According to the law dated 04/01/2020 No. 102-FZ, insurance premium rates have been reduced for all representatives of small and medium-sized businesses (SMEs). However, such a reduction does not apply to all payment amounts, but only those that exceed 1 minimum wage. Thus, the calculation of salary contributions for an accountant has become more complicated. The Federal Tax Service responded to this situation and issued a letter explaining how to correctly calculate reduced insurance premiums in 2021. In this material we provide examples of calculating insurance premiums from April 2021 at reduced rates.

Also see:

- How coronavirus affected insurance premiums: an overview of changes

- How to correctly calculate insurance premiums from April 2020

What changes should be taken into account when calculating contributions?

According to Law No. 102-FZ, all small and medium-sized businesses that pay income to individuals will apply reduced insurance premium rates in 2021:

- 10% – for pension contributions (PPS) (both within the contribution base of RUB 1,292,000 and above it);

- 0% - for compulsory social insurance (OSI) for temporary disability, maternity, pregnancy and childbirth (VNIM and B&R) (regardless of excess of the contribution base - in the amount of 912,000 rubles);

- 5% – for compulsory medical insurance (without using the base).

At the same time, the reduced tariff begins to apply if the payment exceeds 1 minimum wage (according to legislators, this fact should encourage employers to increase small salaries).

For more details, see our material “For whom and what insurance premiums have been reduced since 04/01/2020”.

IMPORTANT!

The new rules for calculating insurance premiums are effective starting with payments for April 2020 .

The monthly division of amounts into taxable contributions at the previous rates and at reduced rates, in which it is also necessary to take into account the excess of the maximum base for compulsory pension insurance and compulsory social insurance, raised a lot of questions among accountants. The Federal Tax Service undertook to answer these questions: letter No. BS-4-11/11315 dated July 13, 2020 contains, among other things, practical examples of calculations that you need to familiarize yourself with and take them into account in your work.

Amount of contributions for “beneficiaries”

Some payers Art. 427 of the Tax Code of the Russian Federation allows the use of reduced interest rates on insurance premiums in 2021. They apply to payments within the tax base limit. Starting next year, a new category of insurers - Russian developers of electronic component base - will be included in the preferential category, and the tariff for IT companies will be further reduced.

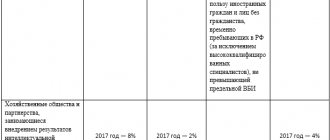

Since the tariffs are different for each category of beneficiaries, we will summarize the rates applicable for insurance premiums in 2021 into a single table.

Table 3. Reduced rates for preferential categories of payers

| Preferential payer category | Pension Fund, % | FSS,% | Compulsory medical insurance,% |

| Participants in the special administrative region, in accordance with Law No. 291-FZ of August 3, 2018 (Kaliningrad Region, Primorsky Territory), making payments to crew members of Russian vessels for the performance of labor duties | 0 | 0 | 0 |

| Payers paying labor compensation to the crews of ships registered in the Russian International Ship Register | 0 | 0 | 0 |

| Participants of the Skolkovo project | 14 | 0 | 0 |

| Russian organizations producing and selling their animated audiovisual products | 8 | 2 1.8 - foreigners | 4 |

| Participants in the free economic zone of Crimea and Sevastopol (law dated November 29, 2014 No. 377-FZ) | 6 | 1,5 | 0,1 |

| Residents of the territory of rapid socio-economic development (law of December 29, 2014 No. 473-FZ) | 6 | 1,5 | 0,1 |

| Residents of the port of Vladivostok (law dated July 13, 2015 No. 212-FZ) | 6 | 1,5 | 0,1 |

| Residents of the special economic zone in the Kaliningrad region (law of January 10, 2006 No. 16-FZ) | 6 | 1,5 | 0,1 |

| IT companies in the Russian Federation engaged in the development and implementation of computer programs and databases, providing services for the development, adaptation, modification of computer programs, databases, installation, testing and maintenance of programs | 6 | 1,5 | 0,1 |

| Russian organizations designing and developing electronic components and electronic (radio-electronic) products | 6 | 1,5 | 0,1 |

