Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 08/03/2019

Reading time: 5 min

0

268

In the event that an item of fixed assets is disposed of, or the owners realize that such an item is no longer capable of bringing economic benefits to the company or can no longer be used for production purposes, then it must be written off from accounting. Write-off is carried out through the process of liquidation of fixed assets.

- What is the liquidation of fixed assets and what are its goals?

- Progress of the procedure

- What documents are drawn up

- Rules for preparing the act

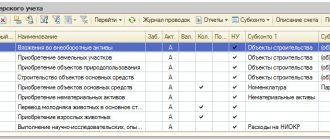

- Accounting entries

What is the liquidation of fixed assets and what are its goals?

The liquidation of fixed assets (fixed assets) means the process of writing them off from the balance sheet of an enterprise with the process of dismantling them due to physical or moral obsolescence.

Damage to a fixed asset (regardless of the possibility of its further use) entails mandatory inventory at the enterprise. This is indicated in paragraph 27 of the Regulations according to Order of the Ministry of Finance No. 34n of 1998.

The procedure for liquidating fixed assets from the balance sheet is prescribed in paragraphs. 94-97 Methodological guidelines for accounting, approved in Order of the Ministry of Finance of 1998 No. 33n. These standards today are advisory in nature for accountants and other responsible persons.

Liquidation of a fixed asset is necessary in the following cases:

- for its write-off in the event of an accident, natural disaster or other emergency and the impossibility of further use for its intended purpose or restoration;

- to write off an object due to its physical and moral wear and tear;

- in case of long-term non-use of the facility for the production of products , performance of work and provision of services or for management purposes;

- in other cases established by law.

Liquidation of a fixed asset can be complete or partial. In the latter case, we are talking about this type of write-off when a certain part of the object can be used in the future (for example, as raw materials in production or for the repair of fixed assets).

Features of the formation of residual value during partial liquidation

It is unlawful to apply the norms for writing off the residual value during the complete liquidation of property for non-operating expenses for partial liquidation, because there is no condition for decommissioning the equipment (clause 8, clause 1, article 265, clause 13, article 259.2 of the Tax Code of the Russian Federation). Therefore, it is allowed to write off the residual value of property with non-linear depreciation for partial liquidation of the object as one-time expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 19, 2011 No. 03-03-06/1/503).

Progress of the procedure

Previously, the process of writing off fixed assets was strictly regulated. During this procedure, a special commission was necessarily created, which was supposed to make the final decision on liquidation. Now this norm is not mandatory and write-off of fixed assets is carried out according to the rules established by local documents.

The requirements of Federal Law No. 402 “On Accounting” on the procedure for liquidation are advisory in nature, but are often practiced today.

The liquidation procedure for fixed assets involves the following stages:

- At the preparatory stage, the feasibility of further use of fixed assets, the effectiveness or ineffectiveness of restoration is determined . For this purpose, by order of management, a special commission of competent employees may be appointed. It usually includes accountants and persons responsible for the safety of fixed assets. Outside experts and inspectors may be invited to participate in the work of the commission. Based on the results of the commission's registration, an order is usually issued.

- Next comes the stage of the commission's work . The competence of the commission includes: inspection of the facility using certain technical documentation; establishing the impossibility of its use; assessment of the reasons for writing off an object; assessment of the possibility of using individual components and assemblies of the object and its assessment; control over the withdrawal of precious metals and non-ferrous metals from fixed assets; determining the weight of the object and transferring it to the warehouse, etc.

- The results of the commission's work and the decisions it makes are documented . Based on the results of the commission’s work, a decision may be made to write off a fixed asset or to repair it or disassemble it into spare parts. The decision made must be justified: members of the commission should indicate the reasons that prompted them to liquidate fixed assets.

- Parts, assemblies and assemblies (for example, suitable for repairing other operating systems) are received as scrap or waste , and unusable ones are received as recyclable materials.

- A note about disposal of fixed assets is made in the inventory card or book.

- An order to liquidate a fixed asset is created.

Decommissioning of an object without dismantling

The Ministry of Finance believes that it is possible to write off the facility without dismantling it. The position of officials is as follows: write-off of property occurs as a result of disposal of the object in accordance with a correctly executed liquidation act.

It is not necessary to confirm the fact of dismantling (Letter of the Ministry of Finance of Russia dated December 8, 2009 No. 03-03-06/1/793).

Tax authorities also believe that this condition is not mandatory and the costs of write-off and the amount of remaining depreciation can be included in non-operating expenses on the basis of a liquidation act without dismantling (Letter of the Federal Tax Service of Russia for Moscow dated September 30, 2010 No. 16-15 / [email protected ] ).

The earlier position of the tax authorities differed from the explanations of the Ministry of Finance. Federal Tax Service officials said that it was impossible to liquidate the facility without dismantling it. A taxpayer who has not carried out an analysis of a written-off fixed asset does not have the right to write off liquidation expenses, depreciation and residual value as non-operating expenses (Letter of the Federal Tax Service of Russia for Moscow dated 04/07/2009 No. 16-15/033038).

Since employees of the Federal Tax Service show an ambiguous decision on this issue, it is still recommended to take into account their wishes and carry out dismantling work. If the object has been lost and it is impossible to organize work to dismantle it, it is still necessary to carry out some work to eliminate the consequences. They should be documented with primary documents. In this case, you will have every reason to legally liquidate the property.

See also “Capitalization of materials after dismantling fixed assets - postings.”

What documents are drawn up

In the process of liquidating fixed assets, you need to prepare some mandatory documents:

- Certificate of liquidation of fixed assets.

- Inventory accounting card, form No. OS-6 (or other document accepted by the company for accounting of fixed assets). Filling out this card completes the process of liquidation of a fixed asset.

- Act on an accident or accident that led to the impossibility of further use of fixed assets.

- A document confirming the removal of the vehicle by the traffic police (if the car is written off).

- Order to liquidate a fixed asset.

Unreasonable demands of the tax service

There are often cases when a fixed asset is written off before the end of its useful life, and representatives of the tax service demand that the amounts of input value added tax previously submitted for deduction be restored. This requirement concerns the residual value of the written-off property.

However, such a requirement does not comply with current legislation. When liquidating fixed assets before the end of their service life for the specified reasons, the organization is not obliged to pay the specified amount to the budget. This conclusion has been fully confirmed by judicial practice.

Rules for preparing the act

In the process of liquidation of fixed assets, it is imperative to document this process and draw up an act on the liquidation of fixed assets. The act of liquidation of fixed assets is prepared based on the results of the inventory.

Currently, unified accounting forms are no longer mandatory for use. Therefore, when preparing an act, accountants can develop the form of the act independently. Information from the Ministry of Finance No. PZ-10/2012 also indicates this. If the company develops the form independently, then it must be fixed in the accounting policy for accounting.

But quite often accountants use the unified form of the act on write-off of fixed assets No. OS-4. It was approved by the State Statistics Committee in Resolution No. 7 of 2003. A unified form allows you to avoid mistakes and take into account all the mandatory information that must be contained in this document.

In the column “Original cost as of the date of acceptance for accounting or replacement cost” for fixed assets that have undergone revaluation, the replacement value at the last revaluation is indicated. If the objects have not been revalued, then the initial valuation is recorded at the time the asset was accepted for accounting.

The column with the amount of depreciation indicates the amount of depreciation since the initial operation.

The costs of writing off fixed assets and the cost of material assets that were received as a result of disassembly are indicated in section 3 “Information on the costs associated with writing off fixed assets from accounting and on the receipt of material assets from their write-off.” This section indicates the cost of spare parts and materials that remain after disassembly and can be useful in production.

The act in form No. OS-4 is prepared in 2 copies. It must be signed by the commission members and the head of the organization. The first copy of the act is subject to transfer to the accounting department and will serve as the documentary basis for writing off the object from the register, and the second copy remains with the responsible person. Such a person, who is responsible for ensuring the safety of fixed assets, is appointed by order of the head of the enterprise.

A second copy may also be needed in case materials remaining from liquidation are transferred to the warehouse. Information about the costs incurred for liquidation and the cost of materials is written down in section 3 of the act in form No. OS-4.

It is worth considering that the form of the act used may vary depending on the type of fixed asset or the specifics of the situation:

- To write off vehicles, you can use the act of writing off vehicles in form No. OS-4a.

- When writing off a group of fixed assets - an act in form No. OS-4b “Act on writing off groups of fixed assets”.

A sample act of liquidation of fixed assets can be downloaded here.

Impact of OS liquidation on taxes

Each transaction with fixed assets must be recorded in the balance sheet of the business entity. Write-offs are also included in this category, but such transactions must be taken into account as accurately as possible, since this affects the calculation of the tax base for certain payments to the treasury.

Yes, VAT:

- It is not accrued on fixed assets that have been written off completely.

- Restored if there is a partial balance on the organization’s accounts.

- When third-party companies are involved in the dismantling of a liquidated facility, it is accepted for deduction on a general basis.

- It is required to be calculated when balances on settlement documents are realized.

Valid accounting balances are reflected in unrealized income, even if their future use is not planned. Income will be counted from the moment the write-off act is prepared and certified by the signatures of all members of the commission. The tax base changes to the size of the corresponding cost (PBU 6/01).

In order to avoid problems with taxes, it is important to calculate everything correctly during liquidation