Basic Concepts

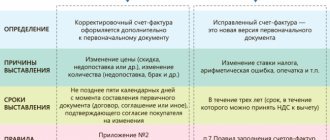

The correcting invoice confirms the change for VAT deduction, which was created due to changes made to the primary invoice.

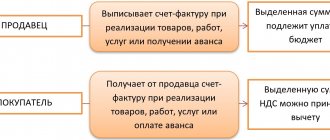

The seller issues a CSF if the cost of the goods, works or services supplied has changed. This happens due to an increase or decrease in the number of previously shipped products or their price characteristics (clause 1 of Article 169 of the Tax Code of the Russian Federation). If the amount has increased, the customer deducts value added tax from the increased price. If an adjustment invoice is received from the supplier for the reduction, then the buyer must restore the VAT accrued on the amount of the reduction in value. When the supplier has questions that require the generation of adjustments to the invoice, he must obtain the buyer’s consent to such changes. To do this, the seller sends a corresponding notification letter or provides the customer with information by telephone.

When generating a corrective invoice, the change in cost is determined, as well as the original and new price of the product. If the price characteristics of at least two shipped lots change, either general clarifications or adjustments are issued for each delivered lot separately.

The invoice and adjustment invoice, their form and procedure for preparation are approved in Decree of the Government of the Russian Federation No. 1137 of December 26, 2011. From 10/01/2017 you need to use updated forms of main and corrective documents. They are enshrined in the RF PP No. 981 dated 08/19/2017.

Exposure dates and period

IMPORTANT. The corrective invoice must be drawn up no later than 5 days from the moment the seller receives consent from the buyer to issue it (it must be confirmed by primary documents).

Failure to timely draw up, register or submit such a document to the tax office may result in a fine or blocking of the payer’s accounts.

As for the time of its submission, this must be done for the same period for which the main account will be (or was) submitted, for which the adjustment was made. Only in this case will it be possible to count on the realization of the rights to the due deductions.

More details about the timing of issuing adjustment invoices are described in this article.

When is it necessary to exhibit

Let's figure out when a correction invoice is issued without fail? The primary invoice is updated when the price and quantitative characteristics of goods, works, and services sold change.

There are a number of cases where the supplier is required to prepare an adjustment to the original invoice:

- Return of low-quality and defective goods.

- Clarification of the cost of products that were supplied at a preliminary price.

- Return of registered goods by a customer who is not a VAT payer.

- Detection by the buyer of a shortage or excess in the received consignment.

- Discrepancy in the volume of work or services accepted by the customer with the data specified in the primary documentation (acceptance certificates).

- Coordination of disposal of low-quality products, including those previously accepted by the buyer for accounting.

Purpose of writing

As mentioned above, an adjustment document is drawn up for the sole purpose of making amendments to the main (regular) account without directly changing or altering it. This is very convenient, as it allows you to make adjustments only to the required items, rather than correcting the whole thing.

In addition, such an invoice is a tax reporting document and, just like the main one, must be submitted to the local tax authority in a timely manner for accounting and exercising the rights to the necessary deductions.

When it is not necessary to exhibit

In what cases is an optional adjustment invoice issued? For example, if the supplier provided the customer with preferential conditions - bonuses, incentive payments, which do not have any impact on the cost of the products shipped and do not change the VAT tax base (clause 2.1 of Article 154 of the Tax Code of the Russian Federation).

If technical inaccuracies or arithmetic errors are discovered, corrections are made to the original invoice form.

IMPORTANT!

As of January 1, 2019, the VAT tax rate in Russia has changed (clause 4 of Article 5 No. 303-FZ of August 3, 2018). Now the value added tax is 20%. This must also be taken into account when preparing an adjustment invoice.

What columns does the document form contain?

The header of the corrective invoice form contains fields for filling in information about the buyer and seller, their addresses, tax data, and so on. Behind these fields begins a table in which all the basic information is indicated. It contains the following columns:

- units of measurement (including their code and real name);

- volume (or quantity) of goods or services;

- the cost of services, goods or property rights;

- the amount of excise tax (if it is absent, it is put “without excise tax”);

- tax rate;

- net tax amount;

- as well as the total price of goods including tax.

