Accounting

Alexey Borisov

Leading expert on labor relations

Current as of March 25, 2020

Accountable debts on the balance sheet can be shown as either an asset or a liability. It all depends on who owes whom at the reporting date - the employee owes the employer or vice versa. Where do I get the figures for the balance sheet for accountable amounts and in which lines should I place them? What are the rules to take into account? This will be discussed in our material.

Data source - account 71

The balance sheet includes the debt of employees and the employer for accountable amounts from accounting. All necessary information is accumulated on account 71 “Settlements with accountable persons.

The debit of account 71 reflects the amounts issued to employees:

- for various administrative and economic needs: purchase of stationery, payment for repair services for office equipment, purchase of household chemicals and cleaning products for office cleaning, etc.;

- to pay for travel expenses: purchasing tickets, paying for rented accommodation on a business trip, hotel services, etc.;

- for entertainment and other similar expenses.

Entries on the debit of account 71 are made on the basis of supporting documents: cash receipts orders or bank statements, depending on the source of payment: from the cash register in cash or in non-cash form through a bank account to the accountant’s card.

If an employee spent more than was given to him, the debit of account 71 reflects the amount of repayment by the employer of the overexpenditure to the employee.

Reserves at the enterprise

The provision for doubtful debts relates to the liabilities of the enterprise

Now let’s define the nuances: the reserve for doubtful debts is an asset or a liability in accounting.

In this situation, it is appropriate to consider the basic terms.

Note that the company's financial assets relate to its own part of the company's liabilities.

Accordingly, accountants reflect material and monetary funds formed to stabilize the liquidity of the enterprise in the passive part of the balance sheet.

The formation of a reserve for doubtful debts is determined by special nuances. This amount, by law, is a maximum of 10% of the organization’s revenue.

For this reason, specific figures here are calculated based on the determination of profit in the tax or reporting period. Moreover, here in accounting this position is reflected in credit account 63 with correspondence on the account. 91.02 “Other expenses”.

Note! A correctly completed accounting does not show account balances 63. Moreover, immediately when indicating the amount of debts of debtors, the economist reduces the amount of debt by the figure indicated in the RSD.

The formation of a reserve for doubtful debts is possible only if a certain procedure approved by law is followed

Keep in mind that the use of such a reserve is allowed only in a situation where the loss caused by the appearance of a hopeless arrears is covered. Such nuances are stipulated by Article 266 of the Tax Code of the Russian Federation .

Note that here the tax period is considered to be the calendar year, and the reporting period is the first quarter, half a year and 9 months, respectively.

Don’t forget, the procedure for forming a fund is established by law and requires clear grounds, confirmed by documentation and inventory.

This will require initial agreements with indebted counterparties and papers confirming the actual insolvency of the partner. Here they use extracts from the Unified State Register of Legal Entities, information on the registration of a partner, or a copy of documents from the court about the beginning of the bankruptcy procedure.

Nuances of accounting

Let's talk about options for reflecting RSD in an organization's accounting department. Unspent funds are written off here under the item “Other income” by posting D-63, K-91.01. If the reserve is accrued, account 63 becomes a credit account, and 91.02 becomes a debit account. True, here the entry is already in the enterprise expenses line.

Here economists use account entries 63

In this publication, readers will learn about ways to replace the debtor's assets during external administration and bankruptcy proceedings.

An increase in such a fund is reflected in the same scheme. But when it comes to reducing the reserve, the posting takes on the following form: D-63, K-91.01, but under the item “Other income”. A similar entry is made in the case of restoration of a previously accrued fund. As for writing off arrears at the expense of the fund, here the entry becomes as follows: D-63, K-62, K-58 or K-76.

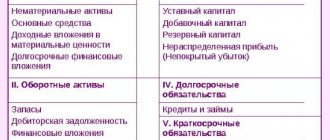

Filling out the balance: two general rules

If on the date of drawing up the balance sheet for account 71 you have non-zero debit and/or credit balances, the “accountable” debt must be reflected in it. In this case, two important rules should be observed:

This means that the debt of reporting entities is reflected in the balance sheet in expanded form: separately for debit and credit - if the relevant data is available in the records.

The second rule for reflecting settlements with accountables in the balance sheet is related to the period of circulation (repayment) of accountable amounts:

Typically, settlements with accountable persons occur multiple times within a calendar year, that is, they are short-term in nature. Therefore, they are reflected in the assets of the balance sheet in section II “Current assets”, and in the liabilities in section V “Current liabilities”.

If, based on the specifics of the company’s work and the specifics of relationships with accountable persons, certain amounts are repaid within a period exceeding 12 months after the reporting date, these amounts should be shown in the balance sheet based on the general rules - as part of long-term assets.

