Current legislation provides that any legal entity must have its own legal address where its executive body is located. This address is used to communicate with the company's counterparties, as well as government agencies. If a case of unreliable address is detected, the registering authority has the right to make a corresponding note in the Unified State Register of Legal Entities, which in the future may lead to the exclusion of the organization from the state register. In addition, situations often arise when the address of a legal entity is recognized as “mass”. It is impossible to register a legal entity at such an address, and for companies that do have a similar address, this is another reason for close attention from the tax authorities. Therefore, it is very important for all participants in economic activity to know how to check the legal address.

Mass address criteria

Order of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. ММВ-7-14/ [email protected] provides that in order to recognize an address as a mass address, the fact of registration of five organizations at one address is sufficient. If such a fact is established by the tax authorities, then checking the information in the Unified State Register of Legal Entities for accuracy during the initial registration or change of address of a legal entity cannot be avoided.

The question often arises about registering an LLC or individual entrepreneur at the address of a large business center. Since it hosts many organizations, the address can be considered mass. The Letter of the Federal Tax Service of the Russian Federation dated January 31, 2014 N SA-4-14/ [email protected] contains a recommendation that details exactly how to register so as not to arouse suspicion.

Thus, in clause 14.2.05.60 of the Letter it is specified that in the documents submitted for state registration, when filling out the application, detailed elements of the address that is the location of the legal entity must be entered. We are talking about the address landmarks of the object: house (possession), building (building, etc.), apartment (office, etc.).

If the documents do not contain specific address elements, then this absence cannot indicate the presentation of documents reflecting the actual address of the company.

So, we can distinguish two key criteria for a mass address:

1. Many legal entities are registered at one address. At the same time, “many” can mean a different number, depending on the subject of the Russian Federation.

According to the Order of the Federal Tax Service of the Russian Federation dated December 29, 2006 N SAE-3-09/ [email protected] , each Department of the Federal Tax Service of Russia for a constituent entity of the Russian Federation issues its own minimum criterion for selecting a mass registration address. For this purpose, a corresponding administrative act is issued. For example, the same address is indicated during state registration as the last location of 10 or more legal entities, 5 or more legal entities, etc.

2. There is no connection with legal entities registered at the same address. This indicates that representatives of the legal entity are not located at a specific address, and correspondence is returned with the mark “the organization has left”, “after the expiration of the storage period” (Letters of the Ministry of Finance of the Russian Federation dated November 14, 2017 N 03-12-13/75024, N 03- 12-13/75027).

The tax office refused registration due to a mass address: what to do?

If a businessman forgot to check the legal address for mass registration or did not complete the action for other reasons, contacting the tax office is associated with an increased risk. If there are other companies officially located in the selected premises, the Federal Tax Service will refuse to complete the registration procedure. In this situation, the founder of the company can:

- Re-select and check the legal address for mass registration, and then re-send the documentation to the Federal Tax Service. In this case, the state duty will have to be paid again.

- Go to court and try to appeal the decision. Such proceedings are handled by the arbitration court. By choosing this option, the founder must be prepared for lengthy proceedings. The process takes several months. The success of the proceedings depends on the individual nuances of the situation. During the procedure, the mass status of the legal address will be checked.

The choice of method depends on the decision of the company’s founders. If they want to speed up the registration procedure, they better prepare the documentation again and choose a new location for the company.

The role of banks in the process of combating shell companies

Banks have also begun to check for signs of shell companies. Some even provide a service to verify the counterparty at the client bank. This option is usually a traffic light service that warns of the presence of suspicious information in red.

Since banks “joined” the practice of identifying shell companies, another threat has loomed over entrepreneurs and organizations - now their account may be blocked. For this, a sufficient reason is the transfer of money to dubious business partners who may be “located” in places of mass registration.

"Black list" of the Federal Tax Service

Violation of existing rules will also affect the owner of the property, who has registered several legal entities on the premises. Addresses that appeared in the proceedings as mass addresses are blacklisted. It will not be possible to register a company in such a premises.

It will not be possible to prevent an address from being included in the “black list”. The only way out in this situation is to go to court. Proving that only one company is registered on the premises can be problematic. For this reason, an entrepreneur must check the legal address for mass availability in advance.

