Invoice for individual entrepreneurs: with or without tax?

VAT payers cannot issue tax-free invoices to the counterparty - regardless of who the buyer is (individual entrepreneur or company).

It also does not matter that the buyer is not a VAT payer (for example, applies a simplified tax regime). Although in such a situation, if certain conditions are met, invoices may not be issued if the buyer is a VAT non-payer and the parties have agreed not to issue invoices. Tips for drafting a non-invoicing agreement can be found here .

You can find a ready-made sample agreement on non-issuance of invoices when selling goods under a supply agreement in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

If you are not a VAT payer or are exempt from tax, you can issue VAT-free invoices for individual entrepreneurs or companies:

- at their request;

- due to the requirements of tax legislation.

According to paragraph 5 of Art. 168 of the Tax Code of the Russian Federation, exempt from VAT under Art. 145 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up invoices without highlighting the amount of tax, but with the inscription or stamp “Without tax (VAT)”.

Important! ConsultantPlus warns As a general rule, there is no need to issue invoices for transactions that are listed in paragraphs 1 - 3 of Art.

149 of the Tax Code of the Russian Federation (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation). An invoice will have to be issued in two cases: For details, see K+. Trial access to the system is free.

What do sample invoices without VAT look like?

Let's look at two examples.

Example 1

Individual entrepreneur Elmir Gilmutdinovich Kasimov, who uses OSNO, entered into an agreement for the supply of 420 kg of beets with simplified Producer LLC. At the request of the entrepreneur, Producer LLC compiled and handed over an invoice to him. The company filled out the invoice in the usual manner, except for columns 7 and 8, dedicated to the rate and amount of VAT. In these columns, instead of numerical values, Manufacturer LLC put the inscription “Without VAT”.

This is what a sample invoice for an individual entrepreneur without VAT might look like:

Example 2

An entrepreneur using the simplified tax system, Nabiullin Timur Rudolfovich, provided a service to the company using the general system of Trading LLC. At her request, on May 20, 2020, the entrepreneur issued an invoice in the amount of RUB 54,150. without VAT.

What a sample invoice from an individual entrepreneur looks like without VAT, see below:

You can find out whether invoices without VAT need to be registered in the sales book in the Ready-made solution from ConsultantPlus by receiving free trial access to the system.

Filling example

As of October 1, 2017, new requirements for the preparation of this document began to apply. The filling procedure is as follows:

- In line (1) we indicate the serial number and date of issue. For all types of SF there is a common numbering. They are recorded in chronological order (it is allowed to add a letter designation to the number). When making corrections, in line (1a) we indicate the number of the correction; when filling out for the first time, a dash is added.

- Lines (2), (2a), (2b) contain information about the seller:

- for legal entities, it is necessary to indicate the full or short name, detailed address as written in the Unified State Register of Legal Entities, identification numbers (TIN/KPP);

for individual entrepreneurs, the full name, address as entered in the Unified State Register of Entrepreneurs, TIN and registration information are entered.

- If the shipper and the seller are represented by the same organization, in line (3) you must indicate “Same.” If the shipper is another company or person, enter the full or short name and address. We put a dash if the invoice relates to work or services.

- In line (5) you need to indicate the payment document number only if there is an advance payment; if there is no prepayment, then this item remains blank.

- Information about the buyer is entered in lines (6), (6a), (6b) similarly to (2), (2a), (2b). If the buyer and the consignee are represented by the same organization, in field (4) you need to put o. If the consignee is another organization, indicate its name and address. If the invoice is for work performed or services provided, a dash should be included.

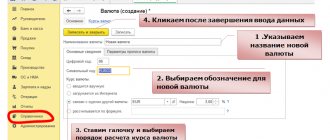

- In line (7) select the name of the currency. Accounting programs automatically enter the digital code.

- Line (8) is for the government contract ID. For other contracts it is not necessary to fill it out.

- The following columns are filled in in the table:

- Column 1 contains the names of goods, works or services.

- Column 1a indicates the product code. This field concerns only deliveries to the countries of the Euro-Asian Economic Union.

- Units of measurement are entered in columns 2-2a in accordance with OKEI. If the invoice concerns work or services, dashes should be added.

- In column 3 we indicate the quantity or volume based on units of measurement. If 2-2a is not filled in, there will also be a dash here.

- In column 4 the price per unit is entered as it is given in the contract.

- The total cost of each item excluding tax is reflected in column 5. The final line will contain the total cost of the entire delivery.

- Column 6 is filled in only for excisable goods. Here you need to indicate the amount of excise tax included in the price. In other cases, the note “Without excise duty” is made.

- When registering a SF without tax, in fields 7 and 8 you need to make the entry “Without VAT”. If some items are subject to tax, the rate and amount are entered opposite them.

- Column 9 reflects the cost of goods, works or services including tax.

- Column 10 must contain the digital product code. Columns 10, 10a, 11 are filled in for goods produced outside the Russian Federation.

- Columns 5, 8 and 9 of the bottom line contain the totals.

In the Federation Council, it is allowed to indicate two addresses (letter of the Ministry of Finance of the Russian Federation No. 03-07-09/85517 dated December 21, 2017). If the actual address, which differs from that recorded in the register, is recorded in the contract, it should be entered in an additional line.

Invoices without VAT are signed according to general rules. The paper form is certified by the signatures of the manager and chief accountant or authorized persons. If the document is issued by an individual entrepreneur, it must contain the personal signature of the individual entrepreneur or an authorized representative. You can find out more about the invoice for individual entrepreneurs.

Certification of an invoice with a facsimile signature is not acceptable (letter of the Ministry of Finance No. 03-07-09/49478 dated August 27, 2015). When exchanging documents electronically, a certificate of the electronic signature verification key is required (letter of the Ministry of Finance of the Russian Federation dated September 12, 2016 No. 03-03-06/2/53176, Federal Tax Service of the Russian Federation dated May 19, 2016 No. SD-4-3/8904).

The invoice is certified only by one enhanced qualified electronic signature of the manager or authorized person. The electronic document does not require the signature of the chief accountant.

You can find out more about filling out an invoice.

From the video you will learn how to correctly fill out an invoice if the company is not a VAT payer:

Invalid wording of column 7

Column 7 of the invoice indicates the tax rate. If this document comes from a VAT non-payer, this column does not contain numerical values. An invoice without tax is also called zero - this means that according to such a document:

- the seller does not have an obligation to pay tax to the budget;

- The buyer does not have the opportunity to claim a deduction.

What's special about column 7 of the zero invoice? The fact is that you cannot indicate “0” in it. Entering this figure by an entrepreneur will most likely result in negative consequences. Tax authorities will consider that he:

- carried out a transaction taxed at a rate of 0% and will be required to submit a VAT return;

- erroneously indicated a zero rate for goods (works, services) taxed at 20 or 10%, and will offer the individual entrepreneur to pay tax to the budget.

To prevent such misunderstandings from arising, in column 7 of the invoice, an individual entrepreneur (not recognized as a tax payer) must indicate “Without VAT.” With this formulation, the entrepreneur who issued it does not have any obligations (neither reporting nor payment).

Whether it is necessary to issue invoices to individuals, find out here .

Which solution should you choose?

Distinctive features of VAT when deducting individual entrepreneurs. Personal income taxes allow you to minimize your risks. Take advantage of the special advantages. mode is necessary in order to interest the client. The decision to charge VAT involves issuing an invoice after the goods have been shipped. You can avoid paying tax twice if you do not write it out twice: on the advance invoice and on the shipping invoice. Those who work under the simplified system must keep documents for 4 years.

On video: Online cash register for individual entrepreneurs, LLCs and UTII. How to work. Step-by-step instruction

An invoice without errors: where can you expect trouble?

