Each tax must be paid by the organization on time. This rule applies not only to the tax paid by an organization for property included in the Unified Gas Supply System, but also to the tax that is transferred for property not included in it. If the tax amount is not received within the specified period, the tax service begins to calculate penalties, for payment of which the organization will have to use the KBK code 18210602010022100110.

Not all organizations know about this code, but only those who have already missed the tax payment deadline. After all, practically no accounting department, where there have never been any delays in paying taxes, is unlikely to be interested in the CBC intended for the payment of penalties or fines. Therefore, what is KBK 18210602010022100110 and what tax needs to be paid in 2021, many organizations have to find out only in very unpleasant situations related to the delay in payment of property tax.

Decoding KBK 18210602010021000110

According to BCC 18210602010021000110, enterprises pay a fee on property that does not belong to companies that are part of the Unified Gas Supply System (UGSS). The UGSS is a technological complex consisting of gas production, processing and storage facilities. Therefore, it includes gas production enterprises. For these companies, the property tax is calculated at separate rates, conditions, and tax funds are paid using other details.

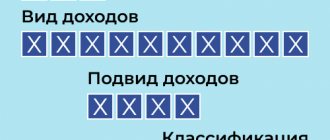

The budget classification code consists of 20 digits, which are divided into seven blocks. Each combination corresponds to a specific value:

- 182 - department controlling revenues: Federal Tax Service Inspectorate.

- 1 - type of income: tax.

- 06 - collection group: property tax.

- 02010 - tax category, budget to which funds are sent: tax on property of organizations that does not belong to the Unified State System. The money is transferred to the regional budget.

- 02 - specific treasury category: budget of a constituent entity of the Russian Federation.

- 1000 — payment type: standard.

- 110 - definition of funds: tax revenues. Revenue also includes customs payments.

You have to pay for the house

Any object is eligible for taxation. This even applies to country houses. Now, regardless of whether it is residential or non-residential, the house is taxable. Therefore, you will have to pay for all real estate for which there are title documents. Any individual can find out the amount of tax on an object in their possession from a notification or a personal visit to the tax service.

The fact is that even if the property was acquired quite recently, the tax office becomes aware of this after a while. Therefore, within a certain time, they receive a notification stating that the individual is obliged to pay tax within a specified period using a special KBK code.

KBC for payment of penalties and fines

In addition to the standard amount of corporate property tax, enterprises sometimes pay penalties and fines on this fee.

Penalty

Sometimes the payment slip indicates KBK 18210602010022100110. What tax for 2021 should I pay using this number? Penalties on the property tax of organizations on property not subject to the Unified State Tax System.

Penalties are assessed to the organization if the property tax is not paid on time or not paid at all. After delay, tax authorities charge penalties in accordance with Art. 75 of the Tax Code of the Russian Federation. Unlike fines, the amount of this penalty increases every day. Until the 31st day, the refinancing rate of the Central Bank is applied - 1/300, and from the 31st day of delay - 1/150. The formula is shown in the picture.

Fines

A fine is a monetary penalty in a fixed amount in the form of interest or a specific amount. Financial penalties are imposed on non-payers of fees and penalties. If a tax resident did not report on time on the declaration, did not pay the fee, accrued penalties, did not do this for the first time, or did it intentionally, then simply penalties cannot be avoided. This case is regulated by Art. 122 of the Tax Code of the Russian Federation. The size of the sanction depends on the severity of the offense and the reasons.

To pay a fine for the property tax of an enterprise on property not subject to the Unified State Tax Code, the payer indicates KBK 18210602010023000110 in the receipt.