Calculation of reduced contributions to compulsory pension insurance when the maximum base is exceeded

EXAMPLE

Payments in the amount of 1,200,000 rubles were made to the employee for January-March 2021. For April 2021, the specified employee was accrued another 200,000 rubles. That is, the amount of payments in favor of the employee, determined by the cumulative total from the beginning of the billing (reporting) period, in April 2021 exceeded the maximum base value for calculating insurance premiums for compulsory health insurance by:

(1,200,000 + 200,000) - 1,292,000 = 108,000 rubles.

200,000 - 108,000 = 92,000 rubles - the amount of payments for April 2020, which is included in the maximum base for calculating insurance premiums for compulsory health insurance.

In this case, at the usual rates of insurance premiums, part of the payments for April 2021, not exceeding the minimum wage, is levied, i.e. 12,130 rubles.

Part of the monthly payments in excess of the minimum wage, which does not exceed the maximum base for calculating insurance premiums for compulsory health insurance, in the amount of 92,000 - 12,130 = 79,870 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

The part of payments that exceeds, from the beginning of the billing (reporting) period, the maximum value of the base for calculating insurance premiums for compulsory health insurance, in the amount of 108,000 rubles, is subject to insurance premiums for compulsory health insurance at a rate of 10%.

Calculation of contributions to compulsory pension insurance for April 2021:

- 12 130 × 22% = 2668,60

- 79 870 × 10% = 7987,00

- 2668.60 + 7,987.00 = 10,665.60 rub.

Fixed contributions for individual entrepreneurs

From the moment of state registration of entrepreneurial activity, individual entrepreneurs are required to transfer fixed insurance contributions to the budget for themselves. In 2021, the amount of payments remained the same, at the level of 2021 (law of October 15, 2020 No. 322-FZ).

If the entrepreneur’s income is more than 300,000 rubles, an additional 1 percent contribution to the Pension Fund is paid to the budget from the amount exceeding this limit. In 2021, the maximum amount for pension insurance contributions is limited to RUB 259,584.

Table 5. Individual entrepreneurs’ contributions “for themselves” in 2021

| Contributions of individual entrepreneurs “for oneself” | Amount, rub. |

| For pension insurance | 32,448 + 1% on income exceeding 300 thousand rubles. (but not more than RUB 259,584) |

| For health insurance | 8426 |

Calculation of reduced contributions to OSS

EXAMPLE

Payments in the amount of 750,000 rubles were made in favor of the employee for the period January-March 2021. For April 2021, the specified employee was accrued another 250,000 rubles.

The amount of payments in favor of the employee, determined by the cumulative total from the beginning of the billing period, in April 2021 exceeded the maximum base value for calculating insurance premiums for OSS at VNiM by:

(750,000 + 250,000) - 912,000 = 88,000 rubles.

250,000 - 88,000 = 162,000 rubles - the amount of payments for April 2020, which is included in the maximum base for calculating insurance premiums for OSS at VNiM.

In this case, at the usual rates of insurance premiums, part of the payments for April 2021, not exceeding the minimum wage, is levied, i.e. 12,130 rubles.

Part of the monthly payments in excess of the minimum wage, which does not exceed the maximum base for calculating insurance premiums for OSS at VNiM, in the amount of 0 = 149,870 rubles, is subject to insurance premiums for OSS at VNiM at a rate of 0%.

The part of payments that exceeds, from the beginning of the billing period, the maximum base for calculating insurance premiums for OSS at VniM, in the amount of 88,000 rubles, is not subject to insurance premiums for OSS at VniM on the basis of clause 2 of Art. 425 Tax Code of the Russian Federation.

Calculation of contributions to OSS for April 2021:

- 12 130 × 2,9% = 351,77

- 149,870 × 0% = 0 rub.