Reflection of taxes and fees

Thus, the credit balance determines the financial obligations of the enterprise, and the debit balance determines advance payments with overpayments

The next problem faced by employees of the economic department is debt to the budget.

An accounting asset or liability is filled in in this situation, we will look into it below.

According to financiers, the same rule applies here as in the case above.

Accordingly, accounts become transferred from the active part to the passive section . Please note that such nuances apply to all settlement transactions of the enterprise.

Transactions for the transfer of budget payments are carried out on account 68 . The loan in this situation reflects the amounts of arrears and actual accruals.

Accordingly, income tax is entered into the accounting department in the form of an entry: D-99, K-68. The personal income tax reflection looks like this: D-70, K-68. But the receipt of money into budget accounts requires a debit entry.

Thus, the credit balance determines the financial obligations of the enterprise, and the debit balance determines advance payments with overpayments.

Correct distribution of balance sheet items among budget payments is the key task of an accountant

Note that particular difficulties arise here when determining VAT accounting. This fee is paid when selling services or products of the enterprise. In addition, value added tax is also reflected in purchase and sale transactions of company property.

For these reasons, when making an accounting entry, associate account 68 with positions 90–91 . In situations where this contribution is deductible, it is appropriate to refer to accounts 19–20, 23 and 29.

As you can see, knowledge of the nuances of accounting guarantees the absence of misunderstandings with the tax service. Remember, correctly reflected positions on the payment of budget fees here become a key point for the smooth functioning of the company.

Please note that in order to correctly reflect financial income and losses, the purpose of the payment and the balance of the amount in the counterparty’s accounts are important.

Reportable debts in a simplified balance sheet

Debt on accountable amounts must also be reflected in the simplified balance sheet. The same rules and approaches apply as described above for a regular balance.

The only clarification is that in the simplified balance sheet, the lines where accountable debt falls are called slightly differently:

Let us remind you that clause 4 of Art. 6 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. Small enterprises, non-profit organizations, and participants in the Skolkovo project have the right to draw up a simplified balance sheet using the form from Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Topic: Accounting and double entry method

Subject: Fundamentals of Accounting Topic: Accounting accounts and the double entry method Topic of the lesson: Active-passive accounting accounts Active-passive accounting accounts Active-passive accounts keep records of settlements with various organizations or individuals, as a result of which mutual obligations may arise that called accounts receivable or accounts payable. If an enterprise uses borrowed funds, then it has accounts payable to other organizations or individuals who are creditors of this enterprise.

If the enterprise is owed by other organizations or individuals, then these debtors are called debtors, and their debt to the enterprise is receivable. Scheme of an active-passive account Debit Credit Initial balance - the presence of accounts receivable at the beginning of the reporting period Initial balance - the presence of accounts payable at the beginning of the reporting period Debit turnover: increase in accounts receivable; reduction in accounts payable Loan turnover: increase in accounts payable; reduction in accounts receivable Final balance - the presence of receivables of the enterprise at the end of the reporting period (when it, the enterprise, is owed) Final balance - the presence of accounts payable to the enterprise at the end of the reporting period (when it, the enterprise, owes) Debtors owe the enterprise, and the enterprise itself owes creditors .

The word “debit” is derived from the Latin word debet, which means “should,” and “credit” is derived from the Latin word credo, which means “to believe.” Active-passive accounts may have both debit and credit balances; in some cases, these accounts may have both debit and credit balances.

We recommend reading: How to register a family in official housing

Penalty for errors in reporting

If you show the final balance of payments in the balance sheet (the difference between accounts receivable and accounts payable on account 71), the indicators on line 1230 “Accounts receivable” of the asset and line 1520 “Accounts payable” on the liability side of the balance sheet will be unreliable. And this is fraught with negative consequences: a distortion of any balance sheet indicator by 10% or more is considered a gross violation of accounting rules.

The punishment for this violation is a fine on company officials from 5,000 to 10,000 rubles. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation). If the violation is committed and detected again, the fine will double. And the top officials of the company may be disqualified for a period of 1 to 2 years.

An example of filling out a balance sheet

As of 04/01/2020, the accountable Simonov S. has an overexpenditure of one amount received under the report in the amount of 1000 rubles. and debt on the second in the amount of 5,000 rubles. The deadline for the report has not yet arrived. The amounts are reflected in the opening balances.

In the second quarter, S. Simonov received 1,000 rubles from the cash register. (debit turnover) and compiled an advance report for the second amount in the amount of 4,500 rubles. (credit turnover).

After this, another accountable Vasiliev A. received an amount for household needs - 2800 rubles. (debit turnover).

