In order to attract customers, banks often offer various bonus programs. This procedure motivates citizens to open a current account in a certain bank.

Interest accrual on the account balance is the most popular type of bonus. In this case, free money “works”, is not frozen and is not withdrawn from circulation. Current accounts with bonuses can be used by organizations at any time.

You shouldn’t expect big profits from such charges, but you can always count on covering the cost of some banking services or compensating for inflation.

Organizations are always willing to use this type of “passive income”. At the same time, accountants are often faced with many questions regarding this type of operation.

What is a deposit or what will be discussed in the article?

From a legal point of view, we will talk about a bank deposit, the rules of which are established by the 44th chapter of the same name of the Civil Code of the Russian Federation.

There is a well-known contradiction regarding the accounting of deposits in the accounting regulatory framework. According to the Instructions for the Application of the Chart of Accounts (hereinafter referred to as the Chart of Accounts), the presence and movement of deposits is taken into account in subaccount 55.3 “Deposit accounts” of account 55 “Special accounts in banks”; on the other hand, according to paragraph 3 of PBU 19/02 “Accounting for financial investments”, deposits in credit institutions are classified as financial investments:

However, the IPPS does not directly provide for taking into account bank deposits in a special account 58 “Financial Investments”, therefore, without going further into theoretical reasoning, we will use account 55.03 “Deposit Accounts” to record deposits. At the same time, it is possible to use account 58 instead - this will not significantly affect the procedure for processing bank deposit transactions in 1C Accounting. In general, the specific method of accounting for deposits in an organization is established by the accounting policy.

Preparation of accounting entries

| √type of deposit; √amount credited to the deposit; √the amount of interest accrued by the bank and the frequency of their accrual; √the amount of the deposit account maintenance fee; √the period of storage of funds in the account; √responsibility provided for each of the parties; √conditions for termination of the contract; √other conditions agreed upon by the parties. |

When a company decides to place “free” funds in a special deposit account with a banking organization, a corresponding agreement “On Bank Deposit” is concluded between the company and the bank, in accordance with Articles 834, 835 of the Civil Code of the Russian Federation. The deposit agreement specifies the following information:

After signing the agreement, the bank opens a deposit account. Funds are credited from the company's current account.

When opening a deposit account, the following accounting entries will be used for deposits and withdrawals from this account:

| Accounting operation | "Debit" | "Credit" |

| Depositing and crediting funds to a deposit account | «58,(55.3)» | "50, 51, 52, etc." |

| Withdrawing funds from a deposit account | "50, 51, 52, etc." | «58, (55.3)» |

These operations are carried out on the basis of primary documentation and bank statements.

Making a deposit in 1C 8.3 Accounting

Let's assume the following business situation:

01/25/2016 Our organization entered into a bank deposit agreement and deposited 1,000,000 rubles into the deposit account. for a period of 6 months at 12% per annum. The agreement provides for monthly accrual and payment of interest.

Thus, in our example the postings will be involved:

- Debit 55.03 - Credit 51: transfer of funds from the organization to deposit;

- Debit 51 - Credit 55.03: entry reverse to the previous one, that is, the bank returns the invested funds.

Note: if the deposit is opened in foreign currency, then account 52 “Currency accounts” corresponds with the account for accounting for financial investments.

- Debit 76 - Credit 91.1: accrual of incoming interest on the deposit;

- Debit 51 - Credit 76: payment of interest on the deposit.

The example uses a demo base based on the Enterprise Accounting configuration, edition 3.0 (3.0.43.241).

Transfer of funds to a deposit in 1C 8.3

To formalize the transaction of transferring funds from the organization’s current account to a bank deposit in 1C Accounting 3.0, use the document “Write-off from the current account.” To create it, let's turn to the Bank Statements journal in the Bank and Cash Department - command group Bank - Bank Statements command:

At the top of the form of this journal there are buttons for manual (Receipt and Write-off) and automated (Upload - starts processing the exchange of documents with the bank) input of bank documents:

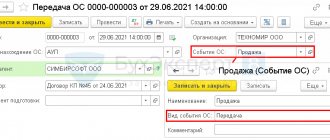

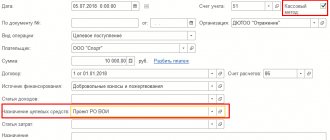

Let's manually create the document Write-off from the current account. Accordingly, by clicking the Write-off button, a new document form will open, all the necessary details of which must be filled out:

- First, you need to select the appropriate Operation Type - in our case it will be Other write-off.

- Next, in addition to the basic standard details, the debit account is indicated - 55.03, and the corresponding analytics are also filled in in the form of a bank account and cash flow item.

- At the same time, the need to indicate the type of SDDS for each specific monetary transaction is established by the organization in accordance with the accounting regulatory framework.

At the output we have the expected posting, reflecting the transfer of funds to the deposit (the Show movements button):

Accrual and receipt of interest on deposits in 1C 8.3

In accounting, in accordance with paragraph 7 of PBU 9/99, interest on a deposit is recognized as other income. In tax accounting, interest on deposits is classified as non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation) and is recognized as received and included in the corresponding income at the end of each month, regardless of the date of their payment (clause 6 of Article 271 of the Tax Code of the Russian Federation). Therefore, in this general case, there will be no discrepancies in the reflection of deposit interest between these two types of accounting.

Provided that the amount of the bank deposit was received by the bank on January 25, 2016. and returned by the bank on June 24, 2016, the distribution of accrued interest by month will be calculated as follows:

The registration of the operation of calculating interest on a bank deposit in the 1C Enterprise Accounting 8.3 program is carried out using a special document Operation. Its creation occurs from the corresponding list: section Operations - group of commands Accounting - command Operations entered manually:

Next, in the form that opens, click the Create button and select Operation from the drop-down menu. As a result, a new document form will open, all the necessary details of which must be filled out.