DAM for the 1st half of 2020 and a reduced rate of insurance premiums in 1C: ZUP

Published 07/22/2020 10:31 Author: Administrator Calculating insurance premiums has always raised many questions among accountants. And during the pandemic, when, according to the Decree of the President of the Russian Federation, insurance premiums were reduced or canceled, there were even more questions. Our colleagues, specialists from Coderus, who are involved in business automation based on 1C, decided to help users with this issue, because they are competent to work with subject areas and, of course, regulated accounting. Leading Coderus analyst Galina Volchkova has prepared “take it and do it” recommendations for accountants who will have to submit the DAM for the first half of 2021. This article will focus on organizations that apply a reduced insurance premium rate.

So, in accordance with the letter of the Federal Tax Service dated June 9, 2021 No. BS-4-11/ [email protected] and checking the control ratios of the indicators introduced by the letter of the Federal Tax Service of Russia dated May 29, 2020 No. BS-4-11/ [email protected] , the most complete implementation of filling out calculations for insurance premiums is done in 1C: ZUP ed. 31 in the following versions and higher:

— Salaries and personnel management, edition 3.1 (3.1.14.97)

— Salary and personnel management, edition 3.1 (3.1.10.491)

Let's immediately say about the recommendations of the developers of the 1C program to switch from version 3.1.10 to version 3.1.14 before September 2021 in order to maintain the ability to receive updates.

Send to the inspection a calculation of insurance premiums in the form approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] for the first half of 2021 by July 30, 2021.

We will not dwell too much on the theoretical part, since we have already written about who is entitled to reduced insurance premiums, let us only recall their rates.

For payments in favor of individuals in the part not exceeding the minimum wage (determined based on the results of each calendar month), contributions are calculated according to general tariffs (Article 425 of the Tax Code of the Russian Federation):

— in the Pension Fund of the Russian Federation – 22% (for payments not exceeding the maximum size of the contribution base) and 10% (for payments above the maximum size of the contribution base);

— in the Federal Compulsory Medical Insurance Fund – 5.1%

— in the Social Insurance Fund – 2.9% or 1.8% (for payments to certain categories of individuals, for example, temporarily staying foreigners).

For payments in favor of individuals in excess of the minimum wage (determined based on the results of each calendar month), contributions are calculated at reduced rates (Article 6 of Law No. 102-FZ):

— in the Pension Fund of the Russian Federation – 10% (for payments not exceeding the maximum size of the contribution base) and 10% (for payments above the maximum size of the contribution base);

— in the Federal Compulsory Medical Insurance Fund – 5%;

- in the Social Insurance Fund - 0%.

The federal minimum wage according to Federal Law No. 463-FZ as of 01/01/2020 is 12,130 rubles.

The reduced rates will apply from April 1, 2021 to December 31, 2021 inclusive.

Payers of reduced insurance premiums, when filling out Appendix No. 1 and Appendix No. 2 to Section 1 of the calculation, in field 001 “Payer tariff code” must indicate the value “20”. This code will appear in the program only after updating to the above releases.

Before compiling a report, let's double-check whether everything in your database is correct.

Step 1. Setting up accounting policies.

To correctly calculate insurance premiums at a reduced rate, you need to specify in the accounting policy settings the type of tariff “For small or medium-sized businesses” from April 2021. This can be done in the “Settings” - “Organizations” section, the “Accounting policies and other settings” tab. .

Step 2. Recalculation of insurance premiums for the 2nd quarter of 2020.

Make sure that the payroll documents for the specified period show contributions at the reduced rates.

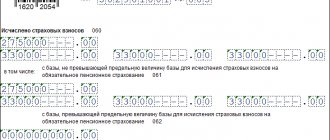

Let’s check whether the program calculated the reduced contributions using the example of I.V. Bazin’s accruals. The salary for April was 75,000 rubles, then the contributions, taking into account the reduced tariff, will be:

Pension Fund: 12130 * 22% + ((75000 - 12130) * 10%) = 2668.6 + 6287 = 8955.60 rubles.

