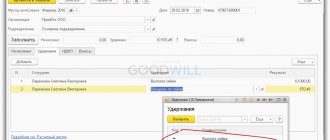

Organization on the simplified tax system. In the 1C:Accounting 8 version 3.0 program, how can I process a refund of wages that were excessively transferred to an employee’s card so that the amount deposited in the cash register does not end up in KUDiR?

A refund of an erroneously transferred amount can be made by depositing funds into the cash register by the employee. The cashier is obliged to issue a cash receipt order in form No. KO-1 (clause 4.1 of Bank of Russia Directive No. 3210-U dated March 11, 2014). In addition, corrections will need to be made to the accumulation register of Mutual settlements with employees . Let's look at the steps in the 1C program.

Refund of overpaid wages: reasons and accounts used

Postings for the return of overpaid wages depend on the reasons causing the need for such a return. Let's look at two common reasons:

- errors were found in the amount of accrued and paid wages;

- salary accruals were made correctly, but a different amount was indicated in the payment order.

In the first case, you need to make the following wiring:

- correcting the accrued salary amount;

- reflecting the employee’s repayment of overpayments.

What accounts can be used when reversing overpaid wages? It all depends on the initial payroll transactions - various accounts may be involved (see the figure below):

For more information about which accounts can be debited with salaries, read this material.

Large companies can calculate salaries using all of these accounts if they have:

- employees of main production departments (payroll: Dt 20 Kt 70);

- employees of auxiliary units (Dt 23 (25, 29) Kt 70);

- management personnel (Dt 26 Kt 70).

In medium- and small-sized companies, there may be fewer accounts involved in payroll. In trade organizations, salaries are calculated using account 44 “Sales expenses”. Incorrectly accrued wages for the overpaid amount must be reversed from the account to the debit of which it was originally accrued.

Refund of overpayment due to errors in the payment order does not require reversal entries for overpaid wages. Accounting reflects only the operation of returning money to the cash desk or to the company's current account.

Results

Postings for the return of overpaid wages depend on whether the amount of earnings is distorted and how the overpayment is repaid (to the cash register or to the current account).

If an adjustment to salary accruals is required, it is necessary to reverse the excess accrued amount and the withheld personal income tax. After the employee returns the overpayment, entries are made to the debit of account 50 “Cash” or 51 “Cash accounts” depending on the type of payment (cash or non-cash transfer) in correspondence with account 73 “Settlements with personnel for other transactions.” You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The employee returns the money himself

An employee can deposit money at the organization's cash desk (Debit 50 Credit 70) or transfer it to a current account (Debit 51 Credit 70).

If an employee was credited with one amount and paid a larger amount, then according to the turnover of the 70th account, everything will fall into place when the employee makes up for this difference.

In the case where the error was precisely in the arithmetic calculation of wages in accrual, the following entries need to be made:

- Debit 20 (26, 23 ...) Credit 70 – reverse excess payroll

- Debit 73 Credit 70 - write off the excess amount for other settlements with employees

After the amounts for wages have been corrected, do not forget to eliminate the erroneous amounts both for personal income tax (reversing the tax accrual for debit 70 and credit 68 of personal income tax), and for insurance contributions (reversing entry for account 20 (26, 25...) and credit 69 accounts )

Example:

The organization erroneously calculated and paid (minus income tax) a salary of 30,000 rubles to an employee. for May, instead of 28,000 rubles. The employee returned the money to the cashier.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 26 | 70 | Employee salary accrued | 30 000 | Payroll statement |

| 70 | 68 personal income tax | Personal income tax withheld | 3900 | Payroll statement |

| 70 | 50 | Salary paid for May | 26 100 | Account cash warrant |

| 26 | 70 | The amount of the salary surplus has been reversed | — 2000 | Payroll statement |

| 70 | 68 personal income tax | Personal income tax reversed | -260 | Payroll statement |

| 73 | 70 | The excess amount was transferred to other settlements with the employee | 1740 | Payroll statement |

| 50 | 73 | The employee returned the money to the cash register | 1740 | Receipt cash order |

How to return the amount of wages overpaid to an employee?

