Indirect expenses are those that, due to the nature of their occurrence, cannot be attributed to any of the existing nomenclature items. Moreover, they are typical for the production of several product items. This may include expenses for renting production premises, salaries of administrative and management staff, and so on.

To correctly account for indirect expenses, the accountant is required not only to reflect them correctly, but also to first correctly set up the accounting policy.

Indirect costs

In accounting, indirect (overhead) costs

- these are expenses that are common to a workshop, production, or organization. And they cannot be directly attributed to a specific type of product, service, work or product.

Indirect expenses in accounting are accumulated in accounts 25, 26, 44 (except for TZR).

These accounting accounts are closed monthly and there should be no balance.

Indirect costs at NU

– these are all other expenses associated with the production and sale of goods (works and services), except for direct and except for non-operating expenses (Article 265 of the Tax Code of the Russian Federation).

At the end of the month the account balance should not be 25!

General production expenses are distributed to the debit of account 20 “Main production” by type of product, work, service during the Month Closing

.

Rules for the distribution of overhead costs are set using the link Methods for the distribution of indirect costs

.

At the end of the month there should be no account balance of 26!

Option #1.

General business expenses are distributed to the debit of account 20 “Main production” by type of product, work, service during the

Month Closing

, i.e. the “full” cost is calculated.

Rules for the distribution of overhead costs are set using the link Methods for the distribution of indirect costs

.

Option

No. 2.

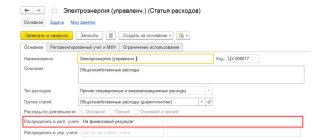

General business expenses are completely written off to the financial result in the debit of account 90.08 “Management expenses” (Direct costing method).

To write off costs monthly, select the option In cost of sales (direct costing)

in

the General business expenses section are included

.

Rules for the distribution of overhead costs are set using the link Methods for the distribution of indirect costs

.

Mysterious transport costs: when they can be classified as indirect and when they cannot

Transportation costs are one of the ambiguous types of costs, which are not always possible to be classified directly as indirect and reflected in the corresponding list of costs in the UE.

Specialists forming a management program face a difficult task - to accurately distinguish between direct and indirect transport costs. To find a solution, it is necessary to proceed from the basic distribution principle: whether an expense is included in direct or indirect depends on what stage of production and (or) sales it is associated with.

In the UE, transport costs can be reflected in the list:

- indirect - if the company delivers goods (products) to the buyer (the method of delivery does not matter: by its own transport, rented or using a third-party carrier);

- direct - if the company incurs expenses for the transportation of purchased goods, raw materials and supplies and takes them into account separately from the cost of inventories: such expenses require distribution taking into account the balance of unrealized inventories at the end of the reporting period.

According to these criteria, certain transport costs may be classified into one of these groups or even both.

“Distribution of transport costs for the balance of goods” will help you get acquainted with the algorithm for distributing transport costs and understand the corresponding accounting entries using examples .

Direct expenses at NU

Direct expenses refer to expenses at the time

of sale

of products, works, services, in the cost of which they are taken into account (Article 318 of the Tax Code of the Russian Federation).

The list of direct expenses is determined in the accounting policy. It must be economically justified and applied for at least 2 tax periods (Article 319 of the Tax Code of the Russian Federation).

In NU, the list of direct costs is specified using the link Methods for determining direct production costs in NU .

In this case, different cost accounting accounts can be used (account 20, 25), the main thing is that the settings for such correspondence are indicated as part of direct expenses.

Nuances of advertising expenses in accounting policies

The inclusion of advertising costs in the list of indirect costs is a common situation for many companies, regardless of the specifics, scale and other features of their activities.

Read about how the tax system affects the recognition of advertising expenses in the following articles:

- “How to take into account advertising costs under the simplified tax system”;

- “Income tax: standardized and non-standardized advertising costs”.