FSS: 12130 * 2.9% = 351.77 rub.

Compulsory medical insurance: 12130 * 5.1% + ((75000-12130) * 5%) = 618.63 + 3143.5 = 3762.13 rubles.

FSS and TS are unchanged, the rate does not change.

Step 3. Checking the calculations with the program.

It is best to do this with the “Checking Contribution Calculation” report, located in the “Taxes and Contributions” section - “Taxes and Contributions Reports”.

This report allows you to immediately see inaccuracies in calculations using the base times the tax rate formula and highlights errors in red. It is very convenient to analyze and check by type of tariff and by different types of contributions.

In this case, we generated a report for only one employee A.V. Bazin, selecting him using the “Settings” button. And so this report is filled out for all employees who had accruals for the selected period.

Step 4. Reconciliation of the accrual base with the base for calculating contributions.

2 reports are suitable for these purposes:

1) “Analysis of contributions to funds” (section “Taxes and contributions” - “Reports on taxes and contributions”);

2) “Full set of accruals” (section “Salary” - “Salary reports”).

The accrual amounts in the Analysis of Contributions by Tariffs must be equal to the Accrued line of the Full Set.

In our example, 980161.45 + 315380 = 1295541.45 rubles.

Step 5. Let's start filling out the calculation of insurance premiums.

The report we are interested in is located in the section “Reporting, references” - “1C-Reporting”.

Click the “Create” button and select “Calculation of insurance premiums” from the “Tax reporting” section.

IMPORTANT! Many accountants, in a hurry typing RSV in a quick search, make a mistake and select the proposed report called RSV-1 PFR. And they are trying to fill out a report.

This is an outdated report form, which was left by the developers for adjustments of previous years submitted to the Pension Fund. Therefore, pay attention to the program prompts in the “Form Editing” field.

Let’s return to our report on insurance premiums and create it using the “Fill” button.

We see that Appendix 1 to Section 1 is divided into 2 points - tariff code “01” and “20”.

Appendix 1 to Section 1 with payer tariff code “01” reflects the calculation of insurance premiums for compulsory health insurance and compulsory health insurance at general rates, based on the amounts of payments and other remunerations made in favor of individuals not exceeding the minimum wage.

Appendix 1 to Section 1 with tariff code “20” reflects the calculation of insurance premiums for compulsory health insurance and compulsory medical insurance at reduced rates, for payments in favor of individuals in excess of the minimum wage.

We would like to draw your attention to the fact that the calculation will also include two appendices No. 2 to section 1 (with tariff code “01” and with code “20”) (with the exception of lines 070 - 090), which reflects the calculation of the amounts of insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity. Lines 070 - 090 reflect information in general about the payer of insurance premiums.

The amounts of accrued contributions for compulsory social insurance according to tariff code “20” will be equal to zero (dashes are indicated in the columns), because the tariff is 0%.

Section 3, accordingly, is also divided into category codes of the insured person on a monthly basis, where “MS” is the base and contributions calculated at a reduced rate, “NR” is the base and contributions based on the minimum wage at the basic rate.

After checking the completion of the form, you must use the control ratio built into the system:

Once all control ratios are met, you can safely send the report to the tax office.

IMPORTANT! We suggest that you familiarize yourself with the list of errors that may occur when filling out the DAM today in our next article.

We remind you that this material was prepared by our colleagues - the Coderus company. They regularly write applied articles and useful instructions on business, automation, and accounting on their website and social networks. Subscribe so as not to miss important and interesting information.

https://coderus.ru/blog/

https://www.facebook.com/alexander.zavyalov.33/

https://www.instagram.com/zavialov_alexander/

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #13 Irina Plotnikova 08/04/2020 07:19 I quote Ekaterina:

Good afternoon, I know. I fill out the registration document for the DogGPC, from there the act is issued. Then the document “Accrual under contracts, incl. copyright”, then the document “Payment to accounts”, and at the end of the month the document for everyone “Calculation of salaries and contributions”, where everything is in the Contributions tab.

