As always, we will try to answer the question “Kbk 18211603010010000140 Decoding In 2021”. You can also consult with lawyers for free online directly on the website without leaving your home.

KBK code 18210102010012100110 must be indicated in payment orders for the transfer of personal income tax (personal income tax) amounts. We are talking about the tax that was withheld by an organization - a tax agent. At the same time, individual entrepreneurs transfer personal income tax to other BCCs.

Attention! We have prepared a KBK guide to insurance premiums for 2020. He will help you correctly list fees, penalties and fines. Relevance has been confirmed by BukhSoft program experts. Download for free:

Budget classification code 18210102010011000110: decoding for legal entities (organizations)

18210102010011000110 BCC in 2021 is used for those payments for which the organization acts as a tax agent. But it is used only when transferring individual tax payments. We will give a decoding of this code and the procedure for its reflection in the payment order.

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

Banking institutions can also fill out a payment document with the KBK code 18211603010010000140. If, when opening accounts for Russian or foreign organizations, identification numbers and a document confirming the presence of registration with the tax service were not used.

Kbk 18211603010016000140: what is the fine of 200 rubles for and what is the tax

Not always organizations and individual entrepreneurs whose property was seized for some reason can immediately understand why they must transfer 30,000 rubles according to the KBK code 18211603010010000140, for which they were assessed such a fine. The assessment of this fine by tax authorities can be for one reason, this is the unlawful use of property that is under arrest or pledged to the tax authority.

- Violation of the procedure for using pledged or seized property (Article 125 of the Tax Code of the Russian Federation).

- Failure to provide information necessary for tax control (Article 126 of the Tax Code of the Russian Federation). If, for example, you do not provide the primary information during a counter-inspection of the counterparty by the tax authorities, then you will face a fine of 200 rubles. for each document not presented (clause 1). And if the tax agent does not submit a personal income tax calculation on time (clause 1.2), then this is also a reason for a fine (that’s why the fine is 1000 rubles according to KBK 18211603010016000140).

Reasons for imposing a fine

Usually it all starts small, namely accounting with the tax service.

Wanting to save on taxes, many organizations try to delay visiting tax offices for a long time. Such actions by the tax services are considered as deliberate avoidance of registration and are punishable by a fine of 40,000 rubles. Subsequent accounting also presents a number of difficulties. It cannot always be entered correctly by an inexperienced accountant. Therefore, during an audit, tax services may subsequently reveal various gross violations in the organization’s accounting of income or expenses. The absence of primary documentation or invoices is considered a violation.

In this situation, the minimum fine assessed by the tax authorities will be 10,000 rubles. But provided that the violation of the accounting rules they identified relates only to one tax period and did not cause a clear tax violation.

But if violations in the introduction of accounting were discovered by the tax authority in several periods, then the minimum fine issued by them will be 30,000 rubles. The most serious offense concerns the base used in calculating insurance premiums. If the tax authorities discover that it has been understated, the minimum fine will be 40,000 rubles.

Not always organizations and individual entrepreneurs whose property was seized for some reason can immediately understand why they must transfer 30,000 rubles according to the KBK code 18211603010010000140, for which they were assessed such a fine. The assessment of this fine by tax authorities can be for one reason, this is the unlawful use of property that is under arrest or pledged to the tax authority.

But it is worth noting that it is not always only organizations or individual entrepreneurs who pay fines. The tax authorities can also collect a fine from a witness. True, this kind of punishment occurs only if the main witness, without providing a valid reason, was absent during the tax process. In this case, he faces a fine of 3,000 rubles.

Banking institutions can also fill out a payment document with the KBK code 18211603010010000140. If, when opening accounts for Russian or foreign organizations, identification numbers and a document confirming the presence of registration with the tax service were not used.

Yes, there are plenty of reasons why tax authorities can fine various organizations, individual entrepreneurs and institutions. But it is worth knowing that if the amount accrued for a violation is not transferred on time according to KBK 18211603010010000140, then after the end of the allotted period, you will have to additionally transfer the penalty amount accrued for non-payment of previously accrued fines.

Kbk 18211603010010000140 for which the fine is 200 rubles

> Accounting and audit > Kbk 18211603010010000140 for which the fine is 200 rubles

Fines for violation of laws on taxes and fees

Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations. A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

Each type of offense punishable by a fine is regulated by government agencies at various levels, so the recipients of the fine will be different. This is why it is so important to indicate the correct BCC in the payment order when paying a fine.