In the UE, this type of indirect costs requires the following detail:

- list of documents (agreement for the provision of advertising services, price agreement protocol, work completion certificate, marketing policy, protocols, orders);

- differentiation of types of advertising for tax accounting purposes - non-standardized (in the media, the Internet, on television, by posting information on billboards) and standardized (holding sweepstakes, awarding prizes during a mass advertising campaign);

- algorithm for calculating normalized advertising expenses when calculating income tax - the total amount of normalized advertising expenses, calculated on an accrual basis from the beginning of the year, should not exceed 1% of revenue without VAT and excise taxes (clause 1 of article 248, clause 3 of article 318 of the Tax Code RF);

- specification of the date of implementation of advertising expenses (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation);

- the accounting account used to reflect advertising costs - in accordance with the Chart of Accounts and instructions for its use, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, advertising costs are accounted for in a separate subaccount. 44 “Sales expenses”;

- the procedure for writing off advertising expenses - writing off the full amount in the period of occurrence or with distribution (the method of distribution must also be reflected in the UP);

- tax register for analytical accounting of advertising expenses - is developed by the company independently or accounting registers supplemented with certain details are used (paragraph 10, article 313 of the Tax Code of the Russian Federation), the form of the register is fixed in the UP.

To avoid mistakes when creating tax registers, familiarization with the material “How to maintain tax accounting registers (sample)?” .

Cost calculation in 1C. Services and works

- revenue is reflected on the credit of account 90.01 by name of work;

- on the debit of account 90.02, from the credit of account 20, the cost of work (services) performed is written off.

Option No. 1. Without taking into account revenue from work (provision of services)

- All costs accounted for on account 20 for work and services will be written off automatically in full in Dt 90.02 always at the close of the month. Regardless of whether the proceeds from loan 90.01 are reflected or not reflected at all.

Option No. 2. Taking into account the proceeds from the performance of work (provision of services)

- If revenue is reflected for a product group, then the costs recorded on account 20 for the same product group will be written off automatically for the entire amount in Dt 90.02 when closing the month.

- If there was no revenue for the item group, then the costs will NOT be written off , but will remain as work in progress in the debit of account 20.

Option No. 3. Taking into account revenue only from production services

- Revenue from works and services should be reflected only using the document Provision of production services

. - If revenue is reflected by product group using this document, then the costs recorded on account 20 for the same product group will be written off automatically for the entire amount in Dt 90.02 when closing the month.

- If there was no revenue for the product group or it is reflected in the document Sales of goods and services

, then the costs will not be written off, but will remain in the form of work in progress in the debit of account 20.

Accounting for indirect costs

In the 1C: Accounting program, there are many documents for reflecting indirect costs. These include receipts of goods and services, technical requirements, write-offs, some routine operations, etc.

In our example, in the receipt document for warehouse rental services, you can configure the accounting account in detail.

Here you can specify not only the accounting account itself. If for some reason you do not have this functionality, check that the settings described above are correct.

After implementation, the document formed the following movements.

Revenue from sales of goods, works and services

Nomenclature group

- this is a type of industrial and technical equipment, i.e. it is a generalized concept that accumulates costs and revenues by type of product, goods, work and services

The link Nomenclature

groups

for sales of products and services determines the types of industrial and industrial goods of own production, the proceeds from the sale of which must be reflected in the income tax return on page 011 of Appendix No. 1 to Sheet 02 “Income from sales and non-operating income.”

To fill out other lines of Appendix No. 1 to Sheet 02, there is no need to make special settings in the accounting policy.

See also:

- Accounting policy designer

- Setting up accounting policies for NU (STS)

- Setting up accounting policies for NU in 1C: Income Tax

- Accounting policy in 1C 8.3 Accounting 3.0

- Accounting policy for accounting: Distribution of indirect costs

- Implementation of work

- Provision of services with write-off of direct costs

- Sales of products

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

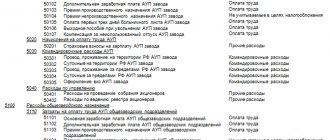

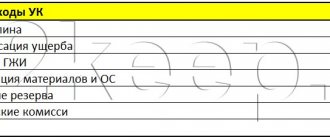

What a sample list of indirect expenses might look like in an accounting policy

Considering that the specifics of different companies are reflected in the types and ratio of direct and indirect costs established in the management program, there is no universal model for such a list.

Nevertheless, it is possible to identify a universal list of indirect costs that may be present in the management programs of many companies. For example, such a list in the UP of a manufacturing company may look like this:

Indirect costs include the following:

- of a communal nature: for heating, lighting and water supply of the administrative building;

- depreciation of buildings used for administrative and managerial needs according to the list specified in the appendix to the accounting policy;

- for wages (including contributions for social needs) of support workers and administrative and management personnel;

- for advertising in the media;

- for rental of transport for administrative needs;

- for the purchase of office supplies and hygiene products;

- entertainment and other expenses (except for direct and non-operating expenses).

