Employer reporting

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of February 5, 2018

How to prepare SZV STAGE 2021. An example of filling out this reporting in 2021 will be very helpful. It’s better to see once than to hear a hundred times, so a completed form for new reporting to the Pension Fund will help HR specialists and accountants cope with the task much more effectively. Agree, no explanation can replace a clear example. We bring to the attention of readers of SZV STAZH a sample of filling out 2021.

SZV-STAZH - what kind of reporting is this?

Previously, the functions of the new report were performed by the RSV-1 form, which included data on the employee’s period of work at the enterprise.

This register has been abolished since this year. Since the Pension Fund of Russia remained responsible for recording the length of service of employees in order to calculate their pension, the body introduced a new form SZV-STAZH, which must be submitted at the end of the reporting year. It includes information about the period of a person’s labor activity at the enterprise.

If you look closely at it, you will immediately notice the similarity of this report with SZV-M, a form introduced last year to record working pensioners.

At the same time, SZV-STAZH has more detailed information, recording the start and end dates of work during the year, as well as indicating and deciphering the periods when the employee did not work, but his place at the enterprise was retained.

Attention! In addition, the employer is required to hand over SZV-STAZH upon dismissal of an employee. The accountant must fill out this report only for this employee, print it out, certify it and hand it over.

In addition, the report must contain information about the accrual and payment of contributions. Since this information is currently submitted by employers to the tax office, the Pension Fund of Russia remains without this information.

When an employee retires, the SZV-STAZH form must be sent to the Pension Fund of the Russian Federation so that this body receives all the necessary information to assign a payment.

Who is required to issue a copy of the SLA to a dismissed employee?

Each insurer (employer) who provides such information to the Pension Fund of the Russian Federation has the obligation to draw up and issue SZV (STAZH, M) certificates upon dismissal of each employee. These include:

- Organizations, individual entrepreneurs who have concluded an employment contract with an employee, licensing agreements (publishing or for the use of copyrighted objects), a civil law contract for the provision of services (performing labor functions), licensing agreements (publishing or for the use of copyrighted objects) and similar agreements and contracts.

- Organizations with a single participant - owner, director, founder (the only member of the organization submits reports for himself)

- Employment Center (for unemployed citizens).

In other words, SZV-STAZH is filled out and sent only by employers, that is, organizations that hired at least one employee during the reporting period. This eliminates the obligation for private lawyers, notaries, members of associations, etc. to submit reports.

Who should submit the SZV-STAZH form

The legislation establishes a list of persons who must submit the SZV-STAZH report:

- Organizations of all forms of ownership that have employment contracts, fixed-term employment contracts and civil law agreements (GPC) with individuals, including their branches and representative offices.

- Entrepreneurs, as well as lawyers, notaries, licensed detectives who carry out private practice, when they use hired workers.

Attention! Thus, this reporting must be compiled and submitted by all employers for employees and persons in whose favor the payment of remuneration is made, on which insurance premiums must be calculated.

Deadlines for passing SZV-STAZH in 2021

The SZV-STAZH form refers to annual reporting, which in general an organization must submit once a year, after its completion. At the same time, the deadline is established at the legislative level by what date to submit for the previous year - until March 1 of the following reporting year.

Attention! Thus, reporting for 2021 must be submitted by March 1, 2021. In addition, this form must be given to employees upon dismissal.

In relation to this report, the rule also applies to postponing the deadline to the next working day if it falls on a weekend or holiday. Therefore, since March 1 falls on a weekend, the due date is postponed to March 2, 2021.

In addition, the deadlines for registration of SZV-STAZH have been determined for:

- When an employment contract with an employee is terminated - on the employee’s final day of work, along with the rest of the required documents.

- When an employee retires, the employer must send the SZV-STAZH to the Pension Fund of Russia within three days from the date of receipt of the request.

Branches and methods of document submission

The completed unified form is submitted to the Pension Fund:

- Enterprises at the place of registration;

- Entrepreneurs according to passport data;

- Branches at the place of activity.

