Importing products or receiving services from foreign contractors are mandatory transactions subject to VAT. The status of the Russian taxpayer is not important in this case - these are legal entities operating under the OSN, economic entities exempt from VAT, and “simplified” enterprises applying special tax regimes.

Goods/services received from abroad are subject to VAT if the following conditions are met:

- they will be resold exclusively within Russian territory;

- the foreign counterparty-supplier is not a tax resident and is not registered with the regulatory authorities of the Russian Federation.

VAT is not charged only on certain characteristic groups of commercial products:

- products received under a foreign trade agreement as gratuitous assistance;

- special-tech equipment not created by domestic companies;

- printed publications and cultural rarities for museums, libraries, archives;

- specific modifications of drugs.

VAT rates according to the Commodity Nomenclature of Foreign Economic Activity

The commodity nomenclature of foreign economic activity (TN FEA) is a special classifier of goods developed by the member countries of the EAEU. It is a table of code values, each of which relates to a specific type of product - a HS code. VAT rates are tied to the HS code. This code consists of 10 digits. The customs declarant, having determined the product code, understands the meaning of the VAT rate. Exact compliance of the selected code with the nomenclature is one of the most important tasks of the customs declarant.

Do you need to determine the HS code? Don't know what fees you will have to pay at customs? – We will help you!

Customs VAT rates

Customs duty and VAT rates differ. Customs VAT rates apply to broader product categories and are regulated by the tax legislation of the Russian Federation (Article 164 of the Tax Code of the Russian Federation). Customs VAT rates from 2021 can take three values: 0%

— tax exemption,

10%

— preferential taxation,

20%

— full taxation.

| VAT rate | Application |

| There are goods the import of which into Russia is exempt from tax, for which VAT will be 0 percent. Before calculating VAT, you need to find out whether this product is eligible for tax exemption and clarify under which customs procedure the product is placed (Article 150, 164 of the Tax Code of the Russian Federation, Government Decree No. 1042 (as amended on March 20, 2018) On approval of the list of medical goods )). To be exempt from this tax, you must provide documents confirming the intended purpose. | |

| 0% | consumables used for scientific research not produced in the Russian Federation;

When placing goods under customs procedures (Article 151 of the Tax Code of the Russian Federation): |

| In some cases, according to Article 164 of the Tax Code of the Russian Federation, the VAT rate will be 10% | |

| 10% | 1) Food products:

2) Products for children:

3) Periodicals, with the exception of periodicals of an advertising or erotic nature.

|

| 20% | In all other cases (clause 3 of article 164 of the Tax Code of the Russian Federation). |

How does the country from which imports come affect the calculation?

The procedure for calculating VAT is determined by two groups of rules:

- related to countries participating in the Eurasian Economic Union (EAEU);

- intended for countries outside this union.

In addition to Russia, the EAEU includes 4 more countries: Armenia, Belarus, Kazakhstan and Kyrgyzstan. There is no customs between them, and interaction regarding the import of goods (including on issues of VAT taxation) is regulated by the Treaty on the EAEU, signed on May 29, 2014 in Astana.

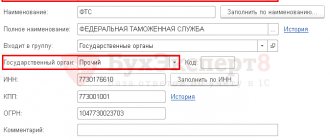

Imports into Russia from all other countries occur through customs and are subject to the procedure established by customs legislation, which is based on the EAEU Customs Code and documents published by the Federal Customs Service of Russia. With regard to the calculation of VAT, the main document here is the order of the State Customs Committee of the Russian Federation dated 02/07/2001 No. 131.

The existence of different rules predetermines not only differences in the procedure for determining the tax base, but also differences in other aspects of working with import VAT. At the same time, there are principles common to them. Among them:

- mandatory taxation of imported goods if they are not exempt (clause 1, article 71 of the Treaty on the EAEU, clause 1 of the appendix to the order of the State Customs Code of the Russian Federation No. 131);

- a single basic list of grounds for tax exemption, referring to Art. 150 of the Tax Code of the Russian Federation (subclause 1, clause 6, article 72 of the Treaty on the EAEU, clause 13 of the appendix to the order of the State Customs Committee of the Russian Federation No. 131);

- the same values used for calculating tax rates (clause 15 of section III of Appendix No. 18 to the Treaty on the EAEU, section 3 of the Appendix to Order of the State Customs Committee of the Russian Federation No. 131).