Now the ending balance in the statement will look like:

Simonov S. - final debit balance: 500 rub.

Vasiliev A. - final debit balance: 2800 rub.

The company records settlements with accountants using subaccount 71.01 “Settlements with accountants in rubles.”

Note! An employee can receive a new sum of money against the report before the previous one is fully settled.

Let's sum it up

- When forming a balance sheet, “accountable” calculations are reflected in the following order: the debt of the reporting person to the company is in the balance sheet asset on line 1230 “Accounts receivable”;

- the company’s debt to the accountable person is in the liability side of the balance sheet on page 1520 “Accounts payable”.

If you find an error, please select a piece of text and press Ctrl+Enter.

Postings and accounting of unreturned imprest amounts

Amounts not returned on time by the accountable person are shown on credit account 71 in correspondence with account 94 “Shortages and losses from damage to valuables”:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Dt 94 Kt 71 - writing off amounts not returned by the accountable as shortages.

Thereafter, depending on the circumstances, such amounts may be reflected as follows:

- deductions from the employee’s salary - Dt 70 Dt 94;

- other settlements with employees - Dt 73 Dt 94.

The unspent amount of the account can be withheld from the employee’s salary only within one month after the date by which the advance must be returned (Article 137 of the Labor Code of the Russian Federation). The deduction is made on the basis of a written order from the manager with the consent of the employee.

In all other cases, this amount is included in other expenses with the employee.

Note! According to Art. 138 of the Labor Code of the Russian Federation, the amount of deduction cannot exceed 20% of the wages paid to the employee.

Active and passive accounting accounts - differences

> > > September 19, 2021 Active and passive accounting accounts are types of accounting accounts, determined based on their function and purpose. In our material, the reader will learn about which accounts are called active and which are passive, and will get acquainted with an example of recording transactions on accounts of different types.

In accounting, all business transactions are recorded in the form of accounting entries using special created accounts, each of which is assigned a unique number.

Similar transactions are grouped in separate accounts. The name of the account directly indicates the specifics of the transaction reflected on it.

All changes that directly occur with economic assets and their sources lead to their change in monetary terms. The list of accounts officially approved in the Russian Federation - Chart of Accounts - is suitable for use in any industry. For example, an accountant of a furniture factory will take into account lumber and furniture fittings on account 10 “Materials”, an accountant of a legal consultation will take into account pens and paper, etc.

n. In practice, enterprises use only accounts that correspond to the specifics of the type of activity in which they are engaged. The accounts used by the enterprise constitute the Working Chart of Accounts of the enterprise, which in turn is an integral part of the Accounting Policy.

For information on applicable accounts in 2021, see the material. The account has a tabular form: the left side is called “debit”, the right side is called “credit”. To indicate the balance of an account either at the beginning or at the end of a period, the term “balance” exists.

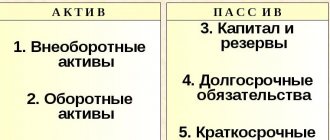

Accounting accounts are either active or passive.

The accounts on the sides of the balance sheet are named and correspond to their contents.

The structure of the accounts is similar (both active and passive accounts have sides called “debit” and “credit”), but the meaning of these sides is different - it is important to remember this. Active accounts are those that are used to record information about the property of the enterprise.

For example: money, incl.

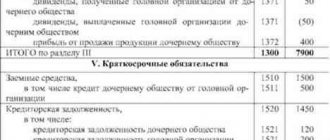

Debt of accountable persons asset or liability

similar amounts;

· accrued income from participation in the capital of the organization, etc.

The debit of account 70 “Settlements with personnel for wages” reflects the paid amounts of wages, bonuses, benefits, pensions, etc., income from participation in the capital of the organization, as well as the amount of accrued taxes, payments under executive documents and other deductions.

Amounts accrued but not paid on time (due to the failure of recipients to appear) are reflected in the debit of account 70 “Settlements with personnel for wages” and the credit of account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for deposited amounts”). .

Analytical accounting for account 70 “Settlements with personnel for wages” is maintained for each employee of the enterprise.

Table 5.1 shows typical entries for accounting for settlements with personnel for wages.

