In "1C: Accounting 8" (rev. 3.0), starting from version 3.0.41, accounting for transactions with loans and borrowings is supported. Now the program automatically determines accounts for received and repaid loans and credits, issued and repaid loans, as well as accounts for accounting for interest paid on loans and borrowings.

We remind you that the parties to the loan agreement can be any legal entities or individuals, so our own organization can both receive loans from counterparties and issue loans to any counterparties. As for a loan, only a bank or other credit organization that has the appropriate license from the Bank of Russia to carry out such operations has the right to provide it. Credits and borrowings are divided into short-term and long-term depending on the duration of the agreement.

Chart of accounts, approved. By order of the Ministry of Finance dated October 31, 2000 No. 94n and included in all configurations of “1C: Accounting 8”, the following accounts are intended for accounting for received loans and borrowings:

- 66 “Settlements for short-term loans and borrowings”;

- 67 “Calculations for long-term loans and borrowings.”

Received credits, borrowings, and accrued interest on credits and borrowings are accounted for in different subaccounts of accounts 66 and 67. A credit or loan can be received both in rubles and in another currency; accordingly, interest can also be accrued in foreign currency. Credits, borrowings and interest on contracts denominated in foreign currency are also accounted for separately in separate subaccounts of accounts 66 and 67.

Loans issued by us to other counterparties are recorded in account 58.03.

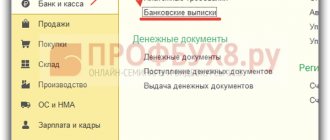

Thus, the possible number of options for accounting for transactions with credits and loans involves the use of more than sixteen second-order accounts. Now the accountant no longer faces the task of choosing the right subaccount. Accounts for transactions with credits and loans are automatically determined by the program in the following documents:

- Receipt to the current account;

- Cash receipt;

- Debiting from the current account;

- Cash withdrawal;

- Payment order.

Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual.

A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity). Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

For the organization giving the loan, it matters:

- Whether the loan is interest-bearing or interest-free;

- what types of activities (usual or other) does this process include for her?

It is important for the recipient of funds:

- for how long they were taken: less or more than a year;

- whether borrowed funds are invested in the creation of an investment asset.

Each of these conditions will affect the selection of account correspondence in the record of transactions performed in connection with the loan.

You will find a selection of forms for drawing up a loan agreement in various situations in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Issuing a loan to an employee through a bank.

The next step is to issue funds to the employee. As we have already agreed, the loan will be issued through the bank! The amount issued is 150,000 rubles. Type of operation: Issuance of a loan.

In the balance sheet for account

73.01 you can see the loan amount.

A document written off from the current account is generated by posting Debit 73.01 Credit 51

Interest on a loan issued - postings

Funds issued as a loan, subject to the accrual of interest on them by the transferring party, are always taken into account as part of financial investments, i.e. in account 58. The issue is recorded by posting Dt 58 Kt 51 (50, 52).

IMPORTANT! An interest-free loan will not be shown on account 58, since it does not correspond to the very idea of financial investments (to generate income). Its amount should be shown on account 76 (Dt 76 Kt 51 (50, 52)).

At the same time, in transactions for calculating interest on a loan issued, another account will be used - 76. Its use will lead to the appearance of a transaction - interest accrued on a loan issued - with correspondence Dt 76 Kt 91 (90). The choice of account in the credit part of this record will determine which types of activities for the lender include issuing a loan: other (in which case account 91 will be used) or ordinary (in this case account 90 will be used).

Interest calculations by organizations are carried out monthly on the last date of this period (clauses 12, 16 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n).

Neither the loan amount itself nor the interest on it are subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation), i.e., there will be no postings regarding this tax on the debit of account 91 (90). If the lender has any costs associated with issuing a loan (for example, a fee to the bank for funds transfer services), then during the period of their implementation they will be debited to account 91 (90).

The receipt of interest payments will be expressed by posting Dt 51 (50, 52) Kt 76.

Providing loans to other companies and reflecting them in 1C: Enterprise Accounting 8

Published 08/12/2018 14:38 In this article we will consider options for financial investments of an organization, namely loans issued to other companies: monetary (interest) and non-monetary (goods, materials), as well as the reflection of these transactions in the 1C program: Enterprise Accounting, 8th edition 3.0.

Cash loan

We conclude a written agreement reflecting the conditions (loan amount, interest for using the loan, loan term). We talked about how to create a payment calendar for a contract in the article Loans to employees in 1C: Enterprise Accounting 8 Interest payments can be set periodically or at the end of the loan term. It should be remembered that financial investments always involve risks (risk of insolvency, bankruptcy of the borrower, etc.). We recommend that the contract provide for penalties for violating the terms. The fewer general formulations, the more constructive, the better for everyone.

Accounting for issued interest-bearing loans is kept in account 58.03 “Loans provided”. The operation of issuing a loan (D-t sch.58.03 – K-t sch.51) is not subject to VAT because The ownership of the loan subject does not pass to the borrower (clause 15, clause 3 of Article 149 of the Tax Code of the Russian Federation). The issuance of a loan is not recognized as an expense of the organization for tax purposes.

Interest on a cash loan is reflected in account 76.09 “Other settlements with various debtors and creditors.” With the OSNO (accrual method) interest on the loan is reflected monthly on the last day of the month, regardless of the date of payment. With the simplified tax system (cash method), interest on the loan is reflected on the date of receipt from the borrower. At this moment, for tax purposes, non-operating income arises (clause 6 of Article 250 of the Tax Code of the Russian Federation).

In essence, interest on a loan is the cost of services for providing a loan; they are not subject to VAT, as is the amount of the principal debt. In the VAT return, accrued interest is reflected in section 5 (code 10100292).

Important: “Input” VAT on costs associated with issuing a loan is not deductible; it is included in the organization’s other expenses. If the share of transactions on issued loans in revenue is less than 5%, then the organization can deduct the entire “input” VAT, fixing this in its accounting policy.

Let's consider the reflection of operations in 1C: Enterprise Accounting 8 edition 3.0.

The accrual of interest on the loan on the last day of the month is included in other income (MI) and non-operating income (NU) on a monthly basis, regardless of subsequent events in the execution of the contract. Such an event could be the forgiveness of a debt to the borrower.

Section “Operations” - “Accounting” - “Operations entered manually”:

If the borrower does not comply with the terms of the agreement, the lender assesses penalties (penalties, fines). The date of reflection of penalties is the date of recognition by the borrower (payment, written consent) of penalties or the date of entry into force of a court decision (for OSNO) and the date of payment of penalties (for USNO).

Important: Penalties for improper fulfillment of the terms of the contract are not subject to VAT because are not related to payment for goods sold and are not listed in Article 162 of the Tax Code of the Russian Federation.

We also reflect in the document “Operations entered manually”:

Let's consider the option when the parties have drawn up an agreement on debt forgiveness.

Forgiveness of the principal debt is not taken into account by the lender as expenses when taxing profits (we do not check the box) (clause 12 of Article 270 of the Tax Code of the Russian Federation).

Loan interest is written off as expenses in accounting (debit of account 91.02), but is not accepted for tax accounting purposes. The date the forgiven interest is written off is the date of the debt forgiveness agreement.

We form an Analysis of the subconto “Counterparties” (borrower).

As can be seen in the figure, the parties agreed to forgive both the loan amount and the interest amount. The agreement is recorded in a written agreement on debt forgiveness, and loan settlements are closed.

Let's consider a non-cash loan (goods, materials).

In economic activities, organizations can provide assistance to each other with goods and materials with payment for services rendered. The peculiarity of the loan agreement concluded in this case is that it must accurately indicate the quantitative, varietal and other characteristics of the transferred goods or materials because subsequently the exact same product or material must be returned. In addition, the agreement specifies the interest rate (per annum) for the loan.

In this case, ownership of goods (materials) passes to the borrowing organization, and is therefore subject to VAT (clause 1 of clause 1 of Article 146 of the Tax Code of the Russian Federation) and is reflected in accounting as sales on the date of shipment.