Risks of working with a counterparty with a mass address

For legal entities themselves, the use of a mass registration address may result in refusal of state registration or in making changes to the Unified State Register of Legal Entities when changing location or address. The Supreme Court, in Ruling No. 306-KG17-21112 dated January 23, 2018, confirmed that if the address of mass registration is indicated in the application for registration of changes in the constituent documents, then the tax authorities may refuse registration. According to the court, the location of a legal entity has significant legal significance, since it actually determines the place of fulfillment of obligations, the place of payment of taxes, the jurisdiction of disputes, as well as the possibility of exercising proper tax control. Based on this, the court considers that filing an application prepared with knowingly false information is equivalent to failure to submit such a document.

A transaction with a counterparty registered at a mass address may be regarded by the tax authorities as an attempt to obtain an unjustified tax benefit. Although the registration of a counterparty at a “mass” address in itself is not used by tax authorities as an independent basis for recognizing a tax benefit as unjustified.

This fact becomes one of the proofs of the counterparty’s dishonesty, combined with such signs as the counterparty’s lack of an official website, customer reviews, advertising in the media, as well as signs at the counterparty’s place of registration, etc. For more information about the signs of the counterparty’s dishonesty, read the article “Unfair play: 15 signs that your counterparty is deceiving you.”

If it is proven that you received an unjustified tax benefit, you face the following consequences:

- additional assessment of tax, penalties, collection of a fine - for non-payment of tax under Art. 122 NK RF;

- administrative fine - for gross violation of accounting (Article 15.11 of the Code of Administrative Offenses of the Russian Federation);

- criminal liability - for a significant amount of arrears (Article 198, Article 199.1 of the Criminal Code of the Russian Federation).

Mass registration - what is it?

Providing office space is a well-established business. It becomes especially profitable when a certain premises are fictitiously rented out under an agreement on postal and secretarial services to several legal entities.

In fact, such an agreement does not contradict the law. It implies that the landlord rents out the premises to the tenant while simultaneously providing services for processing correspondence addressed to the tenant.

Actually, a legal address is mostly needed for communication between a legal entity and tax and other government authorities. That is, it is initially understood that the legal entity does not need the premises itself, since it may well function in another territory.

For this reason, mass registration places have appeared, where dozens of legal entities are registered in a small area.

To suppress mass registration, the subjects of the Federation, through regional regulations, introduced restrictions on the number of legal addresses per unit of physical address. That is, each subject sets his own value threshold, usually from 5 to 10.

Exceeding these values entails the inclusion of the address in a kind of black list of places of mass registration. Accordingly, providing an address from this list entails a refusal to register a legal entity.

When will an address be considered mass?

When 10 or more legal entities are registered under it.

Can I use a bulk address when registering?

Yes, you can. The main thing is to have all the necessary documents (copy of the certificate of ownership, letter of guarantee), i.e. essentially confirmation by the owner of the premises of the contractual relationship with your future organization.

What are the advantages of a mass address?

The only thing that matters is its price. The entrepreneur will pay several times less than for real premises.

What are the disadvantages and dangers of mass address?

The organization may have problems opening a current account. You will not be able to receive documents by mail. It will be impossible to participate in tenders and fully cooperate with state-owned companies. Unscheduled inspections by the Federal Tax Service and even blocking of accounts in some cases are possible. You need to understand the main thing, namely the reason for the increased interest of tax authorities in such addresses - initially their base was created to combat fly-by-night companies.

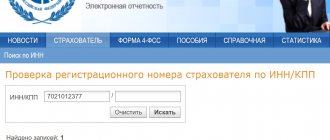

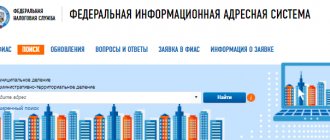

How to check an address for mass availability

You can check the address of the counterparty on the tax website, as well as using the Transparent Business service. The system searches by entered details (region, district, city, locality, street, house) and provides information about persons registered at the address.

You can also find out how many companies are registered at the counterparty’s address using the Kontur.Focus service. The check will also determine whether the director or founder is . Just enter the address in the search bar of the service.