What unites the two groups of rules is the fact that their application is not prevented by the application by the importer of a special regime or exemption provided for in Art. 145 of the Tax Code of the Russian Federation. That is, persons recognized as VAT non-payers for tax purposes in Russia are required to pay the tax accrued when goods are imported into the country.

To calculate VAT you need:

- Correctly determine the product code according to the Commodity Nomenclature of Foreign Economic Activity;

- Determine the tax rate using the code;

- Determine the import duty rate;

- Determine the excise tax rate;

- Calculate the customs value of goods and excise tax;

- Using the formula, we get VAT = (Tam St. + Tam. St. + Share) x VAT rate%.

Example of VAT calculation

Example 1: Goods are imported for an aircraft plant: Pipes and tubes made of aluminum alloys without further processing after extrusion for the production of aircraft engines. Product code 7608208902. VAT = 20%; Import duty = 0%; Excise tax = 0%; Customs value = 78,000 rubles. VAT = 78,000 x 20% = 15,600 rub.

Example 2: An individual entrepreneur imports a batch of strollers from Israel for people who are unable to move. HS code 8713100000. The stroller is a vital medical equipment (preferential product). Import duty = 0, goods are not subject to excise tax, VAT = 0%. To apply these rates, it is necessary to provide documents confirming the intended purpose of the stroller, issued by the federal executive body, and a registration certificate. If supporting documents are not provided, then VAT = 20%.

Examples of calculating the tax base for imports from a country outside the EAEU

Example 1

Signal LLC imports chilled fish from Vietnam, which is not classified as a delicacy. The customs value of the consignment is 300,000 Russian rubles. The goods are subject to customs duties. Its value is 60,000 rubles. The goods are not excisable.

The tax base will be determined as the sum of customs value and customs duty, i.e. it will be equal to 300,000 + 60,000 = 360,000 rubles.

The tax rate applicable to a commodity such as fish is 10%. Accordingly, the tax due will be 360,000 × 10% = 36,000 rubles.

Example 2

Comfort LLC declares the arrival of knitwear from China. Among them are intended:

- for adults - their customs value is 400,000 Russian rubles, the customs duty on them is 80,000 rubles;

- for children - their customs value is 200,000 Russian rubles, customs duty - 40,000 rubles.

When calculating VAT, goods for adults will be subject to a 20% rate, and knitwear intended for children will be taxed at a rate of 10%. Accordingly, the bases need to be calculated separately. The final tax amount will be obtained by summing its two values, calculated from two different bases: (400,000 + 80,000) × 20% + (200,000 + 40,000) × 10% = 120,000 rubles.

How is VAT paid to customs?

Individuals

are not VAT payers, except in certain cases.

Legal entities

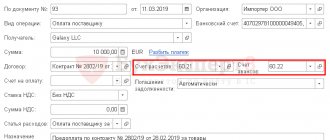

In order to pay VAT and/or other customs payments, you must register with Customs and receive a Unified Personal Account (USA). To avoid unnecessary costs and delays at customs, money must be transferred to the account in advance in the form of an advance payment. You can transfer money by submitting a Payment Order. There are instructions for filling out the Payment Order. In case of overpayment, you can submit a refund request within 30 days. VAT and other payments can be paid without advance payment at the time of filing a customs declaration using the “Round” or “Customs Card” payment system.

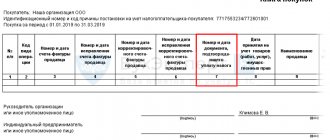

To pay VAT, the Budget Classification Code (BCC), consisting of 20 digits, is indicated in the payment instruction in field 104. KBK determines the address and purpose of the payment for payment of the fee and VAT, KBK takes the value: 15311009000010000180. Field 107 code of the customs authority administering the payment, consisting of 8 digits without spaces, dots and letters, the code does not have a date format. For ELS, in field 107 the code value is indicated: 10000010.