Ekaterina, please check that on the insurance contributions tab in the document “Calculation of salaries and contributions”, are only contributions for compulsory pension and health insurance calculated for these employees?

Social insurance and accident insurance are definitely not included? And also check the card for accounting for insurance premiums for these employees, are you sure that all contributions were not accrued by other documents? Quote 0 #12 Ekaterina 08/03/2020 14:23 Good afternoon, I know. I fill out the registration document for the DogGPC, from there the act is issued. Then the document “Accrual under contracts, incl. copyright”, then the document “Payment to accounts”, and at the end of the month the document for everyone “Calculation of salaries and contributions”, where everything is in the Contributions tab.

Quote

0 #11 Irina Plotnikova 08/03/2020 06:22 I quote Ekaterina:

Good afternoon. But we don’t include in Appendix 2 employees only under a GPC agreement, but employees under a labor and GPC agreement are included. From January to March (and some part of April) we calculated salaries in the BP, in April they transferred them to the ZUP. I marked all the accruals under GPC agreements (which I accrued in the BP) for deletion and re-accepted them according to the rules of the ZUP, re-posted them and they were picked up in the DAM for the 1st quarter in page 030 of Appendix 2. In the DAM for the six months, the GPC were picked up only in April. I re-transformed the dGPC, but the amounts are still not picked up

Ekaterina, good day.

Tell me, what document do you use to accrue Salaries under the GPC agreement for those employees who are not included in the report: the document “Accrual of wages and contributions” or “Accrual under contracts, incl. copyright"? If you use the document “Accrual under contracts, incl. copyright”, then please note that the calculation of insurance premiums is not performed in this document - it is assumed only at the end of the month by the document “Calculation of salaries and contributions”. Therefore, in this case, you need to go to the document “Calculation of salaries and contributions” to the “Contributions” tab and click the “Recalculate contributions” button. Quote 0 #10 Ekaterina 07/31/2020 19:29 Good afternoon. But we don’t include in Appendix 2 employees only under a GPC agreement, but employees under a labor and GPC agreement are included. From January to March (and some part of April) we calculated salaries in the BP, in April they transferred them to the ZUP. I marked all the accruals under GPC agreements (which I accrued in the BP) for deletion and re-accepted them according to the rules of the ZUP, re-posted them and they were picked up in the DAM for the 1st quarter in page 030 of Appendix 2. In the DAM for the six months, the GPC were picked up only in April. I re-transformed the dGPC, but the amounts are still not picked up

Quote

0 Irina Plotnikova 07/31/2020 04:53 Now I will answer the question regarding zero lines in section 3. Based on the letter of the Ministry of Finance of Russia dated 10.30.2019 No. 03-15-05/83472, dated 10.28.2019 No. 03-15-05/ 82910, in the absence of payments to employees in a specific reporting period, employers are required to submit to the tax authority a calculation of insurance premiums with zero indicators in the general manner. The Russian Ministry of Finance has repeatedly reminded us of this. From the reporting for the 1st quarter of 2021, the presentation of such a calculation is directly confirmed by the order of the Federal Tax Service of Russia, which approved a new form of calculation for insurance premiums and the procedure for filling it out. According to the specified document, payers of insurance premiums who do not carry out activities and (or) do not make payments to employees fill out the calculation in a simplified form - they must fill out the title page, section 1 (without attachments) and section 3.

Quote

0 Irina Plotnikova 07/31/2020 04:50 I quote Ekaterina:

ZUP, version 3.1. (3.1.14.129)

Ekaterina, good day.

