Employer reporting

Natalya Vasilyeva

Certified Tax Advisor

Current as of February 6, 2020

When registering with the FSS, organizations and individual entrepreneurs are assigned several numbers, one of which is a subordination code. Let's figure out where this code is reflected and how to find it out if you don't have a notification from the FSS at hand.

What is the FSS subordination code?

The subordination code is assigned by the FSS in relation to a legal entity or individual who is an insured. The FSS is addressing this issue on the basis of Federal Law No. 255 of December 29, 2006. This standard states that the code is assigned:

- within three working days from the date of receipt of information from the tax office;

- along with carrying out the registration procedure for a separate division;

- together with the registration of an individual entrepreneur or an individual who has entered into an employment agreement with an employee.

After this, the Social Insurance Fund sends a notice of registration, which displays the registration number and code of subordination (clause 1.1 of article 2.3 of Federal Law No. 255). This parameter characterizes the affiliation of the person who insured this or that object to a certain branch of the Social Insurance Fund.

To decipher this number, it is best to use the clues contained in Order of the Ministry of Labor of the Russian Federation No. 202n dated April 29, 2021.

If we consider this combination from left to right, the first four digits indicate the code of the territorial department, the last digit depends on the legal form of the entity. For individuals - 3 , for divisions - 2 , for individual entrepreneurs who registered voluntarily - 4 , for legal entities - 1 .

The value of the subordination code for each policyholder is displayed in the reporting prepared according to Form 4-FSS. This mark is placed on the title page. Without having information about this data, the accountant will not be able to send a report. If the information is stored only in paper form, there is a possibility of claims from FSS inspectors .

Registration with the Social Insurance Fund

Subclause 1 of clause 1 of Article 4.1 of Federal Law No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” provides for the right of policyholders to apply to the Fund for payment of compensation upon the occurrence of certain events.

According to Article 2.1 of the said rule-making act, such entities include employers and customers of work, goods or services who make cash payments in cases established by law.

In accordance with paragraph 1 of Article 2.3 of the said Federal Law, all persons making payments to citizens of the Russian Federation are subject to registration with the FSS authorities at their location.

In order to regulate the registration of policyholders with the FSS of Russia, the Ministry of Labor of the Russian Federation issued Order No. 202n. This act approved the procedure for performing registration actions with social insurance subjects.

Clause 16 of the said Order provides that after the policyholder is registered with the Social Insurance Fund, he is assigned a unique registration number. In addition to the specified identifier, the corresponding person is provided with a code of subordination to the FSS (clause 19 of Order No. 202n).

The described indicator meets the following requirements:

- indicated in digital form;

- consists of five values.

From the analysis of this indicator you can find out:

- territorial Social Insurance Fund code at the location of the enterprise;

- the reason for registration with the Social Insurance Fund.

However, all of the specified values can be determined only by finding out the subordination code in the FSS.

It is important to note that the said Order of the Ministry of Labor and Social Policy of Russia contains only an indication of the mandatory assignment of the described indicator, but does not provide options for allowing the policyholder to find out his code. To fill this gap, let’s look at some of the available ways to obtain the required indicator.

Instructions for receiving

Thanks to the subordination code, in 2021 it is possible to obtain data on the exact address of the location of the enterprise and its territorial affiliation. In addition, the classification process is greatly simplified. Enterprises and individual entrepreneurs who have not completed the insurance procedure with the Social Insurance Fund risk receiving a fine for an impressive amount of money .

There is also a risk of confusing the numbers issued to the organization during registration and subordination codes. In practice, these figures are completely different. It is not difficult to distinguish them by the number of digits.

In the registration number their number is 10, while in the FSS combination it is 5. The enterprise ensures that the FSS code is indicated in the situation where a report is sent to government services. This can be done in paper and electronic format.

To send documentation correctly, it is worth considering that each document includes lines in which information is indicated. If there are errors in the code or if it is not indicated, the report will not be accepted. This may trigger reporting failures and the accrual of penalties. So indicating the subordination code is an important aspect, because this combination is of great importance.

Relatively recently, reform took place in the insurance industry. Due to the innovations included in it, many organizations have stopped avoiding payments to employees on sick leave. However, they encountered a lot of difficulties regarding sending the report to the FSS .

Voronezhskoe

Branch 1 Kominternovsky, Leninsky districts of Voronezh

Address:

394006, Voronezh, st.

Stankevicha, 43 Telephone:

Kominternovsky district 473-260-63-40, 473-260-63-39;

Leninsky district 473-260-63-42; specialists in insurance against industrial accidents and occupational diseases 473-277-89-39. Email: Branch 2 Nizhnedevitsky, Semiluksky, Khokholsky, Verkhnekhavasky, Novousmansky, Ramonsky districts of the VORONEZH REGION, Left Bank, Zheleznodorozhny districts of Voronezh Address:

394007, Voronezh, st.

