All taxpayers must maintain tax records for income tax in special registers. Tax accounting is organized on its own, and the procedure for maintaining it is fixed in the tax accounting policy (Article 313 of the Tax Code of the Russian Federation). Tax registers in which accounting is kept are also developed independently, since tax authorities do not have the right to establish mandatory accounting forms. In this article we will look at what tax registers are, how they are maintained, and provide examples of filling them out.

How to create a tax accounting register

To use tax accounting registers, you will have to spend time developing their form, and then consolidate them in the annex to the accounting policy by issuing the appropriate order (paragraph 7 of article 314 of the Tax Code of the Russian Federation).

Read about the nuances of developing a tax accounting policy in the article “How to draw up an organization’s tax policy?” .

The legislator does not limit taxpayers in choosing the type and form of these documents, so tax accounting registers may look different. The volume of information contained in them should give an idea of the basis on which documents and how the tax base is formed. The placement of data in the register can be any (in tabular or text form) - these features are provided for when developing tax accounting register forms.

The only thing you cannot be proactive about when preparing tax registers is the required details. Their composition must comply with the Tax Code of the Russian Federation. For example, when calculating income tax, tax accounting registers containing the following information are used (paragraph 10, article 313 of the Tax Code of the Russian Federation):

- register name;

- date of compilation;

- natural (if possible) and monetary measures of the operation;

- name of accounting objects or business transactions;

- signature of the person responsible for compiling the register and its decoding.

Such registers can be maintained in any way convenient for the taxpayer: on paper or electronically.

What tax registers exist for VAT? See the answer to this question in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

Required details

The lack of unified formats does not give taxpayers absolute freedom in creating registers. Thus, officials have provided a number of mandatory details, in the absence of which the document cannot be considered RNU. These include:

- Name of accounting documentation. For example, a company decided to use a payslip as the RNU for personal income tax. Therefore, the name of the document “payroll” cannot be left. The form must be adjusted by changing the name, otherwise the document cannot be considered a NU register.

- Compilation date and period. These details should be determined without difficulty. A document that is generated over an indefinite period of time cannot be considered accounting documentation. The date of creation (formation, compilation) must also have a specific meaning.

- Monetary or in-kind expression of transactions. That is, the RNU must necessarily contain information about the expression in which a specific operation was performed. For example, an employee’s income is accrued in rubles or received in kind.

- Name of the business transaction. Any fact of the entity’s economic activity must be reflected in accounting, and therefore, the operation must have a specific name. For example, income is accrued, a deduction is provided, tax is withheld, an insurance premium is transferred, and so on.

- Information about the responsible executor, his full name, position and signature. Forms of analytical tax accounting registers must be prepared accordingly, and also certified by the signature (with transcript) of the responsible person.

Consequently, analytical RNU are consolidated (generalized) forms of fiscal accounting, the data of which are systematized and grouped accordingly (Chapter 25 of the Tax Code of the Russian Federation) for a certain period of time (reporting period), without division into accounting accounts.

Requirements for tax registers

From Art. 314 of the Tax Code of the Russian Federation it follows that tax accounting registers (TA) are filled out on the basis of primary accounting documents continuously in chronological order. This means that random or unfounded entry of data into the register, as well as omissions or any deletions are not allowed.

IMPORTANT! There is no decoding of the phrase “primary accounting document” in the Tax Code of the Russian Federation, therefore the primary accounting document can serve as confirmation of the entries in the NU (letter of the Ministry of Finance of Russia dated January 17, 2014 No. 03-03-06/1/1156).

We should not forget that the generated tax registers must be protected from unauthorized correction. Any errors in tax accounting registers are corrected only with appropriate justification, and the responsible executor certifies all adjustments made with his signature and indicates the date.

IMPORTANT! Information reflected in tax registers is a tax secret. For its disclosure (including by tax authorities), administrative and criminal liability is provided (letter of the Ministry of Finance of Russia dated April 12, 2011 No. 03-02-08/41).

Read more about the requirements for tax accounting and tax registers here.

