Accounting books for individual entrepreneurs: new forms

Resolution of the Ministry of Taxes and Taxes dated January 30, 2019 No. 5 approved the Instructions on the procedure for keeping records of income and expenses (hereinafter referred to as Instruction No. 5) and the forms of accounting documents for individual entrepreneurs. The specified documents apply from 04/05/2019.

Instruction No. 5 determines the procedure for keeping records of income and expenses for individual entrepreneurs <*>:

— paying income tax from individuals <*>;

— paying a single tax <*>;

- applying the simplified tax system and keeping records in the Book - in relation to income subject to income tax, and if they decide to keep records of income and expenses on a general basis <*>.

In addition, individual entrepreneurs on the simplified tax system with accounting in the Book must be guided by Instruction No. 5 when drawing up primary accounting documents and drawing up written decisions on the principles and methods of accounting <*>.

Instruction No. 5 establishes a list of new forms of accounting documents (Appendices 2 - 11), which must be maintained by individual entrepreneurs depending on the tax they pay. As before, accounting documents can be maintained both on paper and in electronic form <*>.

Let us consider the main changes that have occurred in the forms of books and the procedure for maintaining records.

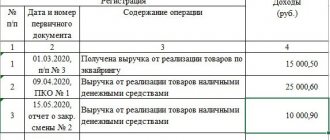

Previously, individual entrepreneurs paying a single tax kept records of revenue for tax purposes in Section I of the book of accounting for gross proceeds from the sale of goods (work, services), accounting for goods imported into the territory of the Republic of Belarus from member states of the EAEU. From 04/05/2019, individual entrepreneurs are required to account for revenue in a separate ledger for accounting for revenue from the sale of goods (work, services) <*>. Compared to the previous edition, the names of the columns in the new book have not changed.

In the book of total accounting of goods, the names of some columns have been changed. This is due to the fact that now the book should take into account goods intended for retail and (or) wholesale trade <*>. Previously, this book was intended only for accounting for goods in retail trade <*>.

The forms of accounting books have not changed, compared to previously existing books:

— fixed assets <*>;

— intangible assets <*>;

— individual items as part of working capital <*>;

— raw materials <*>;

— goods (finished products) <*>.

At the same time, the individual entrepreneur is given the right not to use the above books. In return, they need to develop their own forms, providing them with the necessary indicators for maintaining records and calculating the tax base <*>.

Note that currently individual entrepreneurs are given the opportunity to maintain one general accounting document. In this case, in its individual sections, in accordance with the specifics of the activity, accounting of fixed assets, intangible assets, individual items as part of working capital, raw materials and supplies, goods (finished products), VAT, total accounting of goods <*> is carried out. Previously, this possibility was not provided.

Changes have been made to the names of individual columns in the book of income and expenses. This is due to the fact that in 2021 individual entrepreneurs - “income earners” - are given the right to choose the principle of accounting for income from sales (by payment or by shipment) <*>.

Please note that now, when paying income to individuals in cash, individual entrepreneurs have the right to draw up a payslip in any form. At the same time, it must contain the mandatory details for primary accounting documents <*>.

Filling out journal order No. 11: features

The register combines two sections:

- The first reflects generalized credit turnover on the above accounts;

- In the second, analytical tables are generated for shipments and sales of products and inventory items. The data is summarized by groups necessary for reporting, for example, on sales, shipped and sold inventory items, movement of inventories, cost of products sold. At the same time, analytics on counterparties is carried out. The company builds analytical tables according to the principle of the most appropriate ones in accordance with the types of activities carried out.

Data on K/t account. 40, 41.45 in terms of the cost of shipped and sold GP (D/t 45 K/t 40, 41) are reflected in the first section, based on the corresponding values in the analytical table of the second section, the remaining entries on the credit of these accounts are made on the basis of primary confirmatory documents.

Payments received from buyers (C/t account 90) are indicated in accordance with the results of statements No. 15 and 16, other transactions on the credit of this account are based on the indicators of statements on the account. 50 or 51.

The cost of goods shipped and sold at sales prices, as well as those unpaid at the end of the month, is calculated by summing up the relevant data in statements No. 15 and 16. The cost of the balance of goods shipped at the end of the month is determined by calculation using the indicators in the analytical table.

All transactions are entered into the register in strict chronology with the events that occurred.

Maintaining a book of income and expenses under the simplified tax system: section 2

Section 2 is devoted to the calculation of depreciation charges. In our example, the company has a rotary machine purchased on December 16, 2016 for 28 thousand rubles. and put into operation on December 30, 2016.

The costs incurred when purchasing OS and taken into account when calculating the simplified tax system depend on the time of acquisition and the SPI. The amount of expenses is determined according to the all-Russian classification of fixed assets, assigning a depreciation group to the property. In our example, the SPI is 3 years and the cost will be written off over 7 reporting periods.

Calculation of the quarterly depreciation amount: 28,000 / 7 = 4,000 rubles. It is this calculation that is necessary to fill out both the 1st and 2nd sections of the KUDiR. Over the course of a year, the cost of the machine is depreciated by 16,000 rubles; next year, 12,000 rubles will remain to be written off. All these amounts are indicated in the corresponding columns of the form.

