Errors in settlements with accountable persons can lead to fines for cash violations, as well as additional personal income tax and contributions.

Therefore, it is important to correctly process the issuance of money against the report and avoid mistakes when filling out the advance report. See a sample of filling out an advance report in 2021, to which the inspectors will have no questions. [td]How you can’t give out money on account

When is it necessary to fill out an advance report?

An advance report is a primary document that confirms the amounts of money spent by accountable persons. The document is required to confirm the target expenditure of money.

The advance report is compiled and submitted to the accounting department by accountable persons who were given an advance for the needs of the organization or individual entrepreneur. The period within which the employee is required to report to his employer is three working days from the date:

- the expiration of the period for the provision of amounts specified in the application for the issuance of money on account;

- a person’s return to work when the deadline expires during a period of illness or vacation;

- returning from a business trip.

Please note: an entrepreneur has the right to withdraw money from his current account and spend it for any purpose - both for his own activities and for personal needs. He does not need to prepare an advance report on the amounts spent.

Who is the accountable person

Accountable funds are issued by the manager to the employee of the enterprise for general production or general business expenses. The employee reports for the amounts disbursed on time through an advance report. An employee, having received funds for the needs of the enterprise, is an accountable person.

IMPORTANT!

Advances are issued not only to employees of the enterprise, but also to freelance employees who have entered into civil law contracts with the employer (clause 5 of the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014).

Accountable funds are transferred to responsible employees not only in cash, but also to a bank card by wire transfer (letter of the Ministry of Finance of the Russian Federation No. 03-11-11/42288 dated 08/25/2014).

The employer determines the circle of accountable employees in a special order. Employees agree with the appointment. The management order approves the list of responsible employees who receive accountable funds.

All accountable persons are required to report on expenses incurred, attaching supporting documentation, and provide advance reports to the accounting department on time.

Advance report: form 2021

There is no official advance report form for 2021, which is mandatory for everyone. You can develop the expense report form yourself, taking into account the specifics of the company’s work. But it is more convenient to use a unified advance report on the AO-1 form (OKUD code 0302001). The form was approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55 and must contain the following information:

- on the amount of funds issued on account;

- about the accountable person (full name, position, structural unit);

- about the previous advance (balance, overexpenditure);

- on the appointment of an advance;

- accounting records and others.

Whatever form you decide to use, it must first be approved by the manager in the appendix to the order on accounting policies.

Advance report form 2021[/td]

The advance report form is filled out by employees to whom the company has provided funds in advance. The advance report should answer the following questions:

- whether there are cost overruns;

- whether the documentation (checks, certificates, receipts) was provided in a timely manner;

- whether the persons responsible for the expenditure of advance funds have a debt to the enterprise;

- Is it necessary to deduct a certain amount of material resources from reporting employees from their salaries to pay off advance debt?

Statement

At the time of submitting documents to the accounting department, the employee who took the assets under the report must write a receipt. It indicates that he submitted everything necessary and the report was accepted for verification. The following must be signed on the receipt:

- reporting employee;

- director of company;

- Chief Accountant;

- responsible officer.

After the verification work, the accountant approves the package of documents from the manager and receives his signature.

How to fill out an advance report in 2021

The document is drawn up in one copy. Based on the approved report, the accounting department writes off the accountable amounts as expenses, the employee deposits the unspent advance payment into the cash register, and the accounting department also issues the employee the amount of overexpenditure according to the expense cash order.

The advance report consists of the front and back sides, as well as a receipt. The document is drawn up by the accountant and the accountant: each of them fills out their part.

Front side

The expense report is filled out by the employee, but you can do it for him. You should indicate the name of the company, report number, date, surname and initials of the reporting person, its structural unit and personnel number, position, as well as the purpose of the advance.

Also in the advance report there is a table that indicates information about the previous advance, money received, expenses and balance. If the advance was issued in a foreign currency, the amount is indicated in line 1a in two currencies.

On the reverse side

In the advance report, the employee lists supporting documents (receipts, transport documents, cash and sales receipts, etc.), and the corresponding amounts of expenses.