In the header of the document (the upper non-tabular part) the general details for transactions (if there are several) are filled in.

To add a transaction to the tabular part of the document:

- Click the Add button;

- We fill out the necessary debit and credit accounts, as well as their analytics;

- We indicate the amount. When filling out this field in 1C 8.3, the document header details “Transaction Amount” will be automatically filled in. When the field value is changed or a new line is added, the “Transaction Amount” attribute will be automatically recalculated.

The document Operation in 1C 8.3 generates accounting entries directly:

Next, it is necessary to take into account in 1C Accounting 3.0 (8.3) the actual payment by the bank of interest on the deposit. The document Receipt to current account is suitable for this purpose. Let's create it by clicking on the button Receipt of the journal of bank statements (see above for how to get there), and fill in the details of the new document form that opens:

- First, you need to select the appropriate type of operation - in our case, Other receipt is suitable.

- Further, in addition to the basic standard details, the loan account is indicated - 76.03.

- The corresponding analytics are also filled in in the form of a counterparty, agreement and cash flow item. At the same time, the need to indicate the type of SDDS for each specific monetary transaction is established by the organization in accordance with the accounting regulatory framework:

At the output we have the expected posting, reflecting the receipt of interest on the deposit to the current account:

The above operations of accrual and receipt of interest on the deposit must be carried out in the 1C 8.3 Accounting 3.0 program on a monthly basis according to the contract schedule:

Return of deposit in 1C 8.3

So, at the end of the term of the bank deposit agreement, the bank transferred funds from the deposit account to the organization’s current account, that is, returned the money deposited.

This operation is formalized in 1C Accounting 3.0 on the basis of a bank statement confirming this fact using the document Receipt to current account already mentioned above:

- We indicate the type of operation Other receipt;

- Loan account – 55.03;

- Next, fill in the necessary analytics for the accounting accounts:

Result of the document:

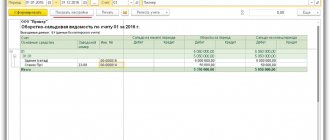

We will generate reports for verification in the 1C 8.3 program: Turnover balance sheet for accounts 55.03 and 76 for the period of deposit settlements and at monthly intervals:

Postings to the bank for services subject to VAT

Banking products not specified in clause 3 of Art. 149 of the Tax Code of the Russian Federation, are subject to VAT at a rate of 18% in the general manner. The peculiarity of these banking services is that it is necessary not only to pay for them, but also to obtain primary documents confirming the fact of their receipt. To reflect expenses for services of credit institutions, subject to VAT, the use of an account for mutual settlements with suppliers is required; most often, account 76 is used for these purposes.

When the bank's services are paid for, the posting is generated in correspondence with the cash accounts:

Dt 76 Kt 51.

When the UPD is received from the bank, a posting is generated in correspondence with the expense account.

Examples of transactions for banking services with VAT are given in the table.

| Banking service | Debit | Credit |

| Service costs under the factoring agreement, including VAT | 91.02 19.04 | 76.13 76.13 |

| Paid expenses under the factoring agreement (statement) | 76.13 | 51 |

| Expenses for servicing a foreign exchange contract, including VAT | 91.02 19.04 | 76.09 |

| Paid the bank commission for performing the functions of a currency control agent (bank statement) | 76.09 | 51 |

| Expenses for collection of proceeds by the servicing bank | 91.02 19.04 | 76.09 |

| Collection of proceeds paid (extract) | 76.09 | 51 |

Bank deposit agreement without interest capitalization

Under a bank deposit agreement without capitalization of interest, the accrual of remuneration for the use of funds throughout the entire term of the agreement is based on the amount placed on deposit. In our example, in the first month, in the second month, and in all subsequent months, the reward will be calculated from 100,000 rubles - the deposited amount.

When interest is calculated without capitalization, the transactions will be the same as under the agreement with capitalization of deposit income.

Receipt to the current account, postings

| t 51 Kt 62 | crediting payment, advance payment from the buyer |

| Dt 51 Kt 60 | advance payment was returned by the supplier |

| Dt 51 Kt 76 | money received from other counterparties (claims, dividends) |

| Dt 51 Kt 68, 69 | refund of overpayment of taxes, insurance premiums |

| Dt 51 Kt 75 | money was received as a contribution to the management company |

| Dt 51 Kt 50 | deposit of cash to the bank is reflected |

| Dt 51 Kt 57 | receipt of funds through transfers on the way |

| Dt 51 Kt 51 | money transferred from another account |

| Dt 51 Kt 91 | Interest accrued on the balance of money on the account |

| Dt 51 Kt 66, 67 | receipt of loan |

| Dt 51 Kt 86 | funds were credited from the budget as financing |

Tax accounting of interest on deposits

In tax accounting, the deposit amount is not recognized as an expense for tax purposes, in accordance with clause 12 of Article 270, clause 1 of Article 346.16 of the Tax Code of the Russian Federation.

In tax accounting, interest on a deposit is recognized as non-operating income and is included in income on the last day of the month, in accordance with clause 6 of Article 250 of the Tax Code of the Russian Federation; paragraph 1, 3, paragraph 6, article 271, paragraph 3, paragraph 4, article 328 of the Tax Code of the Russian Federation. Regardless of the terms of the agreement, the amount of deposit interest must be reflected monthly as part of taxable income.

There is no need to charge VAT on deposit interest amounts and keep separate records of input VAT, according to the Letter of the Ministry of Finance dated 10/04/2013. No. 03-07-15/41198, dated May 22, 2013. No. 03-07-14/18095 and Letter of the Ministry of Finance dated May 17, 2012. No. 03-07-11/145