Has a new form of calculation for insurance premiums been introduced for the 1st quarter of 2020? When and what changes were made to the form last? Who should take the RSV and when? For which reporting period should the new form be used? Where can I download a free form in an easy-to-fill format? The answer to these questions, download links and an example of filling out the DAM for the 1st quarter of 2020 are in this material.

Regulatory regulation of reporting on insurance premiums

Tax Code of the Russian Federation Part 2 Chapter 34. regulates the payment of insurance contributions by employers

Federal Law No. 167-FZ of December 15, 2001 determines payments to compulsory pension insurance

Federal Law of April 1, 1996 N 27-FZ on personalized accounting in the OPS system

Federal Law No. 125-FZ of July 24, 1998 defines the OSS of employees

Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected] – reporting forms for compulsory pension insurance on contributions, their completion and submission

[email protected] of the Federal Tax Service of Russia dated December 21, 2021 determines the completion of Section 3 of the DAM.

Calculation form for insurance premiums according to KND 115111

In 2021, all employers who make payments to employees for their labor are required to submit the DAM.

Reporting must be submitted in the form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551, consisting of 24 sheets and including information on contributions (except for injuries) and on the organization as a whole and personalized.

The correctness of filling out the calculation is checked through reconciliation: more than 300 data must converge in the DAM (Letter of the Federal Tax Service of Russia dated December 29, 2017 N GD-4-11 / [email protected] ). The Federal Tax Service website provides free software for checking ratios, and before sending the DAM, you should check for compliance. If there are discrepancies, the DAM must be corrected.

Submitting the RSV form

From January 1, 2017, powers to regulate contributions to the Federal Tax Service were transferred. Payers are legal entities and individuals with the status of an insurer and are divided into 2 groups: those who make and those who do not make payments to individuals. The RSV is handed over to the Federal Tax Service at the place of location or residence.

For the DAM for the 3rd quarter of 2021, the same form is valid, although it was planned to update the form, but most likely the update of the DAM form will be carried out in 2021.

Fixed amounts of insurance premiums payable for the billing period should be calculated in proportion to the time of activity of individual entrepreneurs who do not have employees.

Head of the Department of Taxation of Personal Income and Administration of Insurance Contributions of the Federal Tax Service of Russia M. Sergeev

Deadlines for the DAM submission for the 3rd quarter

RSV reflects information previously contained in 4 forms: RSV-1, RSV-2, RV-3, 4-FSS, and submitted to the Pension Fund and FSS.

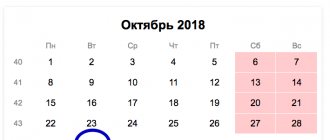

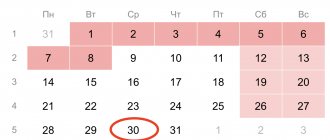

The DAM must be submitted quarterly. The data in the calculation is shown as a cumulative total and reporting is presented for: 1st quarter, half year, 9 months, year. The payment must be submitted to the Federal Tax Service no later than the 30th day of the month following the reporting month. For the 3rd quarter of 2021, the DAM must be submitted on October 30, 2021. The date of submission of the calculation is considered to be the date:

- submitting the form to the Federal Tax Service - confirmed by an acceptance mark

- sending by mail - by receipt

- transmissions via the Internet - recorded by the TKS operator

DAM is presented even in the absence of payments, i.e. An organization or individual entrepreneur must submit a zero calculation to the Federal Tax Service.

Appendix 3 to section 1: benefits costs

In Appendix 3 to Section 1, record information about expenses for the purposes of compulsory social insurance (if there is no such information, then the Appendix is not filled out, since it is not mandatory).

In this application, show only benefits from the Social Insurance Fund accrued in the reporting period. The date of payment of the benefit and the period for which it was accrued do not matter. For example, show benefits accrued at the end of September and paid in October 2021 in the calculation for the 3rd quarter. Reflect sick leave benefits that are open in September and closed in October only on an annual basis.

