The Tax Code of the Russian Federation provides that Russian citizens are required to pay tax on any income. Income can be expressed in several forms: monetary, in-kind and income as a material benefit.

A microloan is in no way considered income, because under the terms of the agreement the borrower will be obliged to repay the borrowed funds. He owns the loan temporarily; after this period, the borrower must repay the money and pay interest for use. MFOs issue loans on the terms of repayment and payment. This is the main difference between a loan and other types of profit.

Withholding personal income tax from material benefits

In order to determine at what rate material benefits are subject to personal income tax, it is necessary to find out what material benefits are and from what sources they are generated.

Income in the form of material benefits arises for the taxpayer on the following grounds (Article 212 of the Tax Code of the Russian Federation):

- Saving on interest on borrowed funds received from an organization or entrepreneur.

- Price difference when purchasing material assets from interdependent persons (entrepreneurs, organizations) under civil contracts.

- Price difference when purchasing securities and financial instruments of futures transactions.

Material benefits are subject to personal income tax in full for all the above reasons. However, there are some peculiarities when obtaining savings on interest for using credit funds.

Firstly, the following are not subject to taxation:

- Benefit in the form of an interest-free credit period using a bank card, received from a bank located in the Russian Federation.

- Interest savings when using loan funds for the construction or purchase of new housing (rooms, apartments, shares) or land for construction in the Russian Federation. This exception applies if the taxpayer has the right to a property deduction, which is confirmed by the tax authority (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

- Saving on interest when refinancing or refinancing loans for the purchase or construction of new housing (apartments, houses, rooms, shares) or land plots for the construction of residential buildings. Valid if there is a valid right to a property deduction, confirmed by the tax authority (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

NOTE! Starting from 2021, financial benefits arising during mortgage holidays are not subject to personal income tax.

Secondly, from 2021, savings on interest for the use of borrowed (credit) funds are recognized as personal income tax income only in cases if:

- the loan was received from an organization or individual entrepreneur that is interdependent with an individual or with which an employment relationship has been established;

- such savings are actually material assistance or a form of reciprocal fulfillment of an obligation to an individual.

It does not matter when the contract was concluded.

If borrowed funds are provided not by a credit or banking institution, but by another enterprise, then personal income tax is withheld from the above savings on a general basis (letter of the Ministry of Finance of Russia dated October 28, 2010 No. 03-04-06/6-256).

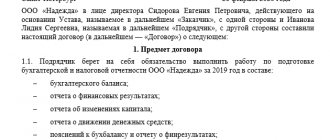

Sample loan agreement for an individual from a legal entity

When applying for a loan to an individual from a legal entity, a bilateral agreement is drawn up.

The document contains the following information:

- at the top of the contract the date and place of drawing up the document is written;

- followed by the full and abbreviated name of the lending organization, full name of the general director, full name of the borrower indicating the date of birth, tax identification number and passport details;

- in the section “rights and obligations of the parties” the amount (in numbers and words) accepted by the borrower is indicated, as well as the obligations and rights of the borrower and lender;

- in the “term of agreement” section, the condition for the entry into force of the agreement (the moment of transfer of money) and its expiration date are stated. It also states that by agreement of the parties, the term of the contract may be extended;

- in the “special conditions” section, the interest on the loan, the final amount to be repaid, the method of repayment (for example, monthly payments), the date of the last payment and a number of additional conditions are indicated;

- the “force majeure” section specifies situations in which the parties may be released from fulfilling obligations for the duration of such circumstances and their consequences (for example, military actions, natural disasters, man-made disasters, etc.);

- in the “contract performance guarantee” section, the amount of the insurance payment is stated, indicating the name of the insurance company;

- in the section “liability of the parties” it is noted that liability arises in accordance with the current legislation of the Russian Federation;

- at the very end, the details of the parties are indicated and signatures are placed.

A sample loan agreement from a legal entity to an individual can be downloaded here: loan agreement from a legal entity to an individual

Material benefit of personal income tax - 2020-2021

The Tax Code reflects the rates for taxation of material benefits with personal income tax in 2020-2021. Thus, if an individual receives a material benefit, the personal income tax rate may be as follows:

- For residents of the Russian Federation, a rate of 35% applies to the excess of the interest savings received from the tax agent over the value of 2/3 of the Bank of Russia refinancing rate on the date of receipt of income on loans in rubles and 9% per annum on loans in foreign currency.

- For residents of the Russian Federation, a rate of 13% is established for amounts of material benefits on goods purchased from related parties and transactions with securities.

- For non-residents there is a flat rate of 30% for all reasons for the occurrence of material benefits.

Read more about rates in the article “What percentage is personal income tax.”

Loan postings

An interest-free loan is not a financial investment, since it does not bring any economic benefits to the organization. A loan to an individual is considered an investment, only the funds are issued at interest.

According to the Chart of Accounts, interest-free loans provided by a legal entity to an individual (if the borrower is not an employee of the organization) are reflected in account 76 “Settlements with various debtors and creditors”, subaccount “settlements on loans provided”.

The wiring will look like this:

- D76 K50(51) – reflects the provision of a loan to an individual from the company’s current account;

- D50(51) K76 – reflects the repayment of the debt by the borrower.

When issuing an interest-free loan to an employee of an organization, instead of account 76, account 73 “Settlements with personnel for other operations” is entered, subaccount 73-1 “Settlements on loans provided.”

If an organization provides an interest-bearing loan to an individual who is not its employee, account 58 “Financial investments”, subaccount “Provided loans” is used.

Interest on loans is recorded in accounting monthly. If a loan is received by an employee of an organization, interest is reflected in the debit of account 73, in correspondence there is a credit of account 91 “Other income and expenses”, subaccount “Other income”.

Interest on a loan received from a third-party individual is recorded on the debit of account 76 “Settlements with various debtors and creditors”, in correspondence with loan 91, subaccount “Other income”.

1

How to calculate material benefits based on interest?

This is the most common type of financial benefit, so we will show the tax calculation for it.

The procedure for calculating material benefits from savings on interest is prescribed in paragraph 2 of Art. 212 of the Tax Code of the Russian Federation.

Loan in rubles

If the loan was received in rubles, then the material benefit is calculated as the excess of the amount of interest for the use of borrowed (credit) funds expressed in rubles, calculated on the basis of two-thirds of the current refinancing rate established by the Central Bank of the Russian Federation on the date of actual receipt of income, over the amount of interest calculated based on the terms of the contract.

The calculation of material benefits received in rubles can be expressed by the formula:

MV = SZ × (2/3 × StCB – StZ) / DG × DZ,

Where:

MB - material benefit;

SZ - loan amount;

StCB - refinancing rate of the Central Bank of the Russian Federation on the date of receipt of income;

See the rate for different periods here.

StZ - loan rate;

DG - number of days in a year: 365 or 366;

DZ - the number of days of using the loan, including interest-free.

An example of calculating personal income tax on material benefits from savings on interest on loans in rubles from ConsultantPlus. On June 3, 2021, the employer issued Kashin K.K. to the employee. (tax resident of the Russian Federation) loan in the amount of 500,000 rubles. at 4.5% per annum until December 1, 2021. The refinancing rate of the Bank of Russia during this period is 7.5% (conditionally). In this case, Kashin K.K. There is a material benefit when saving on interest, since 4.5% < 5% (2/3 x 7.5%). The employee transferred the entire loan amount and the interest accrued for the period of use of the loan to the organization’s account on November 30, 2021. The employer calculated personal income tax on material benefits as follows. You can view the entire example in K+. Trial access is free.

When calculating material benefits, the following must also be taken into account:

1. Material benefit is considered received on the last day of each month during the entire term of the loan agreement. That is, regardless of when interest is paid and whether it is payable according to the agreement, the material benefit is calculated monthly.

It should be taken into account that if the loan was repaid not on the last day of the month, but on some other day, then the material benefit is still calculated on the last day of the month (see letter of the Ministry of Finance dated January 14, 2016 No. 03-04-06/636 ).

2. If within a certain month the loan was partially repaid, then the material benefit is calculated in 2 steps: on the date of repayment of the loan and on the last day of the month.

Loan in foreign currency

If the loan was received in foreign currency, then the material benefit is calculated as the excess of the amount of interest for the use of borrowed (credit) funds expressed in foreign currency, calculated on the basis of 9% per annum, over the amount of interest calculated on the basis of the terms of the agreement.

The calculation of material benefits received in foreign currency can be expressed by the formula:

MV = SZ × (9% – StZ) / DG × DZ,

Where:

MB - material benefit;

SZ - loan amount;

StZ - loan rate;

DG - number of days in a year: 365 or 366;

DZ - the number of days of using the loan, including interest-free.

An example of calculating personal income tax on material benefits from savings on interest on loans in foreign currency from ConsultantPlus The Organization issued on May 13, 2021 to employee Semenov N.N. (tax resident of the Russian Federation) loan in the amount of 10,000 euros at 4% per annum until August 1, 2021. In this case, Semenov N.N. There is a material benefit when saving on interest, since 4% < 9%. The employee transferred the entire loan amount and accrued interest to the organization’s account on July 31, 2021. Let’s assume that the euro exchange rate as of 05/31/2020 was 63.26 rubles, as of 06/30/2020 - 67.50 rubles, and as of 07/31/2020 - 65 ,80 rub. The employer calculated personal income tax on material benefits as follows. Get a free trial of K+ to see the full example.

What are the restrictions?

Any legal entity can provide borrowed funds to one of the founders, its employees or third parties. Current legislation does not impose any restrictions on this procedure.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

A loan agreement is drawn up between an individual and a legal entity in accordance with the Civil Code. The loan can be reimbursable or gratuitous.

If the agreement provides for the legal entity to receive remuneration in the form of interest (all conditions must be specified in the document), the organization will face certain tax consequences.

Loans should not be issued to an unlimited number of persons, otherwise these transactions may be classified as illegal banking activities.

Other nuances of personal income tax with matvygoda

Do not forget that the calculation of material benefits and the personal income tax calculated from it must be documented. For this purpose, an accounting certificate is drawn up.

REFERENCE: The material benefit from saving on interest is reflected in the 2-NDFL certificate under income code 2610.

When calculating personal income tax, remember that income in the form of material benefits is not reduced by tax deductions (clause 4 of article 210 of the Tax Code of the Russian Federation).

The calculated personal income tax on material benefits must be withheld from the nearest cash income paid to the borrower. In this case, the total amount of personal income tax withheld cannot exceed 50% of the income paid. If the balance of personal income tax on material benefits remains undeducted, then it must be withheld at the next payment of income. If this fails, at the end of the year the unwithheld tax must be reported to the tax certificate 2-NDFL with sign 2.

NOTE! Calculated personal income tax, including on material benefits, cannot be withheld from payments that are not income. For example, personal income tax on material benefits cannot be withheld when reimbursing overexpenditures of accountable money by issuing a loan (clause 4 of article 226 of the Tax Code of the Russian Federation).

If personal income tax calculated on material benefits was withheld when paying vacation or sick pay, then the withheld tax on material benefits must be paid no later than the day of its payment, and the withheld tax on vacation or sick pay can be paid later, but no later than the last day of the month of their payment (clause 6 Article 226 of the Tax Code of the Russian Federation).

Example:

As of March 31, a material benefit was calculated in the amount of RUB 8,000. and personal income tax was calculated on material benefits in the amount of 2800 rubles. (8,000 × 35%). On April 4, vacation pay was calculated in the amount of 54,000 rubles, personal income tax on which is 7,020 rubles. (54,000 × 13%), and vacation pay was transferred to the employee minus the calculated personal income tax on vacation pay and financial assistance in the amount of 44,180 rubles. (54,000 – 7,020 – 2,800). Pay personal income tax on financial assistance in the amount of 2,800 rubles. You need to pay personal income tax on the amount of vacation pay in the amount of 7,020 rubles no later than April 5. Needed no later than April 30th.

KBK personal income tax for material benefits in 2020-2021 is the following - 182 1 0100 110.

Material benefits from savings on interest are not subject to insurance premiums.

Issuance of a loan from an organization to an employee of this organization

A loan issued by an organization to its employee is formalized by concluding a bilateral agreement. To receive funds, the borrower must write an application and submit it to management for consideration.

The application must indicate the purpose of receiving borrowed funds. Most often, workers receive loans for the construction or purchase of housing, education and other needs.

Sometimes organizations require collateral from employees, which, as a rule, is property. Such loans are usually issued at low interest rates. All conditions must be clearly stated in the contract. An employee of the Bureau of Technical Inventory is invited to evaluate the property.

Debt repayment is carried out in equal monthly payments, sometimes the employer automatically deducts funds from wages. If the debt is repaid early, no penalties are imposed, which often happens when taking out bank loans.

Thus, taking out a loan from a legal entity can be a very profitable decision. You should first evaluate all the advantages of this type of loan over bank lending.

The most important thing is to monitor the drafting of the contract and carefully study the document for errors and inaccuracies.

A sample loan agreement from an individual to a legal entity is in the article: loan from an individual to a legal entity. Features of providing loans from 18 years of age are shown on the page.

Whether it is necessary to notarize a loan agreement between individuals, read here.

Results

Material benefit is the income of an individual, subject to personal income tax in a special manner, using special tax rates.

Tax must be calculated on each last day of the month. This is done by the tax agent. He also transfers the tax to the budget or informs the taxpayer and tax authorities about the impossibility of withholding. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Situations when tax on borrowed funds is not calculated or is partially calculated:

1. In case the loan is repaid. If the loan is partially repaid, the tax amount is calculated from the difference.

Example 3. Citizen Matveev S.S. in 2014, he entered into a contract for the construction of an apartment for the amount of 1,200 million rubles. The tax inspectorate sent a request to the named citizen to provide explanations about the sources of income. Citizen Matveev S.S. submitted information on income to the tax office (data on wages in the amount of 200 million rubles). He received part of the amount of 1,000 million rubles as a loan from his friend. The borrower returned part of the amount, which is confirmed by a receipt in the amount of 500 million rubles. For the unpaid amount of debt in the amount of 500 million rubles. The tax office has assessed income tax. Similar to examples 1 and 2, tax authorities have the right to request a declaration of income and property from a friend of the borrower.

2. In the event that borrowed funds are received from persons who are closely related or related to the payer.

Persons in close relationships include: parents (adoptive parents), children (including adopted children), siblings, grandparents, grandchildren, great-grandparents, great-grandchildren, spouses.

Persons in a property relationship include close relatives of the other deceased spouse.

Example 4. Citizen Savitskaya N.G. purchased currency in the amount equivalent to 200 thousand dollars. At the request of the tax inspectorate, she submitted a declaration of income and property. According to the declaration, the citizen received a loan for the transaction from her brother, which is confirmed by the loan agreement. There will be no demands from the tax authorities to pay tax, since the transaction was made between close relatives. However, tax authorities have the right to request a declaration of income and property from the borrower’s sibling.

3. Tax on borrowed funds is not calculated on income in the form of loans, credits received by Belarusian individual entrepreneurs (notaries, lawyers) when they carry out entrepreneurial (notary, lawyer) activities. That is, in fact, the named persons have the status of an individual, but they are subject to a procedure similar to the procedure established for legal entities.

Income on an apartment loan is preferential

It’s good that officials agree that the exemption from personal income tax is valid even after the employee has used his deduction. As follows from the Letter of the Ministry of Finance of the Russian Federation dated December 2, 2015 No. 03-04-05/70138, there is no need to re-confirm your rights to a property tax deduction to receive benefits after the deduction has been fully received by the taxpayer.

Please note that the notification issued by the inspectorate must contain a reference to the loan agreement. Otherwise, you will not be able to receive a personal income tax benefit (Letter of the Federal Tax Service dated November 11, 2015 No. BS-4-11 / [email protected] ).

What if the loan was received to repay a mortgage loan that was previously taken out by an employee at the bank? In this case, the personal income tax exemption does not apply. Such explanations were given by officials from the Ministry of Finance of the Russian Federation in Letter dated October 7, 2009 No. 03-04-05-01/727. We agree with them, because the Tax Code of the Russian Federation clearly states the targeted nature of the loan, that is, the money should be received directly for the purchase of housing.

Refund of paid income tax

At its core, income tax on borrowed funds is a guarantee of repayment of the debt. Upon full repayment of the loan, personal income tax paid at the request of the tax authority shall be refunded (or offset against another tax) to the borrower who paid the tax.

In order to initiate an income tax refund, you must write an application to the tax office at the place of registration and attach documents confirming the fact of settlement of debts. Such a document can be a receipt signed by the debtor and the borrower if the payment was made in cash, or a cash order if the payment was made through a cash desk.

However, if the debt is repaid using borrowed funds, then recalculation and refund of income tax occurs only if the funds are received from persons who are closely related or related to the borrower. That is, when repaying a debt, the tax office can again ask the borrower where he got the money to repay the debt.

Some companies practice issuing loans to employees. Moreover, for some loans employees generate income subject to personal income tax, while for others they do not. How do you know whether you need to withhold and pay personal income tax when issuing a loan to employees?