In addition, submission of the form is provided:

- In paper format:

- For entrepreneurs with a staff of no more than 25 people;

- The document is generated in 2 copies;

- An inventory of EFA-1 is being formed;

- All information is transferred to a flash drive;

- The tax specialist puts a mark on the applicant’s copy;

- Copies information from the card.

- In electronic form:

- This form is used by enterprises with more than 25 employees;

- A document is generated on a special resource;

- Signed with an enhanced electronic signature;

- Sent to the Pension Fund through a special operator.

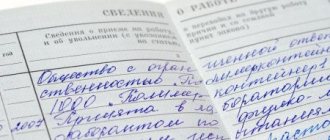

Mandatory documents upon dismissal

On the last working day, the dismissed person must receive:

- Form SZV-STAZH;

- Form SZV-M;

- Information on wages according to the Ministry of Labor form No. 182n;

- Extract of section 3 from the calculation of insurance premiums;

- Labor book;

- 2-NDFL.

The employee has the right to receive all these documents; if the employer does not fulfill the obligation, he is liable and subject to penalties.

Applied computer programs

To generate the form, you can use various programs, but the most popular are the following.

1C version 8.3:

- In the “Salary” section, you must select the “Insurance reporting” tab;

- Next, you need to click the “Generate” icon that appears and select the required one;

- Select a date and indicate the reporting year;

- Select the type of information required;

- The section for employees is filled in with the relevant data.

PUB:

- Here, immediately click on the SZV-STAZH icon, enter information about the policyholder, indicate the type of information and year;

- Next, you should enter all the data as described above.

Reporting methods

There are several ways to send this reporting:

- The report on paper can be submitted directly to the Pension Fund representative. To do this, you need to fill it out in two copies. It is best to prepare it on a computer using specialized programs so that you can generate an electronic file, which in this case also needs to be transferred.

- Through an electronic document management system for entities with more than 25 people involved. This method requires the mandatory presence of an electronic digital signature - EDS, as well as the execution of an agreement with a special communications operator. The majority of employers must submit the SZV-STAZH form this way.

Important! Reporting on paper can only be provided if the number of insured persons is no more than 25 people.

How can I submit a report?

A new report can be submitted in two ways:

- In paper form or sent by mail. In this form, only those policyholders whose average number of employees is no more than 25 can submit this report. The report must be filled out in a special program, printed in two copies, and also copied the electronic file to a flash drive. The PF employee must copy the file to himself and stamp receipt on one paper copy.

- In electronic form. All those with more than 25 people are required to submit electronically. To do this, you need to issue an electronic digital signature (EDS) and enter into a service agreement with the operator company. Information about the results of the report verification will also be sent electronically.

Features of filling out the SZV-STAZH form upon dismissal

The current rules of law determine the employer’s obligation to issue the employee the SZV-STAZH form on the day of termination of the agreement. If it is formed by an enterprise based on the results for the year, all employees of the company are included in it.

You might be interested in:

4-NDFL for individual entrepreneurs on OSNO: who submits, in what time frame, sample filling in 2021

In the case when it is compiled upon dismissal, the information included in this report should concern only the dismissed employee in order to prevent the disclosure of personal information of other employees, which is considered a violation.

When compiling this report for a dismissed employee, he is assigned the “Initial” status, and the current year number is entered, which is also the year of dismissal.

The tabular part indicates the start date of work (if the employee has been working since the beginning of the year, then the start day is indicated), and the date of completion of the employee’s work activity at the enterprise.

If the contract with an employee is terminated on December 31, then the corresponding mark is placed in column 14.

When the SZV-STAZH form is drawn up upon dismissal, sections 4 and 5 do not need to be filled out.

Form and sample form

SZV-STAZH form download free in excel. Form SZV-STAZH sample filling free download in Excel. Download the EFA-1 inventory form in Excel format. Download a sample of filling out the EFA-1 inventory in Excel format.

Report submission form

The SZV-STAZH form combines information about the business entity itself, as well as information about each employee or individual in whose favor the amounts for which insurance premiums need to be calculated were accrued during the year.