It happens that, at the request of a partner, you issued an invoice indicating in column 7 “Without VAT”. All other lines and columns are also filled out without errors in accordance with the requirements of tax legislation. And then you started having minor and major troubles with the tax authorities.

This happens when your partner, when filling out a payment order to transfer money to him, indicates the phrase “Including VAT” in the “Purpose of payment” column. What to do if such an error occurs? The first person who might notice this error will be you. You shouldn’t wait for the tax authorities to react, namely when they:

- will require explanations (clause 3 of Article 88 of the Tax Code of the Russian Federation);

- will be called to the inspection (subparagraph 4, paragraph 1, article 31 of the Tax Code of the Russian Federation);

- the account will be blocked (clause 3 of Article 76 of the Tax Code of the Russian Federation);

- they will make a demand for payment of penalties and fines (Articles 75, 122 of the Tax Code of the Russian Federation) or write off the collection tax specified in the payment order.

To avoid possible problems, notify your partner of the error as soon as possible and ask him to contact the bank to correct the erroneous wording in the payment purpose.

How to correct the wording on the purpose of payment in a payment order is described here .

It should be noted that tax authorities do not have the right to charge additional taxes based only on the phrase in the payment order and their own assumptions. Other evidence supported by documents is needed (for example, for the position of the judicial authorities, see the resolution of the FAS ZSO dated March 28, 2011 No. A45-12006/2010).

Should I include an invoice without VAT from an individual entrepreneur using the simplified tax system in the purchase book?

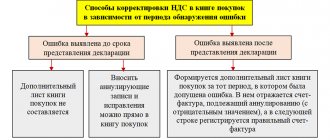

As a general rule, the buyer records invoices received from sellers in the purchase ledger. Based on these records, he determines the amount of VAT deduction. In a zero invoice situation, the buyer does not receive a deduction. Do such invoices need to be reflected in the purchase ledger?

We will not find direct wording that invoices received from sellers with the inscription “Without VAT” do not need to be reflected in the purchase book in the Rules for maintaining a purchase book (approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

But there are many indirect clues there. In particular, from these Rules it follows that:

- the purpose of the book is to register invoices for the purpose of determining VAT deductions (clause 1);

- invoices are registered in it as the right to deduction arises (clause 2 of the Rules);

- Clause 19 contains a closed list of situations when an invoice should not be registered in the purchase book.

As a result, the conclusion suggests itself: since a zero invoice does not increase the amount of VAT deduction, there is no particular point in registering it in the purchase book. It is possible, for example, not to reflect in the purchase book an invoice received from an individual entrepreneur using the simplified tax system without VAT.

There is no penalty for such failure to be reflected in the law. Although there is arbitration practice to challenge tax authorities’ claims for incorrect maintenance of purchase books by VAT payers. But the courts are against the fine (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated June 30, 2006 No. A79-15564/2005).

This might also be useful:

- Calculation of income tax from salary

- simplified tax system for individual entrepreneurs in 2021

- Tax system: what to choose?

- What reporting must an individual entrepreneur submit?

- Individual entrepreneur reporting on the simplified tax system without employees

- What taxes does the individual entrepreneur pay?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Results

Individual entrepreneurs recognized as VAT payers are required to issue invoices with the allocated tax amount.

Entrepreneurs who do not pay VAT are not obliged, but can, at the request of the counterparty, issue an invoice. At the same time, in columns 7 and 8, dedicated to the tax rate and amount, they should put the inscription or stamp “Without VAT”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Packing list

An invoice is used if an individual entrepreneur sells goods to another entrepreneur or legal entity. When selling to ordinary individuals (not individual entrepreneurs), this document is not issued. A consignment note is drawn up in 2 copies:

- one for the supplier as confirmation of the fact of shipment of the goods ;

- another for the buyer - through it he will receive this product.

Most often, the consignment note is drawn up in the form TORG-12 .

Sample invoice TORG-12