The lines are designated as follows: before changes, after changes, increase and decrease.

ATTENTION. The table is filled out in columns and rows.

How to do this correctly will be discussed below.

How to fill out a corrective invoice

Adjustment invoices for reduction are drawn up in two copies: one copy for the supplier, the other for the customer. The buyer receives a legal document confirming the reduction in the cost of previously purchased products.

The introductory part of the invoice is filled out in accordance with the organizational data of the counterparties in the same way as in the primary document (the header lines are transferred from the original invoice).

The corrective form indicates your serial number and date. The numbering of payment and settlement documentation in the institution is carried out in chronological order.

The line below indicates the number and date of the primary register that has been adjusted. In line 1a you must put a dash. If corrections are made to the CSF in the future, in line 1a you will need to indicate the number and date of formation of the changes.

Next, the tabular part is filled in in accordance with the adjustments made to the price or volume of goods shipped, work delivered, services or property rights.

The main feature of drawing up a corrective invoice is to fill out four lines for each changed item:

- A - before the change (indicators of the original document);

- B - after the change (corrected values);

- B - increase (positive difference B-A);

- D - decrease (a negative difference B-A is indicated in a positive value).

The Federal Tax Service in Letter No. SD-4-3/ [email protected] dated 10.23.2018 provides a number of explanations for filling out corrective invoices in 2021:

- If goods, work, services or property rights were shipped before 01/01/2019, then when filling out the adjustment in 2021 for the period preceding 01/01/2019, in column 7 of the tabular part of the CSF, you must indicate the VAT rate that was in effect immediately during the period shipments - 18%.

- If the buyer pays an additional VAT of 2% during the period from 01/01/2019, then this transaction is considered an additional payment for the cost of goods and services. This cost is subject to VAT at the rate of 20/120. After the supplier receives such a 2% tax surcharge, he must issue a corrective invoice for the amount of the difference between the tax payment at the rate of 18/118 and VAT, which is calculated taking into account the 2% surcharge.

- If the customer returns goods to the supplier after 01/01/2019, then such supplier must issue an adjustment that will indicate the cost of the returned products, regardless of the date of their shipment. In this case, column 7 of the tabular part of the CSF will contain the same rate as in the original settlement document.

An adjustment invoice from the supplier for an increase is generated in a similar way.

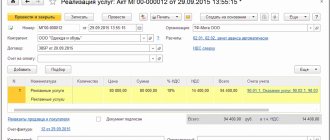

An example of compiling a CSF

On March 26, LLC "Company" shipped goods to JSC "Buyer". On May 25, it was agreed to change the price for “Colored Pencil” from 10 to 9 rubles. Also, when recalculating the delivered goods, it was discovered that “Ballpoint pen” was supplied in the amount of 202 pieces, that is, 2 more than indicated in the shipping documents. 05/28/2018 LLC "Company" exhibits KSF.

In line 1 we indicate the date and number of the CSF, and in line 1b - the details of the document being adjusted.

Lines 2–4 contain the details of the parties to the transaction, as well as the currency of the document.

In the tabular section we indicate changes for each position separately.

At the end of the form, do not forget to sign the responsible persons.

Corrective invoice

It is not acceptable to amend the original invoice document. If technical or calculation errors are detected, either corrective or corrective settlement and payment documents are drawn up.

A corrective invoice refers to a register that is formed when technical inaccuracies are identified in the primary document, as a result of which the final calculation was made incorrectly. Corrections are also made if there are errors in the customer’s name or address.

The regulations for making corrections to the primary invoice were approved in the RF PP No. 1137 dated December 26, 2011 (clause 7 Rules for filling out the Federation Council).

All errors are corrected by creating a new, corrective document. In this case, the number and date of the primary register are retained in the correction invoice. Changes are made to the specially designated line 1a. The serial number of the correction itself and its date are written here.

