from the Unified State Register of Legal Entities with new details.

- Counterparties. It will be enough for them to send a registered letter and inform them about the changes that have occurred.

In order not to get confused in the procedures for changing your legal address, we recommend using the legal support service. This way, you will not only save time, but are also guaranteed to avoid errors in registration documents, thereby preventing possible conflicts with tax authorities.

Income tax

In accordance with paragraph 1 of Art. 288 of the Tax Code of the Russian Federation, taxpayers - Russian organizations with separate divisions - calculate and pay advance payments to the federal budget at their location without distributing these amounts among separate divisions. Payment of advance payments to be credited to the revenue side of the budgets of the constituent entities of the Russian Federation is made by taxpayers - Russian organizations at the location of the organization, as well as at the location of each of its separate divisions.

As we can see, the Tax Code of the Russian Federation connects the transfer of advance payments with the location of the organization at the time of their payment. This means that the amount of the advance payment is transferred by the organization to the budget at the place of its previous location, if the payment is made before the entry into the Unified State Register of Legal Entities about the change of location. After such an entry appears, the tax must be paid to the budget at the new address. This rule applies when transferring any advance payments (both quarterly and monthly, including those calculated based on actual profit), as well as when paying tax at the end of the year.

It is somewhat more complicated with income tax reporting, since it is always submitted for the past period (Clause 1, Article 289 of the Tax Code of the Russian Federation). But at the same time, the Tax Code of the Russian Federation states that such a declaration must be submitted to the tax authorities at the location of the organization and the location of each of its separate divisions. And in the order of filling out the income tax return (approved by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/ [email protected] ), these provisions are specified. In particular, clause 3.2 of the Procedure states that the declaration indicates the checkpoint assigned to the organization by the tax authority to which the declaration is submitted. In this case, the checkpoint of the organization at its location is indicated in accordance with the document confirming the registration of the organization with the tax authority.

This means that the above general rule will apply when submitting reports. If the reporting is submitted before an entry is made in the Unified State Register of Legal Entities about a change in the location of the legal entity, then it must be sent to the “old” inspectorate (after all, this is the checkpoint indicated in the current certificate of registration). And if the reporting has to be submitted after the move (that is, when the old certificate has already lost its validity), then it must be submitted to the “new” Federal Tax Service, even if this declaration relates to the periods preceding the move.

For example, if an organization changed its address in February 2021 (the date of entry in the Unified State Register of Legal Entities is February 20), then it must submit an annual tax return for 2021 to the old inspectorate if it does so before February 19 inclusive. And from February 20, such a declaration must be submitted to the tax authority at the new address, indicating the relevant checkpoints and OKTMO (clause 4.1.2 of the Procedure for filling out the income tax return).

Incorrect completion of the OKTMO code is not grounds for refusal to accept a tax return (clause 28 of the Administrative Regulations of the Federal Tax Service, approved by order of the Ministry of Finance of Russia dated 07/02/12 No. 99n, letter of the Federal Tax Service of Russia dated 02/25/2014 No. BS-4-11/3254 ). Also, incorrect indication of the checkpoint and (or) OKTMO when paying taxes does not entail the accrual of penalties or fines (see “What to do if there is an error in the tax payment form”).

What documents need to be prepared

Before you begin the procedure for changing the LLC address, make sure you have the necessary package of necessary documentation.

To prepare for filing an application to change your legal address:

- ID card of the general director;

- TIN of the general director;

- document certifying ownership (or lease agreement) to the received address (copy).

To register a changed address at the INFS office:

- a prepared statement, certified by a notary, in the form P13001 (for statutory changes) or P1400 (for changing data only in the Unified State Register of Legal Entities);

- minutes of the general meeting on changing the location of the form (not necessary if changes will not be made to the charter);

- the charter of the organization or the list of amendments adopted to it - 2 copies (not necessary if the data will change only in the Unified State Register of Legal Entities);

- a receipt for payment of the state duty (in 2021 this is 800 rubles);

- papers certifying the rights to the declared premises (copies).

For a notary when certifying an application:

- all documents listed above;

- a fresh (not older than a month) extract from the Unified State Register of Legal Entities;

- statutory documents of the organization;

- TIN of the organization;

- OGRN certificate;

- document on the appointment of the head of the company.

NOTE! The notary will only need to see the originals of these documents; he will not need to leave copies. Check the exact list of documents with a specific notary before contacting him.