List of KBK when paying insurance premiums

Current information for taxpayers

List of KBK when paying insurance premiums

Dear taxpayers! Interdistrict Inspectorate of the Federal Tax Service of Russia No. 5 for the Khanty-Mansiysk Autonomous Okrug - Ugra (hereinafter referred to as the Inspectorate), in order to ensure the timely receipt of funds into the budget system of the Russian Federation in accordance with Article 45 of the Tax Code of the Russian Federation, sends a list of BCCs when paying insurance premiums. 18210202010060000160 Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (recalculations, arrears and arrears of the corresponding payment for billing periods expired before January 1, 2017); 18210202010060010160 Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (recalculations, arrears and arrears of the corresponding payment, including canceled ones, for billing periods starting from January 1, 2021); 18210202020060000160 Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (recalculations, arrears and arrears on the corresponding payment, including canceled ones); 18210202031060000160 Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive); 18210202032060000160 Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive); 18210202080060000160 Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions; 18210202090070000160 Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (recalculations, arrears and debt on the corresponding payment, including canceled payments, for billing periods expired before January 1, 2017); 18210202090070010160 Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (recalculations, arrears and debt on the corresponding payment, including canceled ones, for billing periods starting from January 1, 2021); 18210202100060000160 Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (for billing periods expired before January 1, 2013); 18210202101080011160 Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund for billing periods expiring before January 1, 2021; 18210202101080013160 Insurance premiums for compulsory health insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund for billing periods starting from January 1, 2021; 18210202103080011160 Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund for billing periods expiring before January 1, 2021; 18210202103080013160 Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund for billing periods starting from January 1, 2021; 18210202110060000160 Insurance contributions for compulsory pension insurance in the amount determined on the basis of the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) (recalculations, arrears and debt on the corresponding payment, in including canceled ones); 18210202120060000160 Contributions paid by organizations of the coal industry to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions (payment amount (recalculations, arrears and debt on the corresponding payment, including the canceled one); 18210202131060000160 Insurance contributions at an additional rate for insured persons employed on relevant types of work specified in paragraph 1 of part I of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2021 year); 18210202131060010160 Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation Federation for the payment of insurance pensions (for billing periods starting from January 1, 2021; 18210202132060000160 Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of insurance pension (for billing periods expired before January 1, 2021); 18210202132060010160 Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of insurance pension (for billing periods starting from January 1, 2021); 18210202140060000160 Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension; 18210202140060010160 Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (recalculations, arrears and arrears of the corresponding payment, including canceled ones, for billing periods starting from January 1, 2017); 18210202150060000160 Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (recalculations, arrears and debt on the corresponding payment, including canceled ones). Additionally, we inform you that payment of taxes to the Inspectorate from 02/04/2019 is made using the following details: Recipient: Interdistrict Inspectorate of the Federal Tax Service of Russia No. 5 for the Khanty-Mansiysk Autonomous Okrug - Ugra INN 8607100265 KPP 860701001 BIC 047162000 r/s 40101810565770510 001 in the RCC Khanty - Mansiysk OKTMO 71872000 (Langepas) OKTMO 71873000 (Megion) OKTMO 71884000 (Pokachi)

Changes in the BCC for corporate property tax in 2018

In 2021, the object of taxation has changed - movable property will no longer be taxed. This applies to all types of property of organizations - property owned and not owned by companies participating in the Unified Gas Supply System. The budget classification codes have not changed and remain the same. Tax residents pay the fee using base code 18210602010020000110.

Property tax is paid not only by organizations, but also by individuals. The BCC of property tax for ordinary citizens for all types of payments and for all categories owning property differ from each other.

Reminder: KBC for policyholders

The website contains the CBC for compulsory pension and health insurance.

Budget classification codes

I.

Compulsory pension insurance

Legal entities

Calculation period from 2010

| CODE | Name of KBK |

| To pay the insurance part of the labor pension | |

| 39210202010061000160 39210202010062000160 |

|

| To pay the funded part of the labor pension | |

| 39210202020061000160 39210202020062000160 |

|

| Organizations using the labor of flight crew members of civil aviation aircraft to pay supplements to pensions | |

| 39210202080061000160 39210202080062000160 |

|

Estimated period 2002-2009.

| CODE | Name of KBK |

| To pay the insurance part of the labor pension (arrears as of December 31, 2009) | |

| 18210202010061000160 18210202010062000160 |

|

| For payment of the funded part of the labor pension (arrears as of December 31, 2009) | |

| 18210202020061000160 18210202020062000160 |

|

Individuals

Calculation period from 2010

| CODE | Name of KBK |

| To pay the insurance part of the labor pension (fixed payment, arrears as of December 31, 2009) | |

| 39210910010061000160 39210910010062000160 |

|

| To pay the funded part of the labor pension (fixed payment, arrears as of December 31, 2009) | |

| 39210910020061000160 39210910020062000160 |

|

| For payment of the insurance part of the labor pension in the amount determined based on the cost of the insurance year (monthly payments after 2010) | |