Next, all updated data is written down or the necessary new information is added.

The generated correctional register is signed by the head and chief accountant of the executing organization or other responsible persons. If the supplier is an individual entrepreneur, he signs the document and indicates the details of the state registration certificate.

At the same time, the supplier can create an unlimited number of adjustments; the limit on corrective invoices is also not established by law. Even adjustment and correction registers can be adjusted and corrected.

Purpose

Various types of changes occur in business relationships. In particular, the price of a product or service provided changes. The parties agree among themselves that they will continue to work, but on different terms. But the work completion certificates have already been generated and signed, and the prices there are old.

In order to avoid paying a tax fine during possible audits, it is necessary to legally correctly draw up an adjustment report for the work performed. It is when this document is signed that the information in the previous documentation is considered invalid; it is replaced by the data specified in the adjustment paper.

Correction or correction: how not to make a mistake in the invoice form

According to paragraph 3 of clause 3 of Art. 168 of the Tax Code of the Russian Federation, an adjustment invoice is generated in situations where the original price or quantity of goods, work, services shipped or transferred property rights require clarification. The adjustment is an integral application of the primary register; it is an additional document as part of the supplier’s payment and settlement documentation. The adjustment invoice is sent to the customer within a five-day period from the date of submission of the original document and the customer's formal agreement to make the adjustments.

An adjustment is made if prices and quantities of supplied products have changed. For example, the supplier could apply a system of discounts, a defect was discovered in the shipped batch, or some of the products were not delivered to the customer for various reasons.

The main condition for making adjustments is the buyer’s consent to make the changes. This consent must be documented. The customer has the right to disagree with the changes, and then a corrective invoice will not be issued. At the same time, in addition to drawing up a corrective register, the parties can specify various options in the contract or agreement on changes:

- product returns;

- additional supply of goods, works, services or transfer of property rights;

- reverse sale of shipped products, etc.

A corrective or corrected invoice is not an additional document, but an updated primary payment and settlement register. This is not a separate form, but an integral part of the original SF. The details of the correction documentation (number and date) coincide with the original one. Indicators and data that do not affect changes in price and volume of delivery are subject to correction - erroneous name and address, arithmetic and technical inaccuracies and typos.

Correction does not require the consent of the customer or a signed contract between the parties. The deadlines for issuing and transferring ISF to the customer are not regulated.

Clause 7 of the Rules for filling out an invoice states that if errors were made in the primary invoice that do not affect the final result, the identification of taxpayers (supplier and customer), tax rate, VAT amount, or inaccuracies not related to names and volume of goods, works, services or property rights supplied, then the document does not need to be adjusted or corrected (paragraph 2, clause 2, article 169 of the Tax Code of the Russian Federation). There is no need to make corrections to a document in which extra characters are accidentally inserted or the index is incorrectly indicated, punctuation errors are made, or lowercase letters are written instead of capital characters.

What are the differences from the corrected

Some people, and even experts, believe that corrective and corrected documents are identical concepts, but as far as VAT is concerned, this is a big difference, and if you accidentally confuse them, you can receive additional charges for the state tax.

In 2021, an adjustment document is used in the case when, at the time of filing the original paper, it was compiled with correct data, but after that the information changed and the original document became unusable.

On its basis, a deduction or refund of excessively transferred tax for the current period is claimed, in this case the algorithm will be such that a document on changes is first concluded.

The seller forms a CSF for the difference, transfers it to the buyer, and the sheet itself is reflected in the accounting books in the current period.

The corrected document assumes that initially the information in the invoice was entered incorrectly, and after that there was a need to bring the data to the correct indicators.

This leads to the need to submit an updated declaration to the Federal Tax Service, and an algorithm operates in which an error is found in the original paper, it is drawn up properly and corrected, essentially drawing up a new document.

This is reflected in the sales/purchases book in the period when the original document was drawn up, and as a result, an updated declaration is submitted.