Working in the Far North forces you to live and work in uncomfortable conditions: extreme frosts, long dark nights, heavy snowfalls. In these regions, industrial, communal, transport, socio-cultural and other infrastructure is less developed.

However, in the northern regions there are many important enterprises, production facilities and mining facilities of strategic importance. To encourage citizens to live (at least temporarily) and work in the Far North, the state has provided appropriate compensation mechanisms.

These include preferential pension provision for citizens who have worked for a long time in the Far North or equivalent territories. Its essence lies in early retirement and receiving so-called “northern” bonuses.

Harmful working conditions

What factors are harmful to health for people staying in this region? The answer will not be original:

- It is constantly cold here; low temperatures can reach 50 degrees below zero.

- There are not enough vitamins that a person needs for normal life.

- Daylight hours are short compared to other regions of the country.

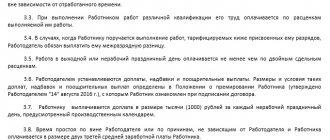

And in view of the above, the state compensates for harmful working and living conditions to all employees who are officially employed in the workplace with additional pay. Its size ranges from 10 to 100% of the salary.

Payroll calculation procedure and formulas

When calculating wages, it is important to consider the following factors:

- Application of various coefficients.

- Calculation of bonuses, allowances and other payments.

- Fine for disciplinary offenses (employee absence from work, absenteeism, immoral acts, etc.).

- Obligation to pay alimony and other payments.

- Advance payment.

- Personal income tax (deducted in the organization by the employer).

These factors tend to decrease or increase wages, but do not affect his salary in any way.

If remuneration is carried out according to the salary system, then the amount to be paid is indicated in the employment contract for each specialty.

The amount of money received for work performed per month will differ from the salary.

To calculate the monthly salary you need:

- Divide the salary by the number of days or hours per month established by the employer.

- The amount of wages per day or per hour (i.e., the number obtained in the first paragraph) is multiplied by the number of days (hours) worked in this month.

- Calculate the amount of payment taking into account personal income tax (13%).

It is important to know that the salary of a military personnel differs from the salaries of civilian workers.

Military personnel receive allowances that depend on:

- Military ranks.

- Position held.

- Duration of military service.

- Conditions for military service.

The total salary consists of:

- salary according to rank;

- salary for the position held.

The personal income tax rate (13%) remains the same. For military personnel, additional tax deductions are also provided, prescribed in Article 218 of the Tax Code of the Russian Federation.

The salary calculation for citizens serving in the Armed Forces of the Russian Federation is calculated as follows:

- Salary by rank + salary by position.

- To the amount received in the first point, we add allowances for the duration, as well as the place of service and other additional deductions.

- From the amount received we subtract income tax in the amount of 13%.

Attention! The management of the organization does not have the right to pay wages to an employee for a full month worked if its amount is less than the established salary. This is regulated by Article 129 of the Labor Code of the Russian Federation.

How is the premium calculated?

The so-called northern ones are calculated depending on the salary established for a particular employee. The rights of citizens and the rules for calculating surcharges are described in the Labor Code of the Russian Federation (Article 315 and 317).

There are several nuances that need to be taken into account. Everyone who wants to go to this region to earn money should know how northern bonuses are calculated.

The amount of the bonus for workers in the Far North depends on the employee’s length of service, the category of the region, the age of the employee and other factors. Let's consider the main nuances.

Some nuances of calculating allowances

There are four categories of regions in the Far North of the country. Depending on which of them the calculation occurs, the regional coefficient changes.

- Employees of the district, which belongs to the first category, do not receive any additional payments for the first six months of work. After this time, the increase will be 10% of the salary. And after six months it increases by another 10%. And thus, the bonus will change upward until it reaches 100% of the employee’s salary. After this, it will not change, provided the salary is stable. If the employee’s salary decreases or increases, then corresponding changes will be observed in the area of calculating northern allowances.

- If an employee works in a region that belongs to the second category, then he is entitled to northern additional payments after six months from the date of employment. They make up 10% of the salary. The increase in the bonus will initially occur every six months by 10%, until the level of 60% of the employee’s salary is reached. Then the increase is carried out once a year by 10% to a level of 80%.

- For employees who work in a region belonging to the third category, the first allowances are provided only after their work experience reaches 12 months. It will be 10% of the salary. The increase in the allowance will be carried out once a year. This will occur before the northern surcharge reaches 50%.

- For residents of the Far North working in a region defined as category 4, the bonus is accrued upon expiration of 12 months of work experience. After this, it will increase once a year until the level of 30% of the salary is reached.

In order to understand how northern bonuses are calculated, you need to know that they are due to all employees who work in the regions of the Far North. This, as mentioned earlier, applies not only to those who live there on a permanent basis, but also to those working on a rotational basis.

How are northern bonuses calculated for shift workers? This happens regardless of whether the citizen works on a permanent or temporary basis, whether he has a part-time job, and so on. Only information about the employee is taken into account, namely length of service and class.

Regional coefficients in the Yamal-Nenets Autonomous Okrug, Khanty-Mansi Autonomous Okrug and regions with harsh climates

Increasing wage coefficients are used not only in the North, but also in other regions with harsh climatic conditions. Unlike northern bonuses, their amount does not depend on the length of work experience. According to the law, this additional payment is accrued to all employees from the first day of employment. The specific size of the coefficient depends on two factors:

- climatic conditions of the area where the work is performed;

- field of activity of the enterprise (the highest coefficient is used in the oil and gas industry, and the smallest in the non-production field of activity).

Since Soviet times, more than 60 resolutions have been adopted on the issue of calculating the coefficient of wages for employees living in areas with harsh climatic conditions. However, today there is no single document regulating this operation.

In 2003, the Russian Ministry of Labor systematized the coefficients for employees in the non-food sector. Based on accepted standards, the maximum coefficient, the size of which is 2.0, is used in the Chukotka Autonomous Okrug, in some areas of Yakutia and the Sakhalin region.

A coefficient of 1.5 is applied to the salaries of citizens working in the territory of the Yamalo-Nenets Autonomous Okrug, as well as in the regions of the Khanty-Mansiysk Autonomous Okrug located north of 60 degrees north latitude.

In other parts of Khanty-Mansi Autonomous Okrug, a coefficient of 1.3 is used.

As for calculating the increasing coefficient for the salaries of citizens working in industry, at the moment there is no systematizing document. It is not uncommon for enterprises in different industries to use different levels of coefficients on the same territory. For example, employees of the gas industry working in the polar zone of the Yamal-Nenets Autonomous Okrug are awarded a coefficient of 1.8, and for employees working in the forestry sector - 1.5. In addition, if the enterprise is financed from the regional budget, then the authorities of the subject can set a larger premium.

Youth allowance calculations

For young people, special rules and procedures for calculating bonuses in the northern regions of the country have been determined. This is due to the fact that young people are reluctant to be involved in work in the regions of the Far North of the Russian Federation. Let's look at how northern bonuses are calculated for young people under 30 years of age.

- The area belongs to the first category.

Accrual occurs six months after employment, subject to successful work at the enterprise. The first increment is 20% of the salary. The next one will be charged in another six months and also at 20% - and so on until the level of 60% is reached. Then the increase will occur once a year up to 100% of the salary.

- An area belonging to the second category.

In order to answer the question of how northern bonuses are calculated for youth under 30 years of age in Khanty-Mansi Autonomous Okrug, it should be noted that this district belongs to the second category. In this area, the first accrual is made after six months from the start of work, it is 20% of the salary. It will then increase every six months by 20% until the level of 60% is reached. After this, after a year, the premium can be increased by another 20%.

- The area belongs to the third category.

In this region of the Far North, the bonus is 10% and increases every six months until it reaches 50% of the employee’s salary.

- The area belongs to the fourth category.

The bonus is 10% of the salary. Increases three times every six months.

List of regions

The list of territories belonging to the regions of the Far North and equivalent areas is given in Resolution of the Council of Ministers of the USSR dated November 10, 1967 No. 1029. From January 1, 2008, they also include the city of republican significance of Pechora and the village of Ust-Lyzha with its subordinate territory (Komi Republic) (RF Government Decree of April 24, 2007 No. 245).

In addition to the regions of the Far North and equivalent areas, a percentage increase for employees working in these areas is also paid in other northern regions.

How are military accruals made?

If you are interested in the question of how northern bonuses are calculated for military personnel, then you need to know that for citizens who perform military service in the Far North, there are several of them, and they are calculated depending on certain factors. These include rank and length of service, in other words, length of service. Allowances are calculated based on the size of the military personnel’s salary. An interesting fact is that when periodically living in the Far North, these gaps can add up to each other, even if some breaks were observed. This applies not only to military personnel, but also to persons who serve in internal affairs bodies.

In order to qualify for the bonus, you must first submit an application addressed to the commander. If the request is not satisfied, then you need to contact the prosecutor's office to resolve this dispute.

Rules for calculating work experience in areas equated to the Far North

Therefore, the legislation of the Russian Federation provides some benefits for citizens living and working in these areas. In particular, this factor affects the amount of pension contributions, and the possibility of early retirement is provided if certain conditions are met. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual.

If you want to find out how to solve your particular problem, contact a consultant:

Here is a list of some subjects of the Russian Federation that are partially or fully equated to the Arctic regions:

- Amur, Arkhangelsk, Irkutsk, Sakhalin, Tyumen and Tomsk regions;

- Transbaikal, Krasnoyarsk, Perm, Primorsky and Khabarovsk territories;

- Republics: Altai, Buryatia, Karelia, Komi and Tyva.

Work experience in regions equated to the Arctic includes mainly labor activity, which can be confirmed by a work book and contracts. Other types of activities are not included in the northern work experience, for example: For persons who worked in areas equated to the Arctic regions, an insurance pension is accrued for 15 calendar years of work according to the formula: 1 calendar year is equal to 9 months of work in territories equated to the Arctic.

Let's look at who is entitled to an early retirement pension in the table below. in territories considered the same as the required insurance period. When moving to a more favorable place of residence, the supplement will be reduced or even canceled, but the value of the basic part of the pension will be maintained. Additional payments to the northern pension are described in the following video: Still have questions?

Find out how to solve exactly your problem - call right now:

What is the northern surcharge coefficient

The northern bonus coefficient is an indicator that increases the established level of an employee’s salary by a certain amount. This is a percentage that depends on the region and other factors in the employee’s working conditions.

In order to answer the question of how to calculate northern allowances in the Yamal-Nenets Autonomous Okrug up to 30 years of age, it must be said that their coefficient is established by law. But local authorities have the right to increase the amount of the surcharge, subject to the availability of additional funds in the district budget. In the Yamal-Nenets Autonomous Okrug and Khanty-Mansi Autonomous Okrug currently this indicator varies in the range from 0.1 to 0.27. Specific numbers can only be obtained at the enterprise, for which you should contact the personnel department or accounting department.

And in order to understand how northern bonuses are calculated in the Komi Republic, we note that the regional coefficient here is 1.6.

Will premiums be canceled when creating a priority development area?

The bill on the creation of the ASEZ is popularly called a document on the abolition of northern bonuses, although in reality it does not say about the termination or reduction of benefits for northerners. A slightly different situation is observed in the amendments to the Labor Code. According to the new article regulating the specifics of the work of enterprises located in priority development territories, the following rules now apply to northern benefits:

- with the consent of employees and employers, northern benefits and payments can be replaced with monetary compensation;

- the amount of compensation, as well as the procedure for its payment, is indicated in work agreements and contracts;

- The salary of employees cannot be lower than the subsistence minimum established in the region.

If these factors are present, within the boundaries of the ASEZ, employers may indeed be exempt from paying northern allowances. But since this is only possible with the voluntary consent of the employee, it is incorrect to talk about the complete elimination of northern benefits.

In addition, these innovations apply only to employees of commercial enterprises and. The law on priority development areas will not apply to municipal and state enterprises.

It is also worth clarifying which regions and districts may be included within the boundaries of the priority development area. According to the document, within three years after the bill comes into force, these territories can be created only in the Far East and in cities with a difficult economy that have a single city-forming enterprise.

Related articles:

- Payments to young medical professionals in 2021

- Average salary in Moscow in 2021

- Benefits and payments to military personnel in 2021

- Teachers' salaries will increase in 2021

- Changes in teacher certification in 2021

- Scholarship for 2021 – 2021 academic year

- Calculation of average earnings in 2021

- What will happen to the Ministry of Emergency Situations in 2021. Salary increase

last information

Given the difficult economic situation in the country, there have been rumors that the northern surcharges could be abolished. But it is worth saying that to date such a decision has not been made at the state level. So no need to worry. Moreover, government authorities intend to further encourage the work of citizens who carry out their activities in the difficult conditions of the north of the country.

Despite the fact that various restrictions and sanctions have been applied to the Russian Federation, the authorities are striving to ensure that workers in the Far North do not lose their benefits and allowances.

The size of the pension supplement for northerners in 2019: indexation and recent changes

One of these services can be found on the official website of the Russian Pension Fund at the link https://www.pfrf.ru/eservices/calc. To obtain up-to-date information, you just need to enter the data requested by the system and click the “Calculate” button.

When working on a rotational basis in the North, it is necessary to take into account that the northern experience is credited to the employee based on the time actually worked. The above professions are management-level specialists, but representatives of blue-collar professions are no less in demand at oil-producing industry enterprises:

- repairmen (50-90 thousand rubles).

- drivers of drilling rigs/truck cranes/bulldozers/excavators (110-120 thousand rubles);

- drillers (115-125 thousand rubles);

In the field of construction in the North, what is most needed is:

- installers (80-120 thousand rubles);

- concrete workers (60-100 thousand rubles);

- finishers (60-120 thousand rubles);

- slingers (50-90 thousand rubles).

- argon welders (80-130 thousand rubles);

- masons (50-100 thousand rubles);

- electric and gas welders (80-130 thousand rubles);

As for the work schedule, each individual organization has its own.

Conditions for calculating additional payment

In order to receive a salary increase, an employee or employee must independently contact his superiors with a request to assign it. Without the direct participation of a citizen who claims an additional payment, nothing will happen by itself. If the request is not granted, you can always contact the local prosecutor’s office to resolve these issues.

To apply for an allowance, you will need to collect a package of documents that can certify your right to receive these additional payments and incentives. All conditions will have to be complied with. Before applying, you should carefully read the accrual conditions. Because if some of them are not met, a refusal will be received.

The important date for calculating additional payments for young people is December 31, 2004. For those who have lived in the northern regions for more than one year at the time of this date and began working after December 31, northern allowances will be accrued at an accelerated rate. Those who started working before the established date receive a bonus, which will be accrued as usual.

Instructions for using a calculator to calculate wages based on salary

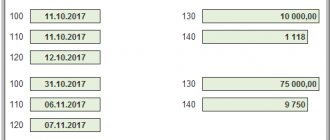

The online calculator has 6 fields to fill out:

- Salary - indicate the amount of salary established by the employment contract;

- Premiums - the sum of all incentive additional payments for the month;

- Deductions - the online calculator field is filled in if you have the right to standard deductions (usually this is a deduction for a child - 1400 for the first, 1400 for the second, 3000 for each subsequent one, 12000 or 6000 for a disabled person - about the child deduction and its size in 2017);

- Regional coefficient - indicated if it is provided for the region;

- The total number of working days per month is usually 21 or 22.

- Number of days worked in a month - do not enter overtime, work on weekends and holidays in this field of the calculator.