Special requirements

In addition to the mandatory details, officials also provided a list of special requirements for maintaining and filling out the RNU (Article 313 of the Tax Code of the Russian Federation):

- information is entered in chronological order, continuously;

- analytical accounting reveals the procedure for forming the tax base;

- the procedure for storing documentation excludes unauthorized access;

- making unreasonable adjustments, corrections and additional entries is unacceptable;

- corrections must be made in accordance with current recommendations;

- correction records must be certified by the responsible person.

In addition, it should be remembered that RNU are the subject of tax secrecy. Persons who have access to RNU are personally responsible for the disclosure of this information.

Tax accounting registers for income tax

To fill out a “profitable” declaration, you will need at least 2 NU registers: one for accounting for income, the other for expenses. Information about income received and expenses incurred, generated according to NU norms, will make it possible to determine profit - an object of taxation, without which the calculation of the income tax itself is impossible.

Read about what the tax base for different types of taxes may be in the article “Basic elements of taxation and their characteristics .

Additional registers will have to be drawn up in the case where the taxpayer has many types of activities, and also, in addition to standard business transactions, operations are carried out with special conditions for the transfer of ownership or for which a special procedure for forming the tax base is provided.

IMPORTANT! If the taxpayer cannot or does not want to develop tax accounting registers, but does not want to be punished under Art. 120 of the Tax Code of the Russian Federation for their absence, he has the right to use ready-made ones. Their forms can be found in the recommendations of the Ministry of Taxes of Russia “Tax accounting system recommended by the Ministry of Taxes of Russia for calculating profits in accordance with the norms of Chapter 25 of the Tax Code of the Russian Federation” dated December 19, 2001.

Example

Specialists of Ritm LLC reflect the information necessary for calculating income tax for the year in the following tax accounting registers (RNU):

- RNU "Income from sales" LLC "Rhythm";

- RNU "Expenses that reduce sales income" LLC "Rhythm";

- RNU "Non-operating income" LLC "Rhythm";

- RNU "Non-operating expenses" LLC "Rhythm".

Taking into account that during the specified period, Ritm LLC had no non-operating income and expenses, let us dwell in more detail on the preparation of tax registers for income received and expenses incurred for core activities.

ConsultantPlus experts spoke about the nuances of organizing tax accounting for income tax. Get trial access to the K+ system and move on to the Ready-made solution for free.

How many lines in the declaration - how many registers?

Having dealt with the main points regarding the status and essence of tax registers, let's talk about responsibility. Legally, a fine directly related to tax registers is established in only one article of the Tax Code. We are talking about Article 120 of the Tax Code of the Russian Federation as amended by last year’s Federal Law No. 229-FZ, which equated tax accounting registers with accounting registers. Now the absence in the organization of both those and others is recognized as a gross violation of the rules for accounting for income, expenses and objects of taxation. For this, the organization faces a fine of 10 to 40 thousand rubles, depending on the duration of the violation and its impact on the size of the tax base (if the lack of a register resulted in its underestimation, the fine is higher).

However, in practice, inspectors try to fine organizations not only for the complete absence of registers. For example, the following situation is common: during an inspection, inspectors ask the taxpayer for tax accounting registers. At the same time, the list of such registers, as a rule, is formed by the inspectors themselves, based on the lines of the declaration. And accordingly, for each document not submitted, a fine is imposed under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. And if the taxpayer expresses disagreement, they also threaten to apply Article 120 of the Tax Code of the Russian Federation, that is, to fine him for a gross violation of tax accounting rules.

But as we have already found out, the Tax Code does not contain a requirement that registers must be built according to the lines of the declaration. Or, simply put, the Tax Code of the Russian Federation does not require that each line of the declaration be justified by the corresponding register. Accordingly, such a requirement from inspectors is illegal. The organization has the right to decide for itself which registers to create separately as tax accounting registers, where it will use accounting registers, and where it will supplement these registers with the necessary tax data (Article 313 of the Tax Code of the Russian Federation). So inspectors can only ask for those registers that justify the data in the declaration. And it is not at all necessary that the number of these registers will coincide with the number of declaration lines.

