Home — Articles

When your organization opens a separate division (hereinafter - SB) in another region, then, as a rule, you already know that you will need to calculate and pay income tax based on the share of profit attributable separately to the organization and separately to the division. But when filling out an income tax return for the reporting period in which the OP was created, everyone constantly faces difficulties with reflecting: - advance payments to the budget of a constituent entity of the Russian Federation for the reporting period; — monthly advance payments for the next quarter. We'll talk about filling out these indicators.

Where to submit declarations

If an organization has separate divisions (branches), then the income tax return must be filed both at the location of the head office and at the location of each separate division. Such requirements are established by paragraph 1 of Article 289 of the Tax Code of the Russian Federation.

Exceptions to this rule are:

- separate divisions of the largest taxpayers. Submit a declaration for them to the tax office in which the organization is registered as the largest taxpayer (paragraph 3, paragraph 1, article 289 of the Tax Code of the Russian Federation);

- separate divisions outside of Russia. Submit a declaration for them to the head office of the organization (clause 4 of Article 311 of the Tax Code of the Russian Federation).

If an organization has several separate divisions in one subject of the Russian Federation, then it is possible to pay profit tax to the regional budget centrally:

- or through the head office of the organization, if it is located in the same region;

- or through any department that will be responsible.

If during the year a responsible separate division is closed (liquidated), this does not mean that there is no need to pay tax to the budget of the given region. Select a new responsible unit and continue paying tax.

This procedure is provided for in paragraph 2 of paragraph 2 of Article 288 of the Tax Code of the Russian Federation and is explained in letters of the Ministry of Finance of Russia dated February 18, 2021 No. 03-03-06/1/9188, Federal Tax Service of Russia dated November 18, 2011 No. ED-4-3/ 19308, dated December 30, 2008 No. ШС-6-3/986.

For more information about this, see How to pay income tax if an organization has separate divisions.

If an organization uses a centralized payment procedure, submit a tax return for a group of separate divisions at the location of the division (head office) through which the organization pays income tax to the regional budget. There is no need to submit declarations at the location of separate divisions through which tax is not paid (letter of the Ministry of Finance of Russia dated February 18, 2021 No. 03-03-06/1/9188, Federal Tax Service of Russia dated June 30, 2006 No. GV-6- 02/664).

If the average number of employees of an organization for the last year exceeds 100 people, income tax returns must be submitted electronically both at the location of the head office and at the location of separate divisions (letter of the Ministry of Finance of Russia dated August 9, 2011 No. 03-03-06 /1/464).

Situation: which tax office can fine an organization for late filing of a tax return for income tax at the location of a separate division?

The inspection where the organization submits a declaration for separate divisions.

Failure to submit (late submission) of a tax return is an offense for which tax and administrative liability is provided.

If an organization is not the largest taxpayer and has separate divisions, then it submits an income tax return both at the location of the head office and at the location of each separate division. Such requirements are established by paragraph 1 of Article 289 of the Tax Code of the Russian Federation. Accordingly, the organization will be brought to tax liability for late submission of a declaration for a separate division by the inspectorate with which this division is registered.

If the organization is the largest taxpayer, then it submits a declaration for separate divisions to the tax office with which it is registered as the largest taxpayer (paragraph 3, paragraph 1, article 289 of the Tax Code of the Russian Federation). This means that it is this inspection that will fine her in case of late submission of the declaration.

Features of separate units

When expanding their influence, various companies create branches in other regions, while such organizations have less power and responsibility. There are two main features of such an enterprise:

- Territorial remoteness from the central unit;

- Providing the population with jobs.

The company conducts its main activities in the form of a branch or representative office. It cannot organize economic activities, but is only a guarantor of the protection of rights and representation of the interests of the main company. At the same time, the legislation stipulates that the founding company does not have the right to use the simplified taxation system, while a separate one has every right to do so. The branch is also not a legal entity; the manager here works exclusively on the basis of a notarized power of attorney.

Organizations of this type may be on a separate balance sheet or without it. The concept of a separate balance sheet includes accounting transactions such as sales of products, compensation of employees, and insurance premiums. Taxes of a separate division without a separate balance sheet are paid by the creating company.