M. N. Volkova

Journal “Payment in state (municipal) institutions: accounting and taxation” No. 6/2016

In what cases is an employer not entitled to make deductions? What is considered a counting error? What is the procedure for returning overpaid wages to an employee if an accounting error has occurred? How to recover overpaid wages if an employee is fired? Is it possible to recover the amount of damage from an accountant who made an error in the calculation? How are deduction transactions reflected in the accounting records of accounting, accounting and corporate accounting?

In practice, situations arise when a payroll accountant makes mistakes when calculating the amounts of wages due to employees. In this case, employees may receive a larger amount or vice versa. In this article we will tell you what needs to be done to return the overpaid wages to the employee.

At the beginning, let's say that if the employee was paid a smaller salary, then you just need to pay it extra. In this case, you need to draw up an accounting certificate and a memo to the head of the institution. If the employee was paid a larger salary, difficulties may arise, since according to Art. 137 of the Labor Code of the Russian Federation, overpaid wages cannot be recovered from an employee, with the exception of a number of cases.

advocatus54.ru

And also, do we set the amounts with a plus or a minus?

How to write off disadvantages in the salaries of fired people 392 of the Labor Code of the Russian Federation; unclaimed debt on deposited wages is subject to write-off after three years in accordance with Art. 196 of the Civil Code of the Russian Federation. Yes, write it off and don’t bother. The tax office doesn’t need this, and if the labor commission comes in now, it will only be based on a complaint and won’t look at that either.

unclaimed debt on deposited wages is subject to write-off after three months in accordance with Art.

The debts remained with those fired. Let's look at both of these situations. Let us also consider the procedure for writing off and reflecting in accounting and tax accounting the amounts of various debts of dismissed employees.

The reasons for employee debts to the employer vary. Info There is an overpayment of insurance premiums. In reporting to the Social Insurance Fund for the current period, it is necessary to take into account the adjustments for their accrual, and the overpayment should be adjusted with further payments.

If, in connection with the deletion of accrual of vacation pay, negative values are formed in the personalized accounting in the Pension Fund of the Russian Federation for an employee, the company’s report will not be accepted. If the debts remain with the dismissed employees, let's look at both of these situations.

Let us also consider the procedure for writing off and reflecting in accounting and tax accounting the amounts of various debts of dismissed employees.

In this case, the employee may have debts to the company.

These methods can be used individually or in combination.

Personal income tax was also withheld excessively in the amount of 1,313 rubles.

What is a counting error?

Currently, the legislation does not contain a definition of the concept of “counting error”. According to the explanations of Rostrud employees, an arithmetic error is considered a counting error, that is, an error made during arithmetic calculations (Letter dated October 1, 2012 No. 1286-6-1). For a more clear understanding of what is recognized as a counting error and what is not, we present a table (the list of errors presented in it is not exhaustive).

| Counting errors | Not counting errors |

| An arithmetic error, for example, when adding up the components of a salary. Note: an error made in arithmetic operations (actions related to counting) should be considered counting (Definition of the RF Armed Forces dated January 20, 2012 No. 59-B11-17) | Incorrect application of legislation, for example: – payment for longer vacations; – double payment for all overtime hours. Incorrect application of the organization’s regulations, including: – payment of a larger bonus; – accrual of additional payments that are not established for this employee |

| Error as a result of a failure of the accounting program. Note: There is currently conflicting judicial practice: – a computer program failure is a special case of a counting error (Determination of the Samara Regional Court dated January 18, 2012 No. 33-302/2012); – program failure – not a counting error, but a technical error (Appeal ruling of the Supreme Court of the Republic of Sakha (Yakutia) dated March 27, 2013 No. 33-709/2013) | Receipt of wages by an employee: – twice; – in a larger amount due to a technical error when entering data. Note: the Ruling of the RF Armed Forces dated January 20, 2012 No. 59-B11-17 states that money paid to an employee twice is not considered a counting error. In addition, the same document notes that technical errors committed through the fault of the employer are not countable |

How to recover overpaid wages if an employee is fired?

To do this, it is necessary, as in the case when the employee continues to work in the institution, to draw up an act and notice, in which also demand the return of the overpaid amount of wages on a voluntary basis, but add that if the employee does not do this, the institution will go to court .