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

Other fines

- 18811643000016000140 – for administrative violations. 18811690010016000140 – compensation for damage to the federal budget.

- 18811690050056000140 – compensation for damage to the budgets of municipal districts.

Payment of traffic fines

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

The 60 days provided for payment begin to count from the issuance of a receipt for a fine or after receiving a letter of receipt issued according to the recording cameras.

Innovations adopted in 2021 threaten non-payers of traffic police fines with the following penalties:

- Late payment will result in a double fine;

- a persistent defaulter may be arrested for 15 days;

- You may be forced to perform community service for up to 50 hours.

Everything depends on the decision of the judge, who takes into account, first of all, the seriousness of the committed traffic violation.

Payment details

Save so you don't lose!

If you have received a notice of a fine from the traffic police, you must pay it using the correct details. Please note that the budget classification codes for this type of fine are the same for all regions of the Russian Federation; they depend on what kind of car you have and what exactly you violated with it. Look for the CBC you need among those listed below.

- 18811630020016000140 – for administrative offenses in the field of traffic.

- 18811630010016000140 – for violating the rules for transporting large and heavy cargo on public roads:

- 18811630011016000140 – for the same violation that occurred on a federal road;

- 18811630012016000140 – if the road was of regional or intermunicipal importance;

- 18811630013016000140 – public road of local importance for urban districts;

- 18811630014016000140 – public road of local significance in municipal districts;

- 18811630015016000140 – public road of local significance for settlements.

- 18811625050016000140 – for violation of legislation in the field of environmental protection.

- 18811626000016000140 – for violating the legislation on advertising on vehicles;

- 18811629000016000140 – for violations in the field of international transportation (federal budget).

- 18811630030016000140 – for all other fines imposed by a municipal body, federal city, urban district.

Running a business always involves a number of difficulties, and most often they relate to accounting. Indeed, many organizations, for various reasons, pay little attention to both maintaining accounting records and timely payment of the tax amount, as a result of which they are faced with such a penalty as paying a fine under KBK 18211603010010000140.

To understand and understand what KBK 18211603010010000140 is, its decoding in 2021, for which it is difficult to immediately say the fine. The fact is that according to this code, payment of a fine is carried out under several articles. The transcript itself states that this code is used to carry out monetary penalties accrued to violators of legislation regarding taxes and fees.

Usually it all starts small, namely accounting with the tax service. Wanting to save on taxes, many organizations try to delay visiting tax offices for a long time. Such actions by the tax services are considered as deliberate avoidance of registration and are punishable by a fine of 40,000 rubles.

Subsequent accounting also presents a number of difficulties. It cannot always be entered correctly by an inexperienced accountant. Therefore, during an audit, tax services may subsequently reveal various gross violations in the organization’s accounting of income or expenses. The absence of primary documentation or invoices is considered a violation.

In this situation, the minimum fine assessed by the tax authorities will be 10,000 rubles. But provided that the violation of the accounting rules they identified relates only to one tax period and did not cause a clear tax violation.

But if violations in the introduction of accounting were discovered by the tax authority in several periods, then the minimum fine issued by them will be 30,000 rubles. The most serious offense concerns the base used in calculating insurance premiums. If the tax authorities discover that it has been understated, the minimum fine will be 40,000 rubles.

Not always organizations and individual entrepreneurs whose property was seized for some reason can immediately understand why they must transfer 30,000 rubles according to the KBK code 18211603010010000140, for which they were assessed such a fine. The assessment of this fine by tax authorities can be for one reason, this is the unlawful use of property that is under arrest or pledged to the tax authority.

But it is worth noting that it is not always only organizations or individual entrepreneurs who pay fines. The tax authorities can also collect a fine from a witness. True, this kind of punishment occurs only if the main witness, without providing a valid reason, was absent during the tax process. In this case, he faces a fine of 3,000 rubles.

Banking institutions can also fill out a payment document with the KBK code 18211603010010000140. If, when opening accounts for Russian or foreign organizations, identification numbers and a document confirming the presence of registration with the tax service were not used.

Yes, there are plenty of reasons why tax authorities can fine various organizations, individual entrepreneurs and institutions. But it is worth knowing that if the amount accrued for a violation is not transferred on time according to KBK 18211603010010000140, then after the end of the allotted period, you will have to additionally transfer the penalty amount accrued for non-payment of previously accrued fines.

