5,00

5

| Reviews: | 0 | Views: | 12215 |

| Votes: | 1 | Updated: | n/a |

File type Text document

Document type: Statement

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

Form No. MB-7 Approved by Decree of the USSR State Statistics Committee dated December 28, 1989 No. 241 +———-+ OKUD code ¦ ¦ +———-+ RECORDING REPORT FOR THE ISSUANCE (RETURN) OF SPECIAL CLOTHING, SPECIAL FOOTWEAR AND SAFETY DEVICES +——————————————-+ ¦ Number ¦ Month,¦Type code¦Workshop, department,¦ ¦ ¦document¦ year ¦operation¦ site ¦ ¦ +———+——+———+————+——¦ +——————— ———————-+ +———————————————————————+ ¦ Number ¦Fami-¦Ta- ¦Workwear, ¦ Unit ¦Co- ¦Date ¦Term ¦Submission, ¦linen-¦safety shoes and ¦measurements¦or- ¦post- ¦service¦sign ¦ ¦order¦name, ¦safety ¦honest¦stupid ¦ ¦ in ¦ ¦ ¦ in ¦ in ¦ ¦ in ¦ ¦ in ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ in ¦ ¦ ¦ ¦ ¦ in ¦ +——— —-+———¦ ¦splu-¦ ¦(delivered- ¦ ¦ ¦ ¦name-¦nomen-¦code¦nai- ¦ ¦ata- ¦ ¦che) ¦ ¦ ¦ ¦ ¦new- ¦clatu-¦ ¦ change ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦rn ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦No. ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——-+——+——+——+——+—+——+——+——+——+——¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦ 6 ¦ 7 ¦ 8 ¦ 9 ¦ 10 ¦ 11 ¦ ¦ ¦ +——¦ +——+—¦ +——+——+——¦ ¦ +——-+——+——+—— +——+—+——+——+——+——+——¦ +——-+——+——+——+——+—+——+——+——+— —+——¦ +——-+——+——+——+——+—+——+——+——+——+——¦ ¦ ¦ ¦ ¦ ¦etc. ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +——+ +———-+ +——————+ ¦ Financially responsible person __________________________________ Print with the back without the heading part. Signature printed on the back. COMMENTS: ———— Used to record the issuance of workwear, safety shoes and safety equipment to enterprise employees for individual use according to established standards and their return during automated processing of credentials. It is filled out in two copies by the storekeeper of the workshop (department, section) separately for the issuance and return of workwear, safety shoes and safety equipment and is documented with the appropriate signatures. One copy is transferred to the accounting department, the second remains with the storekeeper of the workshop (department, section). The same form is used to keep records of workwear accepted from employees for washing, disinfection, repair and summer storage.

Download the document “Sample. Record sheet for the issuance (return) of workwear, safety footwear and safety equipment. Form No. MB-7"

Regulatory regulation of the issuance of personal protective equipment

| Normative act | Scope of regulation |

| Labor Code of the Russian Federation Art. 221 | Providing workers with PPE |

| Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 N 290n | Defines the rules for issuing PPE |

| Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a | Approves form MB-7 |

| Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n | Approves accounting maintenance |

From 01/01/2013, primary documentation forms do not have to be used directly in the form established by law , that is, organizations have the right to independently develop and apply forms that are convenient for themselves, but they must be approved in the organization’s local documents.

Use of Form N MB-7 in an organization

A statement in form N MB-7 is necessary to correctly reflect in accounting the movement of these items in the enterprise through their issuance for individual use by employees.

Due to the fact that at the regulatory level it is mandatory and necessary to provide specialized protective equipment to employees, which are provided by the employer depending on the harmfulness and danger of the organization’s activity (there are free standards for issuing), it is necessary to ensure correct accounting of their movement.

What to protect from

Workwear means clothing, shoes, helmets, hard hats, mittens, etc., designed to protect workers from exposure to various factors:

- high and low temperatures;

- radiation;

- chemicals of irritating, toxic action;

- electricity, etc.

As a rule, wearing special clothing when performing certain work is stipulated at the legislative level, including industry documents and labor protection requirements. If an employee does not have special clothing, the head of the organization may be held accountable by regulatory authorities.

General requirements for filling out the MB-7 form

Form MB-7 is a table filled out by the responsible person. Like all primary documentation, such an accounting statement must comply with the general procedure for preparing primary documentation in accordance with Article 9 of the Federal Law of December 6, 2011 N 402-FZ :

- name of the form (in full)

- start date of statement compilation

- name of the organization and structural unit where the document was drawn up

- information reflected in the document

- quantities and units of measurement

- position, signature, transcript of the person (materially responsible) responsible for registration

- position, signature, transcript of the head of the department where the document was compiled

All cells are required to be filled out. If there is no data in individual cells, then a dash is added.