The institution has the right to go to court, since according to Art. 1102 of the Civil Code of the Russian Federation, a person who has unjustly enriched himself at the expense of another person is obliged to return this unjust enrichment to the latter, except for the cases provided for in Art. 1109 of this code. In paragraph 3 of Art. 1119 of the Civil Code of the Russian Federation states that wages and payments equivalent to them, pensions, benefits, scholarships, amounts of compensation for harm caused to life or health, alimony and other sums of money provided to a citizen as a means of subsistence are not subject to return as unjust enrichment. in the absence of dishonesty on his part and a counting error.

Thus, if an employer paid an employee a larger salary due to an accounting error, based on civil law, he has the right to demand the return of this amount even if the employee quit.

For your information

When going to court, the employer must prepare:

- employment contract with a former employee;

- documents on calculation and payment of wages;

- act of the commission on the identified counting error;

- a notice that was sent to an employee with an offer to voluntarily return the overpaid wages.

Free legal consultation: ON LABOR ISSUES

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. I realized late that these were unaffordable loans for me.

They call and threaten with various methods of influence. What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem.

Working for results We are interested in the success of your business!

Your victories are our victories. We are exclusively results-oriented. Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case.

Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use.

Submitting documents We take care of everything.

Compilation. Collection of the necessary package of documents.

Is it possible to recover the amount of damage from an accountant who made an error in the calculation?

To answer this question, it is necessary to consider two situations: when an agreement on financial liability is concluded with the employee and when such an agreement is not concluded. According to Art. 244 of the Labor Code of the Russian Federation, written agreements on full individual or collective (team) financial liability can be concluded with employees who have reached the age of 18 and directly service or use monetary, commodity valuables or other property. At the same time, lists of works and categories of workers with whom these contracts can be concluded, as well as standard forms of these contracts are approved by the Government of the Russian Federation.

For your information

Currently, lists of positions and work filled and performed by employees with whom the employer can enter into written agreements on full individual or collective (team) financial responsibility, as well as standard forms of agreements on full financial responsibility, are approved by Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85 .

In addition, financial liability in the full amount of damage caused to the employer can be established by employment contracts concluded with the deputy heads of the organization, the chief accountant (Article 243 of the Labor Code of the Russian Federation).

According to Art. 248 of the Labor Code of the Russian Federation, recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer. The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee.

For your information

If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, recovery can only be carried out by the court.

Accounting

In accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, expenses for paying wages are included in subarticle 211 “Wages” of the KOSGU. Accounting for payroll calculations is kept on account 0 302 11 000 “Payroll calculations” (clause 256 of Instruction No. 157n). Consequently, typical transactions for the return of overpaid wages will be reflected as follows:

| State institution (Instruction No. 162n*) | Budget institution (Instruction No. 174n**) | Autonomous institution (Instruction No. 183n***) | |||||

| Debit | Credit | Debit | Credit | Debit | Credit | ||

| Salary accrued | |||||||

| 1 401 20 211 | 1 302 11 730 | 0 109 60 211 0 109 70 211 0 109 80 211 0 109 90 211 0 401 20 211 | 0 302 11 730 | 0 109 60 211 0 109 70 211 0 109 80 211 0 109 90 211 0 401 20 211 | 0 302 11 000 | ||

| The amount of salary was transferred from the institution’s personal account to the employee’s bank card | |||||||

| 0 302 11 830 | 1 304 05 211 | 0 302 11 830 | 0 201 11 610 | 0 302 11 000 | 0 201 11 000 | ||

| Excessively accrued wages are reflected using the “red reversal” method | |||||||

| 1 401 20 211 | 1 302 11 730 | 0 401 20 211 | 0 302 11 730 | 0 401 20 211 | 0 302 11 000 | ||

| 1 209 30 560 | 1 302 11 730 | 0 209 30 560 | 0 302 11 730 | 0 209 30 000 | 0 302 11 000 | ||

| The amounts of excess wages received are reflected in the cash register | |||||||

| 1 201 34 510 | 1 209 30 660 | 0 201 34 510 | 0 209 30 660 | 0 201 34 000 | 0 209 30 000 | ||

| Reflects the deposit of cash into the account on the basis of an expense cash order, a receipt for an announcement for a cash contribution | |||||||

| 1 210 03 560 | 1 201 34 610 | 0 210 03 560 | 0 201 34 610 | 0 210 03 000 | 0 201 34 000 | ||

| The crediting of cash to the account is reflected based on an extract from the personal (bank) account | |||||||

| 1 304 05 211 | 1 210 03 660 | 0 201 11 510 | 0 210 03 660 | 0 201 11 000 | 0 210 03 000 | ||

* Instructions for the use of the Chart of Accounts for Budget Accounting, approved by Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

** Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

*** Instructions for the application of the Chart of Accounts for accounting of autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

* * *

In conclusion, let us once again draw your attention to the main points related to the return of overpaid wages to an employee.

