A bill of exchange is a financial document that records the abstract financial obligation of the drawer to the owner of the bill. This type of document belongs to the category of securities. It can be used as a lending tool. The basic rules of a promissory note are similar to the rules of a loan. Often, it is used as a means of raising borrowed funds. For individuals, bills of exchange are a good tool for storing free money, as well as a source of additional income.

There are two types of bills depending on the parties involved in the transaction. Simple and transferable. The drawer (debtor) will issue a bill of exchange of the first type, and subsequently return the debt obligation under it. The recipient of the amount will be the creditor (bill holder). A third party may also participate in the transaction for the purchase of a bill of exchange. In this case, the debtor issues a bill of exchange for the benefit of a third party, to whom the amount specified in the document will be returned.

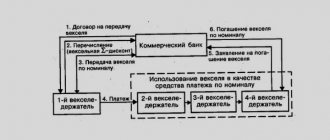

Most often, bill transactions take place with the participation of banks. In this case, the bank is the debtor and carries out bill trading activities on its own behalf. Often these are promissory notes. Each of them has its own identification number and is in electronic form, issued on the basis of an application.

What benefits will we have when we buy bank bills? With their help, the bill holder can make purchases and payments for services. Also, force them as collateral for the loan. Depending on the interest rate, the lender will receive a certain amount of interest. An additional advantage of buying bills is a kind of insurance against inflation, and the fact that they are in sufficient demand in the market.

The essence of a bank bill

The main purpose of securities is to convert cash into a convenient form for subsequent financial manipulations. As a form of attracting free resources of a commercial bank, a bill of exchange performs the following tasks:

- The percentage of income ensures the safety of money during inflationary processes.

- Formation of funds of free resources while maintaining their liquidity . An enterprise that purchases a bill of exchange from a large bank thereby withdraws excess money from circulation and prevents its misuse. At the same time, the designated amounts can be used for quick payment for goods and services if the counterparty accepts bills of exchange for payment.

- Theft protection . A bank bill is usually not issued to bearer, which means that money can only be paid to the person in whose name the security is issued. The transfer of a bill of exchange is carried out using the endorsement procedure. In simple words, this is the application of an inscription on the reverse side, certified by the bank. The presence of the original owner is mandatory.

Advantages and disadvantages

Like any financial instrument, a bank bill has advantages and disadvantages. Which of these is more important is up to you to decide.

Advantages:

- Simplicity of design. You don't even need to open a bank account to purchase.

- Wide application. They can be used to pay, leave as collateral, sell, or give as a gift.

- Profitability is determined in advance.

Flaws:

- Low profitability. Reliable banks are unlikely to offer a rate higher than for a regular bank deposit.

- No guarantees. The securities do not participate in the deposit insurance system. The money invested in them is not protected by anything.

Bank bill and its economic purpose

For a private investor, banking with bills of exchange is not very attractive. They have a lower percentage of return compared to savings deposits, and the minimum denomination is quite large (from 1 million rubles). In addition, the essence of the bill is not to attract investors. For the most part, it is intended for conducting convenient mutual settlements between companies. Often, bills of exchange are accepted as collateral for lending.

The interest rate on a bill of exchange may be higher than usual. Many little-known banks are interested in increasing demand for their securities.

After all, compared to deposit funds, the owner cannot repay a bank bill before the agreed upon date. Therefore, the money remains at the full disposal of the credit institution.

You need to be careful when investing in high-yield bills. Often their issue has the nature of a “pyramid”, when the repayment of old securities is carried out by issuing new securities.

Another nuance is associated with the closure and bankruptcy of a financial institution. First of all, debts to savings account holders are repaid, and the owner of the bill is placed in third place. In addition, his money is not subject to mandatory deposit insurance protection.

Purchase procedure

Both legal entities and individuals can purchase a promissory note. A similar opportunity is also provided for individual entrepreneurs. Transactions involving legal entities are subject to certain restrictions. The process of issuing a bill for such categories of clients is as follows:

- The owner or official representative of the legal entity personally visits one of the Sberbank branches.