How to pay the tax office for violations under KBC act 18211603010016000140

article: → “KBK UTII: penalties, fines.” A fine in case of settlements for insurance payments will be imposed on the enterprise if:

- not the full amount of funds was received from him as a result of illegal actions,

- accounting staff made a mistake in calculating the amount of contributions,

- the calculation base was underestimated.

It happens that a fine can be avoided, but this is only likely in situations where the organization made errors in calculating the amounts of contributions due for transfer, but at the end of the year it paid all the amounts correctly. It happens that the provided report contains correct data on the amount of payments, but the entire amount was not received for payment of contributions.

- Tax accounting

In this article we will look at how to fill out a payment order for fines. Let's look at common mistakes. If an LLC or individual entrepreneur made mistakes as a result of which a tax, fee or contribution was not paid, or the accountant missed the deadline for sending funds to pay taxes, the company will soon receive a request from the Federal Tax Service to transfer the underpaid amounts.

Attention

In addition, a fine and penalties will be assessed. And here you will need the ability to competently fill out payment orders for the payment of fines, otherwise the tax inspectorate will be forced to take more stringent measures against the willful defaulter. Fines and penalties for taxes, fees and contributions To transfer fines or penalties, the same details of the Federal Tax Service are entered in the payment order as when paying taxes and fees.

Why is there a fine of 200 rubles according to KBK 18211603010016000140?

CCP when making cash payments and (or) payments using payment cards 182 1 1600 140 Monetary penalties (fines) for violation of the procedure for working with cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions 182 1 1600 140 Monetary penalties (fines) for violation of the currency legislation of the Russian Federation and acts of currency regulatory authorities, as well as the legislation of the Russian Federation and in the field of export control 182 1 1600 140 FILESDownload KBK for payment of monetary penalties (fines) in .PDFDownload KBK for payment of monetary penalties (fines) in picture format .JPG Fines for violation of laws on taxes and fees Fines are issued for violations of federal laws on taxes and fees, as well as for administrative violations.

18211603010016000140 kbk transcript 2021: what is the fine for?

Important

Notice Payee: INN: KPP: Recipient's bank: account: BIC: corr/s: KBK: OKTMOOOKATO: Abbreviated name of the authority: Payer: Full name: Address: INN: Name of payment: Amount: Payer: (signature) Cashier On this page You can fill out and print the Receipt and details for payment of KBK 18211603010016000140 fine for violation of tax laws and fees, provided for. near the station

Tax Code of the Russian Federation in the Federal Tax Code of Russia for the Moscow Region (IFTS RF No. 2 for the Moscow Region) Monetary penalties (fines) for violation of the legislation on taxes and fees provided for in Articles 116, 118, Article 119.1, paragraphs 1 and 2 of Article 120, Articles 125, 126 , 128, 129, 129.1, 132, 133, 134, 135, 135.

1 of the Tax Code of the Russian Federation Municipal entities of the Moscow region City of Korolev using the form proposed above.

Kbk 18211603010016000140: decryption in 2021

In this case, tax authorities are required to indicate the name of the tax for which the claims arose, its BCC (for example, BCC 18211603010016000140) and a number of other information.

For information on how a demand for payment of taxes and fees should be formalized, read the materials in the section “Request for payment of taxes and fees in 2017–2018.”

But the document that instructs the company to pay according to BCC 18211603010016000140 raises the most questions - what was the fine for in this case and what does this BCC mean? First of all, let’s figure out what the decoding of KBK 18211603010016000140 is.

To administer budget revenues, each type of payment has a special code - KBK (budget classification code). It must be indicated in each payment order for the payment of funds to the budget, as well as in tax reporting sent to the Federal Tax Service, Social Insurance Fund and other government agencies.

Kbk for payment of fines, sanctions, monetary penalties for legal entities

But sometimes these 11 months are not so spent.

So, for such persons you need to take both SZV-M and SZV-STAZH!

Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children).

Kbk for payment of monetary penalties (fines)

Fines and penalties for insurance premiums Monthly, before the 15th day, payments for insurance premiums for the previous month must be transferred to the budget. If this date falls on a weekend or holiday, according to the law, the calculation is made on the next working day. If these requirements are ignored, fines and penalties cannot be avoided.

They will be charged not only for late payment, but also for incorrect calculation of payment amounts and, as a result, transfer of funds in incomplete amounts. The penalty is imposed from the very next day after the end of the period approved by law and will be accrued every day until the debt is repaid.

