The Russian government has amended the document regulating unscheduled inspections of small and medium-sized businesses (SMEs). Now representatives of control and supervisory authorities, including the Federal Tax Service, can suddenly come with an inspection only in a very limited number of cases. Let's look at what changes have been made to the moratorium on inspections in 2021 (Resolution of the Government of the Russian Federation dated June 13, 2020 No. 862).

Also see:

- Features of the 2021 production calendar in connection with coronavirus and non-working days

- What about the timing of desk inspections due to coronavirus: the position of the Federal Tax Service

Decree of the Government of the Russian Federation of June 13, 2020 No. 862

The complete moratorium on tax audits ends on June 30, 2020.

For more information about this and other changes from July 1, 2020, read our article “Memo to an accountant: what are the innovations and changes from July 1, 2021.”

The moratorium on scheduled inspections of SMEs (small and medium-sized businesses) will end on December 31, 2020 (in accordance with Federal Law No. 480-FZ dated December 25, 2018). At the same time, the possibility of conducting unscheduled inspections remains possible - if appropriate circumstances exist.

But legislators continue to consider the consequences of coronavirus measures and restrictions and continue to focus on making life a little easier for small and medium-sized businesses.

The new decree No. 862 dated June 13, 2021 introduced changes to the current procedure for conducting unscheduled tax audits, given in the Decree of the Government of the Russian Federation dated April 3, 2020 No. 438 “On the specifics of the implementation of state control (supervision), municipal control in 2021.”

Resolution No. 862 greatly limits the possibility of conducting an unscheduled inspection of an enterprise or individual entrepreneur related to SMEs in 2021.

Read about who and how will be included in the inspection plan in 2021 in Zen Bukhguru.

The exemption does not apply to tax, Pension Fund and Social Insurance Fund audits.

The law does not apply to tax control and control over insurance premiums.

Therefore, the tax office and funds will, as before, check your reports, and, if necessary, arrange an on-site inspection with examination of all documents and inspection of the premises. The exemption applies only to scheduled inspections, which are carried out by Rospotrebnadzor, the Ministry of Emergency Situations, the labor inspectorate and others once every 3 years. The main goal of such checks is to make sure that in your activities you comply with all the requirements: the cafe premises meets all sanitary and technical rules, the beauty salon has a sufficient number of tools, the store maintains the temperature conditions for storing food, and many others.

Scheduled inspections are carried out only for types of activities for which notification must be submitted. Such types of activities are listed in the Government Decree. These are mainly those related to people’s life and health.

Submit reports in three clicks

Elba will help you work without an accountant. She will prepare reports, calculate taxes and will not require any special knowledge from you.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Who can still be checked?

According to the amendments introduced by Resolution No. 862, inspectors can appear for an inspection in 2021 in the following cases:

- If the company or individual entrepreneur themselves asks for it. For example, an inspection was previously carried out and an order was issued to eliminate violations. And then the company or individual entrepreneur needed confirmation that the order was fulfilled. To begin such an inspection, the person being inspected must submit a request for its conduct.

- A non-profit or religious organization is suspected of extremism (the grounds for conducting an inspection are established in subparagraph 4.2 of Article 32 of the Federal Law “On Non-Profit Organizations” and paragraph 3 of paragraph 5 of Article 25 of the Federal Law “On Freedom of Conscience and Religious Associations” " respectively).

NOTE!

Such checks require approval from the prosecutor's office.

- An unscheduled inspection of an organization is permissible if there are grounds to consider it to have violated state secrets (paragraph 3, part 4, article 30.1 of the Law of the Russian Federation “On State Secrets”).

All other cases of initiation of inspections, including tax authorities, are suspended until 31.12.2020.

IMPORTANT!

Carrying out an inspection contrary to the listed changes is a gross violation of the requirements of the legislation on state control and entails the invalidity of the inspection results in accordance with Part 1 of Art. 20 of the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control.”

For some, routine checks will remain

Legislators did not risk freeing everyone from checks altogether.