The courts also confirm this conclusion. In particular, the Federal Antimonopoly Service of the Volga District, in its resolution dated July 14, 2009 No. A65-27027/2007, indicated that analytical accounting maintained by the taxpayer is needed to summarize information when determining the tax base. At the same time, the analytical register of tax accounting can characterize any element of the tax base at the choice of the taxpayer.

So, a taxpayer can be held accountable only for failure to submit those registers that he really must maintain in accordance with his accounting policies. If the inspection requires those registers that the taxpayer does not maintain and did not intend to maintain, then there can be no talk of any liability (Resolution of the Federal Antimonopoly Service of the North-Western District dated October 10, 2005 No. A42-7611/04-15).

“Profitable” register of NU

Continuation of the example

The income of Ritm LLC in the reporting period consisted of the following components:

- revenue from sales of self-made products (RUB 50,367,000);

- revenue from sales of purchased products (RUB 30,590,000)

- proceeds from the sale of other property (RUB 300,000);

IMPORTANT! It is necessary to take into account in the “income” part the entire amount of products sold during the reporting period, with the exception of the income listed in Art. 251 Tax Code of the Russian Federation.

About what income is reflected in Art. 251 of the Tax Code of the Russian Federation, read the material “Art. 251 of the Tax Code of the Russian Federation: questions and answers" .

IMPORTANT! When drawing up the RNU “Income from sales”, one should not forget that revenue in the register and tax return must be indicated without taking into account VAT and excise taxes (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Information for filling out the “income” RNU is taken from accounting data (according to accounts 90 “Sales” and 91 “Other income and expenses”).

On our website you can download completed tax accounting registers, a sample of which relating to income is drawn up according to the data in the example discussed.

Register of accounting for non-operating expenses of the current period

The register is formed to determine the total amount of non-operating expenses taken into account as expenses of the reporting period.

The composition of non-operating expenses and losses, which for tax purposes are equated to non-operating expenses, is determined by Article 265 of the Tax Code of the Russian Federation.

The register provides the ability to display information both for all and for a specific type of non-operating expenses, which allows for a detailed interpretation of lines 040, 041 of sheet 02 of the Declaration.

The procedure for register formation

The procedure for register formation is shown in Figure 1.

Fig.1. The procedure for register formation

The register is called from the menu item “Tax accounting - Registers for generating reporting data - Register for accounting for non-operating expenses of the current period.”

The register is formed on the basis of entries to the debit of account N09 “Non-operating expenses” for the reporting period. Each such posting corresponds to a line of a given register; therefore, in the future, when describing register indicators, we will mean the posting based on the data of which the line was generated. Expenses associated with transactions on financial instruments not traded on an organized market are not reflected in the register.

The report provides for the output of information both in general for all types of non-operating expenses, and for each type of expense.

Composition of register indicators

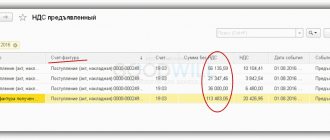

For an example of filling out the register, see Figure 2.

Rice. 2. Register of accounting for non-operating expenses of the current period

Date of operation.

The date of the transaction corresponds to the date of acceptance of non-operating expenses for accounting (posting date).

Type of expense.

The indicator reflects the type of non-operating expenses.

Indicator values are elements of the “Non-operating expenses” enumeration. The following values for the “Consumption type” indicator are possible:

- maintenance of leased property;

- interest on debt obligations;

- banking services;

- fines, penalties, penalties;

- losses from previous years;

- debts that are unrealistic to collect;

- exchange rate and amount differences;

- purchase and sale of foreign currency;

- revaluation of property;

- formation of reserves for doubtful debts;

- loss from assignment of the right of claim;

- VAT on written off accounts payable;

- transactions with financial instruments traded on an organized market;

- negative difference from property revaluation;

- other non-operating expenses.