Composition of reporting

In the declaration, which is submitted at the location of the head office, include all the necessary sheets, as well as appendices 5 to sheet 02, filled out both for the organization as a whole and for all separate divisions (groups of divisions) through which the tax is paid (clause 1.4 The procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600).

Situation: is it necessary to include Appendix 5 to Sheet 02 in the income tax return? The organization and all its separate divisions are located in one subject of the Russian Federation. The tax is transferred to the regional budget through the head office.

No no need.

Organizations that include separate divisions must submit to the tax inspectorate at their location a tax return for the organization as a whole with distribution among separate divisions (Clause 5 of Article 289 of the Tax Code of the Russian Federation). In this case, the part of the tax that is sent to the federal budget must be transferred in full to the location of the organization’s head office (clause 1 of Article 288 of the Tax Code of the Russian Federation). And the part of the tax that is sent to regional budgets must be distributed between the head office of the organization and its separate divisions (clause 2 of Article 288 of the Tax Code of the Russian Federation).

In addition to the declaration sheets, which are common to all organizations, organizations that include separate divisions must submit Appendix 5 to Sheet 02. This Appendix reflects the distribution of the tax base between the head office of the organization and its separate divisions.

If separate divisions are located on the territory of the same subject of the Russian Federation, and the organization pays the regional part of the tax centrally (through a responsible separate division), then Appendix 5 to Sheet 02 is filled out for the group of separate divisions. In this case, in the “Calculation has been completed” field (line 002) of Appendix 5, code 4 is indicated.

From the literal interpretation of the provisions of clause 10.1 and paragraph 4 of clause 10.11 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, it follows that Appendix 5 to sheet 02 is submitted at the location of the head office of the organization, even in the case , if all separate divisions are located in one region, and the head department performs the functions of a responsible division. However, in practice, fulfilling this requirement entails duplication of information about the tax base and the amount of tax. Therefore, in the situation under consideration, the Federal Tax Service of Russia allows us to deviate from the general rule. Thus, if all separate divisions of an organization are located in one subject of the Russian Federation, and the entire amount of income tax is transferred to the budget through its head office, Appendix 5 to sheet 02 may not be included in the tax return. This is stated in the letter of the Federal Tax Service of Russia dated 26 January 2011 No. KE-4-3/935.

The declaration, which is submitted at the location of the separate division, includes the title page, subsections 1.1 and 1.2 (if the organization transfers monthly advance payments), as well as Appendix 5 to sheet 02, filled out for the separate division (clause 1.4 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600).

Calculation example for OP

Let's consider an example of calculating income tax for a separate division under the following conditions:

LLC "Vesna" (Moscow) has a branch "Winter" (St. Petersburg). The total tax base in the billing period is 5 million rubles.

Values of calculated indicators:

| Indicator name | Numeric value | |

| Overall for the company | Including for Zima LLC (branch) | |

| Average number of employees | 150 | 50 |

| Labor costs | 12 000 000 | 4 400 000 |

| Residual value of property | 50 000 000 | 18 000 000 |

The accounting policy of Vesna LLC determines that the indicator of the average number of employees and the residual value of fixed assets is used to distribute the base among non-residential assets.

Specific weight of the labor indicator = 50 / 150 × 100% = 34%.

Share of property indicator = 18,000,000 / 50,000,000 × 100% = 36%.

Profit share = (34% + 36%) / 2 = 35%.

We determine the tax base for the tax base for the branch = 5,000,000 × 35% = 1,750,000 rubles.

We calculate the profit tax of the OP “Winter” = 1,750,000 × 17% = 297,500 rubles.

Filling out the declaration

In subsections 1.1 and 1.2 of the declaration, which is submitted at the location of the head office of the organization, indicate the amount of tax payable to the regional budget without taking into account payments for separate divisions.

In subsections 1.1 and 1.2 of the declaration, which is submitted at the location of the separate division, indicate the amount of tax payable to the regional budget based on the share of profit of this division (group of divisions with centralized payment of tax).

This is stated in paragraph 4.1 of the Procedure approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

In Appendix 5 to Sheet 02, which is submitted at the location of the organization's head office, indicate code 1. This means that the Appendix does not reflect data on separate divisions.