To find out whether it is possible to reduce the list of direct expenses and expand the list of indirect expenses, read the material “List of direct income tax expenses” .

A sample of registration of costs in the accounting policy of a manufacturing enterprise on OSNO was prepared by ConsultantPlus experts. To do everything right, get trial access to the K+ system and study the material for free.

Features of accounting for wages and salaries

Expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services are included in the approximate list of direct expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation). At the same time, the taxpayer has the right to classify expenses for remuneration of employees of the management apparatus as indirect expenses. This is confirmed by judicial practice. Thus, according to the inspectorate, the taxpayer unreasonably included in expenses the costs of maintaining production personnel. The court found erroneous the conclusions of the tax authority regarding the classification of management personnel (chief engineer, head of technical department, site manager, head of the estimate and contract department) as production personnel. In accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, direct costs to be distributed between work in progress and completed work include the cost of remunerating personnel involved in the process of performing work, i.e. blue-collar professions that are not on the taxpayer's staff. All other labor costs relate to indirect costs, which, in accordance with clause 2 of Art. 318 of the Tax Code of the Russian Federation in full relate to expenses of the current reporting (tax) period. The arbitration court concluded that the taxpayer rightfully included in full the expenses for the purposes of profit taxation in the composition of expenses for remuneration of personnel (Resolution of the Federal Antimonopoly Service of the Volga District dated January 29, 2009 in case No. A55-8550/2008). As practice shows, some organizations classify labor costs for personnel involved in the production process as indirect costs. This approach is associated with high tax risks. Let us illustrate this with the following example from arbitration practice. The Tax Inspectorate found it unlawful for the taxpayer to include expenses for remuneration of personnel involved in the production process of goods, including the amounts of the unified social tax and expenses for compulsory pension insurance accrued on these amounts, as part of indirect expenses. The enterprise, taking advantage of the right granted to it, in its accounting policy classified labor costs, unified social tax and insurance contributions for compulsory pension insurance as indirect expenses. Meanwhile, the right to independently determine the list of expenses when choosing the distribution of direct and indirect expenses simultaneously requires the enterprise to justify the decision based on the specifics of the taxpayer’s activities and the technological process, and such distribution must be economically justified. The taxpayer produces and sells alcoholic products. Since the technological process of producing alcoholic products is impossible without the workers who are involved in its production, the arbitration court indicated that the costs of paying personnel involved in the production process are attributed directly to the manufactured products. At the same time, the court correctly noted that an organization has the right, for tax purposes, to classify the costs of remuneration of personnel involved in the production process of goods as indirect costs only if there is no real possibility of classifying these costs as direct costs, using economically justified indicators. Considering that the enterprise did not provide evidence that there was no real possibility of classifying these costs as direct costs, as well as no economic justification for classifying them as indirect costs, the court came to the conclusion that such costs were unlawfully excluded from direct costs without any economic justification. Article 318 of the Tax Code of the Russian Federation cannot be interpreted as allowing the taxpayer to independently and without any justification decide the issue of classifying incurred costs as indirect or direct costs. By providing the taxpayer with the opportunity to independently determine the accounting policy, including the formation of the composition of direct expenses, the Tax Code of the Russian Federation does not consider this process as depending solely on the will of the taxpayer. On the contrary, these standards classify as direct expenses costs directly related to the production of goods (performance of work, provision of services) (Definition of the Supreme Arbitration Court of the Russian Federation dated May 13, 2010 N VAS-5306/10). The position of the court is reflected in the Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 23, 2012 in case No. A27-7287/2011. At the same