Shift work and wages associated with it are a significant problem for accountants and personnel officers. Despite the fact that now this type of work is being used more and more often, not everyone knows what specific payments and in what amount employees are entitled to, as well as what to do with deductions for taxes and insurance payments to mandatory funds. And the workers themselves are far from all aware of what is due to them by law and what remains the good will of the employer. Let's try to understand what shift work is and how financial issues are resolved when using this method.

Payment for shift work: general points

The rotation method differs from all other systems for organizing the work and rest regime of workers primarily in that it provides a number of additional legislative guarantees to workers involved in work on a shift basis (Article 302 of the Labor Code of the Russian Federation).

All shift workers are guaranteed by the Code:

- shift pay as a method of labor;

- payment or free provision of housing;

- payment for days of round trip travel and days of delay in travel due to weather conditions based on the daily rate.

For shift workers working in the Far North or equivalent areas, the following are guaranteed:

- additional increasing coefficients (regional - depend on the area of work);

- allowances for work in the North (the so-called northern, calculated as a percentage of earnings);

- additional paid holidays - the number of days depends on the area of work.

The collective and/or labor agreement may also provide for other guarantees, such as the provision of free food during shifts.

Payroll when applying a work schedule on a rotational basis can be carried out using remuneration systems (or a combination of them for different cases):

- tariff system;

- salary systems;

- time-based;

- time-bonus;

- piecework;

- piecework-bonus;

- other methods and forms of remuneration not prohibited by law.

With the rotational method, remuneration is based on general economic methods. Payroll calculation is based on the tariff rate per hour or per unit of production. The tariff schedule may cover all positions and professions of the enterprise, or may apply only to certain categories of workers, leaving others on the salary system.

What does a full cycle look like?

To take into account everything that needs to be reflected in the calculation sheet, you need to calculate:

- hours and days that a person will get to the object and back;

- moments spent directly on performing direct duties;

- weeks of inter-shift rest.

To automate and optimize production processes, we recommend using special software from Cleverence, with which you can effectively organize the work activities of an enterprise.

Salary for shift work

In general, wages on a rotational basis consist of the following components:

- payment for work performed during the shift - according to tariff rates, categories, production standards;

- payment for overtime hours - is summed up once per accounting period (month, quarter, year - depends on the internal remuneration policy of the enterprise) upon its completion;

- payment for additional days of inter-shift rest (paid days off) for overtime on shift (Article 301 of the Labor Code of the Russian Federation, clause 4.3 of the Basic Provisions on the shift method of organizing work, approved by Resolution of the USSR State Committee for Labor of December 31, 1987 No. 794/33-82 [hereinafter referred to text - Basic provisions No. 794/33-82]);

- allowances: for shift work,

- for the area of work (the Far North and areas equivalent to it),

- for particularly difficult working conditions,

- for harmful working conditions;

Working hours during the shift method are recorded on a cumulative basis.

You can find out more about the features of this method of recording working time here: “Total recording of working time - examples of calculation.”

Compensation and allowances for shift work

As a rule, employers make compensation payments to shift workers - payment for travel from the place of assembly/place of residence to the place of work and back (tickets) and days of travel (tariff or average daily earnings for days on the road). An enterprise can reimburse the cost of travel, or it can issue tickets to its employees, purchasing them centrally from transport companies. Sometimes large companies organize the transportation of their employees on special flights, ordering airplanes, watercraft, and railway cars. Aspects of payment for travel to employees will be discussed in more detail below.

The shift allowance replaces daily travel allowances. The bonus for working on a shift basis is calculated for all days of the shift and for the days the employee is on the road on the way to the shift and back. The amount of allowances at commercial enterprises is established by collective agreement. For state-owned enterprises, there are regulations establishing the amount of allowances.

Details related to the payment of bonuses for shift work are discussed in the Guide “Shift Work” from ConsultantPlus. Get trial access to the system for free and proceed to the explanations.

Industry standards must be taken into account when calculating salaries. Especially if the company is a party to an industry agreement. If such an agreement is not signed by the enterprise, it may be equal to the norms of industry standards, but they will not be binding for the enterprise.

The amount of the bonus for shift work can be set:

- as a percentage of the salary (tariff rate);

- in a fixed amount.

Why is this not a business trip?

Sometimes personnel services confuse shift work with travel, but there are differences:

- Payment. A seconded specialist’s salary will include a working day and small tariff allowances. The shift worker draws up a special document in which all tariffs, terms and conditions are prescribed. Workers are considered to work full days.