Attention! A mandatory appendix to the annual report is an inventory in the EDV-1 format, which is a document also containing basic information about the policyholder, as well as general data on calculated and transferred contributions, as well as the number of insured persons.

Where are the reports submitted?

Similar rules apply to this report when determining the PFR branch that will act as its recipient:

Individuals registered as individual entrepreneurs pass the SZV-STAZH at the place of registration with the Federal Tax Service, that is, according to the registration reflected in their passport.

Legal entities must submit a report form with information about their work experience to the Pension Fund of the Russian Federation at their location.

Branches and representative offices report on this form separately from the parent company, and they submit SZV-STAZH at their location.

Sample of filling out SZV-STAZH

Let's take a closer look at how SZV-STAGE is issued.

Section No. 1 – Information about the policyholder

In the line with the registration number, you should enter the number assigned by the Pension Fund to the employer at the time of registration with this department.

Next, information about the TIN and KPP of the business entity is reflected. If the employer is an individual entrepreneur, his number must consist of 12 characters, and there is no checkpoint code. If the policyholder is an organization, its TIN includes 10 digits, and two empty cells are crossed out.

Below is the abbreviated name of the company, and for an individual entrepreneur - his full personal data (full name). This information must correspond to the constituent documents of the entity.

In the “Type of information” column you should reflect:

- “Initial” – when SZV-STAZH is sent by the subject for the first time;

- “Additional” – in the case when the original report is supplemented with a new one.

- “Pension assignment” – when SZV-STAZH is issued for an employee retiring.

Section No. 2 - Reporting period

There is only one column in which you need to enter the year number of the report.

Section No. 3 – Information about the period of work of the insured persons

This section has a tabular form, and it is necessary to record line by line information about employees with whom the organization had labor agreements or civil contracts during the reporting period.

In the columns “Last name”, “First name” and “Patronymic” personal information about the employee is indicated.

Next comes the “SNILS” column, where the insurance number assigned to the employee in the Pension Fund is recorded.

The column “Work period” includes two separate columns - the start date and end date of the work period. If the employee worked the entire year, then the first and final days of the year are entered here.

If one of the employees needs to show several working periods (for example, he quit and was hired several times during the year), then they are recorded in separate lines below each other. However, the columns with personal data and SNILS are indicated only once - in the first line, and then they are left empty.

When an employee retires, the end date is the expected date of this event.

If work was carried out under a civil contract, then the period of its validity is entered. If payment for the work has been made in full, then the code “AGREEMENT” is written in column 11; if not, “NEOPLDOG”, “NEOPLAVT” must be entered here.

A code is written in the “Territorial conditions” column if the work was performed in special environmental conditions. All possible codes can be found in Appendix 1.

A code is written in the “Special conditions” column if the employee worked in dangerous or harmful conditions that entitle him to receive an early retirement pension. Possible codes can be seen in Appendix 2.

Important! If work was carried out under special conditions, but there are no correctly executed supporting documents, then you cannot enter any codes here.

A mark is made in the column “Information about the dismissal of the insured person” only if the date of dismissal falls on December 31.

You might be interested in:

Declaration 3-NDFL: sample filling for individual entrepreneurs on OSNO

Section No. 4 – Information on accrued (paid) insurance contributions for compulsory pension insurance

This section is filled out only if the report is submitted to persons retiring. It includes two questions and must be answered by checking a box.

Section No. 5 – Information on paid pension contributions in accordance with pension agreements for early non-state pension provision

Information must also be entered into this section only when an employee retires. Here you need to record the periods for which accruals were made, and also answer the question by checking whether contributions were transferred for the specified periods.

Sample of filling out the EDV-1 inventory

Directly together with the fully completed SZV-STAZH form, the organization is also required to draw up and send an inventory to it in the EDV-1 form. There a summary of all the information offered is made.

The compiled inventory can be assigned one of three types:

- "Original".

- "Corrective".

- "Canceler."

To do this, you need to mark the empty box with an “X” next to the selected type.