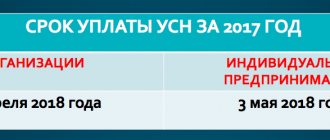

simplified tax system

Payment of tax under the simplified tax system and advance payments thereunder, in accordance with clause 6 of Art. 346.21 of the Tax Code of the Russian Federation, is carried out at the location of the organization. A tax return is also submitted at the location (clause 1 of Article 346.23 of the Tax Code of the Russian Federation).

Fill out and submit a new declaration under the simplified tax system via the Internet for free

These wordings mean that the “Unified State Register of Legal Entities” algorithm is used without any reservations when changing the address by companies using the simplified tax system: while the old address is in the register, the tax and (or) declaration is paid and submitted to the “old” tax office (indicating the corresponding checkpoint and OKTMO). And from the date of changes to the register, money and reporting must be sent to the inspectorate at the new location of the company, indicating the new checkpoints and OKTMO. We again find confirmation in the order of filling out the declaration under the simplified tax system (approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected] ). Clause 3.2 of the Procedure, as in the case of income tax, states that it is necessary to indicate the checkpoint of the exact tax authority to which the declaration is submitted. And you need to take this checkpoint from the registration certificate.

Possible problems and how to avoid them

When changing the legal address, LLC representatives may encounter certain difficulties. To avoid problems with regulatory authorities, carefully check all the information provided, especially about the new legal address. If the INFS, for any reason, doubts the authenticity of the change in the location and/or registration of the LLC, most likely the change procedure will be suspended. This is done to verify the data provided. The check will not take too long - the law allows for a maximum of 30 days. If no violations are found, the tax office will issue a document - a decision to change the address. If the data does not match, the LLC will receive a refusal.

VAT

According to paragraph 2 of Art. 174 of the Tax Code of the Russian Federation, the amount of tax payable to the budget for sales operations (transfer, execution, provision for one’s own needs) of goods (work, services) on the territory of the Russian Federation is paid at the place of registration of the taxpayer with the tax authorities. That is, in this case the general rule we derived also applies. If VAT is transferred to the budget before the date of entry into the Unified State Register of Legal Entities about a change of location, the tax is paid by the organization using the details of the “old” inspection. If the tax is paid after making the specified entry in the register, then it should be transferred according to the details of the “new” Federal Tax Service.

We again find confirmation of this rule in the order of filling out the VAT return (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ). Paragraph 18 of the Procedure says that the checkpoint for reflection in the declaration must be taken from the certificate of registration. And clause 34.1, that the declaration indicates the OKTMO of the territory where the tax is paid (i.e. at the location of the organization - Article 174 of the Tax Code of the Russian Federation).

Transport tax

According to paragraph 1 of Art. 363 of the Tax Code of the Russian Federation, payment of transport tax and advance payments on it is made by taxpayers to the budget at the location of the vehicles. By virtue of paragraphs. 2 clause 5 art. The Tax Code of the Russian Federation recognizes the location of vehicles (except for water and air vehicles) as the location of the organization or its separate division, under which the vehicle is registered in accordance with the legislation of the Russian Federation. Registration of vehicles for legal entities is carried out at the location of legal entities, determined by the place of their state registration, or at the location of their separate divisions. This is provided for in paragraph 28 of the “Rules for registration of motor vehicles and trailers for them in the State Road Safety Inspectorate of the Ministry of Internal Affairs of the Russian Federation” (approved. by order of the Ministry of Internal Affairs of Russia dated June 26, 2018 No. 399).

It turns out that the general procedure for paying tax when moving should also apply here. However, there are some subtleties regarding transport tax.

The fact is that, according to paragraph 1 of Art. Tax Code of the Russian Federation, an organization is subject to tax registration at the location of its vehicles. Moreover, such registration is carried out not at the request of the organization, but automatically, on the basis of traffic police data, clause 5 of Art. Tax Code of the Russian Federation(). This means that if the location changes, the company continues to be registered with the “old” tax authority as the owner of the vehicle until the registration authority receives data on the deregistration of vehicles due to a change in the location of the taxpayer. It turns out that for some time the organization must pay tax and report simultaneously to two tax authorities: to the “new” one, due to the direct indication in Article 363 of the Tax Code of the Russian Federation, and to the “old” one, because before receiving data from the traffic police, he is registered with it at the location of the vehicles.

As for reporting, we find a way out of this conflict in clause 5.1 of the Procedure for filling out a transport tax declaration (approved by order of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21 / [email protected] ). It says that if the location of the organization changes and a vehicle is deregistered during the tax period in the territory subordinate to the inspectorate at the previous location of the organization, the declaration is submitted to the inspectorate at the new location of the organization and registration of the vehicle. In this case, section 2 of the declaration is submitted for each OKTMO, on the territory of which vehicles are (were) registered for the taxpayer in the tax period, taking into account the coefficient determined by the code of line 160 of the declaration.