Table 5.1

| Contents of operation | Corresponding accounts | |

| Debit | Credit | |

| 1 | 2 | 3 |

| Wages accrued to employees of primary and auxiliary production, as well as those involved in sales and sales of products | 20, 23, 44 | 70 |

| Wages were accrued to employees of the general production and general economic departments, as well as service industries and farms | 25, 26, 29 | 70 |

| Wages accrued to employees involved in the procurement and purchase of materials, capital investments, non-capital investments | 10, 12, 08, 30 | 70 |

| Excess amounts paid (wages, etc.) are entered into the cash register - correctional entry | 50 | 70 |

| Temporary disability benefits and other accruals were accrued at the expense of extra-budgetary funds | 69 | 70 |

| Amounts due to employees at the expense of other enterprises, third parties, etc. | 76 | 70 |

| When reserves are created, vacation pay is accrued in accordance with the established procedure - remuneration at the end of the year | 86 | 70 |

| Income tax, unified social tax, according to writs of execution, from the perpetrators of the marriage, for compensation for material damage were withheld from accrued wages and other payments. | 70 | 68, 69, 76, 28,73 |

| Amounts due to employees for wages were paid from the cash desk, transfers were made from bank accounts | 70 | 50, 51,52, 55 |

| Accountable amounts not returned on time are withheld | 70 | 71 |

| Debt under writs of execution has been repaid | 76 | 50, 51 |

| Transfer of income tax and unified social tax to the budget | 68, 69 | 70 |

Go to page: 1

234

| Home » Accountant » Debt of accountable persons |

Amount of amounts issued

The legislation does not establish any restrictions on the amounts given to employees on account.

However, by paying expenses, the accountable person acts on behalf of the company. Consequently, the employee who received the money on account must comply with the maximum amount of cash payments (100,000 rubles under one agreement). This was established by Bank of Russia Directive No. 3073-U dated October 7, 2013.

If an employee violates the established settlement limit, your organization may be fined. The amount of the fine is from 40,000 to 50,000 rubles.

For the same violation, the head of your organization may be subject to a fine of 4,000 to 5,000 rubles (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

EXAMPLE If an employee paid 100,001 rubles from accountable money to another organization in cash under one agreement. (with a settlement limit of 100,000 rubles), your company may be fined in the amount of 40,000 to 50,000 rubles, and the manager - in the amount of 4,000 to 5,000 rubles. If the amount exceeds 100,000 rubles, your employee will pay cash register of another organization not under one, but under different agreements (for example, under a contract for the sale and purchase of goods - 50,000 rubles, and under a supply agreement - 51,000 rubles), there will be no violation. Thus, the accountable person cannot pay under one agreement more than 100,000 rubles, but may have more than 100,000 rubles under the report.

Who can be an accountable person

Employees of the organization, when carrying out business transactions and for going on business trips, receive funds in advance from the accounting department for the implementation of these goals. They are the accountable persons for the institution. Such a person must have a number of qualities:

- This must be an individual.

- Such a citizen must officially be in an employment relationship either with an enterprise (legal entity) or with an individual who has the status of an entrepreneur.

- An employment contract in any form must be concluded between such a person and the organization, i.e. the employee can be hired for permanent or temporary work.

Accountable persons are given an advance for future expenses

The list of persons who can be allocated sums of money to carry out their activities must be endorsed by the head of the enterprise. To regulate this process, accountants use the Rules for Conducting Cash Transactions. For example, before receiving a new advance, each responsible person must fulfill the obligation to provide a report on previously issued amounts.

The main acts that regulate the process

The main documents that accountants must rely on when working with the debts of accountable persons were compiled by employees of the Central Bank of the Russian Federation, the Main Treasury and the Ministry of Finance.

When working, the following acts must be taken into account:

- Directive of the Central Bank of the Russian Federation No. 3210 - U “On the procedure for conducting cash transactions.” This document regulates the procedure for issuing funds to employees of the institution.

- Directive of the Central Bank of the Russian Federation No. 3073 - U “On cash payments.”

- Order of the Treasury of the Russian Federation No. 10n “On approval of the rules for providing cash.” This document reflects the procedure for crediting funds to the bank cards of the institution’s employees.

- Order of the Ministry of Agriculture No. 68 of January 29, 2002

Passive balance: decoding lines

To solve the problem, we will indicate on the debit or credit of which account the balance amounts will be reflected (Table 3.3).

Using this option, the accountant will invariably be faced with the question of whether it is necessary to accrue the amount of UST and contributions for compulsory social insurance against accidents at work and occupational diseases for the amount of the unreturned advance, if this amount is taken into account as part of the income of an individual.

What is an Advance – certain funds that are issued as an advance payment before the shipment of goods, provision of services, or completion of work. This is a payment towards future costs, payment for products. An advance guarantees that payment will be made. A similar position is presented in Interpretation T 16/2013-KpT “VAT on advances issued and received.” BMC methodologists indicated: accounts receivable for advances paid for the purchase of equipment, goods, works, services, etc. show in the reporting the organization’s right to receive the objects provided for in the contract in the appropriate configuration, quantity and proper quality.