When creating an entry to the debit of account N09, reflecting non-operating expenses accepted for tax accounting, the type of non-operating expenses to which this expense relates is indicated as the value of the debit subaccount.

The type of expense indicated in the posting is reflected in this indicator.

Name of the expense transaction.

Information about the transaction that resulted in the appearance of the amount of non-operating expenses recognized as expenses of the reporting period for tax purposes. The indicator value is the content of the transaction.

Sum.

This indicator indicates the amount of non-operating expenses incurred. The value of the indicator is the amount of the posting to the debit of account N09.

Total amount of expenses.

This indicator reflects the full amount of non-operating expenses and losses, equated to non-operating expenses, of the reporting period and is formed by summing the values of the “Amount” indicator and is reflected as its total value.

How to fill out the “expenditure” tax register

Taxpayers may experience certain difficulties filling out expense registers. This is due to the fact that the recognition of expenses in tax accounting does not always coincide with the reflection of similar expenses in accounting. So it is not always possible to use accounting registers without making additional adjustments to them.

For example, certain types of expenses are reflected in full in the accounting system, but are normalized in the accounting system (advertising, representative expenses, etc.). And tax legislation generally prohibits recognizing some types of expenses as expenses that form the taxable base for income tax.

Read about the nuances of recognizing other expenses associated with production and sales here.

Continuation of the example

A specialist from Ritm LLC formed a RNU “Expenses that reduce sales revenue”, which reflected the following types of expenses: costs for basic raw materials and supplies, wages along with accrued insurance premiums, depreciation of property of Ritm LLC, expenses for heat, water, electricity, etc.

The accountant took the information to fill out the register from accounting data (for accounts 20, 26, 44, 91, etc.). During the reporting period, the company did not incur expenses, the recognition of which in the financial accounting does not coincide with the accounting rules, so there was no need to adjust the accounting data.

You can also download a sample of a completed tax accounting register “Expenses that reduce sales revenue” on our website.

IMPORTANT! If tax expenses exceed tax revenues and there is no taxable base for profit in any of the periods (tax or reporting), a declaration must still be submitted to the tax authorities (clause 1 of Article 289 of the Tax Code of the Russian Federation).

What should the register look like?

The Tax Code of the Russian Federation contains practically no information regarding the type of register. The Code contains general information only. That is, the task of preparing documents is assigned to organizations.

But Article 313 of the Tax Code of the Russian Federation specifies mandatory information that must be included in the register. In particular, these are the following points:

- Name.

- Period.

- The name of the operation performed.

- Results of the operation in rubles.

The document is certified by the signature of the responsible employee. The signature is accompanied by a transcript.

If this is a personal income tax register, it includes this information:

- Type of income.

- Personal income tax benefits that reduce the tax base.

- Payment amounts.

- Payment dates.

- Amount of calculated tax.

- Tax withholding date.

- Information about payment slips that confirm tax payment.

The rules relating to tax registers are almost identical to the rules relating to primary accounting. Therefore, some experts have a question about the possibility of replacing registers with accounting documentation. There are no prohibitions regarding this in the Tax Code of the Russian Federation. Moreover, Article 313 of the Tax Code of the Russian Federation provides indirect permission for this. But the same article states that if accounting data is insufficient, it needs to be supplemented. Based on the results of the additions, the register is formed.

ATTENTION! Registers are maintained in both paper and electronic form. Electronic documentation is simply printed if there is a need for this (for example, a tax requirement).

Results

Tax accounting registers are developed by the taxpayer himself, and their form is approved as an annex to the tax accounting policy. They can be compiled electronically or on paper - it doesn't matter. The main thing is that they contain the mandatory details established by the Tax Code of the Russian Federation. There is a basic requirement for information reflected in registers: all entries must be justified and reliable, and from the contents of the register it must be clear how the tax base is formed.

If tax accounting registers are not maintained by the taxpayer, penalties may be imposed by tax authorities under Art. 120 Tax Code of the Russian Federation.

