* One of the most important indicators when calculating UTII (single tax for individual entrepreneurs and

All articles Advance payment for goods on the simplified tax system: the moment of recognition (commentary to the Letter of the Ministry of Finance of Russia

Indirect expenses are those that, due to the nature of their occurrence, cannot be attributed to any one

Legislative measures taken to support business during the fight against COVID-19 apply only to

In which lines of 6-NDFL are negative amounts possible? Can lines of the 6-NDFL report accept negative amounts?

Home / Taxes / What is VAT and when does it increase to 20 percent?

The basis of the fiscal structure of the Russian Federation is made up of payment deductions that have different purposes, characteristics and types:

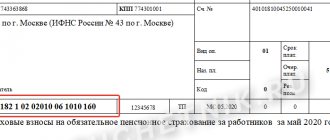

Details for paying taxes Let's consider the main fields of the payment slip when paying taxes: Field 101 is intended

What is a time sheet and why do you need to record time worked? According to the standards, it is mandatory to keep

Every person living in our country has heard about value added tax. This