Leningradskaya, 2 Telephone:

specialists: 473-260-62-78, 473-260-62-74.

Branch representative offices in the following areas: Zheleznodorozhny district, Voronezh 473-260-62-78; Left Bank district of Voronezh: 473-260-62-78; Nizhnedevitsk village 47370-5-12-72; Semiluki 47372-2-14-53; rp. Khokholsky 47371-4-15-94; s.V.Khava 47343-7-11-73; s.N. Usman 47341-5-56-01; rp. Ramon 47340-2-15-50; Levoberezhny, Zheleznodorozhny districts of Voronezh Email:

Branch 3 for payments to victims of industrial accidents and occupational diseases

Address:

394006, Voronezh, st.

Stankevicha, 43 Telephone:

specialists in working with citizens’ appeals 473-260-63-30, specialists in managing personal files of victims 473-277-86-91, 271-73-70.

Email:

Branch 4 Kalach (Kalacheevsky, Vorobyovsky, Petropavlovsky, Pavlovsky, V. Mamonsky, Bogucharsky districts of the Voronezh region)

Address:

397600, Voronezh region Kalach, pl.

Lenina, 12 Telephone:

specialists in working with policyholders 47363-2-29-05.

Branch representative offices in the following areas: Petropavlovka 47365-2-13-84, p. Vorobyovka 47356-3-12-69, Pavlovsk 47362-2-70-44, Boguchar 47366-2-08-68, p. V. Mamon 47355-5-65-13. Email:

Branch 5 of Liski (Novovoronezh, Liski, Kamensky, Ostrogozhsky, Repyevsky, Kashirsky districts of the Voronezh region)

Address:

397904, Voronezh region, Liski, Lenin Ave., 45a

Telephone:

specialists in working with policyholders 47391 -2-42-43.

Branch representative offices in the following areas: urban-type settlement. Kamenka 47357-5-23-14, Ostrogozhsk 47375-4-53-98, Repyevka village 47374-2-26-18, Kashirskoye village 47342-4-21-41, Novovoronezh 47364-2-18-94 . Email:

Branch 6 Rossosh (Rossoshansky, Kantemirovsky, Olkhovatsky, Podgorensky districts of the Voronezh region)

Address:

396650, Voronezh region, Rossosh, st.

Mira, 42 Telephone:

specialists in working with policyholders 47396-2-44-87.

Branch representative offices in the regions: rp. Kantemirovka 47367-6-17-05, village Olkhovatka 47395-4-01-03, village. Podgorensky 47394-5-43-01. Email:

Branch 7 Borisoglebsk (Borisoglebsky, Gribanovsky, Novokhopersky, Povorinsky, Ternovsky districts of the Voronezh region)

Address:

397160, Voronezh region, Borisoglebsk, st.

Svobody, 205 Telephone:

specialists in working with policyholders 47354-6-49-17.

Branch representative offices in the following areas: urban-type settlement. Gribanovsky 47348-3-03-85, Novokhopersk 47353-3-16-06, Povorino 47376-4-28-90, p. Ternovka 47347-5-16-40. Email:

Branch 8, Bobrov (Bobrovsky, Anninsky, Talovsky, Paninsky, Ertilsky, Buturlinovsky districts of the Voronezh region)

Address:

397700, Voronezh region.

Bobrov, st. them. Kirova, 10, room. 1 Phone:

specialists for working with policyholders 47350-4-20-58.

Branch representative offices in the following areas: urban-type settlement. Anna 47346-2-19-33, town. Talovaya 47352-2-36-49, Panino 47344-4-70-82, Ertil 47345-2-23-39, Buturlinovka 8-47361-2-24-64 Email:

Branch 9 Voronezh (Central, Sovetsky district of Voronezh)

Address:

394006, Voronezh, st.

Stankevicha, 43, (Sovetsky, Central districts) Telephone:

Sovetsky district 8-473-260-63-46;

Central region 8-473-260-63-47, specialists in insurance against industrial accidents and occupational diseases 8-473-277-91-22. Email:

How to find out

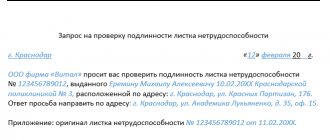

Finding the subordination code is not difficult in the enterprise registration certificate. If it is lost or there is no access to it, you can use other options, for example, obtain information from the Social Insurance Fund.

If errors are made during the code calculation process, this may result in fines ranging from 5 to 50% . Therefore, when a large number of specialists work at an enterprise, the amounts will be significant.