In Appendix 5 to Sheet 02, which is submitted at the location of a separate division, indicate code 2 (if the calculation is made for one division) or code 4 (if the calculation is made for a group of divisions located in the same region).

The tax base on line 030 must be equal to the indicator on line 120 of sheet 02 of the declaration.

On line 040, indicate as a percentage the share of the tax base attributable to the separate division.

For more information on calculating the share, see Indicators for income tax distribution.

The indicator for line 050 is calculated as follows:

| Line 050 of application 5 of sheet 02 | = | Line 030 of application 5 of sheet 02 | × | Line 040 of application 5 of sheet 02 |

In line 060, indicate the income tax rate for the regional budget.

Next, calculate the amount of tax attributable to the separate division:

| Line 070 of application 5 of sheet 02 | = | Line 050 of application 5 of sheet 02 | × | Line 060 of application 5 of sheet 02 |

The sum of lines 070 of all appendices 5 to sheet 02 must be equal to the indicator on line 200 of sheet 02 of the declaration.

On line 080, reflect the amount of advance payments accrued to the regional budget during the tax period. The sum of lines 080 of all appendices 5 to sheet 02 must be equal to the sum of line 230 of sheet 02 of the declaration.

Fill in line 090 if the organization paid tax abroad and counts it against Russian income tax. First, you need to calculate what part of the tax is regional:

| Share of tax attributable to regional | = | Line 200 of sheet 02 | : | Line 180 of sheet 02 | × | 100 % |

Then determine how much of the foreign tax paid is attributable to the separate entity. This must be done based on the share of the tax base indicated on line 040.

In total, the indicator for line 090 should be determined as follows:

| Line 090 of application 5 of sheet 02 | = | The entire amount of tax paid abroad | × | Share of tax attributable to regional | × | Line 040 of application 5 of sheet 02 |

Reduce the tax reflected on line 070 by the offset amount.

On line 100 reflect the difference between line 070 and lines 080 and 090:

| Line 100 of application 5 sheet 02 | = | Line 070 of application 5 of sheet 02 | — | Line 080 of application 5 of sheet 02 + line 090 of application 5 of sheet 02 |

If the result is zero, put dashes on line 100.

If the difference turns out to be negative, indicate the amount received not on line 100, but on line 110 with a plus sign. This will be the tax amount to be reduced. At the same time, compare the amounts on lines 070 and 090. Only the amount of tax paid outside the Russian Federation and reflected on line 090, which does not exceed the amount on line 070, can be taken as offset.

Complete lines 120 and 121 if the organization pays advance payments based on profit for the previous quarter. In line 120, reflect the amount of the advance payment based on the share of the tax base of the separate division:

| Line 120 of application 5 sheet 02 | = | Line 310 of sheet 02 | × | Line 040 of application 5 of sheet 02 | : | 100 |

Line 121 - monthly advance payments for the first quarter of the next tax period - fill out in the declaration for nine months of the tax period. The same amount must be reflected on the line as indicated on line 120.

This procedure follows from paragraphs 10.1–10.8 of the Procedure approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600.

An example of preparing an income tax return for an organization that has several separate divisions. The organization pays tax centrally for a group of separate divisions located in one subject of the Russian Federation

Alpha LLC is located in Moscow (OKTMO code – 45315000). The organization has three separate divisions, two of them are located in the Moscow region:

- in Balashikha (OKTMO code – 46704000001);

- in Mytishchi (OKTMO code – 46634101001).

The third separate division is located in Vladimir (OKTMO code – 17701000001).

Alpha pays profit tax to the budget of the Moscow region centrally, through a separate division located in Mytishchi.

The organization makes monthly advance payments based on actual profits and reports income taxes on a monthly basis. Alfa does not carry out operations the results of which are reflected in the appendices and to sheet 02, as well as on sheets 03–05 of the tax return.

For January–March 2015, the total amount of profit received by the organization amounted to 1,000,000 rubles, including for separate divisions:

- in the Moscow region – 200,000 rubles;

- in Vladimir – 100,000 rubles.

