An invoice in Russia is a tax document of the established form, which is required to be drawn up by the seller or contractor. Based on received invoices in , and based on issued invoices - “Sales Book”.

According to the Tax Code of the Russian Federation, only VAT taxpayers are required to provide customers with an invoice. Companies that are on the simplified tax system are not payers of this tax and do not have to prepare invoices.

The invoice contains data on the name and details of the seller and buyer, the list of goods or services, their price, value, rate and amount of VAT. This list is mandatory and enshrined in the Tax Code of the Russian Federation. The invoice must also contain information about the number and date of issue of the invoice, and, if necessary, the amount of excise tax, the country of origin of the goods, and the customs declaration number.

In Russia, the purpose of an invoice is tax accounting for VAT. It imposes on the seller the obligation to transfer VAT to the budget; for the buyer it serves as the basis for presenting VAT for deduction.

Packing list

The invoice is a primary document, which is drawn up in 2 copies and serves as proof of transfer and the basis for writing off (accepting for registration) the goods. The invoice must contain the signature and seal of the seller and buyer. It is drawn up in two copies, one of which remains with the supplier, the second with the recipient.

Goskomstat has approved a unified form of consignment note (form No. TORG-12), but an organization can use its own form.

The invoice must contain the following details: name, number and date of the document, name of the supplier organization; name of the product, its quantity and cost; positions of responsible persons, their signatures and seals. If the invoice form does not correspond to the Torg-12 form, it can also be accepted for accounting by the purchasing organization.

When participating in trade operations of a third-party transport company, experts recommend abandoning the Torg-12 form and using another document - a consignment note (Bill of Lading).

TORG-12

A consignment note or its unified form TORG 12 is a document used when registering a transaction for the sale of goods. TORG-12 was approved by a decree of the Federal State Statistics Service in 1998 (read about what a TORG-12 consignment note is and why this form is needed here, and from this article you will learn how to fill out this document correctly).

In accordance with the Tax Code of the Russian Federation, it is not necessary to use this particular form. But, as practice shows, tax authorities often “wrong up” other options, so to avoid problems and save time, it is better to use the generally accepted form of the invoice.

TN are drawn up in two copies, one of which remains with the seller, and the other with the buyer, signed on both sides. Be sure to check the presence of stamps.

We talked about how to correctly draw up a bill of lading for an individual entrepreneur and why it is needed here, and from this material you will learn about the features of registering a technical document in electronic form and in the TORG-12 form.

Difference between invoice and delivery note

The following can be distinguished between an invoice and a delivery note:

Documents come in various forms;

An invoice has a strictly regulated form, while a delivery note has a free form;

The delivery note is signed in two copies - by the seller and the buyer, the invoice - only by the supplier;

These documents do not replace each other, but complement each other and are issued simultaneously upon transfer of goods;

An invoice is issued for payment for goods and services, while an invoice is issued only upon shipment of goods, the provision of services is formalized by an act;

Unlike an invoice, an invoice does not confirm the fact of transfer of goods to someone, but only serves as a basis for VAT offset;

Based on the invoice, you cannot make a claim against the supplier of the goods.

Many people who have little knowledge of accounting think that an invoice and an invoice are the same accounting document. This opinion is wrong. In fact, these documents are directly related to the creation of the same operation; the difference exists in their purpose and design.

What is the difference between SF and TN?

Both invoices and delivery notes are important accounting documents. But there are significant differences between them, first of all this is their purpose:

- SF is issued for VAT deduction;

- TN - to account for the transfer of goods.

In addition, you should pay attention to such points as:

- Form. SF are issued in accordance with the form approved by Government Decree No. 1137 dated December 26, 2011, with additions in 2017. TN have a unified, but, by law, not mandatory form TORG-12 (you can find out how to correctly fill out TORG-12 with and without VAT here).

- The SF is signed only by the supplier, and the TN is drawn up in two copies and signed by both parties.

- SF are issued for both the sale of goods and services, while TN are issued only for goods, and certificates of work performed are issued for services.

- The difference between the documents also lies in the fact that the SF is only a justification for paying VAT; with its help, unlike the TN, you cannot make a claim to the supplier or vice versa, since it does not confirm the transfer or acceptance of goods.

- Shelf life. The SF should be stored for at least four years, after the quarter when this document was last used, while the TN must be stored for at least five years.

