Any business involves certain types of costs. Among them, a significant place is occupied by the so-called commercial expenses. The efficiency of the entire economic and production system of the enterprise depends on their formation and management.

Let's consider what an organization's commercial expenses are, what influences their distribution and analysis, how to correctly reflect them in financial accounting, and also give specific examples of calculations regarding commercial expenses.

sales expenses (commercial expenses) in the accounting of a production organization if the accounting policy for accounting purposes provides for the complete write-off of such expenses to the cost of sales?

What costs can be included in business expenses (line 2210)

Depending on whether the enterprise is a trade (wholesale, retail) or manufacturing enterprise, the list of business expenses may vary:

Take our proprietary course on choosing stocks on the stock market → training course

| Kind of activity | What are the costs involved? | additional information |

| Production | Includes any costs associated with sales: – entertainment expenses; – costs of advertising the product; – depreciation costs (wear and tear of office and commercial equipment); – payment for security services; – wages of employees (including office workers) engaged in sales; – costs of maintaining an office and warehouse space. | Any other expenses reflected in the debit of account 44 and related to distribution costs are also taken into account. |

| Trade (retail, wholesale) | Costs of selling manufactured products: – entertainment expenses aimed at promoting the product; – advertising costs; – costs of maintaining warehouses with goods ready for sale; – commission fees; – transport costs (delivery to the place where goods are sent); – packaging costs; – other similar expenses. | If we are talking about a manufacturer (processor) of agricultural products, in addition to commercial expenses include: – costs of maintaining reception and procurement points (including caring for poultry and livestock there); – general procurement costs; – other similar costs. |

A little theory

Today we are considering a topic in which the terms “costs and expenses”, “grouping by costs and expenses”, “classification” are constantly encountered. How to understand where is what? When I looked at books on accounting, each time I caught myself asking myself the question: “In the examples, are these costs or expenses? What is the correct term to use? It seems that the author uses costs and in the next sentence already uses the term costs. Confusion, that's all.

Let us now repeat the meaning of these terms once again, so that later we can clearly perceive what we mean when we say them. Fine?

Costs are the exchange of monetary resources for something else that a business can store and use. For example , a company bought goods and materials. Spent money, but did not lose it, because “money turned into other resources.”

The transfer of materials to production or household needs occurs as follows:

- the cost of these materials is calculated, for example, the average cost.

- Due to posting, materials are reduced by 10th account in the calculated amount and quantity

- and this amount comes to the cost accounts (20, 23, 25, 26, 44)

- until the end of the month, such accumulated amounts can safely be said to be expenses

But when the process of closing the month begins and these costs begin to participate in the calculation of the financial result, then they turn into the concept of expenses, i.e. these are costs taken into account for the financial result to calculate profit, from which “Income Tax” is then taken

Not all desired costs of an enterprise can be classified as expenses. Those. not all costs can be included in the financial result formula for calculating profit. Permission for certain types of expenses is stipulated in the Tax Code (Tax Code of the Russian Federation).

Let's look at cost accounting accounts in the following activities:

How are business expenses written off?

Enterprises are allowed to independently decide on the procedure for writing off business expenses (the rules are not approved by legislative and regulatory acts). At the same time, companies are required to consolidate the write-off method they have chosen in their accounting policies.

Important! For manufacturing companies, there are recommendations for writing off business expenses, which are given in the text of the Instructions for using the Chart of Accounts.

Product manufacturers are recommended to write off sales costs as a debit to their account. 90 “Sales” s/ac. 2 “Cost of sales”. The costs of a manufacturing company for transportation and packaging should be distributed among the varieties of shipped goods based on considerations of an independently selected indicator (cost of ready-to-sell products, volume, weight, quantity).