- After the details of the transaction are announced, an issuance agreement is signed between the bank and the legal entity (can be concluded within the framework of a constructor agreement if the company has a current account with the bank).

- The full amount of the transaction (agreed value or funds corresponding to the nominal value) is transferred to the designated account.

- The document is issued after the account is fully replenished.

In this case, you should pay attention to the following nuances:

- While individuals can purchase a product for cash, a similar opportunity is not provided for legal entities. Only cashless payments will do.

- The agreement can be concluded by the owner of the legal entity, manager or authorized representative.

- To conclude an agreement, you will have to provide your Taxpayer Identification Number (TIN), KPP, legal address and account details.

- The company representative must have a passport (or other identification document), the company charter, a card with sample signatures and other papers. The trustee will have to prepare a power of attorney giving permission to carry out such transactions on behalf of the company.

The moment the full amount of funds is credited to the account is considered the date of creation of the bill. It cannot precede the conclusion of a written contract.

One legal entity has the right to issue several bills of exchange at once. At what price can you buy a Sberbank bill of exchange? The cost is determined based on an agreement with the client and can reach several million rubles.

Sample bill of exchange

Profitability

It is impossible to indicate the exact amount of income from the use of this financial instrument. The interest rate for each case is set individually and depends on the current situation in the financial market. The timing of the return of the bill and receipt of funds, which significantly affects the amount of income, also depends on the specific bill holder.

However, the security holder who has the above data in hand can independently make the calculation. When using interest-bearing bills, you need to use the following formula: D = SV * 1 + (N / (Ng * 100)) * PS. In this example:

- SV – denomination;

- N – days during which the product was in the hands of the holder (counted from the moment of creation);

- Ng – number of days in a year;

- PS – established interest rate.

It is easier to calculate the yield on a discount bill. To do this, it is necessary to subtract the purchase price of the security from the sale price of the security. If necessary, you can request this information from a bank employee. But he will be able to make a settlement only if the date of the future sale of the paper is known.

Types of bank bills

The legislation does not provide for any specific features of the circulation of bank bills. Their legal framework is the same as that of ordinary issuers. IOUs of credit institutions can be purchased by both legal entities and ordinary citizens.

The purchase of a bank bill is associated with the receipt of income in the form of a discount. What it is? The acquisition of a security at a cost lower than the face value of the document. Unlike an ordinary deposit, a bill of exchange can be used as a store of value, while also acting as a settlement instrument for purchases or payments.

When calculating the yield on a discount liability, it is important to consider taxation. Enterprises calculate and pay the amount of income tax according to generally established rules.

Interest-bearing bills are transferred at par, and upon redemption, interest is paid in relation to the amount of debt. The profitability of interest-bearing securities is determined from the moment of issue until the agreed period (wordings such as “at the time of presentation” or “on presentation, no earlier than...”) are included in the text.

The terms of bank promissory notes can vary - from 3 months to three years. The most optimal in terms of profitability are considered to be those types of bank bills that are issued for a period of 1 year.

Typically, bank transactions with a bank bill are associated with:

- Servicing promissory notes: issuance, exchange, repayment, as well as certification of endorsement.

- Storage of securities on a paid basis.

Existing tariffs

Sberbank tariffs are not adjusted too often. You can check current positions on the official website or by calling support. To date, the following parameters have been set:

- operations related to the account, execution of a bill of exchange, as well as the provision of information or exchange and replacement are carried out without charging a fee;

- the cost for storage ranges from 15 to 45 rubles per day;

- interest is determined on an individual basis, since it is impossible to accurately predict the exchange rate and profitability of the institution.

As a result, it is impossible to predict with confidence even an approximate amount of income. The cost of a bill depends on a variety of indicators: inflation, bank profitability, exchange rate fluctuations and other factors. Typically, security holders receive up-to-date information about profits only on the day of return.

Purchase and redemption of bank bills

A special feature of the security is that it does not have official quotations and is not traded on the stock exchange. The cost of a bill of exchange (for example, Sberbank) can be found on electronic portals. One of them is the Russian bill system (www.bills.ru).