Its size is directly dependent on the current refinancing rate and is equal to 1/300 of its part.

How to fill out a payment order for fines to the tax office in 2018

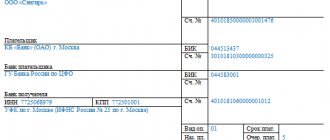

How to fill out a payment order for fines if there is a requirement and a UIN When you have a notification from the Federal Tax Service that you have been fined or have been charged penalties, data appears to be entered in some columns of the payment order, which would remain zero in its absence: Cell : instead of zero we write UIN. Cell: indicate the tax period.

Cell: report document No. (Federal Tax Service requirements). Cell: the document date will be the day the paper was received from the Federal Tax Service.

How to fill out a payment order for fines in the absence of a requirement and UIN As we have already said, the difference between filling out a payment order in the presence of a documented requirement from the Federal Tax Service and filling it out without notification from the Federal Tax Service is that cells 22, 107, 108 and 109 will contain the value “ 0".

A company has the right to fine only if a company deliberately misleads employees of the Federal Tax Service by indicating in the report an underestimated base for calculating contributions, the amount of which depends on the amounts transferred to the employees of the enterprise within one year. There are penalties for late payments, but there is no basis for fines.

How penalties and fines for insurance premiums will change in 2021 From January 1, 2021, settlements for insurance premiums will be placed under the control of the Federal Tax Service, which means penalties for late payments and arrears will now be imposed in a manner similar to taxes and fees. Now organizations will not have to pay penalties for the day when they made payments on contributions; previously, penalties were assigned for this date as well.

It follows that if payment is made one day later than the deadline, there will be no consequences in the form of penalties.

The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

The 60 days provided for payment begin to count from the issuance of a receipt for a fine or after receiving a letter of receipt issued according to the recording cameras.

Innovations adopted in 2021 threaten non-payers of traffic police fines with the following penalties:

- Late payment will result in a double fine;

- a persistent defaulter may be arrested for 15 days;

- You may be forced to perform community service for up to 50 hours.

Everything depends on the decision of the judge, who takes into account, first of all, the seriousness of the committed traffic violation. Line

Accountant's Directory

This is regulated by Article 119.1 of the Tax Code of the Russian Federation; when an authorized employee submits reports with incorrect data.

This is regulated by Article 119.2 of the Tax Code of Russia; in the event of a gross violation of the rules for maintaining and analyzing tax accounting.

This is regulated by Article 120 of the Tax Code of Russia; in case of violation of a certain procedure for the use of a seized or pledged object. Regulated by Article 125 of the Tax Code of Russia; failure to provide information for tax analysis. This is regulated by Article 126 of the Tax Code of Russia; documents are provided incorrectly - Article 126.1 of the Tax Code of Russia; failure to appear at the hearing regarding violations as a witness.

The full list of codes is contained in the KBK classifier (order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n).

This is where you need to look for the decryption 2021-2021 KBK 18211603010016000140.

Kbk 18211603010016000140 - why the fine of 200 rubles?

Kbk 18211603010016000140 - why the fine of 200 rubles? This question can be asked by the head of a company to his chief accountant after receiving a request from the tax office. How KBK 18211603010016000140 stands for and on what basis the tax authorities demand payment of a fine under it, we will tell you in our article.

Decoding KBK 18211603010016000140 (2018–2019)

Kbk 18211603010016000140: what is the fine of 200 rubles for and what is the tax

How to enter KBK 18211603010016000140 into a payment order - sample

Results

Decoding KBK 18211603010016000140 (2018–2019)

Our readers - practicing accountants - often receive letters from the tax office demanding the payment of a certain tax or fee.

This happens if the taxpayer violated the law and did not transfer any payment to the budget on time in full.

In this case, tax authorities are required to indicate the name of the tax for which the claims arose, its BCC (for example, BCC 18211603010016000140) and a number of other information.

For information on how a demand for payment of taxes and fees should be formalized, read the materials in the section “Request for payment of taxes and fees in 2017–2018.”

But the document that instructs the company to pay according to BCC 18211603010016000140 raises the most questions - what was the fine for in this case and what does this BCC mean?

First of all, let’s figure out what the meaning of KBK is 18211603010016000140. To administer budget revenues, each type of payment has a special code - KBK (budget classification code). It must be indicated in each payment order for the payment of funds to the budget, as well as in tax reporting sent to the Federal Tax Service, Social Insurance Fund and other government agencies.