During the same period, the total amount of income tax accrued by Alfa amounted to 200,000 rubles, including 20,000 rubles to the federal budget. (RUB 1,000,000 × 2%).

The amount of income tax accrued to the budget of the Moscow region is equal to: 200,000 rubles. × 18% = 36,000 rub.

The amount of income tax accrued to the budget of the Vladimir region is equal to: 100,000 rubles. × 18% = 18,000 rub.

The amount of income tax accrued to the budget of Moscow is equal to: (1,000,000 rubles – 200,000 rubles – 100,000 rubles) × 18% = 126,000 rubles.

For January–February, Alfa accrued advance payments for income tax in the following amounts:

– to the federal budget – 15,000 rubles; – to the budget of Moscow – 118,000 rubles; – to the budget of the Moscow region – 28,000 rubles; – to the budget of the Vladimir region – 15,000 rubles.

The amounts of tax to be paid additionally for January–March 2021 are:

– to the federal budget – 5000 rubles. (RUB 20,000 – RUB 15,000); – to the budget of Moscow – 8000 rubles. (RUB 126,000 – RUB 118,000); – to the budget of the Moscow region – 8000 rubles. (RUB 36,000 – RUB 28,000); – to the budget of the Vladimir region – 3000 rubles. (RUB 18,000 – RUB 15,000).

The tax office at the location of the head office of the Alpha organization submitted a declaration consisting of the following sections:

- title page;

- subsection 1.1 of section 1, which reflects the following data:

– OKTMO code (line 010) – 45315000 (three cells left empty have dashes); – BCC of income tax credited to the federal budget (line 030) – 18210101011011000110; – the amount of tax to be paid additionally to the federal budget (line 040) – 5,000 rubles; – KBK of income tax credited to the budget of Moscow (line 060), – 18210101012021000110; – the amount of tax to be paid additionally to the budget of the city of Moscow (line 070) – 8000 rubles.

- sheet 02, indicating general calculations for the entire organization;

- appendix 1 to sheet 02; (see Appendix 1 to sheet 02 of the income tax return)

- appendix 2 to sheet 02;

- appendices 5 to sheet 02, compiled by:

– by the head office of the organization (the accountant indicated code 1); – for a group of separate divisions located in the Moscow region (on line 002 of this application, the accountant indicated code 4); – for a separate division located in the city of Vladimir (on line 002 of this application, the accountant indicated code 2).

To the tax office of the city of Mytishchi, Alpha submitted a declaration consisting of the following sections:

- title page;

- subsection 1.1 of section 1, which reflects the following data:

– OKTMO code (line 010) – 46634101001; – KBK of income tax credited to the budget of a constituent entity of the Russian Federation (line 060), – 18210101012021000110; – the amount of tax to be paid additionally to the budget of the Moscow region (line 070) – 8,000 rubles;

- Appendix 5 to Sheet 02, compiled for a group of separate divisions (the accountant indicated code 4).

To the tax office of the city of Vladimir, Alpha submitted a declaration consisting of the following sections:

- title page;

- subsection 1.1 of section 1, which reflects the following data:

– OKTMO code (line 010) – 17701000001; – BCC of income tax credited to the budget of a constituent entity of the Russian Federation (line 060), –18210101012021000110; – the amount of tax to be paid additionally to the budget of the Vladimir region (line 070) – 3000 rubles;

- Appendix 5 to sheet 02 compiled for one separate division, therefore the accountant indicated code 2.

Alpha does not submit an income tax return to the tax office of Balashikha.

Formation of application indicators five

To calculate the tax that must be paid at the location of the branch, it is necessary to determine the share of the tax base attributable to each branch.

To calculate the tax base on line 040 of appendix five, the arithmetic average of two indicators is determined:

- the share of the average number of employees (salary costs) of the branch in the average number of employees for the company as a whole;

- the share of the residual price of the branch’s property subject to depreciation in the residual price of the depreciable property of the entire company as a whole.

Updated declarations

The detailed procedure for submitting updated declarations in the event of liquidation of one of the separate divisions of the organization is presented in the table.

Situation: where to file an updated income tax return for a liquidated separate division? At the time of drawing up the declaration, the organization transfers the tax centrally, through another division located in the same region.

Submit the updated declaration to the tax office at the location of the unit through which the organization pays tax to the regional budget. If the organization pays the regional budget through the head office located in the same subject of the Russian Federation, then submit the updated declaration to the tax office at the location of the organization's head office.

Updated declarations must be submitted on forms that were in force in those reporting (tax) periods for which corrections are made. For more information, see How to submit an amended tax return.

In the updated declaration, indicate the same OKTMO (OKATO) and KPP codes that were indicated in the primary declaration for the liquidated separate division. This is stated in letters of the Federal Tax Service of Russia dated November 18, 2011 No. ED-4-3/19308, dated June 30, 2006 No. GV-6-02/664.

The procedure for filing updated income tax returns for existing and liquidated separate divisions before (after) the transition to centralized tax payment is given in the table.

Situation: what adjustment number should I indicate in the updated income tax return for a closed separate division?

Indicate the number corresponding to the number of updated declarations filed for the closed separate division.

An updated income tax return for a closed, separate division must be submitted to the location of the head office or responsible division of the organization. Despite this, the declaration should indicate data that relates directly to the closed unit. This follows from the provisions of paragraph 2.8 of the Procedure, approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600. Thus, the adjustment number must be indicated based on the number of updated declarations filed specifically for a closed, separate division, and not for the entire organization as a whole. For example, if the first updated declaration is submitted for a closed separate division, and three updated declarations were submitted for the head department, enter the number 1, not 4, in the “Adjustment number” field.

Situation: is it necessary to submit “zero” income tax returns at the location of the head office? The organization conducts only activities on UTII through a separate division in another region.

No no need.

At the place of conduct of activities subject to UTII, the organization must submit quarterly declarations for this tax (Article 346.30, paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation). When calculating income tax, organizations that apply UTII do not take into account income and expenses arising in the framework of activities that have been transferred to a special tax regime (clause 10 of Article 274 of the Tax Code of the Russian Federation). If an organization does not conduct any other activities, then it is exempt from paying income tax (clause 4 of Article 346.26 of the Tax Code of the Russian Federation).

“Zero” income tax returns in the situation under consideration do not need to be submitted (clause 2 of Article 80 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated August 31, 2011 No. 03-11-06/3/96, Federal Tax Service of Russia for Moscow dated March 31, 2009 No. 16-15/030023). Submit only your financial statements to the tax office at the location of your head office. In addition, you should notify the tax office in writing that during the reporting (tax) period the organization did not conduct any activities other than those subject to UTII. The tax office may require an explanation from the organization about the structure of income reflected in the financial statements. Therefore, it is better to immediately indicate this information in the Explanatory Note to the balance sheet. Similar explanations are given by representatives of the tax department (see, for example, letters from the Federal Tax Service of Russia for Moscow dated July 14, 2008 No. 18-11/066220, dated August 28, 2007 No. 20-12/081757).

For more information about the procedure for preparing a tax return, see How to fill out an income tax return.

Practical situation

Now, having dealt with the main points, let’s consider the order of filling out the lines of Appendix No. 5 to Sheet 02 using a specific example.

Initial data

The separate division was closed on August 13, 2015.

Data for the first half of 2015 are shown in the table.

Table. Indicators of the organization for the first half of 2015

| Index | Meaning |

| Tax base for the entire organization | 150,000 rub. |

| Share of the organization's head office | 58,37% |

| Share of a separate division | 41,63% |

| Profit tax rate in a constituent entity of the Russian Federation at the location of the head office and at the location of a separate unit | 18% |

| Amount of accrued tax for the first quarter of 2015 (line 080 of Appendix No. 5 to sheet 02): - at the head office of the organization - for a separate division | RUB 10,510 7610 rub. |

The amount of monthly advance payments payable in the quarter following the current reporting period to the budget of the constituent entity of the Russian Federation (line 310 of Sheet 02 for the half-year of 2015) 8880 rubles.

[150,000 rub. x 18% – (RUB 10,510 + RUB 7,610)].

Filling out the primary declaration for the six months

To make the changes clearer, let us first present the procedure for filling out Appendix No. 5 to Sheet 02 for the first half of 2015 for the head office of the organization and a separate division without taking into account the closure of a separate division. And then - the filling procedure taking into account the closed separate division.

Appendix No. 5 to Sheet 02 for a separate division (primary):

Line 030 - 150,000 rub.

Line 031 - not filled in.

Line 040 - 41.63%.

Line 050 - 62,445 rub. (RUB 150,000 x 41.63%).

Line 060 - 18%.

Line 070 - 11,240 rub. (RUB 62,445 x 18%);

Line 080 - 7610 rub. (line 070 of Appendix No. 5 to Sheet 02 for the first quarter of 2015 + line 120 of Appendix No. 5 to Sheet 02 for the first quarter of 2015).

Line 100 - 3630 rub. (page 070 of Appendix No. 5 to Sheet 02 for the half-year of 2015 - line 080 of Appendix No. 5 to Sheet 02 for the half-year of 2015).

Line 120 - 3697 rub. (line 310 of Sheet 02 for the half-year of 2015 x line 040 of Appendix No. 5 to Sheet 02 for the half-year of 2015: 100) (RUB 8,880 x 41.63: 100)

The remaining lines are not filled in.

Appendix No. 5 to Sheet 02 for the head office of the organization (primary):

Line 030 - 150,000 rub.

Line 031 - not filled in.

Line 040 - 58.37%.

Line 050 - 87,555 rub. (RUB 150,000 x 58.37%)

Line 060 - 18%.

Line 070 - 15,760 rub. (RUB 87,555 x 18%);

Line 080 - 10,510 rub. (line 070 of Appendix No. 5 to Sheet 02 for the first quarter of 2015 + line 120 of Appendix No. 5 to Sheet 02 for the first quarter of 2015).

Line 100 - 5250 rub. (line 070 of Appendix No. 5 to Sheet 02 for the half-year of 2015 - line 080 of Appendix No. 5 to Sheet 02 for the half-year of 2015).

Line 120 - 5183 rub. (line 310 of Sheet 02 for the half-year of 2015 x line 040 of Appendix No. 5 to Sheet 02 for the half-year of 2015: 100) (RUB 8,880 x 58.37%: 100).

The remaining lines are not filled in.

Filling out an updated declaration for the half-year

So, the separate division was closed on August 13, 2015. There is a need to submit an updated tax return for the first half of 2015 in order to adjust advance payments for August and September 2015.

When filling out an updated declaration for the first half of 2015, only line 120 will be subject to change.

For a separate division in line 120 of Appendix No. 5 to Sheet 02, the total amount of monthly advance payments was 3,747 rubles, therefore, the organization must transfer 1,249 rubles monthly.

In the updated tax return for a separate division, one monthly payment should be left on line 120.

Appendix No. 5 to Sheet 02 for a separate division (updated):

Line 030 - 150,000 rub.

Line 031 - not filled in.

Line 040 - 41.63%.

Line 050 - 62,445 (150,000 x 41.63%).

Line 060 - 18%.

Line 070 - 11,240 rub. (RUB 62,445 x 18%).

Line 080 - 7610 rub. (line 070 of Appendix No. 5 to Sheet 02 for the first quarter of 2015 + line 120 of Appendix No. 5 to Sheet 02 for the first quarter of 2015).

Line 100 - 3630 rub. (line 070 of Appendix No. 5 to Sheet 02 for the half-year of 2015 - line 080 of Appendix No. 5 to Sheet 02 for the half-year of 2015).

Line 120 - 1232 rub. (RUB 3,697: 3 months).

The remaining lines are not filled in.

Appendix No. 5 to Sheet 02 for the head office of the organization (updated):

Line 030 - 150,000 rub.

Line 031 - not filled in.

Line 040 - 58.37%.

Line 050 - 87,555 rub. (RUB 150,000 x 58.37%).

Line 060 - 18%.

Line 070 - 15,760 rub. (RUB 87,555 x 18%).