After checking the expense report, fill out the “Accounting entry” table. Indicate the corresponding accounts and amounts. Put a mark to check the report.

In numbers and words indicate the amount in which the report is approved. Next, put the signatures and transcripts of the signatures of the accountant and the chief accountant, as well as the amount of the balance or overexpenditure (if any) and the details of the receipt (expense) documents for which funds are deposited/issued.

You can fill out the document either on paper or electronically. But if the company issues expense reports electronically, then they will need to be printed so that employees can sign them.

Employees must attach documents confirming expenses to the expense report. Documents are needed to confirm and justify expenses when calculating income tax. Before filling out the expense report, it is safer to generate supporting documents in chronological order, check their correctness and number them.

Procedure for compilation

Information required:

- about the establishment, number and date of the document being drawn up;

- about the employee who received an advance;

- the amount of funds issued and their intended purpose;

- actual expenses (all supporting primary documents are attached).

The front part contains data on the movement and write-off of advances and on analytical accounts reflecting the accounting of funds in the organization. All completed information is certified by the signatures of the responsible accountant who issued the money and accepted the return of the accountable amounts, the chief accountant and the employee who received the advance amount. The accountant fills out a tear-off receipt confirming the verification of the primary documents. This is confirmed by an example of filling out an advance report. After registration and tearing off, the receipt remains with the accountable person. On the reverse side, the employee enters a detailed breakdown of expenses, and the responsible accounting employee indicates the amount to be recorded and the accounting account through which the expenses will be posted.

Advance reporting is generated in a single original copy. This is the nomenclature internal document flow of the institution; it is not necessary to affix a seal.

IMPORTANT!

Corrections excluded! If you make any mistakes, or even more so, you will have to fill out a new form.

The numbers are out of order: will the seller be punished?

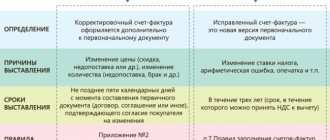

Mistakes happen to everyone, and violation of invoice numbering, alas, is not uncommon. The most common occurrences are missing numbers or non-compliance with chronology (an invoice that is later in date has a lower number than the previous ones, or vice versa). Duplication is a rarer case, because basically everyone works with accounting programs and the software simply does not allow you to assign the same number to different documents.

It is extremely difficult to bring the broken numbering into chronological order, since as a result of shuffling invoices, the numbers of later documents that have already been transferred to buyers will “creep”. Therefore, the question arises: is it necessary to do this?

We answer: not necessarily, since tax legislation does not provide for liability for violation of the rules for numbering invoices for the seller. In Art. 120 of the Tax Code of the Russian Federation talks about a fine for the lack of invoices, but it cannot be applied to the situation with “dropped out” numbers. We can talk about the absence of invoices only when there is an obligation to issue them, but it has not been fulfilled - missing a number does not apply here. However, all this does not mean that the rule of a single chronology can be ignored.

What to consider when numbering invoices

The list of mandatory details of shipping, advance and adjustment invoices is contained in paragraphs. 5, 5.1 and 5.2 art. 169 of the Tax Code of the Russian Federation, respectively. One of these details is the serial number. At the same time, the Tax Code itself does not establish the order of numbering of invoices and refers us to the by-law - the resolution of the Government of the Russian Federation (clause 8 of Article 169 of the Tax Code of the Russian Federation). For 2020, a similar document is the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

However, nothing has changed regarding the issues of invoice numbering. Thus, since the entry into force of Resolution No. 1137, there have been no fundamental innovations in numbering in its text. Some clarifications took place in the summer of 2014 (Resolution of the Government of the Russian Federation dated July 30, 2014 No. 735), when the type of dividing mark used in invoices of separate divisions, participants in partnerships and trustees was determined. This sign became the slash (fraction, slash) - “/” (previously it was simply a dividing line, but it was not specified whether a slash was meant or a dash).

The main points about the numbering of invoices were given by ConsultantPlus experts. Get trial access to the system and move on to the Ready-made solution.