| 39210202100061000160 39210202100062000160 |

|

| For payment of the funded part of the labor pension in the amount determined based on the cost of the insurance year (monthly payments after 2010) | |

| 39210202110061000160 39210202110062000160 |

|

II. Budget classification codes for compulsory health insurance

Legal entities and individuals

Calculation period from 2010

| CODE | Name of KBK |

| To the Federal Budget Compulsory Medical Insurance Fund | |

| 39210202100081000160 39210202100082000160 |

|

| To the territorial budget of the Compulsory Medical Insurance Fund | |

| 39210202110091000160 39210202110092000160 |

|

III. Budget classification codes for payment of additional insurance contributions for the funded part of the labor pension

| CODE | Name of KBK |

| 392 1 02 02041 06 1100 160 |

|

| 392 1 02 02041 06 1200 160. |

|

IV . Penalties, fines

Calculation period from 2010

| CODE | Name of KBK |

| 39211620010060000140 | Fines for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation |

| 39211620050010000140 | Fines imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48-51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” |

| Billing period 2002-2009 | |

| 18210908020061000140 18210908020062000140 18210908020063000140 |

on contributions to the Pension Fund of the Russian Federation as of January 1, 2001. |

Account details to which insurance premiums are to be credited:

INN 2801008213 KPP 280101001

UFK for the Amur Region (OPFR for the Amur Region)

account 40101810000000010003

GRKTS GU BANK OF RUSSIA IN THE AMUR REGION. BLAGOVESHCHENSK BIC 041012001

Payment documents must indicate the purpose of the payment, the registration number in the territorial body of the Pension Fund and the Compulsory Medical Insurance Fund, the KBK in accordance with the listed insurance premiums, OKATO of the territorial body of the Pension Fund or the Compulsory Medical Insurance Fund at the place of registration of the policyholder.

Share news

What BCCs for FFOMS contributions are established in 2019–2020

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using BCC 18210202103081013160 (if related to the period from 2021) and BCC 18210202103081011160 (if related to the period until 2021).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

BCC for insurance premiums in 2019–2020 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2019-2020, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period is paid until 2017) are established.

IMPORTANT! The income of an individual entrepreneur on UTII for the purpose of calculating fixed insurance premiums is imputed income, not revenue (letter of the Ministry of Finance of the Russian Federation dated July 18, 2014 No. 03-11-11/35499).

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2021, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2020 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (letter from the Ministry of Finance of Russia dated 04/07/201 7 No. 02-05-10/21007).

Find out about the current fixed payment amount for individual entrepreneurs at.

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202010061010160 (if accruals relate to the period from 2017) and KBK 18210202010061000160 (if accruals are made for the period before 2021) .

What BCCs for insurance premiums are established for the Social Insurance Fund in 2019–2020

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

Read more about the specifics of calculating insurance premiums when signing civil contracts in the article “Contract and insurance premiums: nuances of taxation.”

Income code 2001 in certificate 2-NDFL

This code reflects the amounts that were paid in the form of remuneration to the director, members of the board and other governing body. That is, 2001 is intended to indicate amounts that are not related to the work activities of managers. It does not include wages, vacation pay and other payments. Other codes have been set to reflect them.

Code 2001 can only be used if the director of the enterprise received remuneration as a member of the board of directors or other management apparatus.

Code 2012 in the 2-NDFL certificate: what does it mean

This code is intended to reflect the amounts that were paid to the employee as vacation pay during the month. Only these payments are indicated in the certificate under code 2012. This is due to the fact that vacation pay is calculated in a special manner.

When drawing up a document in 1-C Accounting, you need to be careful. The program automatically adds vacation pay, which is taken into account using the 2012 code, to the basic salary. These are errors for which penalties are provided.

It is also not uncommon for novice accountants to confuse code 2012 with code 2013, which is intended to indicate the amount of compensation for unused vacation.

Income code 2000 in the 2-NDFL certificate: what is it

This code reflects the amount of wages received by an employee working under an employment contract. Code 2000 in 2-NDFL does not include bonuses and other material incentives. A different code is intended for them - 2002. This is due to the fact that bonuses are classified as a different type of income.

In addition, the following payments are not indicated under code 2000 in the certificate:

- remuneration under civil contracts;

- income received by an employee in kind.

That is, code 2000 is suitable for indicating wages that the employer paid to the employee in cash or transferred to an account (salary projects).