Let's consider an example with a non-cash loan of materials (raw materials).

The accounting entries in this case will be as follows:

The issuance of a loan is not recognized as an expense for tax purposes.

Important: When repaying a non-monetary loan, the principal debt must be repaid with the same product (materials), and if the purchase price for this product differs from the original price, the difference will not be taken into account for profit tax purposes. The borrower draws up a document for the sale of goods (materials) at original prices and charges VAT.

The accounting entries will be as follows:

After processing and repaying a non-monetary (goods, materials) loan, we create Account Analysis 58.03.

Thus, VAT accrued by the lender for payment to the budget when issuing a non-monetary loan is taken as a deduction when repaying the loan. But it also happens differently.

After returning the loan from the borrower to the simplified tax system, the lender loses VAT because "Simplers" do not issue invoices. This must be taken into account when concluding a contract. Perhaps this loss will be compensated by further fruitful cooperation. In any case, “when you do good to others, you first do good to yourself.” (B. Franklin)

The accrual of interest on a non-cash loan is similar to the accrual of interest on a cash loan (Debit 76.09 “Subconto” - “Borrower” K-t 91.01 “Interest on loans received”).

VAT on accrued interest is determined by calculation (for example, 18/118; 10/110) upon receipt of funds from the borrower (clause 4 of Article 164 of the Tax Code of the Russian Federation). Payment of interest in this case is associated with payment for the property transferred to the borrower.

The lender issues an invoice in 1 copy. and transfers it to the borrower, the borrower does not have the right to a tax deduction. We create an invoice “for advance payment” because Only this document assumes the estimated VAT rate. We select the transaction type code “01” “Sales of goods, works, services and operations equivalent to them.”

We create an analysis of account 76 in the context of sub-accounts to check the correctness of VAT calculation on interest paid.

We generate the report “Analysis of subconto” - “Borrower”. The report reflects movements on all related accounts for a given borrower.

Loan settlements are closed.

Create a thriving business: change the paradigm of thinking, and your wildest dreams will become your working plans!

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+3 Alexey 10.10.2019 14:31 Why, when transferring a non-monetary loan (goods, materials) on 06/05/2018, cocoa beans are written off from 10.01. in the amount of 64,551.48 rubles, and is returned in the amount of 254,237.29 rubles. and why is the transfer not at cost?

Quote

+1 Irina 08/15/2018 22:58 I quote Alina:

Good afternoon Tell me, why is VAT charged on interest when issuing a non-cash loan, but not when issuing a cash loan?

Alina, thanks for the good question!

Chapter 21 of the Tax Code of the Russian Federation names a closed list of transactions that are not subject to taxation (exempt from VAT). Only transactions for providing loans in cash and interest on them (clause 15, clause 3 of Article 149 of the Tax Code of the Russian Federation) are directly named in this list. They are reflected for reference in the VAT return in section 5 (code 10100292). The logic behind this is as follows: -the money loan agreement does not contain any signs of implementation, therefore the interest associated with this operation is not subject to VAT; -a non-monetary loan agreement (for goods, materials) contains the features of a loan agreement and a purchase and sale agreement because ownership is transferred and a sales document is drawn up. Interest on the loan in this case is associated with payment for the property transferred to the borrower. Sales proceeds are determined based on all receipts associated with payments for the sale of goods, expressed in cash and in kind (clause 2 of Article 249 of the Tax Code of the Russian Federation). Quote 0 Alina 08/15/2018 03:46 Good afternoon! Tell me, why is VAT charged on interest when issuing a non-cash loan, but not when issuing a cash loan?

Quote

Update list of comments

JComments

Interest accrued on the loan received - postings

The recipient of the borrowed funds will have their receipt recorded either in account 66 (if the loan is short-term - up to a year) or in account 67 (if the funds are taken for a period exceeding 12 months). The wiring will be as follows: Dt 51 (50, 52) Kt 66 (67).

The accrued interest will be credited to these same accounts, separating them in the accounting analytics from the amount of the principal debt. That is, in the entry for calculating interest on a loan received in the credit part there will be an account 66 or 67. The choice of the account that falls into its debit part will determine the fact of use or non-use of the funds received when creating an investment asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Interest amounts on a loan that is not related to the creation of an asset regarded as an investment (it has a long period of creation and high cost) should always be taken into account in other expenses - Dt 91 Kt 66 (67), accruing the corresponding amounts monthly (clause 6 of PBU 15/2008).

If borrowed funds are involved in expensive long-term investments, then the interest on them will form the cost of property (fixed assets or intangible assets) created with the participation of the corresponding investments: Dt 08 Kt 66 (67). During a long (more than 3 months) break that arose in the process of making investments, and upon completion of investments in the object, the continuing accrual of interest on the loan should be included in other expenses (clauses 11, 13 of PBU 15/2008).

The tax nuances of accounting for interest on loan agreements in various situations are discussed in detail in the Transaction Guide from ConsultantPlus. Get trial access to the system for free and learn how, when taxing, you need to take into account interest on loans related and not related to the acquisition of depreciable property, spent on paying dividends, etc.

Legal entities using simplified accounting methods have the right not to separate expenses associated with the creation of investment assets from other expenses.

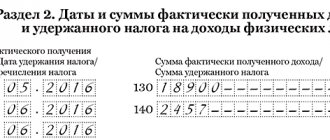

Payment of interest will be reflected by posting Dt 66 (67) Kt 51 (50, 52). If their recipient is an individual, then his income should be subject to personal income tax (Dt 66 (67) Kt 68).

An example of applying for a loan to an employee in 1C

Let us consider in detail the execution of operations for issuing and repaying a loan. Let’s assume that an employee of the organization PromTech LLC, S.V. Larionova. A short-term loan was issued in January 2021.

Our example conditions:

- The loan amount is 120 thousand rubles

- Loan term – 12 months

- Loan percentage – 6%

- Refinancing rate – 11%

We will calculate the amounts of payments, interest and personal income tax using special processing (Fig. 1). If there is no such processing, you will have to count manually.

Debt repayment begins in the month following the month the loan was issued, in our case, from February 2021.

Fig.1

Formulas by which interest and material benefits are calculated:

- Amount of interest = Amount of Debt * Interest * Number of days in a month / Number of days in a year

- Amount of financial benefits = Amount of Debt (2/3 refinancing rate - interest) *Number of days in a month/Number of days in a year;

All calculations have been completed. Now let's see what documents need to be generated in 1C to reflect the loan.

Results

The entry for accrual of interest on a loan occurs both for legal entities giving the loan (to a legal entity or individual) and for those receiving borrowed funds (from a legal entity or individual). The first accounts for the issued debt itself in account 58 (Dt 58 Kt 51 (50, 52)), and the interest on it in account 76, accruing them monthly in correspondence with the financial results account (Dt 76 Kt 91 (90)). The second, depending on the period for which the funds are borrowed, the amount of debt is attributed to account 66 or 67 (Dt 51 Kt 66 (67)) and interest is accrued there. If borrowed funds are not involved in the creation of an investment asset, then they are accrued by posting Dt 91 Kt 66 (67). Participation in the creation of an asset regarded as an investment requires taking into account interest on the loan in the cost of this asset (Dt 08 Kt 66 (67)).

Sources:

- Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical postings for account 67

Correspondence 67 accounts and main entries for long-term loans and borrowings are presented in the table below:

| Dt | CT | Wiring Description |

| 50,51,52,55 | 67 | Receipt of long-term loans and credits Repayment – reverse postings |

| 07,10,11,41 | 67 | Received a commodity loan with material resources from an agricultural organization |

| 66 | 67 | Re-issuance of loans |

| 67 | 51,52,55 | Crediting a loan or borrowed funds to a bank account |

| 60 | 67 | Payment to the supplier/contractor through long-term loans or borrowings |

| 68 | 67 | The budget debt was paid through long-term loans |

| 76 | 67 | Paid debt to other creditors through credits or loans |

| 91 | 67 | Interest accrued on loans or credits received |

| 91 | 67 | Positive exchange rate differences in foreign currency are taken into account. Negative - reverse wiring. |