Benefits at the expense of the employer for the first three days of illness of the employee should not appear in Appendix 3. Enter all data into this application on an accrual basis from the beginning of the year (clauses 12.2 – 12.4 of the Procedure for filling out the calculation).

As for the actual filling, the lines of Appendix 3 to Section 1 should be formed as follows:

- in column 1, indicate on lines 010 – 031, 090 the number of cases for which benefits were accrued. For example, in line 010 - the number of sick days, and in line 030 - maternity leave. On lines 060 – 062, indicate the number of employees to whom benefits were accrued (clause 12.2 of the Procedure for filling out the calculation).

- In column 2, reflect (clause 12.3 of the Procedure for filling out the calculation):

– in lines 010 – 031 and 070 – the number of days for which benefits were accrued at the expense of the Social Insurance Fund; – in lines 060 – 062 – the number of monthly child care benefits. For example, if during the entire 3rd quarter you paid benefits to one employee, enter the number 9 in line 060; – in lines 040, 050 and 090 – the number of benefits.

An example of reflecting benefits. For 9 months of 2021 the organization:

- paid for 3 sick days. At the expense of the Social Insurance Fund, 15 days were paid, the amount was 22,902.90 rubles;

- awarded one employee an allowance for caring for her first child for July, August, September, 7,179 rubles each. The amount of benefits for 3 months amounted to 21,537.00 rubles. The total amount of benefits accrued is RUB 44,439.90. (RUB 22,902.90 + RUB 21,537.00).

Penalties for late delivery of the DAM

For submitting the DAM for the 3rd quarter of 2021 later than October 30, an organization or individual entrepreneur faces a fine. The Federal Tax Service also has the right to block accounts for failure to submit the DAM within 10 days after October 30. The report is not submitted if it contains errors specified in Article 431 of the Tax Code of the Russian Federation, of which the Federal Tax Service notifies the policyholder. Within 5 days from the date of electronic notification, the form with errors must be corrected and submitted; if the notification is sent by mail, then corrections must be submitted within 10 days from the date of sending. If corrections are submitted within these deadlines, the date of acceptance will be the day of the initial submission of the calculation.

Sanctions

Violators of the deadlines and procedures for submitting reports under the DAM face fines.

Late payment deadlines:

- Liability under Article 119 of the Tax Code of the Russian Federation. The fine will be 5% from the amount subject to additional payment based on the calculation for each full or partial month of delay. In this case, the minimum fine will be 1 thousand rubles, and the maximum will be 30% of the surcharge amount.

Important! If you correctly calculated the contributions and paid them on time, then for late delivery of the DAM you face a fine of 1 thousand rubles.

- Responsibility under Article 15.5 of the Code of Administrative Offenses for officials. This is a fine of 300-500 rubles.

Serious fines threaten those who underestimate the contribution base :

- For gross violation of accounting rules, which led to an understatement, a fine is imposed under Part 3 of Article 120 of the Tax Code of the Russian Federation in the amount of 20% of the unpaid amount, at least 40 thousand rubles.

- For non-payment or incomplete payment of insurance premiums as a result of underestimation of the base - a fine under Part 1 of Article 122 of the Tax Code of the Russian Federation in the amount of 20% of the unpaid amount of contributions.

In addition, violations of the procedure for submitting the DAM :

- if the policyholder was supposed to submit a zero calculation, but did not do so, the fine based on paragraph 1 of Article 119 of the Tax Code of the Russian Federation will be 1 thousand rubles;

- for failure to comply with the reporting form (submitted on paper, although it should have been according to the TKS), a fine will be imposed on the basis of Article 119.1 of the Tax Code of the Russian Federation in the amount of 200 rubles.

Methods for submitting the RSV in 2021

DAM for the 3rd quarter of 2021 is provided in 2 ways:

- in paper form - by policyholders with up to 25 people and in this form the verification will take 10 days

- in electronic form – by policyholders with more than 25 people, such calculations are checked automatically

- in electronic form – by policyholders with up to 25 people with a qualified signature

If an employer with more than 25 employees submits the DAM for 9 months in 2021 in paper format, then a fine will be imposed.

