Organization on the simplified tax system. How to process a salary refund in the 1C:Accounting 8 version 3.0 program,

The individual paid for the organization admin05/06/2021 02/15/2018 In practice, situations often arise when

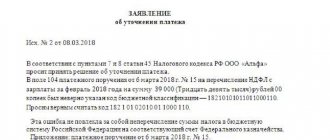

Employer reporting Denis Pokshan Expert in taxes, accounting and personnel records Relevant on 5

The advance report in 2021 is filled out to confirm the issued accounts. View and download the form

Directory of KBK budget classification codes for 2013 We present to your attention a directory of budget classification codes

Length of working hours Companies have recently practiced a slight reduction in working hours for women,

Current legislation provides that any legal entity must have its own legal address where it is located

Initially, the list of discounted publications was approved by Decree of the Government of the Russian Federation dated January 23, 2003 No. 41, in which

The Unified Agricultural Tax is a preferential treatment for agricultural producers, allowing them to pay to the budget

VAT rate 0: transport services The procedure for calculating value added tax is established in Chapter.