Increase in the minimum wage from January 1, 2021: was it or not?

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation).

The Moscow authorities increased the minimum wage in Moscow from January 1, 2021. What is the size of the new minimum wage in Moscow in 2021? From January 1, 2018, the minimum wage in Moscow is 18,742 rubles (Decree of the Moscow Government dated September 12, 2017 No. 663-PP).

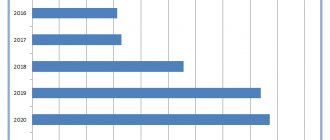

At the end of 2021, Moscow authorities recorded the cost of living for the third quarter of 2021. (Decree of the Moscow Government dated December 5, 2017 No. 952-PP). But the amount turned out to be 289 rubles less than the subsistence level for the second quarter. Therefore, the minimum wage in Moscow from January 1, 2021 remained at 18,742 rubles. After all, it is impossible to reduce the minimum wage due to a decrease in the cost of living (clause 3.1.1 of the agreement dated December 15, 2015). By the way, this amount has not changed since October 1, 2021. You can trace how the minimum wage increased in Moscow (see table by year):

| Validity | Amount (rubles per month) |

| 01.10.2017 – | 18742 |

| 01.07.2017 – 30.09.2017 | 17642 |

| 01.10.2016 – 30.06.2017 | 17561 |

| 01.01.2016 – 30.09.2016 | 17300 |

| 01.11.2015 – 31.12.2015 | 17300 |

| 01.06.2015 – 31.10.2015 | 16500 |

| 01.04.2015 – 31.05.2015 | 15000 |

| 01.01.2015 – 31.03.2015 | 14500 |

| 01.06.2014 – 31.12.2014 | 14000 |

| 01.01.2014 – 31.05.2014 | 12600 |

| 01.07.2013 – 31.12.2013 | 12200 |

| 01.01.2013 – 30.06.2013 | 11700 |

| 01.07.2012 – 31.12.2012 | 11700 |

| 01.01.2012 – 30.06.2012 | 11300 |

| 01.07.2011 – 31.12.2011 | 11100 |

| 01.01.2011 – 30.06.2011 | 10400 |

| 01.05.2010 – 31.12.2010 | 10100 |

| 01.01.2010 – 30.04.2010 | 9500 |

| 01.09.2009 – 31.12.2009 | 8700 |

| 01.05.2009 – 31.08.2009 | 8500 |

| 01.01.2009 – 30.04.2009 | 8300 |

| 01.09.2008 – 31.12.2008 | 7650 |

| 01.05.2008 – 31.08.2008 | 6800 |

| 01.09.2007 – 30.04.2008 | 6100 |

| 01.05.2007 – 31.08.2007 | 5400 |

| 01.09.2006 – 30.04.2007 | 4900 |

| 01.05.2006 – 31.08.2006 | 4100 |

| 01.10.2005 – 30.04.200 | 3600 |

| 01.05.2005 – 30.09.2005 | 3000 |

| 01.10.2004 – 30.04.2005 | 2500 |

| 01.05.2004 – 30.09.2004 | 2000 |

| 2nd half of 2003 | 1800 |

| 01.01.2003 – 30.06.2003 | 1500 |

| 01.09.2002 – 31.12.2002 | 1270 |

| 01.01.2002 – 30.08.2002 | 1100 |

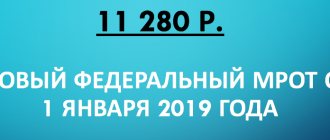

From January 1, 2021, the federal minimum wage is 9,489 rubles. See “Minimum wage from January 1, 2021.” However, the Moscow “minimum wage” is higher than the federal one. After all, regions have the right to set their own minimum wage, but not less than the federal one (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

The minimum wage in the capital Moscow directly depends on the cost of living for the working population living in this region. This follows from clause 3.1.2 of the tripartite agreement between the Moscow Government, Moscow associations of trade unions and employers, concluded on December 15, 2015. Therefore, this amount continues to apply from January 1, 2018:

| Region | Region code | Minimum wage (RUB) |

| Moscow | 77 | 18 742* |

* The minimum wage includes additional payments, allowances, bonuses and other payments, except for payments in accordance with Articles 147, 151–154 of the Labor Code.

Minimum wage in 2018–2019 in the regions

The minimum wage established in the region cannot be less than the federal minimum wage. It is determined by an agreement between representatives of the government of a constituent entity of the Russian Federation, trade unions and employers. Employers in the region who have not submitted to the government of a constituent entity of the Russian Federation compelling reasons for not joining this agreement are required to apply the regional minimum wage when setting wages (Article 133.1 of the Labor Code of the Russian Federation).

To learn about the cases in which additional payment is made up to the minimum wage, read the article “Additional payment up to the minimum wage for external and internal part-time workers .