If you contact the FSS, you need to provide several documents :

- taxpayer identification number;

- passport;

- an order that can confirm the existence of the right to receive information;

- other documents (to be established at the discretion of the competent employee).

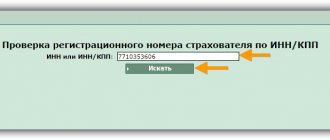

By TIN of the organization

Using your taxpayer identification number, you can find out information about the required code on the FSS website. To do this, you must follow the following instructions:

- register on the official FSS web resource;

- log into your personal account using your own login and password;

- follow the link;

- In the field that is free, indicate the TIN.

If the data is entered correctly, all information will be displayed on the screen, including the FSS subordination code .

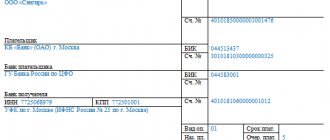

By registration number online

Another way is to obtain information through the territorial office of the fund. To do this you will need:

- TIN;

- identification document (usually a passport);

- an order indicating the existence of authority to obtain data.

Exact information about the list of documents can be checked by contacting the territorial office of the FSS. These papers will allow you to obtain reliable and complete information about the registration number, which, in turn, will lead to obtaining data about the code.

Common errors and penalties for errors in 4FSS

The most common mistakes that taxpayers make in their reports:

- The company data is incorrect: TIN, KPP, OGRN.

- An error in the insurance number, without the correct number indicated, the Fund will not count the report.

- There is no subordination code: it carries information about the affiliation of legal entities or entrepreneurs to a given region; if you do not enter it, you will not be able to submit the report.

- There were errors in the tables, they did not indicate the debt at the beginning of the period, the amount was set as non-accreting.

In case of late submission of the report:

- When the report is submitted, but with a delay, for each day of delay you face a fine of 5% of the amount of contributions for each full and partial month of delay, but not more than 30% and not less than 100 rubles.

- If the delay exceeds 180 calendar days, the fine will be 30% of the amount of contributions, and starting from the 181st day, the fine will additionally increase by 10% for each month of delay. In such a situation, the size of the maximum fine is not limited, and the minimum is 1,000 rubles.

- If the report was not provided to the organization at all and the official may be subject to a fine of up to 500 rubles.

Additional data for individual entrepreneurs

Individual entrepreneurs, having gone through the official registration procedure, also receive a subordination code. Along with this, they are assigned a registration number. It will remain unchanged for 2021. This value is mandatory in the reporting process.

The first four digits included in the registration number indicate the Social Insurance Fund in which the company was registered. The next six digits are the serial number of the individual entrepreneur. The code of his subordination always ends with the number 3. If it is some other number, you must make a second application to the Federal Insurance Service.

The formation of an individual entrepreneur's accounting file takes place on the basis of documentation received by the department. At the same time, the FSS stores it in electronic format. If an individual entrepreneur plans to change his place of residence, he will also have to change the code in the new place. To do this, you will need to submit an application to the local FSS office.

Along with this, the changes will also affect the subordination code . If an entrepreneur dismisses all employed employees, he will receive the right to deregistration, since there will be no need to make insurance contributions. To solve this problem, you will also need to submit an application, which is completed in a free form. After this, the deregistration procedure will take no more than 14 days.

Sometimes in the documentation used in the reporting process, there is a special field to indicate the code. It contains 4 cells. There is a space before the fifth. In this situation, regardless of location, all five digits without a space are required.

Payments made by the Federal Social Insurance Fund of the Russian Federation

In case of illness or injury of the insured, including in connection with an operation for artificial termination of pregnancy or in vitro fertilization, payment of benefits from the Social Insurance Fund of the Russian Federation is made from the fourth day, in other cases - from the first day of incapacity.

2. Maternity benefit The amount of the benefit in 2021 depends on average earnings, calculated in calendar days for the two previous calendar years (2017 + 2021), taking into account length of service.

If the length of service is less than six months, the benefit is limited to the minimum wage. Average monthly earnings are equal to the minimum wage if there is no salary for two years or if monthly earnings for 2 years are below the minimum wage. To calculate benefits, the following periods are excluded from calendar days for 2 years: - temporary disability, maternity leave, parental leave;

What does the subordination code give?

The main role of the FSS subordination code is the ability to obtain current and reliable information regarding the enterprise .

There are also a few more tasks. For example, preventing the illegal use of a communication network, the possibility of organizing a simple and accessible classification of organizations, searching for a particular branch of the Social Insurance Fund using a classifier.

Thus, the FSS subordination code represents an important indicator , which can be found out quite simply.

You can find out about the procedure for submitting reports to the Social Insurance Fund in the video below.