Tax registers, samples of which you can download on our website, allow you to group available information about the company’s income and expenses and correctly calculate income tax.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

7.1. Basic requirements for analytical tax accounting registers

As established by Art. 313 of the Tax Code of the Russian Federation, if the accounting registers contain insufficient information to determine the tax base in accordance with the requirements of Chapter. 25 of the Tax Code of the Russian Federation, the taxpayer has the right to independently supplement the applicable accounting registers with additional details, thereby forming tax accounting registers, or maintain independent tax accounting registers. Accordingly, when maintaining tax accounting, a taxpayer can: • if the accounting procedure does not differ from the tax accounting procedure, use accounting data to carry out tax accounting; • if the accounting procedure differs slightly from the tax accounting procedure, supplement the accounting registers with additional details and thereby create tax accounting registers; • if the accounting procedure differs significantly from the tax accounting procedure, maintain independent tax accounting registers. Article 313 of the Tax Code of the Russian Federation, prohibiting tax and other authorities from establishing mandatory forms of tax accounting documents for taxpayers, contains a provision that the forms of analytical tax accounting registers for determining the tax base, which are documents for tax accounting, must necessarily contain the following details: • register name; • period (date) of compilation; • transaction meters in physical (if possible) and monetary terms; • name of business transactions; • signature (deciphering the signature) of the person responsible for compiling the specified registers. General provisions on analytical tax accounting registers are contained in Art. 314 of the Tax Code of the Russian Federation (it is easy to notice that these provisions are in many ways similar to the provisions of Article 10 of the Federal Law “On Accounting” on accounting registers). Article 314 of the Tax Code of the Russian Federation defines that analytical tax accounting registers are consolidated forms of systematization of tax accounting data for the reporting (tax) period, grouped in accordance with the requirements of Chapter. 25 of the Tax Code of the Russian Federation, without distribution (reflection) among accounting accounts. It is stated that tax accounting data is data that is taken into account in development tables, accountant’s certificates and other taxpayer documents that group information about taxable objects. Article 314 of the Tax Code of the Russian Federation also establishes the following: • the formation of tax accounting data presupposes the continuity of reflection in chronological order of accounting objects for tax purposes (including transactions, the results of which are taken into account in several reporting periods or are postponed for a number of years). At the same time, analytical accounting of tax accounting data must be organized by the taxpayer in such a way that it reveals the procedure for forming the tax base; • analytical tax accounting registers are designed to systematize and accumulate information contained in primary documents accepted for accounting, analytical tax accounting data for reflection in the calculation of the tax base. The most significant difference between analytical tax accounting registers and accounting registers is the absence of double entry. This means that the additional details that the taxpayer uses in accordance with Art. 313 of the Tax Code of the Russian Federation has the right to independently supplement the applicable accounting registers for the formation of tax accounting registers; they should not provide for double entry. The formal difference between analytical tax accounting registers and accounting registers is the sources of their maintenance. Analytical tax accounting registers systematize the data contained in development tables, accountant's certificates and other taxpayer documents that group information about taxable objects; in accounting registers - data from primary documents accepted for accounting. The above difference is formal because, based on what is given in Art. 313 of the Tax Code of the Russian Federation, the classification of documents that confirm tax accounting data, development tables and accountant’s certificates can only be classified as primary tax accounting documents. Tax accounting registers are maintained in the form of special forms on paper, electronically and (or) any computer media. According to clause I of Art. 10 of the Federal Law “On Accounting”, accounting registers are kept in special books (magazines), on separate sheets and cards, in the form of machine diagrams obtained using computer technology, as well as on magnetic tapes, disks, floppy disks and other computer media. Clause 1 9 of the Regulations on Accounting and Financial Reporting in the Russian Federation establishes that when maintaining accounting registers on computer storage media, it must be possible to output them to paper storage media. According to Art. 314 of the Tax Code of the Russian Federation, the forms of tax accounting registers and the procedure for reflecting in them analytical data of tax accounting, data from primary accounting documents are developed by the taxpayer independently and are established by appendices to the accounting policy of the organization for tax purposes. Tax accounting registers are formed for all transactions that are taken into account in one way or another for tax purposes. It also states that if the procedure for grouping and recording objects and business transactions for tax purposes corresponds to the procedure for grouping and reflecting in accounting, then the accounting registers can be declared by the taxpayer as tax accounting registers and, therefore, the objects recorded in such registers will be taken into account for calculating the tax base in the amounts and manner provided for both in accounting and in the legislation on taxes and fees. The taxpayer analyzes the business transactions that arise in the course of his activities and independently determines for which accounting objects he must develop and approve forms of tax accounting registers, which must provide the totality of all the data necessary for the correct determination of the indicators of the tax return for corporate income tax , based on the requirements of Ch. 25 of the Tax Code of the Russian Federation on the issue of accounting for relevant income and expenses. The correct reflection of business transactions in tax accounting registers is ensured by the persons who compiled and signed them. A completely similar provision is contained in clause 2 of Art. 10 of the Federal Law “On Accounting” in relation to accounting registers. When storing tax registers in accordance with Art. 314 of the Tax Code of the Russian Federation must ensure their protection from unauthorized corrections. Correction of an error in the tax accounting register must be justified and confirmed by the signature of the responsible person who made the correction, indicating the date and justification for the correction made. Almost similar provisions regarding accounting registers are contained in paragraph 3 of Art. 10 of the Federal Law “On Accounting”. The difference is that, according to the addition made to Art. 314 of the Tax Code of the Russian Federation by Federal Law No. 57-FZ of May 29, 2002, correction of an error in the tax accounting register must be justified and confirmed by the signature of not just the person who made the correction, but the responsible person (apparently, this addition implies that corrections in the register tax records can only be entered by the persons who compiled and signed this register). In addition, when making a correction to the accounting register, the Federal Law “On Accounting” does not provide (but, obviously, it implies) indicating in the register the justification for the correction made.