1. The institution has the right to return the amount of wages overpaid to the employee only in strictly established cases:

- if a counting error was made;

- when the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards;

- if the payment to the employee of excess wages occurred in connection with his unlawful actions established by the court.

2. If overpaid amounts are discovered, the employer must draw up a report on the incident and notify the employee about it.

3. Even if the institution has the right to return overpaid amounts, it is necessary to obtain the employee’s written consent to withhold these amounts (or the employee voluntarily returns them).

4. Withholding the overpaid amount from the employee’s salary may last for several months, since the provisions of Art. 138 Labor Code of the Russian Federation.

5. If an employee refuses to return the excess amount received or the deadline for making a decision has expired, the institution has the right to go to court.

6. The institution may recover the overpaid amount from an employee who made a non-counting error.

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

What amounts overpaid to an employee can be withheld from his salary?

Manager of Sapphire LLC /Ivanov I.I./ Application-consent of an employee for the return of excess earnings due to an accounting error - sample to the General Director of Sapphire LLC Igor Vladimirovich Petrenko from the manager Ivan Ivanovich Ivanov Statement I, Ivan Ivanovich Ivanov, do not object against deductions from my salary for January 2021 of an amount of 2,500 (Two thousand five hundred) rubles, excessively given to me due to a counting error that arose when calculating wages for December 2021. February 20, 2021 /Ivanov I.I. / An example of the return of overpaid wages. Suppose, in the process of work, manager Ivanov I.I. December salary was issued incorrectly. The employee’s salary was 40,000 rubles, after withholding personal income tax, the employee should have received 34,800 rubles.

Instead, he was given 37,300 rubles, the overpayment amounted to 2,500 rubles.

In addition to the general restrictions established regarding deductions from an employee’s salary at the initiative of the employer, it is also necessary to take into account specific restrictions depending on the grounds for deductions. Withholding of unpaid advances, unreturned accountable amounts, overpaid wages. Such deductions can only be made if the following conditions are simultaneously met (Part.

3 tbsp. 137):

- one month has not expired from the date of expiration of the period established for the return of the advance, repayment of debt or incorrectly calculated payments;

- the employee does not dispute the grounds and amounts of the deduction.

Attention If these conditions, or at least one of them, are not met, then the employee’s debt can only be collected in court. Or the employee can voluntarily repay the debt by depositing funds into the employer's cash desk.

We comply with deadlines for reimbursement (withholding overpayments)

After establishing the reasons for the overpayment, it is necessary to remember the terms during which the overpaid amounts can be withheld from the employee.

The employer has the right to decide to deduct from wages no later than one month from the date of expiration of the period established for repayment of incorrectly calculated payments, and provided that the employee does not dispute the grounds and amount of the deduction (Article 137 of the Labor Code of the Russian Federation).

As noted in the appeal rulings of the Moscow City Court dated 02.28.2013 No. 11-3853/2013, the Sverdlovsk Regional Court dated 05.22.2014 No. 33-7209/2014, if at least one of these conditions is not met, that is, the employee challenges the withholding or has expired month period, the employer loses the right to withhold these amounts. This can only be done through the court.

The employee can return the money of his own free will. Most often this is what happens, because few people want to spoil their relationship with their employer. If an employee wants to return the overpayment, he can deposit the excess into the cash register or agree to have it deducted from his salary.

If the employee refuses to return the overpayment, it will have to be written off from net profit.

We have implemented a number of control procedures, so errors in calculating and transferring salaries are practically excluded. And even if we make a mistake, we will compensate for the damage at our own expense - this is provided for in the service agreement.

Responsibilities of the Payroll Accountant