Check Features

Services for online verification of a legal address are provided by the official website of the Federal Tax Service, which you can access through its special service.

Please note that after entering all the required data, the site will require you to enter a captcha, that is, a set of numbers shown in the picture. After entering them, you can click the “Find” button.

The service will display on your monitor the total number of legal entities that were previously registered at the address you entered. For example: “Total entries in the registry: 6681, entries found: 2, entries submitted: 2.” The service also makes it possible to download a complete list of found records in Excel format.

What is a legal address

The legal address for organizations is determined by Russian legislation as the location of the legal entity, which is determined by the location of its permanent executive body (Article 54 of the Civil Code of the Russian Federation), that is, the director, general director, structure performing the functions of managing the enterprise. This address is indicated in the Unified State Register of Legal Entities. You can use the address of the founder’s office in this capacity; you can also register a company at the address of a rented office.

For individual entrepreneurs, according to 129-FZ, the registration address can only be his home address, which is indicated in the Unified State Register of Individual Entrepreneurs.

The legal address should not be confused with the actual one. The actual address is the address where the company's production facilities, warehouses, etc. are physically located.

The most important thing that is required from a company’s registration address is its authenticity . You need to use the real address at which the company actually conducts business.

What could be the danger?

It is necessary to understand that the registration of a considerable number of companies at the same address is not considered a criminal offense, and also does not entail the liquidation of the activity.

If the organization is in fact located at a specific address and is accessible for communication, then the only negative point in this case will be the drawing of special attention to the existing circumstance.

In addition, numerous questions may arise from direct counterparties who are collecting information about a potential partner and who have received information regarding the mass of the registration address.

If clear explanations are given, as well as confirming them in a documentary way, then the problem as such should not arise.

The situation is much more complicated if the company or legal representative at a specific legal address is completely absent.

In this case, we can confidently talk about such things as:

| Not receiving mail | In this case, it may simply be lost or received by the final recipient late, which in some situations entails quite negative consequences |

| No company representatives at all | At a specific legal address of registration |

In the latter case, this fact is of particular importance for situations in which it is extremely important to confirm the fact of the company’s real entrepreneurial (commercial) activities.

For example, for the purpose of refunding value added tax (VAT) or during an attempt to sign a loan agreement.

In addition, difficulties arise during the formation and signing of contracts with new counterparties.

Banks vs shell companies

Banks are now also checking companies to see if they are one-day companies. Some of them even introduced a special service - upon request of a client, a potential partner is checked at the client bank. As a rule, it looks like a service traffic light, highlighting in red companies whose information looks suspicious.

However, the participation of banks in the search for shell companies creates an additional threat for bona fide businessmen and enterprises - the risk of blocking their accounts. Your account may be blocked on the basis, for example, of money transfers to suspicious recipients whose address turned out to be one of the places of mass registration.

In what cases can the tax inspector find fault with the address?

Tax officials can complain for any reason, but there are four options:

- An inaccurate address is indicated or information about the director’s office is not provided;

- The specified location is included in the list of bulk addresses;

- No evidence that the owner gave consent to register the organization;

- The inspector was unable to enter the premises when he came to check.

To complete the registration, you must control the process. After submitting your documents, use one of the following options:

- Without waiting for an invitation to send the director to the tax office. This will help dispel doubts before they arise. You can call the tax office and find out which office you can go to and at what time;

- Wait for a call from the tax office or wait for the registration results. Before receiving a positive decision, try to ensure that the director does not leave for a long time and can arrive during the working day to confirm his identity.

Bulk address: how to protect yourself?

If for any reason it is impossible to check whether a legal address is widespread, the business owner must take a number of measures to protect himself from possible problems:

- You should enlist the support of the owner in matters of interaction with the bank and the tax service. A categorical refusal to cooperate should raise red flags.

- If you are purchasing a legal address, you should give preference to the offer that includes postal services. If the tax office finds out that the letters it sends do not reach the company, the company will come under suspicion. This will lead to unexpected inspections.

- As an additional service, experts advise purchasing the provision of a workplace. A businessman can be there all the time or come at a certain time. The nuances of the service depend on the agreement with the owner of the premises. If the owner of the company periodically stays at the legal address, this will create the impression that it coincides with the actual one.