Most likely, according to GPC agreements, this is a release error, and more than one. There is an error No. 60000885 registered on the developers’ website dated July 14, 2020. Description: When filling out the DAM at the SME tariff for employees who have both an employment contract and a GPC agreement, Appendix 2 incorrectly shows the amount accrued. Workaround method (suggested by the developers): Correct the total amount accrued in Appendix 2 based on the fact that the entire amount for GPC should be included in tariff 01, as well as the amount of deduction for GPC - it should also be included under code 01. Amounts for GPC can be viewed in decryption of cells. Unfortunately, this can only be fixed manually for now. It is written that a fix is planned in future versions of the program. Quote 0 Ekaterina 07.29.2020 17:12 ZUP, revision 3.1. (3.1.14.129)

Quote

0 Irina Plotnikova 07.29.2020 15:02 Ekaterina, please write which program do you use to calculate salaries and releases?

Quote

0 Ekaterina 07.29.2020 13:44 I quote Irina Plotnikova:

I quote Ekaterina: Good afternoon. When filling out the DAM, line 030 of Appendix 2 to Section 1 does not include amounts under GPC agreements. Or rather, only 2 contracts were included (the employee was on staff and there was a contract). Tell me, please, what is the reason?

Good afternoon. I created a new report, but still does not take the amount under the GPC agreements (current version). And another question, we did not have accruals for some employees, but they are in section 3 with zero lines. Should it be like this or should they be removed if there are no charges? Ekaterina, good afternoon. Please update the program to the latest release. There were errors related to GPC agreements. After the update, delete the old RSV and create a new one. Do not refill, but rather delete and create a new report. If it’s not difficult, write to us the result - the error went away or not. I quote Irina Plotnikova:

I quote Ekaterina: Good afternoon. When filling out the DAM, line 030 of Appendix 2 to Section 1 does not include amounts under GPC agreements. Or rather, only 2 contracts were included (the employee was on staff and there was a contract). Tell me, please, what is the reason?

Ekaterina, good afternoon.

Please update the program to the latest release. There were errors related to GPC agreements. After the update, delete the old RSV and create a new one. Do not refill, but rather delete and create a new report. If it’s not difficult, write to us the result - the error went away or not. Quote 0 Irina Plotnikova 07/28/2020 20:34 Quoting Ekaterina:

Good afternoon. When filling out the DAM, line 030 of Appendix 2 to Section 1 does not include amounts under GPC agreements. Or rather, only 2 contracts were included (the employee was on staff and there was a contract). Tell me, please, what is the reason?

Ekaterina, good afternoon.

Please update the program to the latest release. There were errors related to GPC agreements. After the update, delete the old RSV and create a new one. Do not refill, but rather delete and create a new report. If it’s not difficult, write to us the result - the error went away or not. Quote 0 Ekaterina 07.27.2020 21:58 Good afternoon. When filling out the DAM, line 030 of Appendix 2 to Section 1 does not include amounts under GPC agreements. Or rather, only 2 contracts were included (the employee was on staff and there was a contract). Tell me, please, what is the reason?

Quote

0 Irina Plotnikova 07.24.2020 17:33 I quote Alexander:

Hello! Filling out the form itself in terms of accruals did not cause any difficulties. But regarding the number of people - questions: subsection 1.1. and 1.2. according to tariff 01 line 010 - the total number of insured should be? ZUP puts a minus on sick leave. And the same data is repeated on line 020. At tariff 20, in lines 010 and 020, only those whose payments exceed the minimum wage are entered. I count - according to 010 - all insured, according to line 020 - those who have an income above the minimum wage. But Appendix 2 of the ZUP in both tariffs puts on line 010 - all insured, on line 020 - to whom payments were made.

Alexandra, good afternoon.

Very similar to release error No. 50013427 (Essence: When generating a report for the 1st half of 2021, after establishing the type of tariff for insurance premiums: For small or medium-sized businesses, several insured persons from line 010 (“maternity leavers”, on maternity leave) disappeared up to 1.5 years, some others are missing) Ways out: the error was accepted by the developers, we are waiting for a corrected release. Therefore, either edit manually if you urgently need to submit a declaration, or wait for an updated corrected release Quote +3 Alexandra 07/22/2020 11:19 Hello! Filling out the form itself in terms of accruals did not cause any difficulties. But regarding the number of people - questions: subsection 1.1. and 1.2. according to tariff 01 line 010 - the total number of insured should be? The ZUP puts a minus on sick leave. And the same data is repeated along the line 020. According to tariff 20, in lines 010 and 020 it is entered only by those whose payments are greater than the minimum monthly wage. I count - by 010 - all insured persons, on line 020 - by those whose income is higher than the minimum monthly wage. But Appendix 2 ZUP in both tariffs puts on line 010 - all insured, on line 020 - to whom payments were made.