time, in another situation, the taxpayer was able to confirm the legality of classifying labor costs as indirect expenses. Thus, the tax authority decided that the organization’s actions to attribute direct expenses on wages and deductions for the unified social tax to expenses of the current period in full (as indirect expenses) without taking into account the sale of products in the cost of which they are taken into account are unlawful. The inspectorate considered that the costs of paying employees, regardless of their job responsibilities, are in any case included in the cost of production, i.e. are direct costs; in this case, it is not necessary to determine the share of participation of each employee in the production of a separate batch of goods. However, the court came to the conclusion that the enterprise correctly and justifiably accounted for the disputed expenses as indirect expenses. This accounting procedure does not contradict Art. Art. 318, 319 of the Tax Code of the Russian Federation, the company’s accounting policy. The taxpayer provided a reasoned justification for the need for such accounting of expenses. The enterprise included in indirect expenses (tax accounting) the wages of employees employed in the main production; deductions from the salaries of such employees; the amount of depreciation of fixed assets not directly involved in the process of production (shop buildings, buildings in which production equipment is located, workplaces - tables). The taxpayer, by virtue of Art. Art. 254, 318 and 319 of the Tax Code of the Russian Federation provide the right to exclude certain costs from the list of direct costs with the provision of appropriate justification. When assigning expenses to a particular group (type), one should proceed from their nature, and the taxpayer has the right to classify material costs as indirect costs in the absence of a real possibility of classifying them as direct costs, using economically justified indicators. The organization’s choice of method for distributing direct and indirect costs must be technologically sound and economically justified. In the case under consideration, the taxpayer provided appropriate justification. According to the position of the Constitutional Court of the Russian Federation (Resolution dated February 24, 2004 N 3-P) and the Presidium of the Supreme Arbitration Court of the Russian Federation (Resolutions dated February 26, 2008 N 11542/07 and dated December 9, 2008 N 9520/08), business entities independently choose ways to achieve results from entrepreneurial activity . The enterprise indicated that due to the production specifics of the enterprise, workers are forced to constantly move within the structural unit, therefore they cannot be strictly tied to work on any one equipment or to the production of a certain type of product. Therefore, it is impossible to determine the share of the wages of a specific employee (group of employees) in the cost of each specific sold batch of products. The technological cycle of manufacturing a product sometimes lasts several months; a large number of employees from several departments are involved in its production, and the wages of each employee are calculated based on their fulfillment of the standard (plan) in the reporting period. At the same time, the employee’s fulfillment of production standards is only part of a long process of product production, when the completion of one stage is the basis for the beginning of each subsequent operation in the chain until the release of the finished product. Additional payments to employees (payment for vacations, preferential hours for teenagers, breaks from work for nursing mothers, time spent performing state and public duties, medical examinations) also cannot be reliably correlated with the production process. With regard to fixed assets (depreciation amount), namely the buildings of workshops, buildings in which equipment is located, workplaces (desks), the enterprise explained that the area of workshops is occupied by equipment no more than 30 - 50%, and therefore the operation of these fixed assets funds does not directly affect the production of products by the enterprise - in contrast to fixed assets directly used in production (presses, furnaces, machines, equipment, mills, drying drums), depreciation for which is classified as direct expenses. The court found the procedure used by the taxpayer for calculating indirect expenses to comply with the requirements of the provisions of Chapter. 25 Tax Code of the Russian Federation. Taking into account the peculiarities of the enterprise’s production process, the court recognized the proven need to take into account as indirect expenses the wages of workers involved in the main production, deductions from it, and depreciation on fixed assets not directly involved in the production process. These conclusions were made in the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 30, 2012 in case No. A44-1866/2011.