Read about the latest changes that significantly changed the form and rules for filling out an invoice.

Storage

After the received report has been verified by the company's accountant and documented with suitable entries, and the balance amounts have been returned or withheld, the document is sent for storage.

According to the articles of the Tax Code of the Russian Federation, advance reports in commercial or non-state enterprises are stored for different times depending on the type of paper:

- 4 years – storage period for accounting and tax reports, statements, advance reports, from which taxes are calculated;

- 10 years is the period for primary documentation in which expenses due to losses incurred are transferred to the coming periods;

- 5 years – for initial advance reports.

In government organizations, these types of documents must be stored for at least 5 years.

***

So, we found out that the advance report is used to confirm that accountable funds were spent as intended. The document is partially filled out by the employee and sent to the accounting department. The latter, when conducting the document, must put a number on it. Numbering is carried out in such a way that it is convenient for the business entity itself.

Similar articles

- Payment order number

- How to correctly fill out an advance report - sample?

- Sample advance report for a business trip

- Advance report on business trip 2016-2017 (sample)

What are the rules for numbering invoices?

The main (and only) rule is that numbers are assigned in chronological order as invoices are compiled/issued (subparagraph “a” of paragraph 1 of the rules for filling out an invoice, subparagraph “a” of paragraph 1 of the rules for filling out an adjustment invoice) .

An organization can set the numbering renewal period independently in its accounting policies, depending on the number of documents it prepares. For example, you can resume numbering from the beginning of the next year, quarter, month. The only thing that officials spoke out against was the daily numbering of invoices from the first number (letter of the Ministry of Finance of Russia dated October 11, 2013 No. 03-07-09/42466).

Invoice numbers may not only consist of numbers: the use of letter prefixes and digital indices is allowed. The latter must be included in invoices:

- separate divisions (the document number separated by a slash is supplemented by the digital index of the OP, fixed in the accounting policy);

- participants of partnerships or trustees (the company’s transaction index for a specific agreement is also indicated through a slash).

Read more about invoice details and their significance for this document in this article.

conclusions

An advance report is one of the few documents that does not change its purpose and form over the years. Therefore, the practice of state and non-state companies proves its importance when working with any monetary assets from the cash register. This is the only document confirming the intended use of funds by the employee, and therefore proving his legal behavior.

When starting the registration of accountable funds and upon completion of the accounting audit, the manager must carefully review all documents, since it is he who retains the right to reduce or increase the period for providing joint stock company for a particular employee. Also, his signature on the package of papers at the time of approval automatically proves that all controversial and conflict situations with the remainder of the assets have been resolved and the parties have no claims against each other.

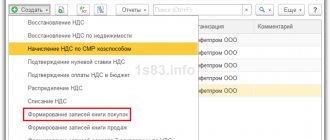

All the nuances of drawing up an advance report in the 1C program are presented below.

Results

An advance report is a summary of information about the funds received by the employee, the amounts spent from these funds and the remaining unused balance of money (or overspending).

Each of the amounts spent is confirmed by its supporting document, on the basis of which the accountant makes the appropriate accounting entry or entries if the amount requires a breakdown (for example, when allocating VAT or dividing the amount paid simultaneously for materials and services). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Will jumping numbering affect the buyer?

Most likely it will not be affected. An error in the invoice number does not prevent the identification of the seller, the buyer, the name of the goods (work, services) and their cost, the rate and amount of VAT, and therefore does not provide grounds for refusing the buyer a deduction (clause 2 of clause 169 of the Tax Code of the Russian Federation) . In any case, such claims by controllers have long been easily disputed. According to some courts, even the absence of a number in the invoice should not deprive the VAT deduction (resolutions of the Federal Antimonopoly Service of the Central District dated 04/08/2013 in case No. A14-7612/2011, FAS Moscow District dated 08/10/2011 in case No. A41-41420/ 09).

For other non-fatal errors in the invoice, read the material “What errors in filling out the invoice are not critical for VAT deduction?”