An individual paid for the organization

admin05/06/2021 02/15/2018 In practice, situations often arise when the General Director or any other employee of the company would like to pay for a legal entity. Since November 30, 2016, such an opportunity has appeared, and Article 45, paragraph one of the Tax Code of the Russian Federation states that tax payment can be made by another person.

By the way, insurance contributions for compulsory pension insurance, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund (except for the Social Insurance Fund from the National Insurance Fund and the Pension Fund) can also be paid by another person from January 1, 2021. So, we propose to consider an example and fill out with us a receipt for payment of the trade fee for the 4th quarter of 2021 for the organization of DomUyut LLC by an individual Levashov M.

A. Strictly in accordance with the Rules for indicating information in the details for transferring funds from the Federal Tax Service of Russia. Details of DomUyut LLC: TIN 7718346970 KPP 771801001 Details Levashov Maxim Alekseevich: TIN 772516010145. Address:

Procedure for writing a letter

An order letter to the counterparty with a request to transfer money for the organization to another enterprise is drawn up in free form. But there are certain details that should be included in the letter.

It states that the creditor is asking to transfer funds to a third party to offset the existing debt. The debtor must also provide the details of the creditor to whom the debt will be repaid and to which the transfer should be made. The form of payment itself can be any: cash or non-cash.

What information must be provided?

Among the information that must be indicated in the letter of repayment of debt obligations are the following:

- The name and legal address of the company to which the original debtor delegates to fulfill obligations for another person . The details of the organization are also indicated, which allow it to be clearly identified.

- Information about the person to whom the letter is sent (usually the CEO or director).

- Document number and date of its preparation (the number is indicated in accordance with the company’s current numbering system for outgoing documentation).

- A clear indication of the obligation that the company asks to be fulfilled for it (for example, “to pay on account of the company for the shipped goods under the sales contract...”). These are, in particular, the details of the contract or other document from which the obligation arises (for example, a supply agreement, delivery note, acceptance certificate, etc.).

- Payment amount, including VAT (in digital and letter formats). If the payer transfers a larger amount, the letter may become the basis for the return of the overpayment, according to the definition of the Supreme Arbitration Court of 2007 No. 14950/07.

- Counter-obligation of an old debtor : for example, writing off part or all of a third party’s debt to him. Typically, a company will ask a third party to pay off a debt on its behalf in exchange for another obligation. Therefore, the fact of repayment of the obligations of a third party should be additionally indicated in the letter, otherwise an unscrupulous counterparty will be able to subsequently demand repeated fulfillment of obligations.

- Information that should be entered by the payer in the payment order in the column with the purpose of payment (“Payment for goods under supply agreement No.... from...). If there are inaccuracies in this column, the creditor has the right to request a letter from the payer clarifying and adjusting the purpose of the payment. This may be required in case of disputes with the inspection authorities.

- The letter can include a requirement to provide a copy of a payment order from a third party sent to the creditor . This will help the old debtor in case of possible disputes with creditors over unpaid debts. Without such a copy, the debtor may be left without evidence of fulfillment of his obligations. The letter may specify the time frame for transferring a copy of the document (for example, “within 5 days after payment”) and the preferred method of transfer (for example, sending to the registration address by registered mail or in electronic format).

Who signs the letter

The letter is signed by a person who is authorized to act on behalf of the company. This is its sole executive body (director) or a representative vested with a power of attorney. In the latter case, the payer should request a copy of the power of attorney, otherwise the counterparty may subsequently refer to the fact that he did not give any instructions to transfer money.

The organization pays for the individual

Payment is recommended to be made on behalf of the individual in whose name the services are registered.

For individuals, payment for services is possible by receipt through Sberbank of the Russian Federation, WebMoney, Yandex.Money, ROBOKASSA, QIWI Wallet.