Results

The taxpayer determines the list of direct expenses independently based on the specifics of his technological process. Costs related to production and sales are classified as indirect costs only if there is no real possibility of classifying them as direct costs.

Errors in the distribution of expenses between direct and indirect lead to distortion (most often understatement) of the tax base, the accrual of fines and penalties. Therefore, any expense for the purpose of calculating income tax must not only be tested for compliance with Art. 252 of the Tax Code of the Russian Federation, but also to classify correctly.

Depreciation on real estate

The situation with premises is somewhat more complicated. After all, often both production and non-production facilities are located in the same building. The Tax Code does not allow dividing the depreciation of a single object. This means that the company needs to clearly decide whether such costs are classified as direct or indirect.

This can be done through economic analysis. It is necessary to look at how much (as a percentage) of the area is occupied by production facilities, and how much by non-production facilities. If it turns out that the production space clearly takes up less than half, then the amount of depreciation for the entire premises can be considered indirect costs (see the decision of the Supreme Arbitration Court of the Russian Federation dated 08.16.12 No. VAS-9792/12, where the judges recognized the inclusion of depreciation for the building in indirect costs as legal , where production equipment occupied no more than 30-50% of the premises area).

At the same time, we recommend that in the accounting policy not only the fact that these costs are classified as indirect, but also the main points of the calculations. This can be done, for example, in an annex to the accounting policy. In the event of a dispute, the accountant will not have to re-prepare the evidence - it will always be at hand.

Rental payments

Whether rental payments are classified as direct or indirect expenses directly depends on what exactly is being rented and how the leased item is used by the company. It is clear that rental payments for machines or computers that are used to produce products cannot be classified as other than direct expenses. But the office rental fee can already be considered from the point of view of the share that the “production part” occupies in this office (see resolution of the Moscow District AS of September 30, 2014 No. F05-10544/14). And since these ratios can change from year to year, this is another reason to audit accounting policies and bring them into line with reality, so as not to overpay taxes and avoid conflicts with inspectors.

The Tax Code of the Russian Federation is not rules, but guidelines

Article 318 of the Tax Code of the Russian Federation lists the types of expenses that the legislator considers possible to be classified as direct.

According to Article 318 of the Tax Code of the Russian Federation, direct expenses may include, in particular:

- material expenses for the acquisition of raw materials, materials used in production or serving as a necessary component in the production of goods (works, services), as well as for the acquisition of components undergoing installation, semi-finished products undergoing additional processing in the organization.

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as insurance payments accrued on such amounts;

- depreciation of fixed assets used in the production of goods, works, and services.

However, it is important for an accountant to know that this list is only a guideline. After all, the Code directly states “may be attributed, in particular.” Simply put, the taxpayer has the right to classify even the costs directly named in this list as indirect in his accounting policy. Conversely, any other costs not directly named in Article 318 of the Tax Code of the Russian Federation can be included in direct costs.

However, such “transfers” cannot be made arbitrarily. The classification of expenses as direct or indirect must be justified. This requirement is made by both the tax authorities (letter of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] ; see “Federal Tax Service: the distribution of direct and indirect expenses must be justified”), and the courts (see the definition of the Supreme Arbitration Court RF dated June 22, 2012 No. VAS-7511/12).

Procedure for writing off expenses

Regardless of when payment for products is received, direct costs must be written off in the period in which the products were sold. Even if payment is received in the next reporting period. You should not write off expenses for finished products in warehouses, work in progress, and shipped goods.

Direct expenses can be written off at a time only to organizations providing services. They can attribute the entire volume of direct costs to the reporting period. For organizations engaged in performing work, this rule does not apply, since when performing work, the result is presented in material form.

Indirect expenses in tax accounting are not subject to distribution. They are written off at a time, in the same tax period in which they were produced. The amount of taxable profit is reduced.

To bring accounting and tax accounting closer together, try to balance the size of production costs with direct expenses in tax accounting.

Using the cloud service Kontur.Accounting will help you correctly divide expenses into direct and indirect, as well as reflect them in a timely manner and in full. Within 14 days you can keep records and prepare reports in Kontur.Accounting for free.

For direct income tax expenses, there is a special accounting procedure provided for by the Tax Code of the Russian Federation.

The essence of direct expenses is that they are taken into account only in the part attributable to goods, work, services or products after processing, sold in the current tax or reporting period (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). This statement is explained, in addition, in letters of the Ministry of Finance of Russia dated July 20, 2017 No. 03-03-06/1/46286, dated October 31.

It is separately stated that such expenses must be written off in the period when the products are sold, even if the funds to pay for them were received in the next tax period. Confirmation of this can be found in the resolution of the Federal Antimonopoly Service of the West Siberian District dated June 15, 2011 No. A45-12953/2010.

How to keep tax records of direct and indirect expenses – TaxReview.Info

In tax accounting, production and sales costs are divided into two groups:

This procedure is established by paragraph 1 of Article 318 and Article 320 of the Tax Code of the Russian Federation.

Who distributes the costs

It is not always necessary to distribute expenses into direct and indirect. The diagram will help you understand in which case this needs to be done:

As you can see, non-trading organizations in which income and expenses are determined on a cash basis do not need to divide expenses into direct and indirect. The same applies to those who use simplified or imputation instead of the general regime, as well as entrepreneurs. The latter, even if they are in the general regime, do not pay income tax.

All this follows from the provisions of Articles 272, 318 and 320 of the Tax Code of the Russian Federation.

Composition of direct and indirect costs

The composition of direct and indirect costs differs for manufacturing and trading organizations.