| Forward |

Accounting ledger example

One of the most common registers is the balance sheet. It is not only easy to fill out, but is also necessary for any commercial enterprise to fill out: in fact, it is this statement that reflects the current balance sheet of the enterprise, as well as its total capitalization.

Therefore, the balance sheet can be used as a sample. It looks quite simple: the content is divided into semantic blocks “How much was before accounting,” “During accounting,” and “By the end of the accounting period.” A table is compiled, divided into two subblocks under each column (the “Debit” and “Credit” blocks, the main ones in accounting).

It is not at all difficult for an experienced accountant to fill out such a table, especially in accounting. documentation, balance sheets are practically the simplest type of register. However, it does give a good initial understanding of what a register looks like and why it is needed, as well as how to fill it out.

How are registers approved and filled out?

Until 2013, when amendments were introduced to Russian legislation regarding the preparation of accounting documents, all enterprises were required to record information on a unified form. Now it is permissible to use any document suitable for registration; You just need to provide the following information:

- the name of the document itself;

- legal name of the accounting company;

- time coverage of the document;

- form of registers and chosen classification order;

- an indication of all currencies and units of measurement given in the document;

- Full name and position of the person who does accounting.

The document must be approved by the person responsible for accounting (usually the chief accountant): the documentation must be signed and certified with the seal of the organization.

Please note: previously it was prohibited to make changes to the completed unified form. Now, starting in 2013, careful corrections in documentation have become acceptable.

How to create registers

As already mentioned, the law does not prescribe a form for registers. It is determined by the organization independently. The developed form is fixed in the accounting policy. To do this, an order must be issued.

Registers can vary dramatically in appearance depending on the company. There are no restrictions in law regarding form. But the taxpayer must comply with the general rule - all information required for tax accounting is indicated in the registers. From the data provided it should be clear how the tax base was formed.

Data can be grouped in different ways. The use of tables and lists is allowed. However, the grouping tool used must be included in the accounting policy.

Despite certain freedom, the taxpayer must be aware of a number of restrictions. In particular, the register must contain mandatory details. If these details are not present, the register will be considered invalid.