Minimum wage and Moscow salary: dependence

Moscow employers (organizations and individual entrepreneurs) must set a salary no less than the Moscow minimum wage (RUB 18,742) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If your such refusal has been sent, then the salary in Moscow from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). For many employers, the difference is noticeable: 9253 rubles. = (RUR 18,742 – RUR 9,489).

The Moscow minimum wage, applied from January 1, 2021, already includes a tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow minimum wage. This procedure follows from clause 3.1.3 of the Tripartite Agreement.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

Results

The abbreviation MROT stands for minimum wage.

It is installed at both the federal and regional levels. The federal minimum wage increases 1–2 times a year. The regional minimum wage may be revised more often, but in any case cannot be less than the federal minimum wage. The size of this parameter determines the minimum salary level and the minimum amount of sick leave payments and child benefits. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibility

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

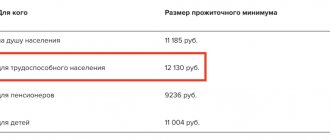

Connection with a living wage

The living wage in Russia is an indicator designed to assess the standard of living of citizens and establish a base amount for calculating remuneration for the work of employees. The PM also forms the federal budget based on the needs of Russians, because it includes the consumer basket and funds for providing social support to citizens. The cost of the consumer basket includes prices for:

- food, non-food products and services;

- costs of rent, fees, taxes (NDFL).

Accordingly, in order for citizens to have enough funds to pay for the minimum amount of products, services, mandatory payments and taxes, the state must allocate at least this amount. This procedure is established by law. But until 2021 the law was broken. Therefore, since last year, Russian minimum wage officials have taken a course towards moving closer to the subsistence level. Thus, the minimum wage in 2021 until May of the previous period was 6% less, and after that the minimum wage level increased by 11.25% of the subsistence level. Now the minimum wage for 2021 is calculated so that citizens have funds to compensate for the consumer basket.

From the first increase in the minimum wage to the minimum wage, it was decided to establish equality between the indicators. Perhaps in 2021 and subsequent years the minimum wage will not lag behind the subsistence level.

When in Moscow to rely on the federal minimum wage

Let us highlight several situations when in Moscow in 2021, instead of the regional minimum wage, it is necessary to use the federal one (even if there was no refusal to join the agreement).

Calculation of benefits

To calculate social benefits, use the federal minimum wage, not the regional one. Let us remind you that “minimum” social benefits are received by employees with earnings below the minimum wage or with short work experience (up to 6 months) (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Accrual of vacation pay

The federal, and not the regional, minimum wage should also be taken into account when calculating vacation pay. The average monthly earnings calculated for calculating vacation pay cannot be lower than the minimum wage (clause 18 of the Regulations, approved by Government Resolution No. 922 of December 24, 2007). Therefore, you need to compare the calculation result with this indicator. And if the comparison is not in favor of the employer, you will have to make an additional payment up to the federal minimum wage.

Calculation of individual entrepreneur contributions “for oneself” for 2021

Insurance premiums for individual entrepreneurs “for themselves” for 2021 are also determined based on the federal minimum wage. In this case, you need to take the value set at the beginning of the year (RUB 7,500). However: from 2021, individual entrepreneurs’ contributions “for themselves” are no longer tied to the minimum wage. The Tax Code - in paragraph 1 of Article 430 - now spells out fixed amounts that all businessmen will have to pay throughout the year. And these fixed payments do not depend on the amount of income. And it doesn’t matter whether the businessman worked at a profit or at a loss. As a general rule, all individual entrepreneurs will have to pay such contributions to the Federal Tax Service budget. See “Insurance premiums for individual entrepreneurs from 2021“.

Source: “HR Blog”.

Read also

21.11.2017

Minimum wage: decoding the concept

The acronym MROT, widely used since the 1990s, stands for minimum wage.

And today the importance of this indicator is difficult to underestimate, because this is the basis from which the minimum amounts of sick leave and benefits for pregnant women are calculated, as well as mandatory insurance payments of self-employed persons for periods until the end of 2021 (from 2021 this link has been canceled). To learn about the amounts in which self-employed persons pay contributions starting from 2021, read the article “What insurance premiums does an individual entrepreneur pay in 2018-2019?” .

Previously, this universal indicator also served to calculate some taxes, fines and a number of obligations under civil contracts, in which the condition of linking to the minimum wage was introduced. But currently the minimum wage is not applied for these purposes.

Calculation of sick leave according to the minimum wage

In the cases mentioned above, sick leave payments are determined by the level of the minimum wage. To calculate sickness compensation in 2021, you can take the following example:

- A new employee got a job at the company. There was a difficult economic situation in his region, so from 2016 to 2021 he did not work. After a month of staying in the organization, he went on sick leave, and a week later he presented sick leave to the HR department for 5 days.