- Body check. Before going to another city for a couple of days, you will not need to undergo an examination and confirm your health.

- Deadlines. There are no restrictions on weeks of stay for a business traveler. Upon his return, he goes to work. If people go to development, then they cannot be there for more than 1-3 months, after which a rest period follows.

- Goals. People go on a business trip to fulfill a specific assignment - to increase sales, to launch a line. The rotation method simply involves a regular 12-hour shift.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Payroll calculation using the rotation method - example

Foreman Ivanov I.I. works at an enterprise that uses a rotational work schedule.

Shift work conditions are as follows:

- Shift work schedule: 15/15(16). 16 days of rest are provided in months in which there are 31 days, 14 days of rest in February. In our example, the month under consideration is December 20XX.

- In December, the shift begins on the 5th. 4 days of the month (from the 1st to the 4th) - the road to the shift. The end of the watch is on the 19th, from the 20th to the 23rd - the road from the watch.

- The working shift on watch is 11.5 hours all days except the day before the end of the watch. On this day, work lasts 11 hours.

Question: Why are there no days off for 15 days of work during a shift?

Answer: in accordance with table 3.1 “Recommended work and rest regimes” of the Guidelines for optimizing work and rest regimes for rotational and expeditionary rotation methods of organizing work in the North, approved. Ministry of Health of the USSR 04/25/1988 No. 4614, with a 15-day work schedule, shifts are organized in such a way that by changing shifts from the day shift to the night shift, the required number of hours for inter-shift rest is formed (according to clause 4.3 of the Basic Provisions No. 794/33-82, the duration of inter-shift rest including lunch breaks - at least 12 hours).

- The hourly tariff rate is 300 rubles/hour.

- Compensation for shift work is 700 rubles/day.

- Payment for travel time is 100% of the daily wage based on an 8-hour working day.

- The accounting period is quarter. For our example, we provide salary calculations for December and calculate payment for hours worked overtime in the accounting period. The employee worked for the 4th quarter of 20XX: in October - 184 hours, in November - 172 hours, in December - 172 hours. Or 528 hours per quarter when the norm is 519 hours.

ATTENTION! In the context of the COVID-19 pandemic, officials have developed rules for working on a rotational basis. Initially, they were valid until the end of 2021. But the government, by Decree No. 2310 dated December 28, 2020, extended the validity of these rules until the end of 2022.

Read more about the temporary work rules for shift workers in the review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

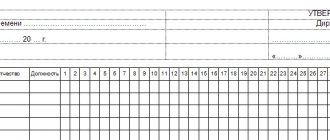

We remind you that the employer is required to draw up a work schedule for the entire accounting period (in our case, a quarter). In our example, this is table 1.

The following markings are used to indicate days in the schedule:

- DD - days on the road;

- RD - working days of the shift;

- Airborne Forces - a day off during a shift between shifts (in our case there are no such days);

- On weekends.

In order to more clearly display the periods of work and rest of I. I. Ivanov, we present the calendar of December 20XX with the calculation of days on the road, on shift and days of inter-shift and inter-shift rest:

- from December 1 to December 4 - 4 days on the way to the place of work;

- from December 5 to December 19 - 15 days on duty;

- from December 20 to 23 - 4 days on the way home;

- from December 24 to December 31 - 7 days off.

Only 8 days on the road, 15 working days, 8 days of rest.

1. Number of hours worked per month:

14 × 11.5 + 1 × 11 = 172 hours.

2. The employee worked 15 days. With a 40-hour work week and a normal work shift, the number of hours that an employee would have worked for the same period in December (see paragraph 4 of clause 4.5 of Basic Provisions No. 794/33-82):

15 working days × 8 hours = 120 hours.

3. Number of days of shift work:

(172 – 120) / 8 = 6.5 days.

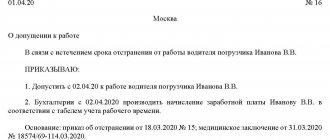

For these days, paid days off are provided (paragraph 3 of article 301 of the Labor Code of the Russian Federation, clause 4.5 of the Basic Provisions No. 794/33-82). The December report card takes the form presented in Table 2.

When drawing up the report card, we use form T-12, approved. Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. The employer is obliged to keep records of working hours, as stated in Art. 91 and Art. 300 Labor Code of the Russian Federation. At the same time, the form for recording working hours can be independently developed by the enterprise. In our case, the enterprise established in its accounting policy that the T-12 form is used to record working time.