Read about why a delivery note is needed and whether it can replace a sales receipt in our material.

What data is included in the invoice?

The invoice is issued by the seller or contractor upon completion of the work performed or services provided. Presentation of this document is mandatory if the company is refunding VAT (the amount must be indicated in the document), i.e. is on the general taxation system. In other situations, an invoice is usually not required. If the presence of this document is mandatory, it must be executed in the same period when the transaction was made (a service was provided, confirmed by a certificate of completion, or goods were purchased, as evidenced by the presence of a delivery note).

In fact, the accountant issues both an invoice and an invoice both when providing any services and when completing a purchase and sale agreement. The only difference is the purpose of these documents. The buyer needs an invoice in order to pay for the services provided, which are specified in the contract. It is for this purpose that the invoice contains the details for transferring the required amount of money and the services or goods for which this amount will be paid.

An invoice is needed so that the transaction performed is reflected in tax accounting, i.e. VAT must be recorded on the completed service or product that is planned to be performed under the specified transaction.

As a rule, the invoice bears the seal of the service provider (mandatory), while the invoice does not. Another difference between these documents is that the invoice must be submitted to the tax office, since this document is a strict reporting form, while an invoice does not have this function.

Invoice (IF) is a document that certifies the actual shipment of goods, or the provision of services, as well as their cost. In accordance with paragraphs. 6.7 hours 2 tbsp. 9 of the Law of December 6, 2011 N 402-FZ, the Federation Council is not a primary accounting document.

Why is SF needed? An invoice is issued by sellers or performers to the buyer, or customer, after the buyer accepts the product or service.

Attention!

The only purpose of an invoice is to record value added tax. As a result, this document is a tax document and has a strictly established template.

Based on the SF, the accounting department creates a “purchase book” and a “sales book.”

Organizations conducting business under the simplified taxation system do not use them, since in such situations the second party has the right to use other documents, for example, a payment order, to account for VAT.

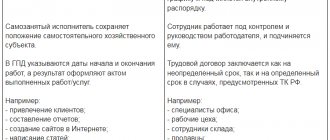

Separation of primary documents by business stages

All transactions can be divided into 3 stages:

Stage 1. You agree on the terms of the deal

The result will be:

- contract;

- an invoice for payment.

Stage 2. Payment for the transaction occurs

Confirm payment:

- an extract from the current account, if the payment was made by bank transfer, or by acquiring, or through payment systems where money is transferred from your current account;

- cash receipts, receipts for cash receipt orders, strict reporting forms - if payment was made in cash. In most cases, this payment method is used by your employees when they take money on account. Settlements between organizations are rarely in the form of cash.

Stage 3. Receipt of goods or services

It is imperative to confirm that the goods have actually been received and the service has been provided. Without this, the tax office will not allow you to reduce the tax on money spent. Confirm receipt:

- waybill - for goods;

- sales receipt - usually issued in conjunction with a cash receipt, or if the product is sold by an individual entrepreneur;

- certificate of work performed/services rendered.

Sharing

Can an invoice and a delivery note be issued for the same product? SF and TN not only can, but also must be issued for the same product.

Since, as we have already discussed above, this documentation performs different functions in accounting: the invoice reflects VAT, and delivery notes for the transfer of goods (you can find out who should sign the columns “received the goods”, “received the goods” and others) .

Do the numbers for one product have to match?

There are no requirements under the Tax Code, as well as other regulations stating that the SF and TN numbers must match. The main thing is to ensure that the VAT amounts coincide in both cases. Each organization has the right to choose the order and type of numbering of its documents independently.

Which document should be drawn up first?

Can SF be discharged before TN? Since the SF confirms the VAT on the transferred goods, it cannot be written out in advance to the TN,

except in cases where the transaction agreement provides for prepayment. The invoice must be issued no later than five days after shipment of the goods.

Is it possible to combine them?

In 2013, the Federal Tax Service introduced the UTD form into circulation - a universal transfer document that contains elements of tax and accounting. It is based on the invoice base, the rest is an element of the delivery note.

Is registration with different dates acceptable?

The invoice may have different dates from the delivery note.

But you need to consider:

- The SF must be issued no later than five days after shipment of the goods, that is, TN.

- If one of the five days is a weekend, then the required date is postponed to the next working day.