Fill out and submit your transport tax return for 2021 for free online

As for paying tax, we believe that here we need to be guided by the provisions of Art. 363 Tax Code of the Russian Federation. That is, from the moment of changing the address in the Unified State Register of Legal Entities, you must pay tax (including for the period before the move) at the new location. After all, a change in the location of the organization by virtue of clause 5 of Art. The Tax Code of the Russian Federation entails an automatic change of location of vehicles for tax purposes. And in this case, the Tax Code of the Russian Federation does not establish any dependence on the actions of the traffic police and the registration of the taxpayer at the location of the vehicle.

Why change these registration details?

Legal address is the place where the organization is located, reflected in its charter and enshrined in the state register of legal entities. The address at which a legal entity is registered not only determines its territorial location, but also indicates its relationship to a particular regulatory tax authority.

Will the registration number in the Pension Fund change if the organization changes its location ?

If an LLC or a legal entity of another organizational and legal form of business needs to change its legal address, this may be caused by one of the following reasons:

- moving the center of activity to another region;

- more convenient location for reporting;

- the possibility of effective cooperation with another department of the INFS;

- the contract for the provision of a legal address has expired and cannot be renewed.

IMPORTANT! If the address changes, this does not necessarily mean an automatic change in the tax office; sometimes moving the location of a company remains within the scope of the previous INFS division.

Property tax

According to paragraph 3 of Art. 383 of the Tax Code of the Russian Federation, in relation to property located on the balance sheet of a Russian organization, tax and advance payments for tax are subject to payment to the budget at the location of the specified organization. At the same time, for real estate objects in respect of which the tax base is determined as the cadastral value, the tax and advance payments for the tax are subject to payment to the budget at the location of the real estate object (clause 6 of Article 383 of the Tax Code of the Russian Federation)

By virtue of Art. 384 of the Tax Code of the Russian Federation, an organization that includes separate divisions that have a separate balance sheet pays tax (advance tax payments) to the budget at the location of each of the separate divisions. A Art. 385 of the Tax Code of the Russian Federation requires that an organization that takes into account real estate objects on its balance sheet that are located outside the location of the organization or its separate division that has a separate balance sheet, pays tax (advance tax payments) to the budget at the location of each of these real estate objects.

We see that property tax has different payment rules depending on the type of object of taxation. Therefore, here the accountant needs to be doubly careful. But in the general case, property tax also obeys the general rule that we derived above. According to clause 4.2 of the procedure for filling out a tax return for property tax (approved by order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21 / [email protected] ), in section 1 of the declaration on line 010 the OKTMO code for which it is subject to payment of the tax amount. This means that after making an entry in the Unified State Register of Legal Entities, in this line we indicate the OKTMO of the new address.

The exception is the amount of tax (advance payments) paid in relation to real estate for which the tax base is determined as the cadastral value, and also which are located outside the location of the organization or its separate divisions that have a separate balance sheet. According to the property, property tax is always paid to the budget at their location. The tax return is also submitted there (clause 1 of Article 386 of the Tax Code of the Russian Federation).

How to pay personal income tax

In accordance with paragraph 7 of Art. 226 of the Tax Code of the Russian Federation? the amount of tax withheld by the tax agent is paid to the budget at the place of registration of the tax agent with the tax authority. At the same time, tax agents—Russian organizations with separate divisions—are required to transfer calculated and withheld tax amounts to the budget both at their location and at the location of each of their separate divisions.

From the above it follows that the procedure for transferring personal income tax is “tied” to the location of the organization. Therefore, in this case, our “Unified State Register of Legal Entities” algorithm will be fully applied in relation to withheld personal income tax amounts: if the period established by clause 6 of Art. 226 of the Tax Code of the Russian Federation comes at a time when, according to the Unified State Register of Legal Entities, the organization has not yet moved, then the amounts must be sent to the budget according to the old OKTMO. And if on the date of the tax transfer deadline a new address is already registered in the Unified State Register of Legal Entities, then the corresponding OKTMO address should be indicated. At the same time, the amounts paid before the move will not be lost, because after removal, the inspection will transfer the tax agent’s budget settlement card to the “new” card according to the appropriate OKTMO (letter of the Federal Tax Service of Russia dated December 27, 2016 No. BS-4-11 / [email protected ] ).