Measures to improve working conditions

Employers must take some measures every year to improve working conditions for their employees. Companies are required to do this at their own expense. The list of activities that companies can carry out as part of these events is given in the order of the Ministry of Health and Social Development of Russia No. 181n dated 03/01/2012. This list contains activities that are aimed at developing physical education and sports among company employees. For example, costs to improve working conditions include:

- Compensation for employees to pay for the gym in sports clubs or fitness centers;

- Organization and conduct of physical therapy and industrial gymnastics;

- Organization of gyms and clubs for sports activities for employees directly at their place of work.

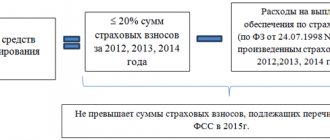

It is not necessary to carry out absolutely all of them. Each company has the right to choose those activities that, from their point of view, are the most effective and appropriate. Then approve your own list. It is important to take into account that the total costs of implementing such measures do not exceed 0.2% of all production costs (226 Labor Code of the Russian Federation). Companies are not required to bear large costs. One of the activities included in this list may be payment for sports activities, for example, partial or full compensation for the cost of subscriptions to sports clubs or sections. Having decided to pay for the gym to employees, it is important to properly formalize and take into account such compensation.

Important! Compensation for payment for sports activities carried out at the expense of the employer can be paid from the current profits of the company, or from the funds of the created reserve fund. The company decides from which sources the payment will be made independently.

VAT

As you know, VAT is charged on transactions related to the sale of goods, work or services (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Sales are recognized as the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person (Clause 1 of Art. Tax Code of the Russian Federation). Thus, in relation to the costs of compensation for workers, the cost of physical education and health services is not subject to VAT. After all, services to employees are provided by a third-party organization, not the employer.

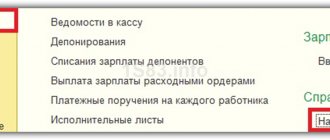

Accounting. Postings

To reflect compensation for sports activities for employees, account 73 “Settlements with personnel for other operations” is used. In this case, compensation expenses are included in other expenses.

| Business operation | Debit | Credit |

| Calculation of compensation for gym fees to employees | 91.2 | 73 |

| Withholding personal income tax | 73 | 68 (sub-account “Personal Income Tax Payments”) |

| Calculation of insurance premiums | 91.2 | 69 |

| Employees received compensation for gym fees | 73 | 51 (50) |

Positive aspects of the bill

The implementation of the proposals will make it possible to increase the number of workers who will take a fresh look at sports and physical activity. Also, these proposals, by reducing the tax burden, are intended to motivate organizations to pay their employees for sports activities. Seeing concern on the part of the employer, many employees will begin to attend sports sections, which will have a positive effect on their health and will make the company’s work more stable.

According to the bill, compensation for sports should not exceed 25% of the minimum wage in each individual region. If, for example, in Moscow there is a minimum wage rate of 14 thousand rubles, then employees can count on monthly financial support to pay for fitness in the amount of 3.5 thousand rubles.

Let's take a closer look at the example

In February 2021, accountant O.P. Petrova was paid compensation for paying for a gym at the fitness center. An additional agreement was drawn up to the employment contract with Petrova, according to which the employee was entitled to compensation in the amount of 2,500 rubles.

Let's consider the procedure for conducting business transactions:

| Business operation | Debit | Credit | Amount, rubles |

| Petrova received compensation for paying for sports activities at the fitness center | 91.2 | 73 | 2 500,00 |

| Petrova received compensation on her card | 73 | 51 | 2 175, 00 |

| Contributions to the Pension Fund were accrued for the amount of expenses for paying for sports activities | 91.2 | 69 (sub-account “settlements with the Pension Fund”) | 550,00 |

| Social security contributions have been accrued for the amount of expenses for paying for sports activities | 91.2 | 69 (sub-account “Settlements with the Social Insurance Fund for contributions to compulsory health insurance” | 72,50 |

Employee, business, state: who pays for fitness

Good afternoon, dear colleagues!