There is no liability for violating this five-day deadline, however, the Ministry of Finance indicates that the buyer cannot claim a deduction for late documents.

Answer

It is not necessary to sign the acceptance certificate of goods if the TORG-12 consignment note is properly executed. Only primary accounting documents can serve as proof of the fact of delivery, based on the fact that any business transaction requires proper documentation (Part Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western Territory dated 03/31/14 No.).

The courts recognize as established the fact of the transfer of goods under a supply agreement, recorded in signed delivery notes, which have a link to the supply agreement (see, for example, resolutions of the Federal Antimonopoly Service ZSO dated 09/08/2009 No.).

The rationale for this position is given below in the materials of the “Lawyer System”

«

Delivery is perhaps one of the most popular contracts in business. Moreover, this type of contractual relationship most “painlessly” reacts to the absence of an agreement, both in the form of a single document signed by both parties, and in the form of documents emanating from the parties, which could be regarded as an offer and acceptance. To prove in court the fact of concluding a one-time supply transaction, primary accounting documents indicating the accomplished fact of transfer of goods by the supplier and their acceptance by the buyer are sufficient. Such judicial practice helps bona fide suppliers, but it can also benefit unscrupulous individuals. For example, the author of this article is involved in a legal dispute in which a company unexpectedly received a claim from a bank to collect a significant amount of debt arising from a supply. The bank refers to the fact that it received the right to claim this debt under a factoring agreement from another company that supplied the goods to the defendant. The defendant denies the fact of delivery, but in support of the fact that it was, the plaintiff presented invoices and other primary documents. As a result, the defendant is forced to prove that there was no delivery and could not have been, relying only on numerous shortcomings in the execution of primary documents, as well as indirect evidence that the company, which appears in the documents as a supplier, was not able to make the delivery. This dispute has not yet been completed, but preparation for it required the author to deeply analyze judicial practice on the question of what documents in similar circumstances are sufficient for the plaintiff to prove the fact of delivery, and, conversely, how the defendant can refute the fact of delivery.

Practice in such disputes is also relevant for cases where a “full” supply agreement has been signed between the parties, since debt collection in any case depends on proving the fact of actual fulfillment of obligations under the contract, namely the fact of acceptance and delivery of goods.

Documents that confirm the fact of delivery of goods

The fact of delivery (that is, transfer of goods to the buyer) is confirmed by primary accounting documents, based on the fact that any business transaction requires proper documentation (Federal Law of 06.12.11 No. 402-FZ “On Accounting”, hereinafter -). Previously, all companies were required to use unified forms of primary accounting documents, but as of January 1, 2013, there is no such requirement, and only indicates the mandatory details that must be present in the primary accounting document. Each company can now approve the form of this document itself. Nevertheless, business is accustomed to unified forms, and the development of new forms requires not only time, but also the reconfiguration of special accounting programs. In addition, it is inconvenient for turnover when the supplier and buyer use different forms of primary accounting documents. Therefore, in practice, in most cases, unified forms are still used.

The court evaluates the evidence according to its internal conviction, therefore, bona fide suppliers, when filing a claim for collection of a delivery debt and proving the fact of transfer of goods, as a rule, do not limit themselves to invoices, but present all possible documents related to the delivery, including acts of reconciliation of mutual settlements, guarantees letters, etc. (decrees, ).

Ideally, the fact of transfer of goods is accompanied by a whole set of primary documents: a consignment note (form No. TORG-12), and if the supplier also delivers the goods, then a consignment note (form No. 1-T), an act of acceptance of goods (form No. TORG-1 or in another form established by the parties to the transaction). The supplier also prepares and transfers to the buyer an invoice, which, although not a primary accounting document (it is a tax document), often appears in disputes about the reliability of the fact of delivery. But the complete set does not exist in every situation. In addition, the available documents are not always prepared properly - sometimes they lack some information, signatures, seals, etc.

The absence of some primary documents may make it difficult or even impossible for the supplier to prove in court that the delivery took place. But the general trend of arbitration practice can be characterized as follows: if there is a properly executed delivery note, then in most cases the courts will consider the delivery of goods proven. At the same time, if the buyer, despite the presence of the invoice, denies the fact of transfer of the goods and can provide any evidence that the delivery could not have taken place, then the court will most likely invite the supplier to provide additional documents confirming the delivery. The list of required evidence may depend on the terms of the supply contract itself (sometimes contracts contain references to certain types of documents used to formalize the delivery, for example, the parties agree on a special form of the acceptance certificate) or on the type of goods supplied.