Typically, banks do not sell their securities themselves. They entrust this area of relationships to investment companies. This creates additional costs for the investor - the amount of the intermediary agent's commission can reach 2%.

A bank bill can be sold in two ways - to the company from which it was purchased with payment of a commission or to a credit institution. The repayment period is of great importance. An overdue document may be rejected by the bank. Despite the disadvantages, the bank bill attracts investors because:

- Has a predetermined profitability.

- It can always be transferred to another person or used as payment.

- The document is accepted as collateral for lending.

- Interest rates often exceed a simple deposit.

- You can always redeem it at the organization where it was purchased.

What does a security look like?

The bill looks like an ordinary document, which reflects the main details of the transaction. Namely:

- series;

- deposited amount;

- date and place of registration;

- information about the legal entity;

- payment terms;

- place of payment;

- signatures of the parties and bank seal.

Regular bill of exchange from Sberbank

The document is standardly produced in green color. However, other palettes can be used.

Accounting for bank bills

Any holder of a debt security can transfer the bill to the bank before the maturity date of the endorsement. The owner is paid the bill amount minus interest for early receipt. In bill law there is such a thing as “Accounting discount”.

A commercial bank may be interested in accounting for bank bills owned by large shareholders, as well as some clients (for example, if a loan has been issued and there is a need to improve the financial condition of the borrower). The decision is made at a high level - managers and directors. At the same time, the financial condition and solvency of the main debtors are carefully analyzed.

Deadlines for payment of obligations

The period for providing payments under a payment document is specified differently. In particular, the following formulations are used:

- no earlier than the day specified in the contract. It is permissible to receive the due profit only after the day specified in the agreement has arrived. Otherwise, no interest will accrue;

- at a certain period. In such a situation, profit can be received only in the time period specified in the contract;

- on a specific day. The bank must make the payment on a strictly designated date. The maximum delay should not be more than 2 days.

The lower limit is two weeks, the upper limit is 3 years. Banks do not use longer periods due to high risks of non-fulfillment of obligations.

More details about the deadlines from the Sberbank website:

Features of cashing

Personal income tax must be paid, but not on the entire amount received upon cashing out. Tax is paid only on income. In the case of an interest-bearing bill, this is interest, with a discount bill, the amount of the discount. The tax holder fills out the tax return independently. All information on the issue is contained in Art. 228 of the Tax Code.

Another feature associated with the purchase of a bill of exchange is the ability to deposit it with the bank where it was purchased. The object will remain here until the moment the owner decides to cash it out. The service is relevant if we are talking about a large amount. It is easy to order the services of collectors at the bank, who will transport the bill itself and the money.

Basic rules for checking a bill

The question of why a bill is needed is clear, however, another question arises - how to check a bill. This particularly applies to cases where the security in question is not directly transferred. You can submit a written request to a banking institution. This is necessary in order to make sure that the bill is in the register and is genuine.

There are certain rules that must be followed when checking the security in question:

- if the rules for drawing up and filling out a bill of exchange prescribed by the state are violated, the security in question is considered invalid;

- if some parts of the document are changed, for example, there are additional signatures, the bill is recognized as a fake;

- all data contained in the security in question must be genuine; additional changes to information about the owner are prohibited;

- fake bills, as a rule, have low quality paper, bright colors, blurry prints and reflections of varying intensity.

It is believed that in order to verify the authenticity of a bill of exchange, it is necessary to contact the person who issued the security in question. This will give a 100% guarantee that the document is genuine.

What it is

A promissory note is a security evidencing an obligation of a debtor, expressed in a specified amount and payable at a specified place, to its owner.

The holder of the bill can transfer it to a third party by placing an endorsement on the form - an endorsement certified by the signature of the owner or a person representing the owner and acting on the basis of a power of attorney. The applied endorsement must be assigned a serial number. According to it, the transfer of the obligation must occur in full, since partial endorsement is not permissible.

All bills issued by Sberbank PJSC are printed on forms with high protection against forgery and are entered into an electronic register.

Important! The Bank does not honor bills issued by organizations with which it has partnership relations.

How to submit for payment

If the owner of the paper does not have the opportunity to come to the payer himself to cash it, you can send a proxy. In this case, a power of attorney is issued by a notary. But when a mark indicating a trustee endorsement is placed on the form, it is not needed. Then the authorized person will simply need to present identification.

Additionally, any bearer will be required to submit an application requesting cash and an acceptance certificate. Everything can be filled out on the spot.

Are there any analogues

Eat. But these will be different instruments with their own characteristics.

For example, to raise funds, a bank may issue bonds. But for this it is necessary to carry out serious preparatory work, which is not always advisable. In addition, not all potential investors have the opportunity to trade on the stock exchange.

Another option is a bank deposit. However, investments in it do not have liquidity. They cannot, for example, be sold. And with early withdrawal of funds, the investor loses almost all profits.

Full and partial transfer of rights to a bill of exchange

The rights to the security in question can be transferred in whole or in part. Also, the owner's details may or may not be indicated on the reverse side. Many issuers who issue promissory notes make a note on the security “without turnover to me.” This is necessary so that they are not paid with their own bill of exchange.

Accounting with the drawer

If a company issues a bill of exchange, then it must account for it in account 009 “Securities for obligations and payments issued” until the bill is repaid. In addition, its value is reflected in account 60 “Settlements with suppliers and contractors” subaccount “Bills issued”.

Please note: the bill is accounted for on its balance sheet at its face value.

If the bill is issued in payment for inventory items, then the amount of interest on the bill that the company will accrue must be taken into account as other expenses (line 2350 of the financial results statement).

Interest on purchased inventory items must be taken into account as part of other expenses, regardless of when they are accrued: before capitalization of inventory items or after (clause 7 of PBU 15/2008). CJSC Aktiv entered into an agreement with LLC Passiv for the sale of a compressor, the cost of which is 42,480 rubles. (including VAT - 6480 rubles). On June 17, as an advance payment under the “Passive” agreement, I issued a promissory note for the same amount. The bill provides for interest accrual based on 20% per annum. In June, the Liability accountant must make the following entries: DEBIT 009 - 42,480 rubles. – a bill of exchange was issued; DEBIT 91-2 CREDIT 60 subaccount “Bills issued” – 302.60 rubles. (RUB 42,480 × 20%: 365 days × 13 days) – interest accrued on the bill for June. “Active” shipped the compressor on July 7, and at the same time “Passive” put it into operation. The Liability accountant made the following entries: DEBIT 08 CREDIT 60 subaccount “Bills issued” - 36,000 rubles. (42 480 – 6480) – the compressor was capitalized; DEBIT 19 CREDIT 60 subaccount “Bills issued” – 6480 rub. – VAT is taken into account; DEBIT 91-2 CREDIT 60 subaccount “Bills issued” – 162.94 rubles. (RUB 42,480 × 20%: 365 days × 7 days) – interest accrued on the bill for 7 days (from July 1 to July 7); DEBIT 01 CREDIT 08 – RUB 36,000. - the compressor was put into operation. On July 17, “Liability” repaid the issued bill along with the interest accrued on it. The company’s accountant should reflect this as follows: DEBIT 91-2 CREDIT 60 subaccount “Bills issued” - 232.77 rubles. (RUB 42,480 × 20%: 365 days × 10 days) – interest accrued on the bill for 10 days (from July 8 to July 17); DEBIT 60 subaccount “Bills issued” CREDIT 51 – 43,178.31 rub. (42,480 + 302.60 + 162.94 + 232.77) – the bill has been repaid and interest on it has been paid; LOAN 009 – RUB 42,480. – the bill of exchange is written off from off-balance sheet accounting. Line 1150 of the balance sheet asset will indicate the cost of the compressor – 36,000 rubles. less accrued depreciation. Interest on the bill in the amount of 698.31 rubles. should be reflected on line 2350 “Other expenses” of the income statement.