Let's talk about the letter of the Ministry of Finance of the Russian Federation dated October 16, 2021 No. 03-01-10/79312 . What prompted me to write this article? President of the Russian Federation Vladimir Vladimirovich Putin once again called on businessmen to take care of the lives and health of their employees. In particular, he called for the introduction of a sports instructor in every organization. Before this, there were initiatives: to organize a first-aid post in every organization, and the Social Insurance Fund even promised to compensate them with some money. There was also an idea to take care of parents: to organize a mother and child room in each organization at the expense of the employer, and for micro-businesses they promised some kind of compensation, and even then, not completely. Our President also announced that it is necessary to have sports instructors so that employees feel healthy at work and that there will be corresponding benefits. But, apparently, the Ministry of Finance does not hear the President... Why do I think that the Ministry of Finance did not hear the head of state? Let's return to this letter from the Ministry of Finance and talk about sports.

What is the essence of the letter from the Ministry of Finance?

So, according to the letter from the Ministry of Finance: if you, the employer, pay for your employees for fitness or pay for your employees for any sports activity in any sports clubs and sections, then on all the money that you paid for your employees, you are required to pay personal income tax - 13%, insurance contributions – 30%. Also, you cannot reduce income tax by the amount of these payments, that is, you will pay another 20% from this money. And the only thing the Ministry of Finance allowed was not to pay VAT on these payments. Otherwise they would have added VAT to us here, you know?

About personal income tax : “The specified article (Article 217 of the Tax Code of the Russian Federation) does not contain provisions providing for exemption from taxation of amounts reimbursed by an organization to employees for the cost of playing sports in clubs and sections, and such income is subject to personal income tax in the prescribed manner.”

About insurance premiums : “Thus, payment for organizing employee classes in a fitness club is subject to insurance premiums in the generally established manner as a payment made within the framework of the labor relationship between the employee and the employer, regardless of the source of this payment and the classification of these expenses as expenses that do not reduce tax corporate income tax base."

About expenses : “At the same time, paragraph 29 of Article 270 of the Code stipulates that expenses for paying for classes in sports sections, clubs or clubs, as well as other similar expenses made in favor of employees, are not taken into account for tax purposes of the profits of organizations.”

About VAT : “In accordance with subparagraph 1 of paragraph 1 of Article 146 of the Code, the object of taxation of value added tax is transactions involving the sale of goods (work, services) on the territory of the Russian Federation. At the same time, according to paragraph 1 of Article 39 of the Code, the sale of goods, work or services is recognized as the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person.

In this regard, the organization is not subject to value added tax in relation to the costs of paying for physical culture and health services actually provided by third-party organizations to the employees of this organization, since the sale of these services is not carried out by this organization.”

What is my attitude towards such things? It is quite simple: we do not have a stable state policy in the field of both economic development and basic things in the form of execution of Presidential Decrees.

One gets the feeling when you analyze the regulatory framework and compare it with what the President said before... It seems that our President either does not read these laws and does not know what is written in them. Because if he had read the laws and knew what was written in them, he would have called the officials and said: “Guys, I promised this, why does the law contradict my promise? Let's fix this situation."

A question for you, colleagues: do you think the actions of ministries and departments contradict the words of the President? Does this add authority to the President or not?

Nowadays, I am faced with the fact that if someone supports the actions of the Government, officials or the President, then he is like a “black sheep”. It is no longer fashionable for us to support the actions of the Government and the President. I do not adhere to this position. Personally, I think that if businessmen are being skinned, and people are also being skinned, then I say so. But, at the same time, if I see that there is something good, some positive movement, then I personally will praise it for making the life of a Russian citizen and a Russian businessman easier.

Sign up for a VIP session.

I look forward to your comments.

Thanks guys, good luck in your business!

Procedure for processing compensation payment

Important! Compensation for gym workers can be provided for in an employment contract, or an additional agreement to it, or a collective agreement.

To do this, the contract can provide the following clause: “The employer pays employees monthly compensation for the cost of sports in any (fitness centers) and sections in the amount of _____ rubles, but no more than the actual costs incurred by the employees for the corresponding month. The payment is made within the salary payment period upon provision to the Employer of a copy of the agreement concluded between the employee and the fitness club, as well as copies of documents confirming actual sports expenses (payment order, payment receipt, checks, etc.).”

Why don't they ask for help?