- Since the employee did not receive a salary during the estimated time, accounting relies on minimum wage indicators. First, the average salary is determined as 11,163*24 months/730 days. = 367 rubles.

- If the employee’s work experience is 4 years 2 months, the benefit will be equal to 60% (less than 5 years). Payments are calculated in this way - 367 * 5 * 60% = 1101 rubles.

Similar situations arise for employees who have returned from maternity leave.

The percentages used for calculation depend on the length of service of the employee:

- less than 8 years - daily earnings are multiplied by 100%;

- 5-8 years – guarantee of payment of 80% of daily earnings;

- For working experience of no more than 5 years, the bonus is 60%;

- If you have less than six months of experience, the amount is calculated from the minimum wage.

To apply for sick leave benefits, the employee must submit an application for compensation within a month. Otherwise, the funds due to him will not be paid.

How to arrange a salary increase due to an increase in the minimum wage

So, if employees at an enterprise receive a lower salary, personnel officers need to inform their superiors about this, and then arrange for a salary increase or salary bonus. First, let’s figure out what payments are included, for example, in the minimum wage from July 1, 2018 in Moscow. According to the norms of Article 129 of the Labor Code of the Russian Federation, this amount includes the entire salary - salary, additional payments, and bonuses, provided that the employee has worked the monthly working hours.

Thus, there are several options for how to arrange a salary increase. The first is to increase the premium part. For example, pay the difference between past and current indicators.

The second option, a little more complicated, is to draw up an order to increase salaries for certain categories of employees and sign additional agreements with them to employment contracts. The date in the agreements must coincide with the date of official entry into force of the changes. Additionally, if there is a staffing table, the employer must make changes to it (or approve a new one, with increased salaries).

Learn more about how to issue an order to change employee salaries.

It may happen that regional authorities are late with the decision and approve the new minimum wage later. This was the situation in Moscow in 2014, when employers learned about the increase in the minimum wage from June 1 only in the middle of the next month. As a result, Rostrud, in Letter No. 2705-TZ dated August 12, 2014, clarified that in this case, employers are obliged to recalculate wages for June. But experts still do not recommend preparing documents retroactively. It is better to do this on the date when the employer learned about the change, and write in the additional agreement and order that the innovations are effective from an earlier date.

To make life easier, the employer can, in the Regulations on Remuneration, prescribe another option for complying with the requirement for the minimum amount of labor - include his obligation to additionally pay up to the regional minimum wage or the subsistence minimum, if the region provides for the equation of these two indicators. In this case, no additional orders or documents will need to be issued; the employee will automatically receive an amount no less than the established minimum.

Since the increase in the minimum wage and, accordingly, wages at enterprises is not associated with changes in organizational or technological working conditions, there is no need to notify employees of the upcoming wage increase 2 months in advance. A two-month warning should be used only if the situation of workers worsens due to the upcoming wage increase.

What value to use from 2021?

According to the Regional Agreement dated September 20, 2017, adopted by government bodies, on the minimum wage in the city of St. Petersburg, the minimum wage from the new year will be 17 thousand rubles. In this case, the salary (or tariff rate) of a 1st category employee must be at least 13.5 thousand rubles. As you can see, the salary is less than the minimum wage, but taking into account compensation and incentive payments (according to Article 129 of the Labor Code of the Russian Federation), they must either be equal, or the salary will be more than the minimum wage.

Compared to 2021, the minimum wage will increase in 2021 by 1 thousand rubles. (in 2017 it was 16 thousand rubles), while no such increase is planned in terms of salary (or tariff rate). In other words, their size will remain at the same level - 13.5 thousand rubles.

What is the minimum wage used for?

The figures characterizing the minimum wage are important for every citizen of the Russian Federation, since they determine quite a few indicators in financial life.

Using this figure, the following economic indicators are regulated:

- remuneration for hired personnel;

- the amount of taxes, fees, fines, duties and other government payments;

- accrual of disability payments, as well as maternity benefits;

- assessment of pension rights;

- other tasks of social insurance.

What does minimum wage mean?

The minimum wage represents the level of wages below which employers cannot set wages for workers working at the enterprise for one month, provided that they have worked the standard duration established by law for this period.

If the salary turns out to be less than the current level, appropriate measures may be applied to the enterprise, but it will still have to bring its salaries to the established amount.

The minimum wage is set both as a single value for the entire territory of the country, and in some regions individually. Currently, the regional minimum wage is valid in all 85 regions of the country.

In addition, the minimum wage is used to determine benefits paid by social insurance and employers in the event of cases of disability, as well as for maternity payments.

Until 2021, insurance premiums that persons registered as individual entrepreneurs made for themselves for the purpose of compulsory insurance (fixed payments) were also determined based on the size of the minimum wage and the current tax rate. Since this year, there has been a separation of the relationship between these quantities.