Section 1 - it contains the details of the organization. Filling out is carried out according to the same principle as Section 1 in the SZV-STAZH form itself.

Section 2 - the “Reporting period” field should always contain “0”, but in the “Year” field the four-digit report year number is written.

Section 3 - the total number of employees for whom information is transmitted in the SZV-STAZH form is entered here;

Section-4 - information must be entered here only when information is submitted with the types SZV-ISKH and SZV-KORR and marked “Special”. The data specified here must contain information for the entire period for which the report is issued.

Section 5 - information is entered in this section if data of the SZV-STAZH or SZV-ISKH types is transferred to employees who, due to work in difficult or harmful conditions, have earned the right to receive pension payments ahead of schedule.

At the end, the form must be signed by the director in the appropriate field and the date on which this was done.

Zero reporting on the SZV-STAZH form?

According to the approved rules for submitting a report, it must be sent to the Pension Fund in the case when an organization or entrepreneur has a valid employment agreement with at least one hired employee. In the case when a self-employed citizen, entrepreneur, lawyer, notary and other persons do not have employees, then they do not need to draw up and submit a document.

This decision is also supported by the fact that the very structure of the report implies the presence in it of at least one line with information about the employee, and if there is none, then such a form will no longer be able to pass error control.

In relation to companies, this cannot be determined unambiguously. The thing is that the company initially has one employee - a director, information about whom is specified in the Charter. It follows that if the company has not signed a single employment contract, even with the director himself, then there is no need to draw up a report and send it, as well as to include the manager there.

Attention! On the other hand, if there is a signed agreement between the director and the company, but there is no activity, a report must be drawn up. In this case, the only person listed there will be the manager.

Problems of this kind also arose when entering the SZV-M form, but in that situation the Pension Fund quickly issued clarifications on how to act in such a situation. As for the new report, there have been no official comments yet.

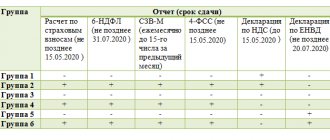

Fines for failure to submit a report or for failure to issue upon dismissal

The law provides for several types of fines, depending on the circumstances under which the violation was recorded:

- The report was sent in full, but after the set date - 500 rubles each. according to information for each employee whose deadline was violated;

- The report was sent on time, but it did not include data on individual employees - 500 rubles each. according to information for each employee for whom information was not submitted;

- The report was sent in full, and within the time limits established by law, but upon inspection it turned out that for some employees false information was provided - 500 rubles each. according to information for each employee for whom the data was submitted incorrectly.

There are also several other fines associated with this reporting:

- If the report was submitted in paper form, while the organization is obliged to submit it only electronically - 1000 rubles;

- When an employee was dismissed, he was not given a report with his information on contributions, or when the employee retired, the report was not sent to the Pension Fund within 3 days - 50,000 rubles.

Liability: what fines may be

If the SZV-STAZH report is submitted to the Pension Fund of Russia unit later than the deadline, the policyholder may be fined. The fine is 500 rubles for each insured employee.

If the SZV-STAZH experience report is submitted on time, but does not show data for all employees, then a fine is also possible - 500 rubles for each insured employee who was not included in the reporting.

A fine is also possible if a company or individual entrepreneur submits a report on time, but shows false information in it. Then a fine is also possible - 500 rubles for each insured employee for whom false data was provided (for example, an incorrect SNILS was indicated). This is provided for in Article 17 of the Federal Law of April 1, 1996 No. 27-FZ.

To avoid a fine, check the SZV-STAZH within five working days from the moment you receive the protocol from the Pension Fund. This is permitted by Article 17 of Federal Law No. 27-FZ dated April 1, 1996. If you meet this deadline, there will be no fines.

As we have already said, if the number of employees is 25 or more, then the policyholder is required to submit SZV-STAZH for them in electronic form. If you submit a “paper” report in violation of this requirement, the policyholder will be fined 1,000 rubles. This is provided for by Part 4 of Article 17 of the Federal Law of April 1, 1996 No. 27-FZ.