Who submits the declaration Order of the Russian Ministry of Natural Resources No. 1043 dated December 10, 2020 amended the current

A tax deduction is an amount by which you can reduce the VAT charged on the sale of goods,

Why is UTII form 3 submitted? An application for UTII form 3 is submitted if the organization

Source: Magazine “VAT Problems and Solutions” In order to correctly calculate the amount of VAT due

The useful life of a vehicle is the period during which the vehicle generates economic value.

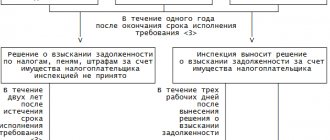

Each tax must be paid by the organization on time. This rule applies not only to

Characteristics of account 82 Accounting for reserve capital (hereinafter referred to as RK) is carried out using account 82,

Why is the program needed? The head of an enterprise or organization is obliged to create an optimal and safe production

Account 66 in accounting Subaccounts of the account “Settlements for short-term loans and borrowings” are presented

An application for offset of overpaid tax is a document with which a taxpayer applies