The delivery note is the minimum document required to prove delivery.

In most cases, the supplier will only need one invoice to prove the fact of delivery (see, resolution of the Federal Antimonopoly Service of the East Siberian District dated 06/09/14, section No. A33-16983/2013,).

Conditions under which an invoice is sufficient.

For the invoice to work as 100% reliable evidence, it must be completed correctly. Otherwise, the court may not accept it as inadequate evidence.

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example,). Of course, the signature placed on the invoice must belong to an authorized person - in particular, an employee of the buying company, whose job responsibilities include acceptance of goods (resolution of the Federal Antimonopoly Service of the Moscow District dated May 21, 2014, section No. A40-70534/13,). The right to accept goods on behalf of the company may be confirmed by a power of attorney, or these powers may be apparent from the situation. In the first case, it is important that the invoice contains the details of the power of attorney (its number and date). In addition, it would be good for the supplier to have a copy of this power of attorney, otherwise the buyer may refer to the fact that the person indicated in the invoice is unknown to him and the power of attorney was never issued to him.”

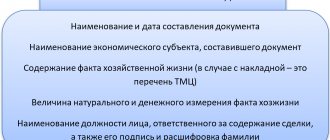

Required details

A standard document for acceptance and transfer of a product or product must include established essential details, without which, in the event of disagreement between the parties, it will be considered invalid.

This act must include the following essential details, and in particular:

- Title of the document;

- the current date and place of its composition;

- detailed information about the persons receiving the goods - the seller, the buyer or trusted persons. This is primarily the first name, last name, passport information, identification code number, citizenship, contact telephone numbers, residential addresses;

- act number;

- a clear representation of the numerical data of the transferred product, and the actual assortment and number;

- indication of the quality data of the product;

- presentation of absolutely all detected defects of the product (if there are no defects, it should be noted that there are no defects);

- probable complaints of the two parties to the agreement that arose during the acceptance and transfer of the product are indicated;

- signatures of both parties;

- seals of the institutions that transferred and received the product;

In addition to the integral data that must be enshrined in the product acceptance certificate, there may also be other auxiliary details noted at the request of the parties.

At certain points, it makes sense to indicate by what method and in what period the payment for the goods was made - before or after the practical transfer of the product.

Also, if the contract takes into account not a one-time, but a long-term supply of goods, an independent document is drawn up.

In addition, counterparties are required to streamline the issue regarding whether it is enough to draw up an acceptance certificate for a single product item, or for a specific batch of product.

the acceptance certificate for goods can be found here (Word, .doc format)

Requirements for filling out in accordance with Article 9 of the Federal Law on Accounting

Article 9 of the Federal Law “On Accounting” states that all business procedures, including monetary procedures, must be documented in the main papers on the basis of which accounting is carried out in the company.

This kind of act must be collected during the procedure or immediately after its completion.

The document that proves the implementation of currency transactions must be drawn up exactly in accordance with the law and be signed by the manager of the organization, the main accountant or an authorized person.

Primary accounting papers must be drawn up in the appropriate form and have the following details:

- Title of the document;

- formation period;

- name of the institution;

- natural and currency expression of a business transaction;

- information about officials;

- signatures of persons;

Certificate of acceptance and transfer of goods under 44-FZ

The act of acceptance and transfer of goods is a document that confirms the fact of transfer of goods from one person to another. The act is filled out at the stage of contract execution. This may be the acceptance of work, goods or services in full, or their individual stages. It is worth noting that the act can be drawn up both for one unit of goods and for an entire batch of goods.

Let's consider who signs the acceptance certificate for the transfer of goods. According to Law No. 44-FZ, the goods are accepted and checked for compliance with the requirements by the customer. However, by his decision, an acceptance committee of five or more people can be created. In the first case, the act is signed personally by the customer; in the second, the document must contain the signatures of all members of the commission, and it must be approved by the customer.

The act is drawn up in two copies. One remains with the customer, the second is taken by the contractor.

Do you work under 44-FZ?

A selection of special materials is ready for you »

Do you purchase according to 223-FZ?

We know that you will find it useful to watch"

The act of acceptance and transfer of documents, information or material means

It is important to understand that by signing the act, the customer agrees that the goods were supplied to him in the required quantity and proper quality, and he has no complaints. If claims are nevertheless identified, the customer can send the supplier a refusal to sign the act. The time frame within which acceptance of the goods must take place, as well as the time period within which it is necessary to send the contractor a refusal to sign the act, are specified in the contract.

The difference between the act of acceptance of the transfer of goods and the delivery note

The question often arises: what is the difference between an invoice and an act of acceptance and transfer of goods - are these documents interchangeable or not? These are different documents. An invoice is an accounting document required for reporting. Formalizing it is a legal requirement.

As for the transfer and acceptance certificate, everything depends on the terms of the contract. The regulatory authorities do not ask for it. But, if the act is specified in the contract, it must be filled out. If the signing of the act is not provided for in the contract, then a delivery note will suffice as an acceptance document. The form of the consignment note – TORG-12 – is approved by the state.

However, remember that the act is important for resolving controversial issues. This is not possible with a regular delivery note. After all, the act is the only paper confirming the fact of transfer of the goods, which indicates all the characteristics of the goods, possibly its defects. The act is signed by both parties and sealed. Therefore, it can provide assistance in court if, for example, the contractor is faced with an unscrupulous customer.

“How to ensure the fulfillment of a contract and warranty obligations under 44-FZ?”

Konstantin Edelev

, expert of the State Order System

Do not sign the contract or acceptance documents until you receive security from the winner. The counterparty chooses in what form to provide contract security or guarantee obligations - provide a bank guarantee or transfer money to the customer’s account. Include the requirement to provide security in the notice or invitation to participate in the procurement, documentation and draft contract. Read how much and how participants provide contractual obligations and guarantees »

Excel for Procurement Specialists An add-in that will greatly simplify the work of a contract manager! Works without transmitting data to the Internet. Download for free to your computer!

What does the transfer acceptance act include?

The form of this document is not legally approved, but there are some requirements for its content. A sample act of acceptance of the transfer of goods under 44-FZ must include the following information:

- The header indicates the number of the application, as well as the number and date of conclusion of the agreement to which the application was drawn up;

- The name of the legal entities, the names of the people acting on their behalf, as well as the name of the documents on the basis of which they act;

- List of goods indicating for each name, quantity, price with and without VAT. Here you can also register product defects;

- Total cost of the goods;

- A footnote that all contract requirements have been met, including quality, quantity and timing, and that the customer has no complaints against the supplier;

- Signatures of both parties.

✔

General information

The contract is prepared after the contractor completes his obligations. The contractor delivers the finished object, and the customer accepts it. The protocol confirms this procedure.

This document does not have independent legal force. It comes as an appendix to a number of other documents - mainly to the contract. It contains all the necessary information on the cooperation carried out. In addition, it is the contract that serves as the basis for monetary settlement with the contractor. For each individual case there is a special form of the acceptance certificate:

- by quantity or quality of cargo;

- acceptance of technical equipment;

- acceptance of a construction site, etc.

The acceptance certificate sheet will be visual evidence in legal proceedings. You must approach filling out the paper with all attention and responsibility. In case of claims, this information will help you win the lawsuit. Control of paperwork is assigned to the relevant government agencies.

If the client is dissatisfied with the result, this must also be included in the acceptance certificate template. However, claims must be justified. For example, there may be a discrepancy with the original design. After specifically identifying the shortcomings, methods for eliminating them should be prescribed and deadlines for new work should be set.

Bill of lading form

By virtue of the norms of Federal Law dated December 6, 2011 N 402-FZ “On Accounting,” all facts of an organization’s economic activities are subject to registration with primary accounting documents approved by the head of the organization upon the proposal of the official charged with maintaining accounting records.

In this case, the organization can use both independently developed documents and unified forms of primary documentation contained in special albums and approved by the State Statistics Committee of Russia.

Thus, Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132 approved the Album of unified forms of primary accounting documentation for recording trade operations, among which is the consignment note (form N TORG-12), used to register the sale of inventory items to a third-party organization.

Therefore, in practice, organizations use a consignment note in the TORG-12 form to register the sale (release) of inventory items to a third-party organization.

A consignment note can be generated and stored both in paper form and electronically.