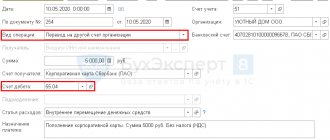

In case of payment through a bank, if the Payer does not coincide with the Client (customer of services), you will need to provide an application addressed to the General Director of Komtet LLC from the person who made the payment about the purpose of the payment (see sample). Dear Alexander Vladimirovich, I ask you for the payment made by “NAME OF THE PAYING ORGANIZATION” (TIN/KPP) from (xx.xx.xxxx) in the amount of ... rubles (indicate the account number or billing account number), to be counted against the payment for Petrov Petrovich.

Number. Seal. Signature. The letter must be submitted by mail to our address: 440600, Penza, st. Suvorova, 92, or a scanned electronic version with your signature by e-mail to the Contents of transactions ¦Debit ¦Credit¦ Amount,¦ Primary ¦¦ ¦ ¦ ¦ rub.

Accounting

In this case, compensation to the contractor for travel expenses is part of the price of the contract for the provision of paid services (advertising services). Advertising expenses are recognized as expenses for ordinary activities (as business expenses) (clauses 5, 7 of the Accounting Regulations “Expenses of an Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

Expenses in the form of compensation to the contractor for the cost of travel to the place of provision of services are recognized in the amount subject to reimbursement on the date of fulfillment of the conditions established by clause 16 of PBU 10/99, which in this case are fulfilled on the date of submission by the customer of the contractor’s report on actual expenses incurred with the attachment of supporting documents (Clause 6 PBU 10/99).

Accounting records for reflecting the transactions under consideration are made in the manner prescribed by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of transactions.

Payment by a third party for services provided to a company by an individual

published: 06/13/2016 The law directly provides for the possibility of a company paying for the services of an individual by a third party.

This follows from paragraph 1 of Art. 313 of the Civil Code of the Russian Federation, according to which the fulfillment of an obligation may be entrusted by the debtor to a third party if the law, other legal acts, the terms of the obligation or its essence do not imply that the debtor is obliged to fulfill the obligation personally. In this case, the creditor is obliged to accept the performance offered for the debtor by a third party. A contract for the provision of paid services (performance of work) is not an obligation that requires personal performance by the debtor.

We recommend reading: Material damage after a fire, what is included

Thus, the obligation can be fulfilled by a third party. In this case, the performer of the obligation can be either a legal entity or an individual. Fulfillment of obligation

Tax payments are allowed to be paid by other persons

Date of publication: 04/10/2017 10:35 (archive) In order to ensure correct accounting of tax payments transferred by another person, Rules have been developed for indicating information in the details of orders for the transfer of funds to the budget system of the Russian Federation (hereinafter referred to as the Rules) according to which: 1. Payers of tax payments, insurance premiums and other payments to the budget system of the Russian Federation indicate in the fields: - “TIN” of the payer - the value of the TIN of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled. If the payer, an individual, does not have a tax identification number (TIN), zero (“0”) is indicated in the payer’s “TIN” details. In this case, it is necessary to indicate in the “Code” field the Unique accrual identifier (document index); - “KPP” of the payer – the value of the KPP of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

When fulfilling the obligation to pay payments for individuals, the payer’s “KPP” details indicate zero (“0”); - “Payer” - information about the payer making the payment: For legal entities - the name of the legal entity fulfilling the payer’s obligation to pay payments in budget system of the Russian Federation; for individual entrepreneurs - last name, first name, patronymic (if any) and in brackets - “IP”; for notaries engaged in private practice - last name, first name, patronymic (if any) and in brackets - “notary”; for lawyers who have established law offices - last name, first name, patronymic (if any) and in brackets - “lawyer”; for heads of peasant (farm) households - last name, first name, patronymic (if any) and in brackets - “peasant farm”; for individuals - last name, first name, patronymic (if any) of the individual fulfilling the payer’s obligation to pay payments in budget system of the Russian Federation. In this case, in the “Purpose of payment” field, indicate: TIN and KPP

NTVP "Kedr - Consultant"

» » » » Can an individual, according to Art. 313 of the Civil Code of the Russian Federation to pay for a legal entity under a transaction worth over 100,000 rubles. in cash to the cash desk of the enterprise Question: Can an individual, according to Art.

313 of the Civil Code of the Russian Federation to pay for a legal entity under a transaction worth over 100,000 rubles. in cash to the cash desk of the enterprise.