Production of goods, works or services

You have the right to determine yourself which costs in the production of goods, works or services are classified as direct and which as indirect. The list of expenses is approved by the head of the organization and recorded in the accounting policy.

When making your choice, be guided by the following principles. As part of direct expenses, reflect those costs that are directly related to production or sales. In this case, you can focus on industry specifics and proceed from the specific features of the production process in the organization itself.

Typically, direct production costs include:

- material costs. In particular, the costs of purchasing raw materials and materials that will be used directly in production, as well as components undergoing installation, and semi-finished products that require additional processing;

- expenses for remuneration of employees engaged in production activities and social insurance contributions accrued from these amounts. The same applies to contributions for insurance against accidents and occupational diseases;

- depreciation of fixed assets that are used in the production of goods, works or services.

This follows from paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

The remaining costs that are not directly related to production or, according to technical regulations, are not included in it, are classified as indirect. In addition to non-operating expenses, they are considered separately.

At the same time, recognize as indirect only those expenses that cannot be classified as direct for objective reasons. For example, the costs of raw materials and supplies, which are included in the cost of a unit of production, can only be classified as direct.

All this follows from Article 318 of the Tax Code of the Russian Federation. This is confirmed by letters from the departments - the Ministry of Finance of Russia dated February 7, 2011 No. 03-03-06/1/79 and the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] A similar position is expressed in the definition of the Supreme Arbitration Court RF dated May 13, 2010 No. VAS-5306/10 and resolution of the Federal Antimonopoly Service of the Ural District dated February 25, 2010 No. F09-799/10-S3.

Trade

For trade organizations, the list of direct expenses is fixed. It is given in Article 320 of the Tax Code of the Russian Federation. Direct costs include:

- purchase price of goods. How to calculate it, organizations have the right to determine independently. For example, you can include expenses that are associated with the purchase of goods. These are, in particular, expenses for packaging, warehouse and other costs paid by another organization. Fix the selected option in your accounting policy for tax purposes;

- costs of delivering goods to the buyer's warehouse (when they are considered separately from the cost of the goods themselves).

All other expenses (except for non-operating expenses provided for in Article 265 of the Tax Code of the Russian Federation) are considered indirect and reduce income from sales of the current month.

This procedure is provided for in Article 320 of the Tax Code of the Russian Federation.

Situation: can the costs of delivering goods from the supplier to your warehouse using your own transport be considered direct expenses when calculating income tax? The organization is engaged in trade.

Yes, you can.

The cost of delivering goods to the buyer’s warehouse should be included in direct costs by a trading organization. However, no separate conditions or restrictions have been established. This means that it does not matter whether the buyer pays for delivery to a third party or transports the goods on his own.

But the costs of maintaining your own vehicles used for transporting goods should be classified as indirect costs. They are not directly related to the purchase of goods. This follows from the provisions of Article 320 of the Tax Code of the Russian Federation. A similar opinion is expressed in the letter of the Ministry of Finance of Russia dated January 13, 2005 No. 03-03-01-04.

Situation: can a trade organization include as direct expenses when calculating income tax the costs of delivering goods that it ships to customers directly from manufacturers' warehouses? The organization is engaged in trade.

No, he can not.

Direct costs include the costs of delivering purchased goods (transportation costs) only to the organization’s warehouse, if they are not included in the purchase price.

Since during transit trade the goods are shipped directly to the buyer, bypassing their own warehouse, the specified conditions are not met.

Therefore, such transport costs should be considered as expenses associated not with the acquisition, but with the sale of goods.

Costs associated with the transportation of goods sold are indirect. At the same time, they reduce income from the sale of these particular goods. This procedure follows from the provisions of Article 286 and paragraph 3 of Article 320 of the Tax Code of the Russian Federation.

When to recognize expenses

Write off indirect expenses in full in the period to which they relate. That is, according to the rules of Article 272 of the Tax Code of the Russian Federation.

https://www.youtube.com/watch?v=yK_YhXcuejA

But direct costs will have to be distributed. That part of them that relates to the balances of work in progress or unsold goods cannot be recognized as current expenses. This can only be done as goods and works are sold, the cost of which includes such expenses.

This is stated in paragraph 2 of Article 318 of the Tax Code of the Russian Federation.

Direct costs do not need to be distributed between the costs of the current tax (reporting) period and the cost of services not accepted by customers at the end of this period.

