The concept of materials and raw materials in accounting

These nomenclature groups include assets that can be used as semi-finished products, raw materials, components and other types of inventory assets for the production of products and services, or used for the own needs of an organization or enterprise.

Purposes of materials accounting

- Control of their safety

- Reflection in accounting of all business transactions involving the movement of inventory items (for cost planning and management and financial accounting)

- Formation of cost (materials, services, products).

- Control of standard stocks (to ensure a continuous cycle of work)

- Identification of shortages, losses, damage to materials

- Analysis of the effectiveness of the use of mineral reserves.

Subaccounts 10 accounts

PBUs establish a list of certain accounting accounts in the Chart of Accounts that should be used to account for materials in accordance with their classification and item groups.

Depending on the specifics of the activity (budgetary organization, manufacturing enterprise, trade, etc.) and accounting policies, accounts may be different.

The main account is account 10, to which the following sub-accounts can be opened:

| Subaccounts to the 10th account | Name of material assets | A comment |

| 10.01 | Raw materials | |

| 10.02 | Semi-finished products, components, parts and structures (purchased) | For the production of products, services and own needs |

| 10.03 | Fuel, fuel and lubricants | |

| 10.04 | Container materials, packaging | |

| 10.05 | Spare parts | |

| 10.06 | Other materials (for example: stationery) | For production purposes |

| 10.07, 10.08, 10.09, 10.10 | Materials for processing (outside), Construction materials, Household supplies, equipment, Working clothes, equipment (in warehouse) |

The chart of accounts classifies materials according to product groups and the method of inclusion in a certain cost group (construction, production of own products, maintenance of auxiliary production and others, the table shows the most used ones).

How to properly account for and write off fuel and lubricants?

How to account for fuels and lubricants in accounting. How to correctly calculate fuel consumption rates. Where and how and in what amounts should fuel and lubricants be written off at the enterprise, what kind of wiring is done?

Fuel and lubricants are fuels and lubricants, which include fuel, lubricating oils, brake and coolant fluids. That is, these are all those materials that will be useful during the operation or repair of vehicles.

Why is it important to properly account for fuel and lubricants? Expenses for fuels and lubricants reduce the base from which income tax is calculated. In order for the tax amount to be calculated correctly: neither overestimated nor underestimated, you need to correctly calculate the norms by which fuel and lubricants will be written off.

Of course, I would like to write off fuel and lubricants in a larger amount to reduce taxes. However, unjustifiably inflating costs does not lead to anything good. The Tax Code of the Russian Federation clearly states that expenses written off as expenses must be economically justified and documented. Only in this case the tax authority will not have any additional questions.

In order to write off fuel and lubricants in the required amount, you need to calculate them correctly. All accountants know about the so-called fuel write-off standards, but nevertheless, a lot of questions arise about this. What are these standards, by whom and how are they established, can they be calculated independently or do we need to use standards approved by law?

How to write off fuel and lubricants correctly?

Indeed, the Ministry of Transport of the Russian Federation has established standards for the write-off of fuel and lubricants - these are some recommended figures that can be used as a guide when operating vehicles.

For write-off, you can use these approved standards, but the Tax Code of the Russian Federation does not say that these standards are mandatory for use. Organizations can independently calculate and approve fuel consumption standards for themselves, based on the characteristics of their activities.

If an enterprise decides to use the standards approved by the Ministry of Transport, then the standards for the consumption of fuel and other lubricants for the type of transport used by the enterprise are determined and written off as expenses in accordance with the specified figures.

If an enterprise wants to develop its own standards for the consumption of fuel and lubricants, then it can go in two ways.

How to calculate the fuel consumption rate yourself?

So, to determine your standards, you need to make some calculations and measurements. There are two ways to do this.

In the first case, technical documentation for the vehicle used is taken, which shows the standard consumption of fuels and lubricants for a given vehicle. Based on these data, set standards for various weather conditions, seasons, take into account traffic congestion in your city, traffic congestion and other factors.

In the second case, you can use real data on fuel consumption, which can be obtained using measurements. This method of determining standards is more convenient and realistic; it is what organizations usually use.

How to measure fuel consumption?

The process of taking measurements and developing fuel write-off standards should be controlled by a special commission, which is appointed by the head of the enterprise by administrative document.

Next, you need to determine what the real fuel consumption of a particular vehicle is.

For example, take a car for which fuel write-off rates are calculated. Fuel, such as gasoline, is poured into its empty tank. The tank is filled completely, the amount of gasoline filled and the speedometer readings at the moment are noted. The vehicle should then be used in normal operating mode. As soon as the fuel in the tank runs out, the speedometer readings are recorded again. The difference between the speedometer readings with a fully filled fuel tank and an empty one is found, this will be the number of kilometers that the car has driven on a fully filled tank (mileage).

There are two numbers: the amount of fuel filled and the mileage in kilometers on this fuel. Divide the first figure by the second and get fuel consumption per 1 km. The resulting figure will be the standard that must be used to write off fuel for this vehicle.

Such measurements are carried out for all types of transport used at the enterprise. The fuel consumption rate per 1 km is determined.

In the future, if it is necessary to write off fuel and lubricants as expenses, it will be enough to take this standard and multiply it by the mileage of the car, and write off the resulting value as expenses of the organization.