Quote

Update list of comments

JComments

Calculation of reduced contributions for additional days off provided to the employee by law

If payment is additional. weekends are reimbursed from the Social Insurance Fund under Art. 262 of the Labor Code of the Russian Federation (for example, additional days off are provided to care for a disabled child), it should be subject to contributions in the general manner.

Taking into account the specifics established for SMEs, the policyholder must impose contributions on part of such monthly payments:

- within the minimum wage – at a rate of 30%;

- exceeding the minimum wage - at a rate of 15%.

In order for the Social Insurance Fund to reimburse these expenses without any problems, you need to make the calculation as follows:

- Determine the share (proportion) of payments for additional days off in the total volume of payments for the month.

- Multiply the resulting value by the amount of insurance premiums accrued for the month from the total amount of payments.

EXAMPLE

The total amount of payments during the month in favor of an individual is 75,000 rubles, of which 15,000 rubles are payment for additional days off provided to care for a disabled child.

The SME subject calculates insurance premiums from the total amount of payments:

12,130 × 30% + (75,000 - 12,130) × 15% = 13,069.50 rubles.

The share of payment for additional days off provided for caring for disabled children in the total amount of payments for the month is:

15 000 / 75 000 = 0,2.

Calculation of insurance premiums by SMEs only from the amounts paid for additional days off provided for caring for disabled children:

13,069.50 × 0.2 = 2,613.90 rubles.

Insurance premiums from the amounts paid for additional days off provided to care for a disabled child, taking into account the provisions of Federal Law No. 213-FZ, are subject to reimbursement from the Social Insurance Fund of the Russian Federation in the amount of 2,613.90 rubles.

Read also

19.05.2020

How tariffs have changed

The tariff rate for calculating the premium is presented as a percentage of the base on which insurance premiums are calculated:

| Pension insurance | Medical support | Social Security Disability Insurance |

| 26% | 5,1% | 2,9% |

To calculate the amount of contributions for each type of insurance, there are a number of conditions that regulate the calculation of the amount that will be paid to the state. The basis for taxation is the total earnings of the enterprise’s personnel, all accrued types of income, from which the corresponding percentage of the insurance premium is determined.

- The total amount of income received is recorded for each employee;

- As soon as the total earnings accumulated during the year reaches the established value, a regressive scale operates, i.e. the contribution rate decreases.

Each case has its own maximum income limit scale and tariffs:

The value that regulates the rate of contributions for all types of insurance is reset to zero by the end of the year, and the income received by the employee does not accumulate.

Changing tariffs

Let's take a closer look.

Cancellation of benefits

The preferential rates for social contributions were abolished for the two largest categories of payers for whom it was most convenient to enjoy the privileges:

- Entrepreneurs.

- Companies under special regimes.

This category of beneficiaries previously had the opportunity to pay only contributions to the Pension Fund in the amount of 20% of the wages of their employees.

A large number of entrepreneurs and organizations fell under the terms of the benefit, thanks to which they had the opportunity to officially employ people for themselves, and at the same time save their money without making much effort.

So, if these organizations had officially employed persons, then the company could save up to 10% of the payroll precisely by making such contributions.

Who is entitled to benefit?

Since 2021, new benefits have been introduced into the legislation, which will be valid until 2024. All categories except those listed above can take advantage of the benefits, although interest rates will also increase for them.

To take advantage of the benefits, the organization must meet a number of conditions:

- Have sufficient turnover.

- Business should be considered rare.

- The organization must confirm its status.