The reason is that a service for tax purposes is recognized as an activity whose results do not have material expression. Services are sold and consumed in the process of their provision.

In this regard, there is no need to distribute all costs incurred, both direct and indirect, among services. You have the right to recognize them in the current period. This procedure for accounting for direct costs must be fixed in the accounting policy.

This follows from paragraph 5 of Article 38, Article 313 and paragraph 3 of paragraph 2 of Article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348.

Expenses when there is no income

Situation: how to take into account direct and indirect expenses when calculating income tax using the accrual method if there is no income from sales in the reporting period. Is the organization not a newly created one?

If there is no income in the reporting period, the organization can only recognize indirect expenses.

The explanation is simple - you can recognize direct expenses only as goods, works or services are sold, the cost of which includes the costs. Direct expenses that relate to the balance of unsold products cannot be taken into account when calculating income tax.

As for indirect expenses, they are in no way tied to the revenue received. They can be taken into account in the current period. And expenses in tax accounting are recognized only as expenses that meet the following criteria:

- are aimed at generating income and are economically justified;

- documented.

These are the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Moreover, if a specific expense does not bring direct income to the organization, this does not mean that it is unreasonable. It is enough that it is necessary for the activity that will result in the income generated.

Therefore, indirect expenses of an organization can be recognized even in the case when income has not yet been received in the reporting period. Such conclusions are expressed in letters of the Ministry of Finance of Russia dated August 25, 2010 No. 03-03-06/1/565, dated May 21, 2010.

No. 03-03-06/1/341, dated December 8, 2006 No. 03-03-04/1/821.

Expenses relate to several periods

Situation: how to take into account indirect expenses that relate to several reporting periods when calculating income tax using the accrual method?

Such expenses need to be distributed.

Indirect expenses when calculating income tax using the accrual method are taken into account in the period to which they relate. Consequently, it is impossible to write off indirect expenses that relate to several reporting periods at a time (clause 2 of Article 318, clause 1 of Article 272 of the Tax Code of the Russian Federation).

This is the procedure.

Write off indirect expenses evenly across reporting periods.

Do this if you can determine the period during which costs will be incurred or revenues will be received under the contract.

Determine the period for writing off expenses based on the duration of the contract or other document. For example, according to a license form, which will indicate its validity period. (paragraphs 2 and 3, paragraph 1, article 272 of the Tax Code of the Russian Federation).

Distribute indirect expenses yourself. This can only be done if the period to which the expenses relate cannot be determined. For example, a contract is concluded for an indefinite period. This condition is provided for in paragraph 2 of paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

In particular, such costs can be distributed:

- evenly over the period approved by order of the head of the organization;

- in proportion to the income received from sales.

The chosen method of distributing expenses relating to several reporting periods is determined in the organization’s accounting policy for tax purposes.

An example of how indirect expenses relating to several reporting (tax) periods are reflected when calculating income tax

On April 1, 2021, the organization entered into a contract with A.S. Kondratiev copyright agreement for the transfer of non-exclusive rights to use the musical work created by Kondratiev. The contract was concluded for two years (from April 1, 2021 to March 31, 2021).

Under the terms of the agreement, Kondratyev is paid remuneration in the form of a fixed one-time payment in the amount of 144,000 rubles.

When calculating income tax, an organization uses the accrual method. The organization’s accounting policy for 2021 for tax purposes establishes that expenses under long-term contracts are written off as current expenses evenly throughout the entire validity period of these contracts.

The reporting period for income tax in an organization is a quarter. The amount of remuneration that an accountant can take into account in the tax base of each reporting period is 18,000 rubles. (RUB 144,000: 8 quarters).

In addition, there is a certain group of indirect expenses that are included in the reduction of the tax base not at the time of occurrence, but according to a special algorithm defined by Chapter 25 of the Tax Code of the Russian Federation. Such expenses, in particular, include expenses for scientific research and development (Article 262 of the Tax Code of the Russian Federation), insurance costs (clause 6 of Article 272 of the Tax Code of the Russian Federation), etc.

For more information about accounting for deferred expenses, see How to account for expenses related to several reporting periods for income tax purposes.

Source: https://NalogObzor.info/publ/nalogi_s_juridicheskikh_lic/nalog_na_pribyl/kak_vesti_nalogovij_uchet_prjamih_i_kosvennih_raskhodov/2-1-0-71