Making calculations for the third quarter of 2021 - example

What should the calculation of contributions for the third quarter, or more precisely, for 9 months of 2021, look like?

To independently calculate the amount of insurance premiums payable on compensation in favor of individuals, use our calculator.

Example

At Barbariska LLC, the total salary for 9 months of 2020 was 390,000 rubles. Broken down by month in the third quarter, salaries were paid as follows:

- July - 40,000 rub. (Vasiliev A.P. - 30,000, Smolnikov A.V. - 15,000 rubles);

- August - 50,000 rub. (Vasiliev A.P. - 30,000, Smolnikov A.V. - 20,000 rubles);

- September — 50,000 rub. (Vasiliev A.P. - 30,000, Smolnikov A.V. - 20,000 rubles).

Let us remind you that from April 1, 2020, contributions above the minimum wage are calculated at reduced rates for small businesses.

ConsultantPlus experts explained how to apply reduced tariffs in practice. If you do not have access to the system, get a trial demo access for free.

Based on this information, we will prepare a calculation of insurance premiums for 9 months of 2021, a sample of which can be downloaded from the link:

Procedure for filling out the ERSV 2021

| Sheet (section) | Required |

| Title page | Everyone |

| Information about an individual (not an individual entrepreneur) | Individuals who are not individual entrepreneurs and have not indicated the TIN |

| Section 1 with appendices and subsections | Everyone who paid income |

| Section 2 with appendices and subsections | Heads of peasant farms |

| Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 | paying contributions according to additional tariffs |

| Appendices 5–8 to section 1 | applying reduced tariffs |

| Appendix 9 to section 1 | paying income to foreign employees (stateless, temporarily staying in the Russian Federation) |

| Appendix 10 to section 1 | Making payments to students in student groups |

| Appendices 3 and 4 to section 1 | Those paying insurance coverage under OSS |

Pension and medical contributions: subsections 1.1 – 1.2 of Appendix 1 to Section 1

Appendix 1 to section 1 of the calculation includes 4 blocks:

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance”;

- subsection 1.2 “Calculation of insurance premiums for compulsory health insurance”;

- subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation”;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.”

In line 001 “Payer tariff code” of Appendix 1 to section 1, indicate the applicable tariff code. In the calculation for the 3rd quarter of 2021, you need to include as many appendices 1 to section 1 (or individual subsections of this appendix) as tariffs were applied during the reporting period of 2021 (from January to September inclusive). Let us explain the features of filling out the required subsections.

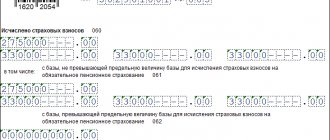

Subsection 1.1: pension contributions

Subsection 1.1 is a mandatory block. It contains the calculation of the taxable base for pension contributions and the amount of insurance contributions for pension insurance. Let us explain the indicators of the lines of this section:

- line 010 – total number of insured persons;

- line 020 – the number of individuals from whose payments you calculated insurance premiums in the reporting period (for the 3rd quarter of 2021);

- line 021 – the number of individuals from line 020 whose payments exceeded the maximum base for calculating pension contributions;

- line 030 – amounts of accrued payments and rewards in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not included here;

- in line 040 reflect:

- line 050 – base for calculating pension contributions;

- line 051 – the base for calculating insurance premiums in amounts that exceed the maximum base value for each insured person in 2021, namely 876,000 rubles (clauses 3–6 of Article 421 of the Tax Code of the Russian Federation).

- line 060 – amounts of calculated pension contributions, including:

– amounts of payments not subject to pension contributions (Article 422 of the Tax Code of the Russian Federation); – the amount of expenses that the contractor has documented, for example, under author’s order agreements (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is reflected within the limits determined by paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

– on line 061 – from a base that does not exceed the limit (RUB 876,000); – on line 062 – from a base that exceeds the limit (RUB 876,000).

Record the data in subsection 1.1 as follows: provide data from the beginning of 2021, as well as for the last three months of the reporting period (July, August and September).

Subsection 1.2: medical contributions

Subsection 1.2 is a mandatory section. It contains the calculation of the taxable base for health insurance premiums and the amount of insurance premiums for health insurance. Here is the principle of forming strings:

- line 010 – total number of insured persons for the 3rd quarter of 2017.

- line 020 - the number of individuals from whose payments you calculated insurance premiums;

- line 030 – amounts of payments in favor of individuals (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). Payments that are not subject to insurance premiums are not shown on line 030;

- on line 040 – payment amounts:

– not subject to insurance premiums for compulsory medical insurance (Article 422 of the Tax Code of the Russian Federation); – the amount of expenses that the contractor has documented, for example, under author’s order agreements (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation.

Subsection 1.3 – fill out if you pay insurance premiums for compulsory pension insurance at an additional rate. And subsection 1.4 - if from January 1 to September 30, 2021, you transferred insurance contributions for additional social security for flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.

Calculation of contributions for disability and maternity: Appendix 2 to Section 1

Appendix 2 to Section 1 calculates the amount of contributions for temporary disability and in connection with maternity. The data is shown in the following context: total from the beginning of 2021 to September 30, as well as for July, August and September 2021. In field 001 of Appendix No. 2, you must indicate the sign of insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity:

- “1” – direct payments of insurance coverage (if there is a pilot social insurance project in the region);

- “2” – offset system of insurance payments (when the employer pays benefits and then receives the necessary compensation (or offset) from the Social Insurance Fund).

Next, we will explain filling out the lines with decoding:

- line 010 – total number of insured persons for the 3rd quarter of 2017;

- line 020 – amounts of payments in favor of the insured persons. Payments that are not subject to insurance premiums are not shown in this line;

- line 030 summarizes:

- line 040 – the amount of payments and other remuneration in favor of individuals who are subject to social insurance contributions and exceed the limit for the next year (that is, payments in excess of 755,000 rubles in relation to each insured person).

– amounts of payments not subject to insurance contributions for compulsory social insurance (Article 422 of the Tax Code of the Russian Federation); – the amount of expenses that the contractor has documented, for example, under author’s order agreements (clause 8 of Article 421 of the Tax Code of the Russian Federation). If there are no documents, then the amount of the deduction is fixed in the amount specified in paragraph 9 of Article 421 of the Tax Code of the Russian Federation;

On line 050 - show the basis for calculating insurance contributions for compulsory social insurance.

Line 051 includes the base for calculating insurance premiums from payments in favor of employees who have the right to engage in pharmaceutical activities or are admitted to it (if they have the appropriate license). If there are no such employees, enter zeros.

Line 053 is filled in by individual entrepreneurs who apply the patent taxation system and make payments in favor of employees (with the exception of individual entrepreneurs who conduct activities specified in subclause 19, 45–48 clause 2 of article 346.43 of the Tax Code of the Russian Federation) - (subclause 9 p 1 Article 427 of the Tax Code of the Russian Federation). If there is no data, then enter zeros.

Line 054 is filled out by organizations and individual entrepreneurs that pay income to foreigners temporarily staying in Russia. This line requires showing the basis for calculating insurance premiums in terms of payments in favor of such employees (except for citizens from the EAEU). If there is nothing like that - zeros.

On line 060 - enter insurance contributions for compulsory social insurance. Line 070 – expenses for the payment of insurance coverage for compulsory social insurance, which is paid at the expense of the Social Insurance Fund. However, do not include benefits for the first three days of illness here (letter of the Federal Tax Service of Russia dated December 28, 2016 No. PA-4-11/25227). As for line 080, show in it the amounts that the Social Insurance Fund reimbursed for sick leave, maternity benefits and other social benefits.

Show in line 080 only amounts reimbursed from the Social Insurance Fund in 2017. Even if they concern 2021.

As for line 090, it is logical to use the formula to determine the value of this line:

If you have received the amount of contributions to be paid, enter code “1” in line 090. If the amount of expenses incurred turned out to be more than accrued contributions, then include code “2” in line 90.

Some calculations for insurance premiums submitted to the Federal Tax Service in 2021 indicate negative amounts of accrued contributions. Such data cannot be reflected on the individual personal accounts of insured persons. In this regard, policyholders who have made such an error must submit an updated calculation. The Federal Tax Service reported this in letters dated 08/23/17 No. BS-4-11/ [email protected] , dated 08/24/17 No. BS-4-11/ [email protected] Also in these letters it is reported that in line 090 the amount is always reflected in a positive value (that is, you cannot put a minus). How, then, can you report that benefit costs have exceeded assessed contributions? To do this, you need to specify the corresponding line attribute. Namely:

- “1” - “amount of insurance premiums payable to the budget”, if the amount calculated using the above formula is greater than or equal to 0;

- “2” - “the amount of excess of expenses for payment of benefits over calculated insurance premiums”, if the amount calculated according to the above formula is less than 0.

If the calculation contains negative values, the inspectors will require the necessary changes to be made and an updated calculation to be submitted to the inspection.

Filling out the title page

On the title page you do not need to fill out the part: “To be completed by an employee of the tax authority”; this part must be left blank. The rest is filled in if the information is available: INN and KPP, period code, name of the organization, OKVED code and full name of the person who signed the DAM and date, Federal Tax Service code, code of the place of reporting.

| Code | Value (by place of residence or registration) |

| 112 | individual (not individual entrepreneur) |

| 120 | IP |

| 121 | private lawyer |

| 122 | private notary |

| 124 | member (head) of the peasant farm |

| 214 | Russian organization |

| 217 | successor of the Russian organization |

| 222 | a separate division of a Russian organization |

| 335 | a separate division of a foreign organization in the Russian Federation |

| 350 | international organization in Russia |

For section 1, an appendix consisting of subsections is filled out; subsections 1.1 and 1.2 are mandatory to complete, and others - if information is available.

| Annex 1 | |

| Subsection 1.1 – calculation of the base for the OPS | |

| 010 | number of insured persons |

| 020 | number of employees from whose income compulsory pension insurance was accrued |

| 021 | number of persons whose payments exceeded the limit for pension contributions |

| 030 | payments to individuals |

| 040 | income that is exempt from taxation under Article 422 of the Tax Code of the Russian Federation |

| Subsection 1.2 – for compulsory medical insurance | |

| Appendix 2 – for OSS | |

Payments not reflected in the calculation of contributions:

- accountable amounts

- loans

- payments to the contractor-individual

- dividends

- new Year gifts

Section 2 reflects the obligations of the heads of peasant farms; it includes 1 appendix providing information about the head and members of the farm

Section 3 of the DAM reflects information separately for each employee (Section 3 is filled out separately for each), it reflects:

- TIN

- SNILS

- Full name

- Date of Birth

- employee country code

- floor

- passport details

- is or is not insured

Important! The number of sections 3 must correspond to the number of insured persons receiving income, including those dismissed (sign of a dismissed person - 1).

Subsection 3.2.1 reflects:

- payments to individuals

- base is calculated

- amount of contributions to compulsory pension insurance

Subsection 3.2.2 reflects:

- contributions at an additional rate when accruing amounts to an employee with harmful working conditions

Errors and clarification of calculations

It is possible that an error will be discovered in the calculation of contributions already submitted. Further actions depend on whether the error led to an underestimation of the amount of contributions. If it is, then the policyholder, regardless of his wishes, must submit an updated calculation. If not, then submitting clarifications is the right, but not the obligation of the policyholder.

The updated calculation must include those sections and appendices that were previously submitted to the Federal Tax Service. You only need to fill out other sections and appendices if additions are made to them.

There is one exception to this rule. It refers to section 3, that is, to personalized information. When submitting an updated calculation of premiums, the policyholder must, in any case, include section 3. But not for all insured persons, but only for those in respect of whom clarifications and additions were made. In this case, you must fill in all the fields of section 3 - both those requiring and not requiring adjustments.

The need to submit a zero RSV

If policyholders did not make accruals and payments to individuals in the reporting period due to, for example, suspension of activities, then these employers must submit a zero DAM form for the 3rd quarter of 2021.

However, not all sections of the calculation are required to be completed. The payer (except for the head of the peasant farm) needs to formalize:

- title page

- sections 1 and 3

- subsections 1.1, 1.2

- appendices 2 and 3

In the zero DAM, for indicators where there should be numbers, zeros are entered, and in others - dashes.

In section 3, the page with personal data for the manager is filled out, and the subsections are not filled out because no payments were made.

Section 3: personalized accounting information

Section 3 “Personalized information about insured persons” as part of the calculation of insurance premiums for the 3rd quarter of 2021 must be filled out for all insured persons for July, August and September 2017, including those in whose favor payments were accrued for the 3rd quarter of 2021 within the framework of labor relations and civil contracts. Subsection 3.1 of Section 3 shows the personal data of the insured person - the recipient of the income: Full name, Taxpayer Identification Number, SNILS, etc.

Subsection 3.2 of Section 3 contains information on the amounts of payments calculated in favor of an individual, as well as information on accrued insurance contributions for compulsory pension insurance. Here is an example of filling out section 3.

Example. Payments were made to the citizen of the Russian Federation in the 3rd quarter of 2021. Contributions accrued from them for compulsory pension insurance are as follows:

| Index | July | August | September | 3rd quarter |

| All payments | 28000 | 28181.45 | 28000 | 84181.45 |

| Non-taxable payments | — | 4602.9 | — | 4602.9 |

| Contribution base | 28000 | 23578.55 | 28000 | 79578.55 |

| Contributions to OPS | 6160 | 5187.28 | 6160 | 17507.28 |

Under these conditions, section 3 of the calculation of insurance premiums for the 3rd quarter of 2021 will look like this:

Please note that for persons who did not receive payments for the last three months of the reporting period (July, August and September), subsection 3.2 of section 3 does not need to be filled out (clause 22.2 of the Procedure for filling out the calculation of insurance premiums).

Copies of section 3 of the calculation must be given to employees. The period is five calendar days from the date when the person applied for such information. Give each person a copy of Section 3, which contains information only about them. If you submit calculations in electronic formats, you will need to print paper copies.

Give the extract from Section 3 to the person also on the day of dismissal or termination of the civil contract. The extract must be prepared for the entire period of work starting from January 2021.

Error when submitting ERSV in the absence of payments

Contribution base – the sum of all remunerations for the billing period, except for amounts not subject to contribution. The base is determined separately for each insured person on an accrual basis.

The base of contributions to compulsory pension insurance and contributions to social insurance has a limit, beyond which contributions are not collected. With the exception of contributions for the main category of payers for compulsory pension insurance - 22%, payments in excess of the contribution base for compulsory pension insurance amount to 10%.

The maximum base value in 2021 is: OPS - 1,021,000 rubles, OSS - 815,000 rubles.

Answers to common questions

Question No. 1 : How is SNILS checked?

Answer : The Federal Tax Service uses the following algorithm when checking the accuracy of SNILS. The SNILS control number is determined as follows:

- each digit is multiplied by its position number

- these products are summed up

- the last 2 digits of the remainder are a control number that should not be more than 100.

Question No. 2 : What is the amount of contributions for individual entrepreneurs?

Answer : In 2021, the OPS is 26,545 rubles. (if the payer’s income is not higher than 300,000 rubles), if the income is over 300,000 rubles. a fixed amount of 26,545 rubles is paid. + 1% of the amount of income in excess of 300,000 rubles, but not more than 212,360 rubles. (8*26545 rub.). Compulsory medical insurance is paid in a fixed amount of 5840 rubles.

FAQ

Question: Is it necessary to indicate the amount of maternity benefits - hospital benefits and child care benefits in the calculation?

Answer: This declaration indicates all payments to employees. The report has a separate line to indicate payments that are not subject to insurance premiums.

Question: How can I indicate in my calculations that an entrepreneur applies a reduced rate of insurance premiums?

Answer: The report must indicate the tariff code. The reduced tariff corresponds to the tariff code - 08.

Question: How to submit a report if the due date falls on a day off?

Answer: In this case, the report must be submitted no later than the first working day following the day off.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Free legal advice Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call