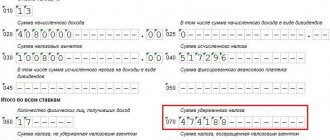

The amount of withheld tax in 6-NDFL is line 070. It reflects the amounts calculated and

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

First, a little theory. Production cost accounting is directly related to product output and cost calculation.

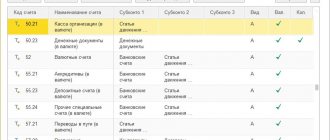

To account for VAT calculations, use account 68 “Calculations for taxes and fees” and

Accounting in an organization and an enterprise is carried out on the basis of legally established rules and

“Equipment for installation” (account 07) is an accounting account that is used to reflect the costs of

Active accounts are accounts for recording the movement of company assets, that is, for reflecting

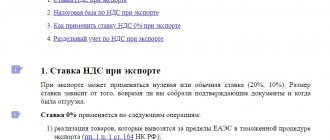

Exporting goods and own products outside of Russia is a financially profitable operation for taxpayers.

Individual entrepreneurs in their activities are faced with the need to fill out various documents. Most of them

October 7, 2019 Finance Lazareva Valeria As you know, every employer plays the role of a tax agent