Components of the act

Form MB-4 is filled out on both sides of one sheet. There are three tables on one side and one on the other.

First part

The informative function of the first part of the act is to indicate when filling out:

- Number of the act for write-off of special clothing according to the MB-4 form.

- The organization on whose balance sheet the items are listed.

- If there is a structural unit of the organization. If it is not there, then the line is left blank.

- Forms of paper according to OKUD - 0320002. It is already indicated in the attached form.

- OKPO code.

The last two columns of this list are presented in the form of a miniature table. It is located in the upper right part of the sheet, immediately after the link to the legislative framework.

The first part of the document continues with the second table, which describes accounting and should contain data on:

- The date of drawing up the write-off act.

- Transaction type code adopted in accounting documents.

- Structural division.

- Type of activity.

- Corresponding accounts: sub-account and analytical accounting code for which the transaction takes place.

- An accounting unit of product output (in this particular case, workwear).

Below these two small tables there is a third, main one, which should inform the worker studying it about:

- An item of clothing: its name, number according to the nomenclature, size.

- The unit of measurement of an object. In this case it will be a thing. The OKI code for this unit of measurement is 796. Although this code is considered universal.

- The quantity of clothing in the specified units of measurement. Here it is important to indicate pairs individually if pieces are indicated, and by units if pairs are indicated in units of measurement.

- The price of workwear subject to write-off. These numbers are necessary for recording paper in the organization's accounting records.

- The amount excluding VAT, as well as the amount of depreciation.

- Reason for departure, code.

Second part

The final part of the act for writing off workwear in the MB-4 form is on the next page. Usually the first input data takes up a lot of space due to the list of items being written off. If they fit on one sheet, then there is no need to make changes to the form.

FOR YOUR INFORMATION! If, if necessary, a table with a list of protective clothing takes up two or more sheets, then the place of the second part is on the third or subsequent sheets.

The table is dedicated to employees and includes:

- Full name of the employee.

- Personnel Number.

- Date of issue of the personnel number.

- Signature of the person who handed over the workwear (direct user).

- Description of the settlement with the perpetrators.

- Type and method of deduction: what kind of depreciation, cost of the product minus depreciation, type of deduction code.

- Withholding percentage (the column may remain empty if there is no fixed rate amount), withholding amount.

- The amount of the monthly payment for large expenses.

- Signature of the person responsible for loss, breakage, etc.

At the very end there should be signatures of the responsible persons: manager, accountant (after filling out the first part), storekeeper (or other person financially responsible for the safety of workwear), as well as the date of affixing these signatures and position. This document (MB-4) in completed form is attached to form MB-8 - write-off act.

Special requirements for filling out the MB-7 form

Form MB-7 is used at the enterprise mainly when processing accounting data in an automated form.

This form must be filled out in 2 copies by the person who is materially responsible (MRO) , for example, in the person of the storekeeper of a structural unit, while 1 completed copy of the form is provided to the accounting department by the person responsible for the movement of the IBP, the second, as a fact of the accuracy of the information, remains with MOL.

Special equipment, clothing and shoes belong to the group of low-value and wearable items, which, like all property of the enterprise, are subject to inventory. Depending on the field of activity, the employee is obliged to follow special requirements, rules, instructions of occupational safety and health, that is, if he needs to use the provided personal protective equipment in his work.

By virtue of Art. 21 of the Labor Code of the Russian Federation, the employee is obliged to comply with labor protection and occupational safety requirements.

Ministry of Labor and Social Protection of the Russian Federation P.S. Sergeev

The procedure for filling out the table of form MB-7

The basic information of the form is presented in the table, where the following information is entered in order:

- serial number of issue (in chronological order)

- Full name of the employee

- employee personnel number

- identification characteristics of personal protective equipment

- Name

- nomenclature number

- unit

- code

- name of the unit of measurement

- number of items issued for each item

- date of entry (transfer) into operation

- PPE service period

- confirmation of receipt or delivery of PPE with the employee’s signature

Important! When an employee receives special protective equipment, financial responsibility is transferred to him for the period of operation. If an employee refuses to receive PPE, the employer may face disciplinary action.

How to fill out a form for the issuance of special clothing

The registration card is issued immediately upon hiring. The most vulnerable point is the wording regarding the name of standard industry standards: you must not make a mistake and refer to the correct document. Such standards exist, for example, for:

- Agriculture;

- chemical industry;

- mining;

- metallurgy;

- construction;

- transport.