Line 080 - 10,510 rub. (line 070 of Appendix No. 5 to Sheet 02 for the first quarter of 2015 + line 120 of Appendix No. 5 to Sheet 02 for the first quarter of 2015)

Line 100 - 5250 rub. (line 070 of Appendix No. 5 to Sheet 02 for the half-year of 2015 - line 080 of Appendix No. 5 to Sheet 02 for the half-year of 2015).

Line 120 - 7648 rub. (5183 RUR + (3697 RUR – 1232 RUR).

The remaining lines are not filled in.

Features of reflecting trade fees

The form, electronic format of the income tax declaration, as well as the Procedure for filling it out, approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600, do not provide for the possibility of reflecting the paid trade tax. Before making changes to these documents, the tax service recommends doing the following.

Appendix 5 to sheet 02

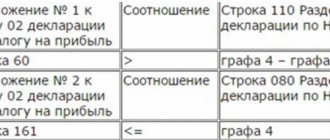

Indicate the amount of the paid trade fee on line 090 of Appendix 5 to sheet 02 (with codes 1, 2, 3, 4 according to the details “Calculation prepared (code)”). Do this in the same way as when reflecting the amount of tax paid (withheld) abroad, which is offset against the payment of tax to the regional budget. In this case, the amount of trade duty and tax paid abroad reflected in the declaration cannot exceed the amount of tax (advance payment) that is subject to credit to the regional budget (line 070 of Appendix 5 to Sheet 02). That is

| Line 090 of Appendix 5 to Sheet 02 | <= | Line 070 of Appendix 5 to Sheet 02 |

In addition, when filling out line 080 of Appendix 5 to Sheet 02, reduce the amount of accrued advance payments by the amount of the trade fee reflected in the tax return for the previous reporting period. That is

| Line 080 of Appendix 5 to sheet 02 of the declaration for the reporting period | = | Amount of accrued advance payments for the current reporting period | – | Line 090 of Appendix 5 to sheet 02 of the declaration for the previous reporting period |

Sheet 02

Reflect the amount of the paid trade tax on lines 240 and 260 of sheet 02 of the declaration. In this case, the amount of trade duty and tax paid abroad reflected in the declaration cannot exceed the amount of tax (advance payment) that is subject to credit to the regional budget (line 200 of sheet 02). That is

| Page 260 sheets 02 | <= | Page 200 sheets 02 |

In addition, when filling out line 230 of sheet 02, reduce the amount of accrued advance payments by the amount of the trade fee reflected in the tax return for the previous reporting period. That is

| Page 230 sheets 02 of the declaration for the current reporting period | = | Amount of accrued advance payments for the current reporting period | – | Page 260 sheets 02 of the declaration for the previous reporting period |

Such clarifications are contained in the letter of the Federal Tax Service of Russia dated August 12, 2015 No. GD-4-3/14174. Appendixes 1 and 2 to this letter provide examples of how trade fees should be reflected in income tax returns.

Advance payments for a closed unit

The Federal Tax Service of Russia, in a letter dated July 12, 2010 No. 16-15/073317, indicated that if an organization decides to terminate the activities (closing) of its separate division, payment of advance payments for subsequent reporting periods and tax for the current tax period at the former location of this separate division no division is made.

Considering that income tax returns are compiled on an accrual basis from the beginning of the year, in order to correctly distribute profits across an organization without separate divisions and its separate divisions, the tax base for the organization as a whole for subsequent reporting periods and the current tax period, subject to distribution, is determined without taking into account the tax base of a closed separate division in the amount calculated and reflected in the declaration for the reporting period preceding the quarter (month) in which it was closed.

And in a letter dated February 24, 2009 No. 03-03-06/1/82, the Ministry of Finance of Russia explained that if a separate division is closed after one or two deadlines for paying monthly advance payments for the quarter in which this separate division is closed, then in the specified tax declarations for a liquidated separate division, monthly advance payments can be withdrawn only for unfulfilled payment deadlines and, at the same time, payments for the organization without the separate divisions included in it can be increased by the same amounts.

Thus, for a closed separate division, advance payments are made until the closure of such a division; all subsequent payments are made at the location of the parent organization.

For example, if a separate division is closed on August 13, 2015, the organization must submit an updated tax return for the first half of 2015 and adjust advance payments for August and September 2015.