To calculate the amount of business expenses to be written off, you must first calculate the value of the special coefficient using the formula below:

Knowing the value of this coefficient, you can proceed to calculating the volume of business expenses of the enterprise to be written off:

Example of accounting for account 44

Let's look at the expenses of commercial enterprises and the procedure for reflecting them on accounts 44 and 90 using an example. The condition is given: In March 2015, the factory incurred the following types of expenses:

- for delivery of products – 240 thousand rubles;

- for storage of goods - 30 thousand rubles;

- procurement - 15 thousand rubles;

- loading - 48 thousand rubles.

Total - 333 thousand rubles. The production cost of sold products as of March is 1.1 million rubles, and the cost of manufactured products is 4.7 million rubles. The balances of accounts 43 and 44 are taken equal to zero.

Let's write off the amounts for business expenses:

- Dt 90.2 Kt 44 – 288 thousand (240 thousand + 48 thousand) – expenses for loading and delivery of goods, which are entirely related to sold products, are written off.

- Let's distribute the amount of expenses for packaging material and storage between the goods sold and the balance in the warehouse:

- 30 + 15 = 45 thousand rubles. – total amount of expenses;

- 45 × 1100 ÷ 4700 = 10.532 thousand rubles. – the amount of expenses attributable to the cost of goods sold;

- Dt 90.2 Kt 44 – 10.532 rub. – part of the business expenses was written off.

For accounting purposes, enterprises have the right to completely write off the debit amounts of account 44 to account 90.2, without distributing expenses between sold products and warehouse balances. But in tax accounting data it is necessary to indicate strictly those business expenses that are associated with sold products.

Selling expenses are the main indicator of the profitability of a particular production or sales activity, thanks to which it is possible to conduct a qualitative analysis of costs and income.

Commercial expenses are written off to (line 2210) in accounting

The following regulations and legislative acts will help you understand how to write off business expenses:

| Regulatory act, law | Application area |

| Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n | Instructions for the chart of accounts |

| Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n | Approval of Appendix 3 to the guidelines. Instructions for allocating costs for normal inventories. |

| Order of the Ministry of Agriculture of Russia dated January 31, 2003 No. 26 | Approval of appendices 3 and 4 to the guidelines. Distribution instructions for inventories that are formed in agricultural companies. |

Expenses accumulated on the account. 44, are subject to debit to the account every month. 90. But at the end of the month, this account may have a balance related to unsold finished goods (for manufacturing companies) or remaining unsold goods (for trading enterprises). The mentioned balance appears due to the distribution of transport and procurement costs, including costs for:

- procurement of agricultural raw materials, poultry and livestock (from companies engaged in agricultural production and processing);

- transportation (from trading enterprises and intermediary firms);

- packaging and transportation (from product manufacturers).

Distribution is carried out according to instructions approved by regulations listed in the table above.

Budget

Budgeting is a modern financial tool designed by enterprises to implement certain goals. Timely preparation of budgets and their adjustment are an important detail in their formation for an enterprise. At the same time, a budget for business expenses is also drawn up. With its help, you can determine the company’s costs for market research, product advertising and sales.

In the process of drawing up the budget, it is necessary to take into account the fact that its amount is taken into account including VAT without depreciation of funds. For business expenses, it is calculated by month. If necessary, this budget can be broken down by day. The schedule must be drawn up daily.

How are selling expenses (line 2210) reflected in the income statement

Selling expenses of trading and manufacturing companies, which were reflected on account 90, are subject to accounting in the total cost of sales. Such costs should be reflected in line 2210 “Business expenses” in the income statement.

It also happens that an enterprise does not use account 44. This is only possible if the costs collected on the account do not have a component that is subject to mandatory distribution. If the company does not use an account. 44, business expenses are usually reflected in account 26, which is closed in 2 ways:

- By writing off the total amount of expenses accumulated by the company on account 26, directly to the debit of account 90 (then commercial expenses fall into line 2220 “Administrative expenses”).

- By including in the cost of finished goods the method of distributing the expenses collected by the company on account 26 (then the expenses are included in the amount of line 2120 “Cost of sales” in the process of writing off the cost of goods sold).

