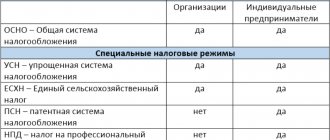

The single tax on imputed income refers to special tax regimes, which are voluntary.

⭐ ⭐ ⭐ ⭐ ⭐ Legal topics are very complex but, in this article, we

It is difficult to find this type of business where a car is required. These include various transportations,

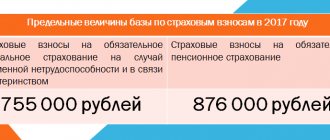

From 2021, the payment of insurance premiums comes under the control of the Federal Tax Service. Changes in administration are related

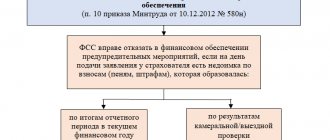

Arrears in 4-FSS: how not to get confused in the terms of the Official explanation of the concept of “arrears in 4-FSS”

An agreement on collective liability allows you to protect the interests of the employer. But it can only be concluded

Which tax regime to choose? Since January, the tax office has automatically removed entrepreneurs and organizations from UTII.

The procedure for tax authorities to request documents from taxpayers has remained virtually unchanged since 2011. The only thing

In taxation, the book of purchases and sales is a summary statement in which all data is entered

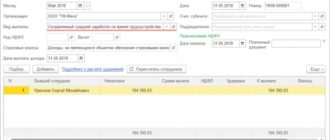

In practice, the dismissal of an employee is accompanied by a number of payments, the taxation procedures of which vary. All payments that