The full list of codes is contained in the KBK classifier (order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n). This is where you need to look for the decryption 2018-2019 KBK 18211603010016000140.

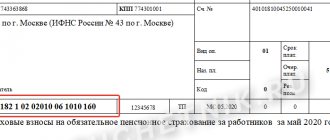

According to the classifier (in the current version) indicating KBK 18211603010016000140 - an explanation of what the fine is for in 2018-2019 - the taxpayer must transfer the fine for violation of tax legislation under the following articles of the Tax Code of the Russian Federation: 116, 119.1, 119.

2, 120 (paragraphs 1 and 2), 125, 126, 126.1, 128, 129, 129.1, 129.4, 132, 133, 134, 135, 135.1, 135.2.

Let's take a closer look at what these articles of the code are and what fines are paid under them.

Subscribe to our accounting channel Yandex.Zen

Subscribe

Do you have any questions about filling out payment forms? Ask them on our forum. On this thread, for example, you can clarify what to do if you sent a payment order indicating the wrong BCC.

Results

In order to understand what kind of KBK 18211603010016000140 this is and what tax should be paid on it, you must first understand the essence of the requests received from the inspectors.

So, you should know that under this code the taxpayer pays fines for violating tax laws. Fine of 200 rubles.

- no matter what tax in 2018-2019 according to KBK 18211603010016000140 - tax authorities have the right to impose on a company that:

- submitted reports on paper, but should have done this using telecommunications;

- did not hand over documents in response to the tax authorities’ demands.

For more information about what other powers the tax authorities have during an audit, read the article “Tax audit - what is it and what is the procedure?”

What are KBKs used for?

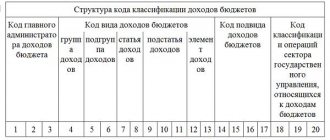

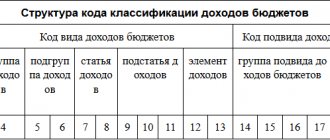

- "Administrator" . The first three signs show who will receive the funds and is responsible for replenishing this or that part of the budget with them, and manages the received money. The most common codes for businessmen begin with 182 - tax authority, 392 - Pension Fund, 393 - Social Insurance Fund and others.

- "Type of income" includes signs from 4 to 13. This group of signs helps to fairly accurately identify receipts based on the following indicators:

- group – 4th character (that is, the first in this paragraph);

- subgroup – 5th and 6th characters; a two-digit code indicates a specific tax, duty, contribution, fine, etc.;

- article – category 7 and 8 (the value of the purpose of the received income is encoded in the settlement documents for the budget of the Russian Federation);

- subarticle – 9, 10 and 11 characters (specifies the item of income);

- element - 12 and 13 digits, characterizes the budget level - from federal 01, municipal 05 to specific budgets of the Pension Fund - 06, Social Insurance Fund - 07, etc. Code 10 indicates the settlement budget.

- “Program” - positions from 14 to 17. These numbers are designed to differentiate taxes (their code is 1000) from penalties, interest (2000), penalties (3000) and other payments (4000).

- “Economic classification” – last three digits. They identify revenues in terms of their economic type. For example, 110 speaks of tax revenues, 130 - from the provision of services, 140 - funds forcibly seized, etc.

Kbk monetary penalties, fines for violation of the law 2021

PENALTIES, FINES

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135. 1 Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation on the use of cash register systems when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the currency legislation of the Russian Federation and acts of currency regulatory authorities, as well as the legislation of the Russian Federation in the field of export control | 182 1 1600 140 |

FILES Download KBK for payment of monetary penalties (fines) in .PDF Download KBK for payment of monetary penalties (fines) in image format .JPG

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

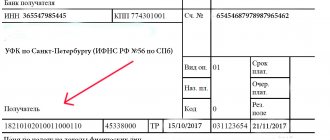

Fill out payment documents correctly

Check details such as KBK, OKTMO, recipient's TIN and recipient's checkpoint, payer's TIN and payer's full name. If the specified details are filled in incorrectly, payments will be classified by the Federal Treasury authorities as “unclarified payments,” which will not only lead to untimely reflection of paid tax payments in the “Settlements with the Budget” card, but will also complicate the identification (determination) of the payer. Only if payment notices are correctly filled out, information about tax payments will be timely and correctly reflected in the “Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the Ulyanovsk Region Share: