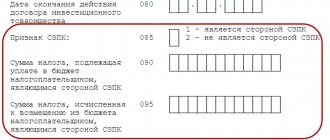

Which form to fill out The current form of the corporate income tax return is approved by Appendix No.

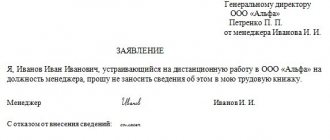

An employment contract without a work book is a contract that can be drawn up

By force of law, each company maintains a number of mandatory and auxiliary documents at the local level,

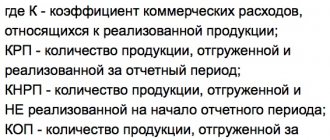

Any business involves certain types of costs. Among them, a significant place is occupied by the so-called commercial

Personal protective equipment (PPE) is used, as a rule, in manufacturing enterprises and in work requiring

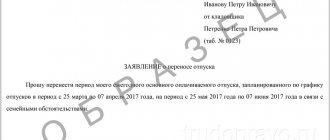

One of the types of rest guaranteed to the working population by Article 107 of the Labor Code is vacation. According to

Accounting Alexey Borisov Leading expert on labor relations Current as of March 25, 2020

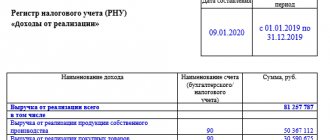

All taxpayers must maintain tax records for income tax in special registers. Tax

On September 9, 2021, the order of the Federal Tax Service of Russia, registered with the Ministry of Justice, was officially published

An important point: if an employee voluntarily works longer than expected, such overtime work is not