Product delivery costs

The difficulty of accounting for transportation costs is that it is necessary to carefully monitor the terms of the supply agreement. There is the concept of free place, which characterizes the point of delivery of goods made at the expense of the seller. Most often, companies use 4 types of transportation:

- pickup (or ex-warehouse of the seller) - delivery costs are borne by the buyer;

- ex-carriage of the place of departure - costs are distributed between the buyer and the customer;

- ex-warehouse of the customer - the cost of delivery is fully paid by the supplier;

- ex-carriage of destination – costs are charged in part to both the customer and the seller.

It is possible to apply other terms of payment for transport services provided for in the contract. It is worth remembering that part of business expenses can only include those amounts that are paid entirely at the expense of the enterprise. If the buyer plans to reimburse costs, then they do not participate in the formation of the cost and are taken into account on account 62.

Example of filling out line 2210 “Business expenses”

Let's look at an example of how line 2210 of the Income Statement is filled in:

| Indicators for s/sch 90-2 sch. 90 in correspondence with account. 44 (rubles) | ||||

| Turnover for the reporting period (2014) | Sum | |||

| 1 | 2 | |||

| 1. According to Dt s/sch 90-2 in correspondence with the account. 44 | 735 555 | |||

| Fragment of the financial results report for 2013 | ||||

| Explanations | Indicator name | Code 3 | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Business expenses | 2210 | (1021) | (734) | |

Selling expenses for the reporting period amounted to 735,555 rubles.

| Fragment of the financial results report for 2013 | ||||

| Explanations | Indicator name | Code 3 | For 2014 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Business expenses | 2210 | (860) | (1021) | |

Provision of services

There are mainly two cost accounts used here - 26 and 91.2.

Moreover, the 26th account accumulates expenses over the course of a month, which will then go to the 90th account, but as expenses. When account 26 is closed (transferred) to account 90, it is called the direct costing method.

A 91.2. the account is immediately an expense, since it itself is already a formula for the financial result. From previous articles we already know that account 91.2 includes such basic expenses of the enterprise as bank services for servicing the current account and interest on the loan.

Account 26 for services includes all other costs: employee salaries, premises rental, office, Internet services, communications, payroll taxes, depreciation of fixed assets. Those. basically everything that relates to current activities. Let's look at the 26th score, let's look at its characteristics.

An example of reflecting business expenses in accounting

The following information is known about the enterprise, the main activity of which is retail trade in food and household goods:

| Business expenses item | Amount (rub.) |

| Depreciation charges (fixed assets) | 41 000 |

| Employees' wages, insurance contributions to funds | 233 000 |

| Expenses for consulting and legal services | 321 000 (including VAT RUB 44,000) |

| Costs for the delivery of goods by transport (subject to accounting as part of distribution costs, according to accounting policies) | 987 000 (including VAT RUB 135,317) |

| Rental payments for sales areas, warehouses and general business areas | 625 000 (including VAT RUB 85,687) |

| Total expenses of the enterprise for the reporting period | 3 125 000 (including VAT RUB 428,437) |

The enterprise accountant will reflect the listed expenses with the following entries:

| Accounting record | Amount (rub.) | DEBIT | CREDIT |

| Input VAT on rental costs is taken into account | 85 687 | 19 | 60 |

| Rental costs included | 539 313 (625 000 – 85 687) | 44 | 60 |

| Accepted for deduction of “input” VAT on rental costs | 85 687 | 68 | 19 |

| Input VAT on transportation costs is taken into account | 135 317 | 19 | 60 |

| The costs of transporting goods are taken into account | 851 683 (987 000 – 135 317) | 44 | 60 |

| Accepted for deduction of “input” VAT on transportation costs | 135 317 | 68 | 19 |

| Input VAT on expenses for consultations and legal services is taken into account | 44 000 | 19 | 60 |

| Costs for consultations and legal services are taken into account | 277 000 (321 000 – 44 000) | 44 | 60 |

| Accepted for deduction of “input” VAT on expenses for consultations with specialists and lawyers | 44 000 | 68 | 19 |

| Accrued wages of employees and insurance payments for wages | 233 000 | 44 | 69, 70 |

| Depreciation has been calculated on fixed assets | 41 000 | 44 | 02 |

| Total distribution costs as of the end of the reporting period | 1 941 996 (539 313 + 851 683 + 277 000 + 233 000 + 41 000) | ||