Documents and information for payment and VAT refund at customs

- List of documents for registration of a Legal entity at customs (View)

- List of documents for registration of an individual entrepreneur at customs (View)

- List of correspondence codes for types of payments paid at customs, KBK (View)

- Payment order for payment of VAT to customs (View)

- Instructions for paying customs duties (Watch)

- Application for refund of advance payments, including VAT (View)

- Application for refund (offset) of overpaid (collected) payments (See)

- Application for return (offset) of cash deposit (See)

VAT on export of goods

A zero VAT rate has been established for the export of goods from Russia; in addition, the exporter can compensate for the VAT paid when purchasing goods. This is done to avoid double taxation and develop foreign trade activities.

For example,

The exporter purchased goods in Russia in the amount of 5,000,000 rubles and paid VAT at the VAT rate of 20%, the VAT amount was 1,000,000 rubles. He sold the goods he exported for 5,500,000 rubles, with a VAT rate of 0% (Article 164 of the Tax Code of the Russian Federation). Since the exporter works under OSNO and is a VAT payer, he has the right to a refund of the VAT paid. To do this, he must provide documents (Article 165 of the Tax Code of the Russian Federation) confirming the fact of export of goods and payment of VAT. After a desk audit, a VAT refund will be issued.

Examples of calculating the tax base for imports from the EAEU

Example 1

Mir LLC imported 20 office tables to Russia from the Republic of Belarus in August. The price of each of them is 3,000 Russian rubles. Accordingly, the total cost of delivery is 60,000 Russian rubles. The product is not excisable, i.e. the excise tax will not participate in the calculation of the tax base.

Thus, the tax base for this supply will be equal to 60,000 rubles. The applicable tax rate is 20%. At the end of August, Mir LLC will have to pay 60,000 × 20% = 12,000 rubles to the budget.

Example 2

Under a leasing agreement, Quartz LLC received technological line equipment worth 12,000,000 Russian rubles from the Republic of Belarus in June. According to the terms of the agreement, payments are calculated for 12 months and are paid in equal installments. That is, in August, Quartz LLC will have to pay the Belarusian supplier 1,000,000 rubles.

It is this amount that will become the tax base for calculating import VAT for August. The tax from it will be: 1,000,000 × 20% = 200,000 rubles.

Refund of customs VAT when exporting goods

Participants in foreign trade activities have the right to deduct VAT paid by them when importing goods into the Russian Federation only if the exporter is a VAT payer. If the goods are intended for transactions that are subject to VAT, and they are accepted for accounting. A deduction can be made if the goods are intended for operations that are subject to VAT. To confirm your right to a tax deduction, the following documents may be required:

- foreign trade contract with a foreign supplier;

- invoice for payment from the supplier (invoice) invoice;

- customs declaration (copy);

- payment order, bank statements, certified duplicates of payment orders.

The listed documents must be stored for four years.

If an organization is not a VAT payer, then, according to the law, it will not be able to receive a deduction. These are organizations that have chosen tax regimes: simplified taxation system (USNO), unified tax on imputed income (UTI), unified agricultural tax (UST).

Availability of documents

Now let's look at these conditions in more detail. According to customs legislation, the import operation begins when the declaration and all documentation necessary for processing the imported goods are handed over to customs officers. It ends with the release of goods by a customs officer, who puts the appropriate marks on the declaration and other related documents - transport, commercial, etc.

This means that the imported goods will be considered released from customs only when the importer has in his hands a customs declaration and other necessary accompanying papers with a stamp from customs officials authorizing the release.

Services for calculating VAT and customs clearance of goods

Our company “Universal Cargo Solutions” provides services for clearance of goods at any customs office of the Russian Federation, selection of HS codes, determination of the customs value of goods, calculation of customs duties required for payment, including VAT. If necessary, we have the ability to promptly pay customs duties for the client and carry out prompt customs clearance or customs clearance of goods at customs, which significantly reduces time and costs.

We are confident that we will become your reliable partner at customs!

Find out customs VAT or order a service