After filling in the fields, the calculator calculates wages before and after taxes, as well as the amount of income tax and insurance contributions.

The calculator is able to calculate wages both for part-time work and for a full month worked, based on the employee’s salary.

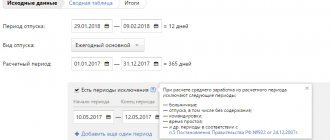

Examples of salary calculations for salaries in 2021

Example 1 - salary for a full month:

The employee's salary, according to the employment contract, is 36,500, plus a monthly bonus is paid for fulfilling the plan in the amount of 3,400. A regional coefficient of 15% is established for the region. The employee has two children aged 10 and 15. The employee worked in full for December 2021, the plan was fulfilled, for which a bonus was awarded. How to calculate wages using an online calculator?

The result of the online calculator is at the bottom of the form:

- Accrued salary = (36500+3400) + (36500+3400)*15% = 45885.

- Personal income tax = 13%*(45885-2800) = 5601.05.

- Salary on hand = 45885 - 5601.05 = 40283.95.

- Contributions to the Federal Tax Service = 45885*30% = 13765.5.

- Contribution to the Social Insurance Fund = 45885*0.2% = 91.77.

Example 2 - wages for less than a full month.

The employee's salary is 37,800. In February 2021, he was ill, and therefore worked 15 days. There are no additional bonuses and no regional coefficient has been established. There are three children: 30, 13 and 8 years old.

How to calculate the salary for an incomplete month using a calculator?

- Salary - 37800;

- Prizes - 0;

- Deductions - 4400 (there is no deduction for the first, 1400 for the second, 3000 for the third);

- Regional coefficient - 0;

- Working days - for February 19 including holidays.

- Days worked - 15.

Calculation result in the calculator:

- Accrued salary = 37800*15/19 = 29842.11.

- Personal income tax = 13%*(29842.11-4400) = 3307.47.

- Salary on hand = 29842.11 - 3307.47 = 26534.64.

- Contributions to the Federal Tax Service = 29842.11*30% = 8952.63.

- Contribution to the Social Insurance Fund = 29842.11*0.2% = 59.68.

Citizens of the Russian Federation living in the Far North, as well as areas equivalent to it, have the status of “working in difficult climatic conditions.” Therefore, salary calculations are made taking into account northern allowances. They significantly increase the employee’s income, because the cost of food and other services in these regions is much higher.

After 30 years...

How are northern bonuses calculated after 30 years in the RKS? For citizens who have worked for a long time in the Far North of the country, some incentives are provided in the form of the opportunity to retire a little earlier than others. To do this, certain conditions must be met.

Thus, women have the opportunity to receive a pension after reaching the age of 50, but at the same time their work experience in the northern regions must be more than 15 years, and their total work experience must be at least 20 years. By the way, when calculating a pension and additional payments to it, the length of service includes maternity periods before and after childbirth. As for northern men, they can receive a pension after 55 years, the northern length of service should be 20 years, and the total length of service should be 25 years.

If a citizen worked in the North less than the established norms, but more than 7.5, then, in order to retire earlier, some incentives are also provided for this category of citizens. For each subsequent year of work, the retirement date approaches 4 months.

Who is entitled to an increased salary?

An additional coefficient is provided to all participants in labor relations: both for those born in the north and for visitors. Art. 316–317 of the Labor Code of the Russian Federation guarantee these compensations.

People who are legally required to increase their salary include:

- men and women who have entered into employment contracts with enterprises on a permanent basis;

- employees performing part-time job duties;

- specialists working remotely (and Article 312.2 of the Labor Code of the Russian Federation states that the benefit is accrued even if the employer is not in the Far North - only the location of the employee is important; for example, if a certain company is located in Moscow, and the employee is in Magadan, then the latter is still entitled to compensation);

- military personnel serving in these territories.

The law protects the rights of northerners, since in the places where they live, prices for the purchase of food, medicine, clothing, as well as payments for housing and communal services are higher than the Russian average.