As before, the list of checks will include:

- Those with activities in the health, education and social spheres. The list of such types of activities is approved by Government Decree.

- Those who had administrative liability for a gross violation, administrative suspension of activities, suspension or revocation of a license. And less than 3 years have passed since the date of such verification.

- Those who have super-dangerous activities (Article 26.2 of Law No. 294).

Timeframe for conducting a labor inspection inspection

According to Art. 353 of the Labor Code of the Russian Federation, federal state supervision over compliance with labor legislation and other regulatory legal acts containing labor law norms is carried out by the federal labor inspectorate in the manner established by Government Decree No. 875 dated September 1, 2012.

However, the current labor legislation also does not establish specifics regarding the period for conducting inspections in relation to medical and (or) pharmaceutical organizations.

Rules for calculating the term

Please note that inspection times are calculated in working days. Working days do not include weekends and non-working holidays officially established by current legislation.

Current legislation establishes the maximum duration of an inspection - 20 working days . In practice, the inspection period may be less than 20 days; the order (instruction) to conduct the inspection indicates a specific number of working days during which the inspection will be carried out and which officials of the control body do not have the right to exceed.

Who is covered by the moratorium?

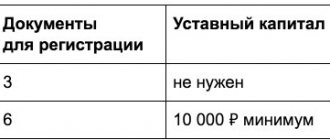

Exemption from tax audits will affect small businesses. These include a number of businessmen who have the following symptoms:

- The amount of revenue from sales;

- Participation (share) of other companies in the company;

- The number of personnel who work for a businessman.

With regard to the moratorium law, the key indicator is the revenue of micro-enterprises. Today it amounts to 120 million rubles. That is, since 2015, the annual revenue of a micro company does not cross this limit. And in this case, for three years, regulation No. 246 of the Federal Law (until the end of 2021) prohibits state control bodies (Rospotrebnadzor, labor commission, fire inspectorate, migration services) from routinely checking businessmen. The period and types of government services that cannot carry out scheduled inspections of entrepreneurs and companies has its own characteristics. The moratorium is not absolutely exclusive. Namely, the regulation of the law dated December 26, 2008 No. 294 FZ provides for exceptions.

The tax structure retains the right to all types of audits. In addition, the company should not have tax violations recorded by inspectors:

- Suspension of economic activity;

- Cancellation of licenses for certain types of business;

- Other administrative penalties.

If these violations took place in the history of the enterprise, then they cannot be avoided by tax inspectors.

What checks does the moratorium cancel?

The moratorium does not apply to all inspections. We are talking exclusively about the cancellation of scheduled inspections for small businesses - on-site or documentary.

The following will continue to operate as usual:

- Any unscheduled inspections based on complaints about the organization’s work or after accidents and emergencies.

- Tax audits of contributions to extra-budgetary government funds. Prosecutor's, insurance, customs, currency checks and a number of others that are not subject to Law No. 294-FZ.

- Monitoring of objects of hazard classes I and II according to industrial, fire, environmental, and radiation safety standards.

How to verify that you belong to a small business

To do this, you need to obtain an extract from the Unified Register of Small and Medium Enterprises. You can do this as follows:

- go to the official website;

- enter registration data;

- print the finished document.

Since the statement already has an enhanced electronic signature, no additional certification is required.

IMPORTANT! According to the instructions of the Federal Tax Service of Russia dated August 8, 2021 No. GD-4-14 / [email protected], local tax inspectorates are not authorized to issue certificates indicating that a legal entity belongs to small and medium-sized businesses.

If you believe that your company is classified according to all the criteria as a small or medium-sized enterprise, but did not find it in the Unified Register on the website of the Federal Tax Service of the Russian Federation, you can submit an application yourself .

In this case, the tax inspectorate will analyze the information provided and, if the decision is positive, will manually enter the legal entity into the Unified Register. Also on the site you can correct incorrect data or enter additional information about your company (report the conclusion of new contracts, participation in partnership programs, list products and add contact information). In addition, you can apply for exclusion from the list. You can view the document by following the link.