If the accountant writes off such expenses in the reporting period to account 90 “Sales” for accounting for revenue, the expenses should be reflected on line 2210 “Business expenses”. Next, in line 1210 “Inventories” (subsection “Work in Progress”) you need to indicate the amount of costs that have not been written off.

What are management costs?

Administrative expenses include amounts generated on account 26 and associated with the maintenance of the company’s common property and the organization of its activities. A distinctive feature of such expenses is that they are not directly related to production, provision of services or trade. An example of management expenses would be the following expenses:

- on guard;

- payment for the Internet, housing and communal services and communications;

- entertainment expenses;

- salaries of accountants, lawyers, personnel officers and other administrative and management personnel;

- labor protection and seminars for workers;

- stationery.

Administrative expenses can be included in the cost of production as products are sold. Then the accountant must write them off by posting to the debit of account 20 (23 or 29) and the credit of account 26.

The second way to account for administrative expenses is to attribute them in full to the cost of the reporting period in which they arose. In this case, the accountant will post Dt 90 Kt 26.

The chosen procedure for accounting for management expenses must be specified in the company’s accounting policy (clause 20 of PBU 10/99).

The cost accounting algorithm depends on the type of activity of the company and each taxpayer approves the chosen option for his own needs. Find out how to correctly record costs in accounting policies with the help of advice from ConsultantPlus. Learn the material by getting trial access to the system for free.

Learn more about account 26 from the publication “Account 26 in accounting (nuances).”

Answers to frequently asked questions about business expenses (line 2210)

Question: For what purpose should manufacturing companies distribute transportation and packaging costs between types of shipped products while partially writing off these costs?

Answer: Indeed, manufacturers need to do exactly this, since not all products that were shipped to customers will eventually be sold. It depends on what exactly is said in the contract between the seller and the buyer:

- if this is a supply agreement, the products are not considered sold until the buyer fully fulfills the terms of the agreement;

- if this is a goods exchange agreement, the products are not considered sold until the buyer makes a counter shipment of the goods.

Other income

Other Revenue is any company income other than revenue:

- rent (for the lessor);

- dividends;

- income from the sale of fixed assets;

- interest on deposits;

- present.

The moment of recognition and measurement of the amount of other income are determined in the same way as for revenue. The exception is gifts. There is no receivable due to a gift, so income is determined based on the market value of the gifted asset.

The division of income into revenue and other income depends on what the company does. For a store, rent is other income, and for a leasing company, it is revenue. The accrued dividends will be revenue for the qualified investor, but other income for the plant. And only gifts qualify as income except from a professional kept woman.

Trade

Accounting account 91.2 accounts, sometimes 26, are also present in trading. Nevertheless, the main accounting account for costs in trade is account 44 “Sales expenses”. Look at its characteristics.

chart of accounts from the 1C Accounting 7.7 program

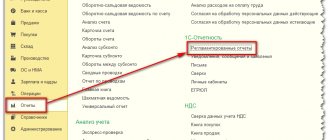

chart of accounts from the 1C Accounting 8 program

We see that the account is analytical: there are subaccounts and subcontos. The account is fully active, so the accumulation of expenses will be on the debit side, and the write-off will be on the credit side of the account.

How does 44 count work?