The 2nd section is filled out for 1 quarter, half a year, 9 months and a year, i.e., by analogy with the 1st section, there will also be four tables.

KUDIR in 2021 for PSN, UST, OSNO, USN, UTII

Let's consider KUDiR 2021 for each taxation in order:

- UTII - in this taxation, a book of income and expenses is not kept at all;

- PSN - KUDiR 2021 I have not found or even information about its changes, therefore on PSN the KUDiR book remains old;

- Unified Agricultural Tax - the book of accounting for income and expenses for Unified Agricultural Tax in 2021 has not changed 100%, since I found this information on the official website;

- OSNO - information on the general taxation system is also missing, which suggests that the changes in the 2017 KUDiR to OSNO have not changed either;

- The simplified tax system is the culprit of the whole celebration; it is the book of accounting for income and expenses of the simplified tax system that has undergone changes in 2021.

You can download KUDiR books with samples of filling out for PSN, Unified Agricultural Tax, OSNO from my article “KUDiR”.

Kudir str.3

To simplify, let us assume that in other reporting periods no operations were carried out other than accrual of depreciation on the machine. At the end of the year, the result is displayed - profit or loss, and a certificate for section 1 is filled out:

- on page 010 – income for the year – 85,000 rubles;

- in line 020 – expenses – 64,400 rubles;

- page 030 is filled out provided that in the previous period Ramet LLC also worked on the simplified tax system and paid the minimum tax at the end of the year. Here the difference between the amounts of the minimum tax paid and the amount received in the normal calculation is calculated. Let’s say that Ramet LLC has been working on the simplified tax system for the first year, which means that page 030 will remain empty;

- result lines 040 and 041 are filled in in accordance with the results obtained. In our example, there is profit, so page 040 is filled in - 20,600 rubles.

Personal income tax is not recorded in the book of income and expenses of the simplified tax system, since the company only acts as a tax agent, withholding tax from wages and transferring it to the budget.

Book of income and expenses on the simplified tax system: filling out the 1st section

The fundamental difference between entering information into KUDiR in the special mode “Income - Expenses” is filling out the 1st section “Income and Expenses”. The list of expenses taken into account is provided by Art. 246.16 Tax Code of the Russian Federation. Since expenses reduce the tax base, they are always under the close attention of the Federal Tax Service, therefore, omitting all sorts of explanations as to which expenses in the KUDiR under the simplified tax system can be taken into account and which cannot, we present a general criterion: expenses are accepted with a competent economic justification, documented evidence and undoubted benefit planned for the future. For example, material expenses, salaries and deductions, etc.

There are no particular differences between filling out KUDiR by a company and an entrepreneur, but the personal expenses of a businessman that are not directly related to making a profit cannot be included in the costs.

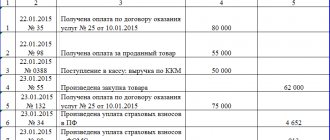

The section is divided into 4 tables for entering information quarterly. Each operation is entered on a separate line indicating the basis - the primary document.

For example, let's take a few operations:

Ramet LLC is engaged in the production of hardware. Consumables were purchased in the amount of 35.4 tr. including VAT for the production of a new order on 01/11/2017. 50 thousand rubles were received from customers for the work performed. 01/15/2017 and 35 t.r. 01/25/2017. The company has 2 employees who were paid a salary of 01/30/2017 - 10 thousand rubles. and insurance deductions of 3 thousand rubles were made. The company has a machine on its balance sheet, the residual value of which at the beginning of the year was 28 thousand rubles.

When comes into force: controversial point

Changes to the form of the book according to the simplified tax system were made by order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n. This Order comes into force after one month from the date of its official publication (published on December 30, 2016), but not earlier than the 1st day of the next tax period according to the simplified tax system. That is, from January 1, 2021. Some experts think so. However, we have a different opinion. Let me explain.

The calendar month after the publication of the said document is December 2021. This month ended December 31, 2021. The next day, January 2021 arrived. The changes come into force no earlier than the 1st day of the next tax period according to the simplified tax system. The tax period according to the simplified tax system is a calendar year. This means the new form of the book will be applied from January 1, 2021, and not from January 1, 2021.

Order of the Ministry of Finance of Russia dated December 7, 2016 No. 227n states that it comes into force precisely after the expiration of a month. And the month of publication is December 2021.

Read also

14.03.2018

Is it mandatory for a company to use Form MX-5?

Unified forms have ceased to be mandatory since the beginning of 2013. The management of the organization has the right to independently decide whether to use them or develop their own. It is only important to remember that the forms created by the company must have a number of details characteristic of such documents, and these forms will also need to be recorded in the accounting policies of the organization by issuing an appropriate order.

Not all companies choose to develop their own documents, since unified forms still have all the necessary columns and rows for entering information.

general information

Accounting is carried out in a document for individual inventory items, products and crops. The basis for entering a position into the journal is a receipt and expense document.

For your information! Keeping records of the receipt of inventory items can be carried out in a company using statements rather than a journal. The choice of one document or another depends on the decision of management and the characteristics of the enterprise.

A journal is kept to record the receipt of products and inventory items at storage locations, as a rule, for a certain calendar period: quarter, half-year, year.

Responsibility for entering information into the document lies with the financially responsible person working in the warehouse. This is what fills the magazine.