Key risks in the event of a tax audit

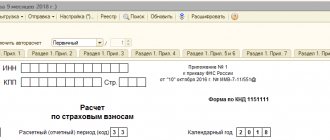

Regarding the work of the Federal Tax Service, it should be remembered that insurance contributions aimed at pension, medical, and social insurance fall under its control. In this part, accruals, as well as timely payment of taxes, are monitored monthly.

In addition, fundamental changes in reporting on the formation of information on personal income tax have led to the fact that the Federal Tax Service monitors the deadlines for fulfilling the obligations of tax agents. In case of violations (late payment of taxes, filing a declaration), strict sanctions are applied to companies. For each violation there is a fine of 20% of the amount of underpayment. If the report is submitted after the deadline, then the minimum fine of 1000 rubles is not the limit. For being late, Federal Tax Service employees have the right to suspend the company's work and block current accounts. With regard to reports on the income of individuals (6-NDFL), the Federal Tax Service conducts desk audits of micro-firms and individual entrepreneurs with employees.

In terms of checking value added tax, tightening of control through changes in legislation regarding export VAT occurred already in October 2021.

Important! In addition to fines, penalties are charged for each day of late receipt of taxes to the budget.

Common Questions

Question 1 : The company submitted its declaration more than three months ago. The Federal Tax Service inspector sent a request to provide documents for a desk audit. Is this requirement legal?

The tax standard mentioned in paragraph 2 of Art. 88NK provides for a period for conducting a desk audit of the KNI of three months from the date of submission of the corresponding report (declaration). Actions within the framework of the audit are carried out according to documents that inspectors receive from the taxpayer. Additionally, in paragraph 6 of Art. 101NK fiscal officials have the right to request any documents during the inspection process to identify violations, or to complete the inspection itself and compile the final results.

Question 2 : What should the accountant of the company do, from whom the Federal Tax Service employees have requested the originals regarding the fact of the audit?

The legal requirement of tax authorities to provide documentation is established by the procedure of paragraph 2 of Art. 93NK, which states that the company must prepare and submit certified copies of all documents to the Federal Tax Service.

Results

The state is in no hurry to introduce a moratorium on tax audits, so it is in the interests of any businessman to always be prepared for the arrival of inspectors. In order not to doubt the correctness of the calculation of your tax obligations, you need to select qualified personnel, establish internal control, competent document flow, and also exercise caution when choosing contractors.

Sources:

- Tax Code of the Russian Federation

- Law on Accounting dated December 6, 2011 No. 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

General period of inspections

In relation to medical and (or) pharmaceutical organizations, scheduled and unscheduled inspections may be carried out, in documentary or on-site forms. The duration of each form of inspection cannot exceed 20 working days.

The period for conducting inspections in relation to a medical (pharmaceutical) organization operating in the territories of several constituent entities of the Russian Federation is established separately for each branch, representative office, separate structural unit of a legal entity, while the total period for conducting an inspection cannot exceed 60 working days .

Toughening of unscheduled inspections

If entrepreneurs still have doubts about whether an audit will come, it is worth carrying out a number of certain activities in the company. It could be:

- Audit of counterparties for reliability;

- Testing and retraining of accounting and personnel personnel;

- Check the budget to identify debts on taxes and fees;

- Carry out an inventory of inventory items and primary documentation for individual transactions.

In particular, the chief accountant can draw up instructions containing the procedure for accepting primary documents (invoices, commodity and transport documents) for accounting, as well as a method for checking them. Draw the attention of staff accountants to the required details: TIN of the counterparty, address of the supplier’s company, tax or excise rates (have they been calculated correctly), signatures and full names of the responsible persons.

It wouldn’t hurt to familiarize yourself with the All-Russian register of inspections on the website: https://proverki.gov.ru. If a company believes that it has come to the attention of inspectors without reason, then it should inform the inspection services about this and notify them of the circumstances in writing. Companies receive a response to their application within 13 days. If the decision is positive, the company will be excluded from the register of mandatory inspections.