It is also important to correctly indicate the terms of use on the accounting card (carefully study the markings applied by the manufacturer).

The rest of the form is easy to fill out. On the front side it is indicated:

- employee data (his full name, name of the structural unit in which the newcomer will work, date of hire);

- height and size;

- industry standards corresponding to the specifics of the enterprise;

- a list of mandatory clothing for him.

If the front side is a kind of characteristics of the employee and a list of special protective equipment that he is entitled to, the reverse side talks about their actual use: the timing of their receipt and return, their condition (percentage of wear).

IMPORTANT!

All personal protective equipment must have a certificate or declaration of conformity: indicate the number of such a document in each line of the list of issued personal protective equipment.

An example of the design of a table of the MB-7 form

| Number in order | Full Name | Personnel Number | Working clothes, safety shoes and safety devices | Unit | Quantity | Date of entry into service | Life time | Signature on receipt (delivery) | ||

| Name | item number | code | Name | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| 1 | Bakeev R.R. | 111 | Mittens | 012345 | 001 | PC | 1 | 01.06.2021 | 2 | Bakeev |

| 2 | Akhmerov V.V. | 123 | Mittens | 012345 | 001 | PC | 1 | 01.06.2021 | 2 | Akhmerov |

Accounting for workwear, safety footwear and special devices

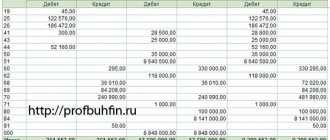

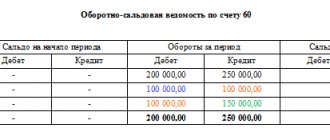

In accounting, the movement of personal protective equipment is reflected in the debit of account 10 “Materials” (in this case, the sub-account “Special equipment and special clothing” is opened) and the credit of production cost accounts (accounts 20, 23, 25, etc.) at the actual cost (expenses) for its production, calculated on the basis of the cost calculation method used at the enterprise for the corresponding type of product.

Write-offs are made in accordance with the Accounting Policy adopted by the organization.

Example for writing off personal protective equipment

To perform a labor function during the summer period, employee A.A. Andreev. issued 04/01/2021:

- light jacket - 1 piece, service life 18 months, cost 5,000 rubles.

- gloves - 1 pc., service life 6 months, cost 300 rubles.

And accepted for storage at the winter workwear warehouse on 04/01/2021:

- insulated jacket - 1 pc., service life 18 months (used for 4 months: December-March), cost 9,000 rubles.

- fur gloves - 1 pc., service life 6 months, cost 300 rubles.

Due to the specialization of the organization, subaccounts were opened on account 10: Special clothing in warehouse and Special clothing in use. The following transactions will be made in the organization:

| Debit | Credit | Operation | Amount, rub. |

| 10 / “Special clothing in use” | 10 / "Special clothing in stock" | Special clothing issued | 5300 |

| 10 / "Special clothing in stock" | 10 / “Special clothing in use” | Workwear put into storage | 9300 |

| 25 | 10 / “Special clothing in use” | The cost of the insulated jacket was partially written off | 2000 |

Answers to common questions

Question No. 1 : How to formalize the issuance of special clothing that was rendered unusable by an employee through his own fault?

Answer : If an employee, who is obliged to treat his workwear with care, as well as all the property of the organization, has intentionally rendered it unusable, then it is necessary to contact the manager, and a commission is appointed that decides to write off the cost to the employee, but during the investigation it is necessary provide an available spare kit. If the investigation does not establish intentional damage, but poor quality, then the cost of PPE is not written off to the employee.

Question No. 2 : Is it possible to issue workwear to an employee for the summer and winter periods without taking it into storage?

Answer : Working clothes, as a rule, require special storage conditions. Therefore, some types of clothing cannot be given to employees for storage at home, as well as for washing or cleaning. Features of storage and care of special devices are regulated by GOSTs for protective equipment. And the movement of clothing is reflected in the MB-7 form and the personal card of the employee for issuing special equipment

What are collective protective equipment

Collective protective equipment (CPF) is a means that is functionally or structurally associated with equipment, as well as the production process.

Collective protection means (CPS) include various types of fences, for example:

- screens;

- shields;

- doors;

- barriers;

- casings;

- visors, etc.

SPS also includes braking devices, safety-locking devices and signaling devices.

Braking devices are:

- workers;

- parking;

- extreme braking.

Safety interlocking devices:

- mechanical;

- electrical;

- electronic;

- hydraulic;

- pneumatic.

Signaling devices:

- light;

- sound.