Registration of a delivery note

Drawing up a delivery note

The delivery note is drawn up in two copies, one of which remains with the supplier organization and is the basis for writing off inventory items.

The second copy of the consignment note is transferred to the buyer (consignee) and is the basis for recording these values and deducting VAT.

Signing the delivery note

Primary documents are signed by the manager and chief accountant or authorized persons.

The list of persons authorized to sign primary documents is approved by the manager in agreement with the chief accountant. Thus, the manager can transfer the right to sign the delivery note and formalizes this right with a power of attorney or order.

In this case, 5 signatures can be affixed to TORG-12:

three from the seller’s side: (manager, accountant, responsible for shipment). In some large organizations, one person signs the delivery note upon shipment. Usually this is a certain “operator” who, based on information received from the accounting department and warehouse, generates a document and signs it with his signature. This procedure must be enshrined either in an order, or in a power of attorney, or in the job descriptions of the “operator”;

Electronic form of trade invoice

The form and procedure for compiling an electronic invoice are no different from the form and procedure for compiling its paper counterpart, with the exception that the electronic document is compiled in one copy, which consists of two files.

One of them is formed on the seller’s side, and the second, when sending a document, on the buyer’s side.

To sign electronic invoices, instead of a handwritten signature, an electronic signature (ES) is used, and the electronic consignment note is signed with one electronic signature on the part of the seller and one on the part of the buyer. Total of two signatures.

At the same time, in the lines “Vacation authorized”, “Chief (senior) accountant”, “Cargo released”, “Cargo accepted” and “Cargo received by consignee” the full names and positions of the relevant persons are indicated, and in the line “By power of attorney No.” - information on the power of attorney of the authorized person.

How to fill it out correctly

The standard layout of the acceptance certificate contains a number of mandatory items. The standard document structure looks like this:

- A cap.

- The reason for compiling the certificate and brief information on it.

- A plate with information about the work performed.

- The presence or absence of complaints from the customer.

- Information about the parties to the agreement.

- Signatures.

Now let's take a closer look at each section of the structure and list additional points.

In the upper right part of the paper it is written which agreement this sheet is attached to. You must indicate the application number and contract number along with the date of its creation. Below, in the middle, is the name of the certificate, its contents and number. The information listed refers to the header of the document.

Then you need to fill out a table on the work performed, where you need to indicate:

- Name of works;

- actual deadlines for completing the process;

- price;

- quality;

- customer comments.

It is mandatory to indicate the fact of inspection of the work performed in the presence of the contractor. The result must comply with the conditions specified in the main agreement.

Identified faults and defects must be recorded. At the same time, the deadlines and procedure for their elimination are indicated.

Affixing the form with a company seal is not a mandatory requirement. From 2021, printing on such documents has been abolished.

Combining an invoice and delivery note into one document

An invoice and a delivery note (TORG-12) can be combined into one document.

Options for combining an invoice and a delivery note into one document

In order to create one document instead of an invoice and a delivery note, there are two options:

Option 1. Use the form of a universal transfer document (UDD) recommended by the Federal Tax Service. In this case, “1” must be indicated in the “Status” field of the UPD.

Option 2. Develop the form of the combined document yourself. To do this you should:

1) supplement the invoice form with the following details (part 2 of article 9 of Law N 402-FZ, clause 9 of the Rules for filling out an invoice)):

a description of the business transaction - the release of goods (for example, “the goods were released” or “the cargo was released”);

the title of the position of the representative of your company who released the goods, with his signature, surname and initials;

a description of the business transaction - acceptance of goods (for example, “received the goods” or “received the goods”);

the title of the position of the company representative - buyer or consignee, with his signature, surname and initials;

2) by order of the head of the organization, to approve such an amended invoice form as a primary document as an annex to the accounting policies.

However, you cannot exclude any invoice details from the combined document.

The procedure for issuing and registering a combined document

The supplemented invoice or UPD must be drawn up:

upon shipment, and not within five calendar days from the date of shipment;

in two copies, one of which is given to the buyer, and the second is recorded in the sales book - just like a regular invoice.

An amended invoice or UPD for the purposes of calculating VAT, income tax, as well as accounting will be documents confirming the shipment.

The buyer's procedure for handling the combined document

Based on the amended invoice or UPD, the buyer can:

accept goods for accounting;

deduct VAT, just like on a regular invoice;

take into account the cost of goods in tax expenses.