For each type of activity, the legislation provides for its own requirements. For example, this may be a requirement that the organization be in a special reserve, have a sufficient number of employees, or obtain a document indicating the existence of the status.

Reduced rates

| Type of payers | Rates, % | ||

| Pension insurance | Social insurance | Health insurance | |

| Russian organizations that work in the field of information technology and are engaged in: | |||

- social services for the population;

- scientific research and development;

- education;

- healthcare;

- culture and art (the activities of theaters, libraries, museums and archives);

- mass sports (except professional).

Who applies the benefits?

By law, the person who pays the premiums is the insurer for all of his employees. Among such payers are:

- Organizations where employees work under an employment contract or a GPC agreement.

- Individual entrepreneur.

- Individuals, if they are sources of income for other citizens, even if they do not have the status of an entrepreneur.

- Individuals engaged in the practice of law or providing notarial services.

Preferential conditions for insurance premiums

A certain category of taxpayers, as before, retained the benefits that they enjoy when calculating and paying contributions for all types of insurance. The methods and legal provisions that give the right to apply the benefit must be strictly observed by the taxpayer, otherwise the right is lost (instructions of the Tax Code of the Russian Federation, Article 427).

Income 70% of the total volume (per year no more than 79 million rubles)

Obtaining the right to apply preferential tariff rates for insurance premiums is achieved by complying with the rules stipulated in tax legislation: applying a preferential tax system, having a main type of preferential activity, and observing the total revenue limit.

Who applies contribution benefits?

Despite the fact that the provision of the legislative act 212-FZ as a whole ceases to be relevant, all payers of contributions retained their obligations in part 34 of Chapter 34 of the Tax Code of the Russian Federation. Persons who are recognized as payers of contributions are considered insurers of their employees for all types of insurance:

- Enterprises that pay individuals (employees) wages under an employment contract or GPC agreement;

- For an individual entrepreneur;

- Private citizens who are a source of income for individuals without the status of an individual entrepreneur;

- Individuals who conduct private legal practice;

- They provide notary services and pay (or not) fees.

At the same time, lawyers, notaries, entrepreneurs conducting economic activities are required to pay the amount of insurance premiums for their activities. Also, having hired employees on staff or paying remuneration to persons for services related to activities under GPC agreements, they are recognized as payers in relation to payments for the labor functions of their employees.

The obligation to charge/pay insurance premiums arises for some payers upon completion of certain actions.

How to get benefits on insurance premiums

The moment of accrual of all payments and income to an individual is determined by the date of accrual. This is usually the last day of the billing period.

Until that moment, and if no employees were hired, the organization did not have any debt on insurance payments. These conditions may not apply to everyone.

An individual entrepreneur, lawyer, or notary is required to pay contributions for all types of insurance from the date of official registration. An individual entrepreneur is automatically a payer and is obliged to pay fixed amounts of contributions to the budget.

Receiving benefits

The moment of accrual of a person’s income and all payments due to him is determined by the date of such accrual. Most often this is the last day of the billing period. Accordingly, until this moment the organization does not have any arrears in contributions.

But not everyone can take advantage of such conditions. For example, individual entrepreneurs, lawyers and notaries are required to pay contributions from the date of their insurance. That is, the absence of hired workers on the staff cannot be a reason for non-payment of contributions, since this category of citizens is obliged to contribute funds for themselves.

All payers independently determine the size of their contribution rates. The main indicators take into account the Tax Code article and several conditions:

- The period of time during which the payer carries out its activities.

- Number of employed workers.

- Revenue volumes

- Type of preferential activity.

general characteristics

Expert opinion

Stepanov Vladislav Vasilievich

Practitioner lawyer with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

The money that the employer transfers for the employees of his organization gives citizens the opportunity to count on receiving several types of payments in the future:

- Pension provision.

- Disability benefits.

- Other benefits of a social nature.

At the moment, all financial resources that are transferred in this way to the country’s budget are immediately used to provide disabled citizens with all the social benefits they are entitled to.

In general, this entire process is regulated in tax legislation.