Do I need to maintain off-balance sheet accounts?

Some accountants ignore the need to maintain records. And in fact, the absence of these accounts does not have a significant impact on the company's fortunes. There is no liability for the absence of AP. However, it must be borne in mind that without off-balance sheet accounts, information about the property status of the company will be incomplete. Inventory of APs serves to obtain reliable information. Based on it, decisions can be made and special management can be appointed.

Information from the AP allows you to correctly evaluate all the company’s assets. If this information is missing, the auditor will not be able to correctly make an opinion about the state of the company. Full accounting of property is also necessary for tax authorities conducting audits. For example, account 001 may store information about leased assets. In this case, the company has the opportunity to justify the costs of repair work.

Information about property that is leased to third parties should be recorded on the property document. In this case, the appropriate accounts will be needed to draw up a financial plan and properly maintain management accounting. Based on the AP, accounting reports can be developed.

How and where to find out the inventory value of an apartment

The only parameter that allows you to clarify any information about the inventory information of an object is the address of the apartment. Without it, the request loses its meaning, regardless of the body to which the request is sent.

Multifunctional centers have been created and operate in every region of the country, allowing citizens to receive state and municipal services in various fields of activity. A request for the inventory value of housing at the MFC will allow you to receive an analogue of information from Rosreestr, since the MFC applies to the specified service to obtain information.

Inventory of assets at the AP

Inventory is a procedure during which the status of a company's property and liabilities is monitored. In particular, their actual presence is established. In the process, information from accounting is compared with the actual availability of property. An inventory must be carried out before filling out the annual report.

Let's consider the features of inventory of off-balance sheet accounts:

- A firm rarely has accurate information about the value of property recorded in off-balance sheet accounts. The landlord or an independent appraiser usually has the relevant information. It is recommended to indicate the cost of the property in the rental agreement. The cost is then entered into an off-balance sheet account and then transferred to the inventory list.

- If a company leases an operating system, a separate inventory is drawn up for each tool. These funds should not be mixed with your own assets. The inventories record all the papers that confirm the arrival of funds to the company.

- It is not always possible to determine the exact cost of objects. For example, this is not possible with strict reporting forms. In this case, it is necessary to reflect the conditional value.

- Separate matching statements are prepared for off-balance sheet assets. The results of control activities are recorded in inventories.

Inventory of assets can be carried out not only by enterprises, but also by individual entrepreneurs.

Acceptance of fixed assets for accounting in 2021

results in the payment of property tax, for which rates and benefits are clarified in 2021.

Some fixed assets, after being accepted for accounting, are not subject to tax. Do you have any of these? Read the article. Guest, get free access to the BukhSoft program Full access for a month!

— Generate documents, test reports, use the unique expert support service of the Glavbukh System. Call us by phone (free).

Attention! Familiarize yourself with the basic rules for calculating and paying monthly and quarterly advances on income tax from leading specialists of the Federal Tax Service. Download reference books and sample documents that will help you pay income taxes correctly and on time: Methodological instructions from the Federal Tax Service. Download for free the Federal Tax Service Guidelines.

Download for free the Federal Tax Service Guidelines.

Download for free Complies with all legal requirements Complies with all legal requirements All codes in one file.

Order of conduct

Inventory is carried out in accordance with this order:

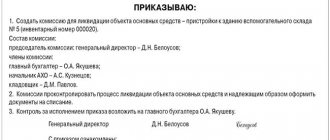

- Appointment of a commission that will conduct the inventory. She is appointed on the basis of an order from the manager and receives powers that will be valid for the entire year.

- Issuing an order on the procedure. The order specifies the timing of the procedure and its reasons. The members of the commission are indicated.

- Carrying out inventory. The event is carried out in the presence of commission members and financially responsible persons.

- Results of the event. The results are confirmed by inventories, which are signed by those present during the inventory. The information is summarized in the Statement of Results.

Inventory INV-1 is compiled in two copies. If discrepancies are found between reality and recorded data, comparison sheets are drawn up. They are created according to the forms INV-18 and INV-19. Form INV-5 is used in relation to property accepted for safekeeping.

What objects are subject to numbering

Codes are assigned to the following objects:

- Fixed assets. These are tangible items that can be used in work for 12 months or more. For example, equipment, tools, furniture, etc.

- Intangible objects. For example, a movie, a multimedia product, technology.

- Non-produced assets. These are the resources of the earth's interior, land plots, etc.

The codes are indicated in the documentation for accounting for fixed assets and are used during inventory. Movable and immovable property is taken into account. Items worth up to RUB 3,000. are not taken into account.

Library collection objects are assigned codes regardless of cost. All objects are subject to numbering, regardless of whether they are used in work or are in stock.

Frequency of inventory of off-balance sheet accounts

As a rule, an inventory count is scheduled before the annual reporting is completed. Before the start of the event, the accountant should have information about the real state of assets in off-balance sheet accounts. The following frequency is allowed:

- It is possible not to establish the condition of objects if it was checked 2-3 months before the end of the year.

- An inventory of the library's holdings is carried out every 5 years, an inventory - every 3 years.

A special procedure has been established for subjects located in the Far North. The event can be carried out when the balances have the least amount of current assets.