In this case, payment for weekends will be carried out in the following way: 6 days - for 8 hours, 1 day - for 4 hours.

We mark work days, days off and paid days off in the same way as indicated in the T-12 form, namely:

- days off between shifts and between shifts - B;

- working days during a shift - VM;

- paid days off - OV.

4. Let's calculate the salary for the time worked:

172 hours × 300 rub./hour = 51,600 rub.

5. Supplement for shift work:

(15 days of watch + 8 days of travel) × 700 rub./day = 16,100 rub.

6. Payment for overtime (paid days off):

6.5 days × 8 hours × 300 rub./hour = 15,600 rub.

7. Payment for days on the road:

8 days × 8 hours × 300 rub./hour = 19,200 rub.

8. Total wages for December:

51,600 + 16,100 +15,600 + 19,200 = 102,500 rub.

9. In addition, in December it is necessary to pay the employee for hours of overtime work according to the summarized schedule. From the conditions of the example, it is known that the employee worked 516 hours during the quarter, which is 5 hours more than the standard:

5 × 8 × 300 = 12,000 rubles.

In total, for work on a rotational basis in December, the enterprise is obliged to pay foreman Ivanov I.:

102,500 +12,000 = 114,500 rub.

Calculating the salary of an employee working on a rotational basis in the North

Payroll calculation for an employee working on a rotational basis in the North has its own peculiarities.

Regional coefficients have been established that must be used when calculating wages. So, if in the above example Ivanov I.I. worked in the Far North, in the Khanty-Mansiysk region, then the northern coefficient applied to his salary is 1.7.

In addition, there is also a bonus for working in the North (“northern”). This premium depends not only on the region, but also on the length of service of the employee in the Far North and in equivalent regions.

Let’s assume that Ivanov I.I.’s northern bonus is 50%.

Then Ivanov I.I.’s salary for working on shift in December 20XX:

172 × 300 × 1.7 + 172 × 300 × 0.5 = 87,720 + 25,800 = 113,520 rubles.

We add all additional payments and compensations calculated in the example above. The final salary of I. I. Ivanov:

113,520 + 16,100 + 15,600 + 19,200 + 12,000 = 176,420 rub.

To clarify the principle of application of northern surcharges and their sizes, read the article “The size of the northern surcharge in the Far North regions.”

Security: payment after the watch

If a person works in security on a rotational basis, then inter-shift rest is provided to him on the same conditions as other employees working on a rotational basis. Security guards usually have overtime after their shift. Therefore, they are calculated paid days off in the same way as in the example above. At the end of the accounting period (month, quarter or year), security staff may be paid overtime based on a double tariff rate.

Moreover, if payment for the main shift time has already been made, then the employer makes an additional charge for overtime (overtime for the accounting period), as in the example above. An employee has the right to receive additional days of rest instead of extra pay for overtime (Article 152 of the Labor Code of the Russian Federation).

More details about the rules for calculating payment for overtime work can be found in the article “How is overtime work paid according to the Labor Code of the Russian Federation?”

Inter-shift rest

The shift method of work involves overtime, in comparison with the legally established norms of work and rest time. Days of rest between shifts are provided to cover this gap and compensate the employee for the costs of his labor. This period is paid based on one tariff rate (daily wage based on salary). Higher calculated indicators enshrined in the local regulations of the organization are also acceptable. The tariff rate is multiplied by the number of days of rest.

Attention! To calculate the number of days of rest between shifts, the actual number of hours worked according to the schedule should be compared with the standard according to the production calendar of a 40-hour working week (if harmful working conditions exist - a 36-hour working week). The positive difference is divided by the standard length of the working day of the corresponding working week - 8 or 7 hours. 12 min.

Travel days are calculated by the employer based on the number of travel days and the daily tariff rate, multiplying the two values.

Payment for travel from shift upon dismissal

If an employee quits while on shift, a legitimate question arises: is the organization obligated to pay him for travel from the shift upon dismissal? First, let’s consider whether the organization is obliged to pay the shift worker’s travel and in what amount.

There are several starting points for making a decision on paying for workers’ travel to and from their shifts:

- from place of residence to place of gathering;

- from the gathering place to the place of work;

- from place of residence to place of work.

ATTENTION! In accordance with sub. 2 p. 1 art. 422 of the Tax Code of the Russian Federation, all types of compensation payments (within the limits established by law) related to the employee’s performance of his job duties are not subject to insurance premiums for payers who are organizations, individual entrepreneurs or individuals - employers. The procedure for paying compensation to employees for travel expenses to their place of work must be fixed in a collective agreement and employment contracts.