Will the limit of 100,000 rubles apply in this case? for cash payments Answer: Article 313 of the Civil Code of the Russian Federation does not contain rules prohibiting the fulfillment of an obligation as a third party by an individual. The creditor is obliged to accept the performance offered for the debtor by a third party if the performance of the obligation is entrusted by the debtor to the specified third party.

If the debtor did not entrust the fulfillment of the obligation to a third party, the creditor is obliged to accept the fulfillment offered for the debtor by such a third party in the following cases: 1) the debtor delayed the fulfillment of a monetary obligation; 2) such a third party is in danger of losing his right to the debtor’s property as a result of foreclosure on this property. The creditor is not obliged to accept performance offered for the debtor by a third party if the law, other legal acts, the terms of the obligation or its essence imply that the debtor is obligated to fulfill the obligation personally. In cases where, in accordance with this article, the fulfillment of an obligation by a third party is allowed, it has the right to fulfill the obligation also by depositing the debt with a notary or making a set-off in compliance with the rules established by this Code for the debtor.

The rights of the creditor under the obligation are transferred to the third party who has fulfilled the debtor’s obligation in accordance with Article 387 of this Code. If the rights of a creditor under an obligation have been transferred to a third party in part, they cannot be used by him to the detriment of the creditor; in particular, such rights do not have advantages if they are satisfied at the expense of the securing obligation or if the debtor does not have enough funds to satisfy the claim in full.

Payment by an individual for a legal entity

Question: Currently the organization does not have a settlement account.

You may be interested in: Recovering private debts.

Is it possible to pay for your service to an individual (founder) for an organization? Can I pay in cash at your office cash desk? Answer: You can pay for the service for the organization from an individual’s personal account or an individual’s bank card, but only if you are an employee of an LLC, for example, a director, and not just the founder of this LLC. So, if you are an employee of an LLC, then You can pay for the service as an individual, and then the organization will reimburse you for the money spent when such an opportunity arises.

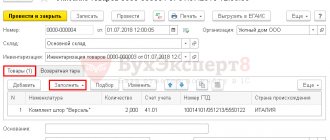

You can do this as follows: First, create an expense report.

In the service, in the Documents tab, add an Advance Report, but in the “Advance Report Type” field, you need to select “payment to supplier.” - Do not fill in the “Advance Payment Document” field. Such a receipt can be taken to the bank and paid in cash for the organization.

○ What is cash payment?

This type of payment represents a direct transfer of funds for goods sold or services provided. They can be used by both legal entities and individuals.

Settlements between legal entities, as well as settlements with the participation of citizens related to the implementation of their business activities, are made by bank transfer. Settlements between these persons may also be made in cash, unless otherwise provided by law. (Clause 2 of Article 861 of the Civil Code of the Russian Federation).

Payment for another legal entity: how to process it, sample

.

The company's supplier requested that payment for the shipment of goods be transferred not to his bank account, but to his landlord.

He explains this by saying that he must pay off his rent arrears, but currently has no available funds. Can a company in such a situation make payment for another legal entity? Yes, today there is nothing unusual in such a request.

After all, the law allows business entities to pay their obligations not only directly. It is quite acceptable that another organization transfers funds on behalf of the debtor. The right of the debtor to transfer the obligation to pay for it to a third party is provided for by the Civil Code. This is stated in Article 313.

A reservation is also made that this is legal in the event that any other laws or conditions of the paid obligation do not require that the debtor fulfill them strictly independently.

VAT upon receipt of payment for goods from a third party

For the supplier, it does not matter who the advance payment came from: from the buyer (customer) or from a third party. The need to calculate VAT depends on whether the goods were shipped:

- if the payment is an advance payment, then on the date of its receipt VAT should be calculated and an invoice for the amount of the advance payment should be issued to the buyer under the contract (the organization for which the payment is made) (clause 2, clause 1, article 167, clause 3, art. 168 of the Tax Code of the Russian Federation);

- if the goods have already been shipped, then the fact that payment has been received not from the buyer under the contract, but from a third party does not have any significance for the supplier, since on the date of shipment the amount of VAT has already been calculated (clause 1, clause 1, article 167 of the Tax Code of the Russian Federation ).