Resolution of the Twentieth Arbitration Court of Appeal dated February 8, 2012

when keeping the minutes of the court session by the secretary Kontseva S.S., having considered in open court the appeal of the administration of the Aleksinsky rural settlement of the Dorogobuzhsky district of the Smolensk region (OGRN 1056721975551; INN 6704009096) against the decision of the Arbitration Court of the Smolensk region dated November 23, 2011 in case No. A62- 3674/2011 (judge Voronova V.V.), accepted on the claim of the open joint-stock company "Plemennoi Equestrian (OGRN 1036740302917; INN 6704008590), to the administration of the Aleksinsky rural settlement of the Dorogobuzhsky district of the Smolensk region (OGRN 1056721975551; INN 6704009096), third e person: Territorial Directorate of the Federal Agency for State Property Management in the Smolensk Region, on the transfer of housing and public utility facilities to municipal ownership,

28. 4-apartment house, inventory number: 06700475000095 (except for privatized apartments NN 2), with a total area of 288.4 sq. m. m, located at the address: Smolensk region, Dorogobuzhsky district, village. Aleksino, st. Begovaya, 4;

Postings carried out following the event

After the inventory has been completed, final acts are drawn up. Commission members and financially responsible employees put their signatures on them. Inventory results must be reflected in accounting. Deficiencies are recorded as follows:

- KT003. Write-off of shortages of objects previously accepted for processing.

- DT91/2 KT76. Attribution of losses to other expenses.

If surplus is found, these entries are made:

- DT003. Capitalization of surplus.

- DT10/1 KT91/1. Surplus materials included in assets.

All entries are made on the basis of previously compiled documentation.

How can you find out the inventory value of an apartment?

The estimated value of an apartment is no different from the same certificate of any other property. The assessment is made according to the same rules and calculation formulas. The procedure for obtaining and the package of documents for providing a certificate of appraised value of an apartment is the same as in other cases.

When calculating the inventory value, the result is much lower than the estimate of the market price of the object, however, cases when these indicators coincide are not excluded. According to the law, the estimated value of real estate must be recalculated according to inflation.

This is interesting: Afghan warrior pension increased in Kazakhstan

When is an inventory of off-balance sheet accounts carried out?

The event is usually held under the following circumstances:

- Sublease of assets.

- Preparation of the annual report.

- Presence of theft and damage.

- Emergency situations, natural disasters.

- Liquidation or reorganization of a company.

- Change of financially responsible worker.

That is, the inventory of APs should be performed when the company faces significant changes. However, it can be carried out more often. The corresponding position is fixed in internal regulations.

How are inventory numbers assigned to fixed assets?

Before you start using a fixed asset, it must be registered. It is at this stage that OS objects receive their inventory numbers and become accounting objects. The assigned number allows you to track all movements and disposal of an inventory item, that is, a specific fixed asset.

The main documents regulating the process of assigning numbers to accounting objects are the “Guidelines for fixed assets accounting”, approved. By Order of the Ministry of Finance No. 91n dated October 13, 2003 (as amended on January 23, 2020), and Orders of the Ministry of Finance No. 174n dated December 16, 2010 and No. 157n dated December 1, 2010, as amended. dated December 28, 2018, regulating, incl. assigning an inventory number to fixed assets in the budget, government bodies and municipal unitary enterprises. Based on these standards, companies themselves develop and establish in their local acts the procedure for assigning numbers to inventory items.

Inventory of off-balance sheet accounts in budgetary organizations

In budgetary institutions, the number of off-balance sheet accounts has been expanded from 11 to 30. The organization can also introduce additional APs. The latter is relevant if 30 accounts are not enough for high-quality management accounting.

Let's look at the features of accounting:

- The debit of the accounts records the received values, issued or purchased guarantees.

- The loan records the removal of valuables from accounting and the coverage of obligations secured in the form of guarantees.

There is no correspondence between off-balance sheet accounts. That is, either CT or DT appears in the wiring. The inventory of assets is carried out in a standard manner: an order is issued, a commission is appointed, and identified inconsistencies are recorded.

IMPORTANT! If you need to write off a debt from account 04, this can only be done by decision of the commission.

Additional features

What is the retention period for inventory orders? They must be stored throughout the entire life of the company, as this is the main documentation.

What to do if one of the committee members was unable to attend the event? An order must be issued to replace this participant.

What to do if an error is found in the document with inventory results? Incorrect information must be crossed out. The correct data is written above the blot.

The document on the results of the event must bear the signatures of all participants in the inventory. Otherwise, the document will not be valid.

Inventory cost of the apartment

Many apartment owners are interested in how to find out its inventory value without visiting the BTI and whether this is possible. On the official website of Rosreestr you can obtain and check all the information you need about your apartment. To do this you need:

All values, except for the differentiation coefficient, are indicated in thousands of rubles. This method is practically inaccessible to an ordinary person, since he does not have such data as the amount of moral and physical depreciation of an apartment building, as well as the value of the coefficient (if desired, this can be found out from official sources), so it is almost impossible to independently calculate the cost of an apartment using this formula .

What is the difference between cadastral and conditional numbers

After registration, information about the property is entered into the State Real Estate Cadastre. Each unit receives an identification mark that has no analogues throughout the country - the cadastral number of the property.

- precise indication of whether the registered property is a separate apartment or a room - part of an apartment

- clarification whether the premises are residential (warehouse, etc.)

- room area

- exact address, floor (for multi-storey buildings)

- if the building in which the apartment is located has a cadastral number, then the apartment must also have a registration identifier

- For a room, its location is described in detail.

04 Sep 2021 lawurist7 172

Share this post

- Related Posts

- Withholding from Pension to the Minimum Living Wage According to Il.

- What benefits were removed from labor veterans?

- When will Veterans be paid in Teikovo, Ivanovo Region?

- Benefits for Labor Veterans When Traveling by Train