To begin with, let us remember that 44 includes those costs that are incurred in the trading process. If the company is engaged only in trade, then it will have 44 and 91.2 cost accounts in its accounting. The most common expense items for trading companies are the wages of sellers and taxes on them, rent, utility bills and everything else that is associated with the place of trade. They fixed the electrical wiring in the store (they provided us with a service) - this will also go towards the 44th bill. If there is a dedicated accountant responsible for the operation of a retail outlet, then all of his wages and taxes from it will go to account 44.

If the company, in addition to trade, also provides services, or there is production, then the wages of the chief accountant, manager, manager’s driver, rent and electricity in the main office, etc. - all this will go to the 26th count. Did you get the meaning?

Special types of costs. Trading organizations have special types of costs: transportation and commercial selling costs. What's interesting about them? Let's figure it out.

Transport costs When purchasing a product, each company would be happy if the supplier, at the same price that sold us the product, also delivered it to our warehouse. But this doesn't happen. Our company always has additional costs for delivering goods to its warehouse. And the further away the supplier is, the higher the overhead (transport) costs.

As a result, we have the delivered goods at the purchase price and some cost for delivery (the cost of transportation costs). Now we have a dilemma: how to handle these transportation expenses? We are allowed two ways:

First way . Take the shipping amount, calculate the proportion and distribute the shipping amount for each item purchased. Document all this by posting to account 41. In this case, the price of the purchased product in the company’s warehouse and in the reports will be as accurate as possible.

And when this product is sold, the most accurate purchase price will be included in the financial result formula. That part of the goods that remains unsold will also contain part of the transport, don’t you agree? In other words, excess transportation costs will not be included in the financial result formula.

Second way . The purchased goods are accounted for 41, and transportation costs are accounted for 44. Then at the moment of “closing the month” 44 the entire account for 90 will be closed. It turns out that transport vehicles were included in the formula, but all the goods were not sold or were not sold at all. In other words, we have unreasonably increased costs, but this is impossible.

In this case, transport costs on account 44 will go to account 90 only in the part in which the goods were sold, i.e. in proportion to the goods sold. As a result, the transportation costs available to our company, when closing 44 accounts, will not all go to 90, don’t you agree? The amount of transportation costs will remain, i.e. 44 account will not be closed entirely - there will be a balance.

Selling expenses These include costs that contribute to the promotion and sale of goods. The most common are packaging, advertising, and marketing activities.

Production

As you noticed, we are moving forward. The production combines 26 counts, 44 counts and 91.2 counts. In addition, it also has its own main accounting accounts - 20, 23, 25, 26, 28.

91.2 and 44 accounts work the same way as for previous types of activities. But the 20th accounts work in a special way. Let me tell you very briefly now.

Basic accounting accounts in production: 20, 25, 26

About account 26 we can say that it collects the expenses of the entire enterprise, such as management and administration. Those. all expenses that cannot be attributed either to trade (44 account) or to production (20, 23, 25, 28). In other words, account 26 is an accounting of administrative expenses for the entire business.

Account 20 is an account for accounting for the production of products itself, but... 23 and 25 are also accounts involved in the production of products. What is the difference? The point is that account 20 first collects only those costs that can be directly attributed to a specific type of product.

Account 25 collects those costs that cannot be accurately attributed to a specific product being manufactured, but can only be attributed to the workshop. An example is indispensable here.

Let’s take one workshop, one machine, one type of product, no matter how many employees. Let them work in turns, in shifts, as they wish. What is production (let's simplify) - this is the cost of raw materials, employee salaries, payroll taxes, electricity for the machine, depreciation of the machine, depreciation or rent of the workshop. Under our condition, all costs incurred immediately fall on this one specific type of product.

Let's complicate production, bringing it closer to the real thing. There is still only one workshop, one machine, two types of products, 4 employees. Two people produce products, one is a watchman, one maintains the cleanliness of the premises.

Well, how can we now accurately determine the costs of electricity, depreciation of a machine, depreciation (rent) of a building, wages of a watchman and technical personnel, payroll taxes for a specific type of product manufactured?