Payment by an individual to a legal entity to a bank account

As a general rule, all organizations and entrepreneurs are required to use cash register systems when making payments (clause

1 tbsp. 1.2 of the Federal Law of May 22, 2003 No. 54-FZ).

According to the amendments in force from July 3, 2021, a deferment was provided for the use of online cash registers in terms of non-cash settlements with individuals who are not individual entrepreneurs (Clause 4, Article 4 of Federal Law dated 07/03/2021 No. 192-FZ ). According to such calculations, the online cash register will be used only from July 1, 2021.

In accordance with banking legislation, non-cash settlements include settlements by payment orders, letters of credit, collection orders, checks, electronic funds, as well as settlements by transferring funds at the request of the recipient of funds (direct debit) (clause 1.1 of the Regulations, approved. Bank of Russia dated June 19, 2012 No. 383-P). The deferment provided does not apply to electronic means of payment.

We recommend reading: Cancellation of discounts on legal entity cards

Is it necessary to punch a receipt if an individual pays for the goods for the organization?

From 07/01/2021, for the purposes of using cash register systems, it does not matter whether funds are received from an individual using electronic means of payment or by issuing a payment order. In both cases, a cash register receipt is required. Based on part 4 of Art. 4 of the Federal Law of July 3, 2018 No. 192-FZ, using forms of non-cash payments and without the use of electronic means of payment, it was possible not to use cash registers.

If money is deposited into an organization’s account from an individual’s account, then it is impossible to reliably determine from a bank statement how it was sent. In the bank statement, the received amounts are reflected, as a rule, in correspondent accounts 40817 or 30233. They provide for recording the movement of funds of individuals, using both electronic means of payment and payment orders.

In all cases of payment by an individual via ESP, the use of cash register is mandatory.

This procedure was in effect previously. By virtue of the provisions of Article 313 of the Civil Code of the Russian Federation, the creditor is obliged to accept the performance offered for the debtor by a third party if the performance of the obligation is entrusted by the debtor to the specified third party. Moreover, if there is no document confirming the authority of an individual to pay for goods in the interests of the purchasing organization, the creditor is not obliged to accept funds (clause

1, 2 tbsp. 313 of the Civil Code of the Russian Federation). According to paragraph 9 of Art. 2 of Law No. 54-FZ, cash register systems should not be used in settlements between organizations.

For settlements involving individuals, the law does not contain exceptions. Taking into account the fact that the transitional provisions provided for in paragraph 4 of Art. 4 of Federal Law No. 192-FZ dated 03.07.2018, according to which organizations and individual entrepreneurs have the right not to use online cash register systems when making settlements with individuals (not individual entrepreneurs) in a non-cash manner (except for settlements using electronic means of payment), have lost their effective from 07/01/2019, the issuance of checks becomes mandatory in all cases of payments for goods (work, services) involving individuals.

Previous payment methods for individuals

Payment for an individual by a legal entity

However, this is only possible if the money went there directly from the bank account of the company or individual entrepreneur:

- when carrying out transactions with securities;

- conducting activities related to organizing and conducting gambling;

- issuance/repayment of loans and interest on them.

- payment of real estate rental;

To do this, it is often necessary to use the following scheme: money is handed over from the cash desk to the bank, and then returned back to the cash desk, after which settlements with individuals are made.

Are there any restrictions on amounts when settling payments between a legal entity and an individual? In addition to the fact that Directive No. 3073-U of the Central Bank of the Russian Federation contains a list of permitted grounds for cash settlements between legal entities and individual entrepreneurs and individuals, it directly states that such settlements can be carried out without restrictions on the amount both in rubles and in foreign currency (p .

Can an individual entrepreneur accept payment to an individual’s account?

There is no legal prohibition on this, but claims may arise from the bank, because the agreement usually states that the account should not be used for business. Also, due to payments to an individual’s account, the tax office may have questions for your counterparties.

To avoid problems with the tax office and counterparties, it is better to accept transfers to the current account of an individual entrepreneur.

In the “My Business” service you can issue invoices in a matter of seconds; your details and the details of your counterparties will be entered automatically. Moreover, you can send the client an invoice with a payment button - this will speed up the settlement process. The service also provides the possibility of mass invoicing.

If your bank is integrated with the My Business service, you can track bill payments online.

A legal entity pays for an individual

an individual entered into an agreement with a developer (legal entity) for the purchase of a house under construction, i.e.

5). List of messages IP/Host: 85.21.83. payment for an individual Guys, someone tell me.

e. an agreement for shared participation in construction, but the payment to the developer for an individual was made by another legal entity.

The payment document states payment under such and such an agreement for I.I. Ivanov. Is this legal? March 27, 2014, 1:36 p.m., question No. 408813 Svetlana,

St. Petersburg 500 cost of the issueissue resolved Collapse Online legal consultation Response on the website within 15 minutes Answers from lawyers (5) 603 answers 308 reviews Chat Free assessment of your situation Lawyer, St. Petersburg

Moscow Free assessment of your situation There are no prohibitions here. This is legal. It is simply necessary to prepare some kind of agreement between this individual and the legal entity-payer in which this would be spelled out - the procedure for payment by the legal entity for the physicist, the procedure for returning money to the legal entity, etc.

How can an entrepreneur accept payments from individuals?

Individuals can pay you for goods and services:

Cash

But for this in most cases you need an online cash register. Who exactly should use an online cash register, who can do without it for now, and who is exempt from this obligation on an ongoing basis - read below.

There are no restrictions on the amount of cash settlements with individuals.

By bank card (acquiring or Internet acquiring)

In order for customers to pay for goods or services with a card, they need to enter into an agreement with the acquiring bank and purchase a terminal.

The bank will charge a commission for each payment. Each bank has its own commission percentage.

Acquiring does not affect the obligation to use an online cash register in any way. The slip issued by the terminal does not replace a cash receipt. Those who are required to use a cash register also use it when acquiring.

To accept payments to your account by card through the website, you need to submit an application to the bank and conclude an agreement. The site must meet the technical requirements of the bank, so it is possible that improvements to the site will be required.

Bank transaction

The client transfers money according to a receipt or payment order to the individual entrepreneur’s account at a bank branch.

Please note that this method of settlements with individuals is equivalent to cash, that is, you need to use a cash register to punch a check.

By postal transfer, including cash on delivery

In this case, the cash receipt should be issued by the post office, not the seller, because It is she who accepts the money and then transfers it to the entrepreneur’s account.

Electronic money

There are two options here: connect directly to payment systems or use the services of a payment aggregator. In the first case, you need to enter into an agreement separately with each payment system and make settings on the website. In the second case, the agreement is concluded only with a payment aggregator, which makes it possible to accept payments in any way convenient for the client. In this case, the commission is higher, but there is less hassle.

A cash register is required when accepting payments using electronic money.

The “My Business” service provides the ability to integrate with payment aggregators so that payments received into the account are automatically displayed in the system.

Do you understand online cash registers?

Let's connect accounting, accounting and cash desk in 20 minutes.

Choose a cash register

An individual pays a receipt for a legal entity

In practice, situations often arise when the General Director or any other employee of the company would like to pay for a legal entity.

Since November 30, 2021, such an opportunity has appeared, and Article 45, paragraph one of the Tax Code of the Russian Federation states that tax payment can be made by another person. By the way, insurance contributions for compulsory pension insurance, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund (except for the Social Insurance Fund from the National Insurance Fund and the Pension Fund) can also be paid by another person from January 1, 2021. So, we propose to consider an example and fill out with us a receipt for payment of the trade fee for the 4th quarter of 2021 for the organization of DomUyut LLC by an individual Levashov M.

A. Strictly in accordance with . Details of DomUyut LLC: TIN 7718346970 KPP 771801001 Details Levashov Maxim Alekseevich: TIN 772516010145.

Address: Moscow, st. Velozavodskaya, d.