In our opinion, the issue here is not so much the high cost of the same fitness (the gyms are already filled enough, which means they can afford it). Another thing is that the subscription fee is relatively low. For example, many centers offer their services at a cost of 15-20 thousand rubles per year with an unlimited number of visits throughout the entire period.

- Is this a lot? Hardly. Moreover, for a small additional payment to this amount you can take your whole family to the gym if you take advantage of special offers, of which there are also many now.

We dare to assume that those who wanted to do their “physics” have already begun to do so, and those who have not yet started simply do not consider it necessary and the cost of the subscription has absolutely nothing to do with it.

Proposing one solution to the problem, the deputies do not seem to understand that it is the promotion of sports that can arouse interest among broad sections of the population in improving their health and giving up bad habits. It’s like in sales, you first need to identify (or form) a need, and then make an offer. And if they don’t agree with the innovations, then they can give a “discount” in the form of compensation.

Thank you for your attention. See you later!

The legislative framework

| Order of the Ministry of Health and Social Development No. 181n dated March 1, 2012 | “On approval of the Standard List of measures annually implemented by the employer to improve working conditions and safety and reduce levels of occupational risks” |

| Article 226 of the Labor Code of the Russian Federation | “Financing of measures to improve working conditions and safety” |

| Article 5.27 of the Code of Administrative Offenses | “Violation of labor legislation and other regulatory legal acts containing labor law norms” |

Rate the quality of the article. Your opinion is important to us:

Will the law on paying for fitness work?

And yet, from the point of view of current legislation, the obligation of employers to pay their employees for visiting fitness clubs cannot be fully called a duty. In this case, you can refer to Article 226 of the Labor Code of the Russian Federation, which provides for the financing of measures to improve working conditions and labor protection in the amount of no less than 0.2% of the cost of producing the decoction (work, services). Moreover, the list of these activities includes not only the development of physical culture. Consequently, the employer can determine the necessary list of these measures based on the specifics of professional risks or even the company’s activities. In other words, he may consider it more necessary to place thematic stands about labor protection or, directly for the development of the physical culture of his employees, he will install a simple treadmill in the staff rest room.

The Ministry of Labor makes the following recommendations: at a general meeting, work collectives themselves can propose to the employer that the money allocated for these needs be spent directly on paying for subscriptions to fitness centers. Perhaps here it is worth involving a trade union or representatives of work collectives, who are obliged to agree with the employer on a list of measures to preserve and improve working conditions, traditionally compiled for the year. We must not forget about other types of possible compensation: holding physical education and health activities within the enterprise, purchasing your own sports equipment, creating your own sports club or playground, reconstructing old playgrounds, paying the wages of coaches hired for your employees, etc.

Effective date of the law

The first deputy chairman of the lower chamber committee on economic policy, industry, innovative development and entrepreneurship, Vladimir Gutenev, names the summer of 2021 as the date for the law to come into force.

Currently, the draft amendments have just been received by the Government of the Russian Federation and are not yet under consideration. It is expected that work on it will begin in the near future and in December 2021 the project will pass to the State Duma.

Given that the planned entry date is summer 2020, the further approval process should proceed without delay.

There is no clarification yet as to what date the law will apply, that is, the costs for what period will be compensated: from 01/01/2020 or from the date the law comes into force.

Should sports activities be compensated by law?

A bill on the payment of compensation to employees who pay for their sports activities was put forward for study back in 2014. The goal of the project was to increase occupational safety and health and improve working conditions. The Government believes that the majority of employees refuse sports due to the high cost of gym memberships, while physical activity has a beneficial effect on health and performance.

Since 2015, all business managers have been recommended to review their financial plans and take into account the costs of partially compensating employees for the cost of going to the gym. But this innovation is not a mandatory measure, that is, the employer has the right to refuse to create more comfortable working conditions for subordinates. And if the employer decides to listen to the advice of the authorities, he has the right to decide for himself how to provide compensation. Money can be spent on the following items:

- organizing sports competitions among employees in order to increase interest in sports and unite the team;

- organizing sports classes in yoga, basketball, football or equipping a swimming pool;

- organization of a gym directly on the territory of the enterprise;

- compensation payment to employees who provided the accounting department with documents evidencing expenses for sports activities (indicating the number of visits).