Regarding the question of whether the employer is obliged to pay for travel from the place of work to the place of residence for an employee who quit after the end of the shift, there cannot be a clear answer. If this clause is not separately stated in the employment contract with the employee, then the employer is not obliged to pay for travel. The person quit - he ceased to be an employee of the enterprise, and the employer’s obligations to him ceased from the moment of his dismissal.

If a person, working in the Far North, quits and at the same time took leave, then the employer is obliged to pay for his travel to the place of vacation. Since in this case, the employment relationship ends only from the end of the vacation or another date different from the end date of work on the shift.

Additional odds

In addition to the hours worked, increasing factors must be used when remunerating a shift worker if required by law. They are used in cases where work is associated with special conditions, or occurs in some specific climatic zones.

Thus, when calculating a shift worker’s salary, the employer must take into account:

- Regional coefficients (colloquially called “northern”, since they are usually associated specifically with the Far North). Their use is mandatory. Even if the employment contract stipulates that the coefficients do not apply, the employee can challenge such an entry in court - and is guaranteed to win the case.

- Bonus “for harmfulness”. If the work is associated with harmful conditions, and it is impossible to eliminate this circumstance, then the employee is entitled to an increase in wages. Its size is regulated by local acts; federal legislation only establishes that such a premium cannot be less than 4%.

- Additional coefficients applied to certain categories of employees. As an example: salary calculations for an installer working at a height of 15 meters should take into account a coefficient of 1.25.

Results

Remuneration for shift work has its own characteristics. Payment is made for work performed during the shift according to tariff rates, categories, and production standards. In addition, bonuses are paid for work on a shift basis, for days on the road, for the area of work (the Far North and areas equivalent to it). Overtime work is paid based on the results of the accounting period. The main difficulties for an accountant of a commercial enterprise arise if the local acts of the enterprise do not clearly define the procedure for calculating and paying wages to persons involved in work on a rotational basis.

Sources:

- Labor Code of the Russian Federation

- Resolution of the State Labor Committee of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 No. 794/33-82

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxation of payments to shift workers

Do not forget that all “salary taxes” do not need to be levied on the entire amount of payments to the shift worker, but only on the salary for the time worked, payment for inter-shift rest days and payment for overtime hours. 6 clause 1 art. 208, paragraph 1, art. 209, paragraph 1, art. 210 Tax Code of the Russian Federation; Part 1 Art. 7 of Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ); clause 1 art. 20.1 of Law No. 125-FZ of July 24, 1998 (hereinafter referred to as Law No. 125-FZ).

An allowance in lieu of daily allowance and payment for days on the road are compensation payments to the employee for the performance of work duties, which are not subject to personal income tax and contributions, including “injury” clause. 3 tbsp. 217 Tax Code of the Russian Federation; subp. “and” clause 2, part 1, art. 9 of Law No. 212-FZ; subp. 2 p. 1 art. 20.2 of Law No. 125-FZ; Letters of the Ministry of Finance dated 09/02/2011 No. 03-04-06/0-197 (clause 3 of section I), dated 06/29/2012 No. 03-04-06/9-187; Ministry of Labor dated September 12, 2014 No. 17-3/B-434; FSS dated April 14, 2015 No. 02-09-11/06-5250 (clause 11 of the appendix).

All these payments are taken into account in “profitable” expenses as labor costs. 3, 17 art. 255 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 02.09.2011 No. 03-04-06/0-197 (clause 3 of section II) and in expenses for the “income-expenditure” simplified tax system subp. 6 clause 1 art. 346.16 Tax Code of the Russian Federation.

***

Shift workers must be provided with three hot meals daily. 6.1 Basic provisions, approved. Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 No. 794/33-82. However, provision of free food to rotation workers is not provided. 302 Labor Code of the Russian Federation. Therefore, paying them for food is not considered a compensation payment. Consequently, it must be subject to personal income tax and insurance premiums, including “for injuries”, and the employer must ensure separate accounting of such payments. 1 tbsp. 210, paragraph 1, art. 211 Tax Code of the Russian Federation; Part 1 Art. 7 of Law No. 212-FZ; clause 1 art. 20.1 of Law No. 125-FZ; Letter of the Ministry of Finance dated March 31, 2011 No. 03-03-06/4/26.

Expenses for free meals for shift workers can be taken into account for profit tax purposes if this is provided for in collective or labor agreements. 25 Art. 270 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated March 31, 2011 No. 03-03-06/4/26.