The conditions in which vehicles are used may vary significantly. Fuel consumption depends on the time of day when the vehicle is used, the time of year, road congestion, traffic congestion, and idle time with the engine running. Therefore, it is necessary to carry out measurements for various conditions and develop several standards for various conditions of transport use.

An organization can also use one standard measured under standard conditions. And to write off fuel and lubricants in conditions different from standard ones, apply correction factors, which also need to be calculated and approved in advance.

Whatever method of determining fuel write-off rates the organization chooses, the results obtained must be reflected in the fuel write-off report, the execution of which should be handled by a commission appointed by the manager. All members of the commission must sign the drafted act, and the head must approve it.

Now, when writing off fuel and lubricants as expenses, the accountant will rely on the approved standards, and he will not have any questions.

Correspondence on account 10

The debit of 10 accounts in the postings corresponds with production and auxiliary accounts (on credit):

- 20.01 (main production)

- 23 (auxiliary)

- 25 (general production)

- 26 (general economic, management)

Besides them:

- 44 (sales expenses)

- 45 (shipped goods)

- 76 (settlements with debtors and creditors)

- 94 (shortages and losses)

- 99 (profit and loss)

- And others - according to the chart of accounts and accounting policies.

Accounting for inventory items in accounting: postings and documents

Accounting for inventory items in accounting is reflected on the basis of primary documentation and can be as follows:

- The purchase of materials is made in cash or by bank transfer, confirmed by a purchase agreement, payment and settlement documents or the transfer of a power of attorney to receive goods and materials with subsequent settlement with the supplier. It is received at the warehouse on the basis of a bill of lading or a receipt order. When purchasing materials, additional transportation and procurement costs (for example, delivery) may be reflected.

- Sale of materials - transfer of raw materials to third parties.

- Transfer - from the founders, contractors or sponsors, is accounted for at the estimated value or on the basis of available documents: contracts, payment documents, appraisal reports, etc.

- Write-off of materials - reflects the expenditure of inventory and materials into production. It may imply both the write-off of materials for actual production and the write-off for general business needs. Depends on corr. accounts (20, 23, 25, 26). Disposal may be reflected due to damage or loss of inventory items.

- Shortage of materials or surplus of materials are recorded as a result of inventory. They may be reflected within the normal limits or as a result of loss/damage.

- Operations with customer-supplied raw materials - features of accounting for materials received from another organization.

For production and for own needs, materials are released from the warehouse upon request - invoice or other documents (based on accounting policies); are written off to the production site, which then includes them in the cost of products or services.

Carrying out inventories

Every year, according to PBU, owners are required to conduct scheduled inventories on the basis of an issued order with designated responsible persons. In addition to them, there may be unscheduled (sudden) audits and inventories. Their goal: control over the safety and correct use and write-off of inventory items .

Postings to inventory items

Materials are accounted for in account 10, which has subaccounts depending on their type (materials, semi-finished products, fuels and lubricants, inventory, others, etc.). In its accounting policy, the organization must establish how it will reflect accounting: simply at actual cost or at accounting prices (in this case, it is necessary to use accounts 15 and).

In order to write off materials, they also choose their own method in the accounting policy. There are three of them:

- at average cost;

- at cost of inventories;

- FIFO.

Materials are released into production or for general business needs. Situations are also possible when surpluses are sold, and defects, losses or shortages are written off.

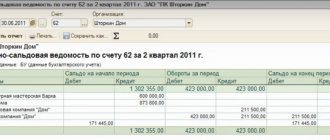

Example of filling out the OCB

Data from NPO "DOBRO" for March 2021. For inventories used by the organization to conduct its main activity:

- purchased MH for the amount of 200,000 rubles;

- released into production in the amount of 220,000 rubles;

- spoiled in the amount of 3000 rubles.

Balance sheet for accounting account 10 for March 2021:

Example of postings on account 10

The Alpha organization bought 270 sheets of iron from Omega. The cost of materials was 255,690 rubles. (VAT 18% - 39,004 rubles). Subsequently, 125 sheets were released into production at average cost, another 3 were damaged and written off as scrap (write-off at actual cost within the limits of natural loss norms).

Cost formula:

Average cost = ((Cost of remaining materials at the beginning of the month + Cost of materials received for the month) / (Number of materials at the beginning of the month + Number of materials received)) x number of units released into production

Average cost in our example = (216686/270) x 125 = 100318

Let's reflect this cost in our example:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 51 | Paid for materials | 255 690 | Bank statement |

| 10.01 | 60.01 | Receipt of materials to the warehouse from the supplier | 216 686 | Request-invoice |

| 19.03 | 60.01 | VAT included | 39 004 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 39 004 | Invoice |

| 20.01 | 10.01 | Posting: materials released from warehouse to production | 100 318 | Request-invoice |

| 94 | 10.01 | Writing off the cost of damaged sheets | 2408 | Write-off act |

| 20.01 | 94 | The cost of damaged sheets is written off as production costs | 2408 | Accounting information |

BASIS: VAT

Input VAT presented when purchasing inventory and household supplies should be deducted (clause 2 of Article 171 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- The organization carries out only VAT-free transactions.

In these cases, include input VAT in the cost of inventory and household supplies. This follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

If an organization carries out both taxable and non-VAT-taxable operations, distribute the input tax on the cost of inventory and household supplies (clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation).