How to correctly prepare an accounting statement in different situations using examples

Let us immediately warn you that primary documents cannot be replaced with an accounting certificate. For example, without invoices and receipts, you will not take into account expenses. Expense reports cannot be replaced either. Therefore, use the certificate as an additional document only to confirm expenses and justify other entries in accounting. Keep the certificates for at least five years, and sometimes longer. For example, during the entire period of loss transfer in tax accounting.

- Important article:

Table. What details should be included in the certificate?

Is it possible to repay loan interest by offset?

As one of the methods of mutual settlements when repaying interest under a loan agreement, counterparties have the right to choose the offset of mutual claims. Offset of claims is possible if 3 conditions are met (Article 410 of the Civil Code of the Russian Federation):

- the lender and the borrower have counterclaims against each other;

- the requirements of both companies are similar;

- the deadline for fulfilling the counterclaim has already arrived.

For offset, a statement from one of the parties is sufficient.

The concept of a homogeneous requirement is not legally established. According to paragraph 7 of the information letter of the Presidium of the Supreme Arbitration Court dated December 29, 2001 No. 65, it is indicated that the requirement for offset may not correspond to obligations of one type. It follows from this that obligations associated with the execution of various contracts, but with the same method of repayment and expressed in the same currency, are recognized as homogeneous.

Example:

received an interest-bearing loan from Alliance LLC in the amount of 20 million rubles. at 15% per annum for a period of 1 year with interest payment at the end of the loan period. That is, Stroimaster is obliged to return 20 million rubles. principal debt and 3 million rubles. percent (20 million rubles * 10%).

For this transaction, the company recorded the following entries:

Alliance LLC purchased office space for 3 million rubles. The companies recorded the following transactions in their accounting records:

sent an application for offset of mutual claims in the amount of 2 million rubles.

Transactions from counterparties will look like this:

We need to fix the mistake

Often, accounting certificates are issued to make corrections in accounting. For example, if you made incorrect entries, made a mistake in the amounts, or reflected the transaction twice. If an error was made in the accounting, draw up a certificate. In it, indicate the reason and essence of the error and wiring.

Example 1. How to issue an accounting certificate to correct errors

In March 2021, the farm received a service certificate from the supplier for 30,000 rubles. The accountant mistakenly posted RUB 33,000. A week later, the error was discovered and bookkeeping certificate No. 1 was issued, and the following was recorded in the accounting records:

DEBIT 20 CREDIT 60

– 33,000 rub. – the posting of services was reversed;

DEBIT 20 CREDIT 60

– 30,000 rub. – services have been capitalized for the correct amount.

Loan from an individual

The organization received a loan from the director in the amount of 80,000 rubles. at 5% per annum for 3 months.

Postings:

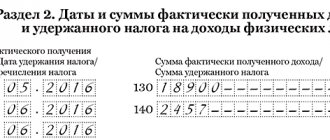

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 50 | 66 | Cash loan received | 80 000 | Receipt cash order |

| 91.2 | 66 | Interest accrued | 600 | Accounting information |

| 73 | 68 personal income tax | Personal income tax withheld from interest | 78 | Accounting information |

| 66 | 50 | Interest paid | 522 | Account cash warrant |

| 66 | 50 | Loan repaid | 80 000 | Account cash warrant |

How to correctly draw up an accounting statement to justify calculations

Often you have to do calculations manually. To justify calculations and confirm income or expenses, issue an accounting certificate. For example, when calculating interest on a loan issued or received, daily allowances or dividends, advances on property taxes.

Sample 1. Accounting certificate when you need to correct an error

Example 2. How to prepare an accounting certificate to justify calculations

In March, the farm sent an agronomist on a business trip from March 19 to March 23, 2021. To calculate the daily allowance for the trip, the accountant prepared accounting certificate No. 2 and made accounting entries:

DEBIT 20 CREDIT 71

– 3500 rub. – daily allowances have been accrued.

Sample 2. Accounting statement for justified daily allowance

Example 3. How to prepare an accounting certificate if you need to calculate interest on a loan issued

The farm issued a loan to a third party on February 28, 2018. The amount is 2,000,000 rubles, the rate is 9 percent per annum. To calculate interest for March, the accountant issued certificate No. 3 and wrote down:

DEBIT 76 CREDIT 91 SUBACCOUNT “OTHER INCOME”

– 15,287.67 rub. – interest accrued on the loan for March.

Sample 3. Accounting statement on interest accrual

Example 4. How to prepare an accounting certificate for VAT calculation

In March, the farm sold potatoes to the public for cash. No invoices were issued. To reflect the accrued VAT, the accountant issued certificate No. 4 based on CCP reports and registered it in the sales book.

Example 5. How to prepare an accounting certificate when calculating tax advances

The farm's real estate includes an administrative and business building. The tax base for it is the cadastral value, which as of January 1, 2021 is RUB 8,103,292.80. The property tax rate is 1.5 percent. Advance payment for property tax for the first quarter – RUB 30,387.35. (RUB 8,103,292.80 × 1.5%: 4). The accountant made the calculation of the advance payment in certificate No. 5.

Sample 4. Accounting certificate for calculating VAT

An accounting certificate helps agricultural companies in court if they need to confirm such expenses in tax accounting:

- monthly income under a contract with a long cycle (resolution of the Federal Antimonopoly Service of the North Caucasus District dated April 25, 2014 in case No. A32-16469/2012);

- the cost of defective products, which reduces income tax (resolution of the Arbitration Court of the North Caucasus District dated April 25, 2016 in case No. A63-7396/2015).

Sample 5. Accounting certificate for calculating advance payment for property tax

In some cases, without issuing an accounting certificate-calculation

not enough. Let's look at what purposes it serves and what it represents.

Typical entries in accounting

When constructing real estate, interest on the loan is included in their initial cost:

- Debit 08 Credit 66 (67).

After construction is completed, a note is made:

- Debit 91.2 Credit 66 (67).

If the interest rate exceeds the standard for controlled debt, then a deferred tax liability arises, which must be reflected at:

- debit of account 68.4.2 and credit of account.

When is it issued?

As a rule, by filling out an accounting certificate form

Only the company's accountant is involved. Senior management is not involved in this process.

Basically, this certificate is necessary when the rest of the “primary” data has already been collected, but for accounting, an additional calculation of some indicator is needed. In practice this could be:

- accounting certificate - calculation of interest, including on a loan

; - accounting certificate - calculation of benefits (for pregnancy and childbirth

, etc.); - accounting certificate - daily allowance calculation

; - accounting certificate calculating compensation for delayed wages

(Article 236 of the Labor Code of the Russian Federation); - accounting certificate - income tax calculation

; - accounting certificate calculating 5 percent VAT

(clause 4 of Article 170 of the Tax Code of the Russian Federation); - accounting certificate - calculation of penalties

; - accounting certificate - calculation of cost distribution

; - accounting certificate - calculation for write-off of gasoline

; - accounting certificate-calculation as an appendix to the certificate of incapacity for work

, etc.

Results

Accounting for received loans and borrowings is reflected in the accounts: 66 - for short-term contracts, 67 - for long-term ones, and issued loans are reflected by the lender in the accounts: 58 - for interest-bearing loans, 76 - for interest-free loans. Interest on loans and borrowings are non-operating income for the lender and non-operating expenses for the borrower.

In some cases, without issuing an accounting certificate-calculation

not enough. Let's look at what purposes it serves and what it represents.

What is the form of an accounting statement?

Mandatory, statutory sample accounting certificate-calculation

absent. This means that for the accounting policy, it is advisable to develop its form independently, taking into account all the features of the enterprise and its document flow. And to approve it by a separate order of the head of the enterprise.

If you are in doubt about how to correctly draw up a sample accounting certificate-calculation

, follow Article 9 of the Law

- Company name;

- the essence of the operation and the calculation for it;

- Date of preparation;

- FULL NAME. responsible persons.

On our portal, download the accounting certificate, if it suits you.

Account correspondence:

Civil relations

In accordance with paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him same kind and quality. The loan agreement is considered concluded from the moment the money or other things are transferred.

According to paragraph 1 of Art. 809 of the Civil Code of the Russian Federation, the lender has the right to receive interest from the borrower on the loan amount in the amount and in the manner specified in the agreement. In the situation under consideration, according to the agreement, interest is paid in a lump sum upon repayment of the loan amount (clause 2 of Article 809 of the Civil Code of the Russian Federation).

The borrower is obliged to return the received loan amount to the lender on time and in the manner provided for in the loan agreement (Clause 1 of Article 810 of the Civil Code of the Russian Federation).

Accounting

For accounting purposes, the amounts of loans received are not recognized as income of the borrowing organization, since they do not meet the conditions for recognizing income established by clause 2 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n (receipt borrowed funds is not a receipt of assets leading to an increase in the organization’s capital).

When returning (repaying) the loan amount, no expenses arise in the accounting of the borrower organization due to clause 3 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

In accordance with paragraphs 2, 5 of the Accounting Regulations “Accounting for expenses on loans and credits” (PBU 15/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n, funds received (returned) under the loan agreement , are reflected in accounting as the occurrence and repayment of the corresponding accounts payable.

Interest payable to the lender according to the terms of the agreement is taken into account as part of other expenses evenly (monthly) during the term of the loan agreement. This follows from paragraph. 2 clause 3, clauses 6, 7, 8 PBU 15/2008, clauses 11, 14.1, 16, 18 PBU 10/99.

Accrued interest amounts are reflected in accounting separately from the principal amount of the obligation for the loan received (clause 4 of PBU 15/2008).

In this case, the amount of accrued interest is paid in a lump sum on the date of repayment of the loan (05/12/2015). Consequently, on this date the organization’s accounts payable are repaid both in terms of the principal amount of the loan and in terms of accrued interest.

Accounting records reflecting the transactions under consideration are made in the manner established by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown below in the table of entries.

Value added tax (VAT)

Operations for the provision of loans in cash, as well as interest on them, are not subject to VAT on the basis of paragraphs. 1 item 2 art. 146, paragraphs. 1 clause 3 art. 39, pp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation.

Consequently, the borrowing organization does not have any tax consequences for VAT either when receiving or returning the loan amount, or when paying interest.

Corporate income tax

In tax accounting, funds received under a loan agreement and returned to the lender are not taken into account when determining the tax base for income tax, either as income or as expenses (clause 10, clause 1, article 251, clause 12, article 270 of the Tax Code RF).

As a general rule, interest on debt obligations of any type is taken into account as part of non-operating expenses based on paragraphs. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, taking into account the features provided for in Art. 269 of the Tax Code of the Russian Federation.

From 01/01/2015, interest on debt obligations of any type, including under a loan agreement (which is not a controlled transaction), is recognized as an expense based on the actual rate (clause 1 of Article 269 of the Tax Code of the Russian Federation). For detailed information on changes in the accounting procedure for interest on debt obligations, see the Practical Guide to Income Tax, as well as the Practical Commentary on the main changes to tax legislation since 2015.

When applying the accrual method, expenses in the form of interest under a loan agreement are recognized monthly (at the end of each month during the term of the loan agreement and on the date of repayment of the loan) based on the interest rate established by the loan agreement and the number of days of use of borrowed funds in the reporting period. This follows from the totality of the norms in paragraph. 2, 3 p. 4 art. 328, para. 1, 3 p. 8 art. 272, para. 2 pp. 2 p. 1 art. 265 Tax Code of the Russian Federation.

In the case of accounting for income and expenses on a cash basis, interest expenses are recognized on the date of actual repayment of the debt for their payment (in this case, on May 12, 2015) (clause 1, clause 3, article 273 of the Tax Code of the Russian Federation).

Application of PBU 18/02

When applying the cash method in tax accounting on the dates of accrual of interest in accounting for January - April, deductible temporary differences arise in the amount of accrued interest and the corresponding deferred tax assets (DTA), which are repaid on the date of payment of interest (clauses 11, 14 , 17 Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

Accounting entries related to the occurrence and repayment of ONA are made in the manner established by the Instructions for the use of the Chart of Accounts and are shown in the posting table.

Analytical account symbols used in the posting table

To balance sheet account 66 “Settlements for short-term loans and borrowings”:

66-o “Calculation of the principal amount of the loan”;

66-p “Calculations of interest on loans.”

| Debit | Credit | Amount, rub. | Primary document | |

| Received funds under a loan agreement | 66-o | 600 000 | Loan agreement, | |

| Interest accrued on the loan for January (600,000 x 25% / 365 x 19) | 91-2 | 66-p | 7808,22 | Loan agreement, Accounting certificate-calculation |

| Cash method: SHE is reflected (7808.22 x 20%) | 1561,64 | Accounting certificate-calculation | ||

| Interest accrued on the loan for February (600,000 x 25% / 365 x 28) | 91-2 | 66-p | 11 506,85 | Loan agreement, Accounting certificate-calculation |

| Cash method: SHE is reflected (11,506.85 x 20%) | 2301,37 | Accounting certificate-calculation | ||

| Interest accrued on the loan for March (600,000 x 25% / 365 x 31) | 91-2 | 66-p | 12 739,73 | Loan agreement, Accounting certificate-calculation |

| Cash method: SHE is reflected (12,739.73 x 20%) | 2547,95 | Accounting certificate-calculation | ||

| Interest accrued on the loan for April (600,000 x 25% / 365 x 30) | 91-2 | 66-p | 12 328,77 | Loan agreement, Accounting certificate-calculation |

| Cash method: SHE is reflected (12,328.77 x 20%) | 2465,75 | Accounting certificate-calculation | ||

| Interest accrued on the loan for May (600,000 x 25% / 365 x 12) | 91-2 | 66-p | 4931,51 | Loan agreement, Accounting certificate-calculation |

| Interest paid on loan (7808,22 + 11 506,85 + 12 739,73 + 12 328,77 + 4931,51) | 66-p | 49 315,08 | Bank account statement | |

| Cash method: SHE repaid (1561,64 + 2301,37 + 2547,95 + 2465,75) | 8876,71 | Accounting information | ||

| Funds were transferred to the lender to repay the principal amount of the loan | 66-o | 600 000 | Bank account statement |

M.S. Radkova Consulting and Analytical Center for Accounting and Taxation

Read the article on how to correctly draw up an accounting certificate, approve it and store it. Download ready-made samples.

An accounting certificate is useful when you need to justify postings, make preliminary calculations or correct errors, set off mutual claims, calculate dividends or recalculate benefits.

Accounting statement: sample filling

Let’s say that Guru LLC issued a loan to another company for a period of February 2021 in the amount of 100,000 rubles at 10% per annum. Below is a sample of an accounting statement calculating interest on a loan.

.

Please note:

in the last column, the accountant of Guru LLC provided a calculation formula based on the column numbers of this certificate.

Sample accounting certificate calculating the amount of interest on loans issued

Sample accounting certificate:

Limited Liability Company "Alfa"

ACCOUNTING CERTIFICATES for calculating interest on loans provided for the month: September___ 20_15_

| No. | Loan agreement | Loan amount, rub. | Annual interest rate, % | Loan term | Number of calendar days in the period for which interest is calculated, days | Amount of interest per month on the loan provided, rub. |

| 1 | 2 | 3 | 4 | 5 | 6 | 7=3*4/365(366)days*6 |

| 1 | Agreement No. 321 dated 03/01/2015 | 10000000,00 | 10 | 30.11.2015 | 30 | 8 219,18 |

| Total | 8 219,18 |

Performer: accountant __________________/ ________________________

Chief Accountant __________________/ ________________________

Amount and procedure for paying interest

The amount of interest on the loan can be specified in the agreement. If there is no such clause, the borrower must pay interest to the organization at the refinancing rate in effect on the date of repayment of the loan (or part thereof).

The procedure for paying interest can also be specified in the contract. But if this condition is absent, the borrower must pay interest monthly until the loan is fully repaid.

If an organization provides an interest-free loan, this condition must be expressly stated in the contract. The exception is loans issued in kind. By default they are interest-free. But if the organization intends to collect interest from the borrower, its amount and payment procedure must be stipulated in the agreement.

All this is stated in Article 809 of the Civil Code of the Russian Federation.

Thus, the amount and frequency of interest payments depend entirely on the conditions under which the lender and borrower entered into an agreement.

Under a loan agreement, interest can be charged both in cash and in kind (clause 1 of Article 809 of the Civil Code of the Russian Federation).

The amount of interest in kind, as a rule, does not need to be calculated - it is established by the parties to the transaction in the agreement (for example, 50 sheets of iron at market value monthly).

Cash interest is set at the annual interest rate. Therefore, to calculate the amount of monthly interest on a loan issued in cash, determine: – the amount of the loan on which interest is charged; – interest rate (annual or monthly); – the number of calendar days in the period for which interest is calculated.

As a rule, in the calculation you need to take into account the actual number of calendar days in a year - 365 or 366 - and, accordingly, in a month - 30, 31, 28 or 29 days. Interest must be accrued from the day following the day the loan was issued until the day it is repaid, inclusive. This procedure is confirmed by clause 3.14 of the Regulations of the Central Bank of the Russian Federation dated August 4, 2003 No. 236-P. For organizations it is not mandatory, therefore the contract can provide for another procedure (for example, establish a fixed amount of interest).

Determine the amount of monthly interest on the loan provided in cash as follows:

2. In what cases is it necessary to prepare an accounting certificate?

An accounting certificate must be prepared in any cases where an accountant needs to justify transactions or calculations. For example:

This primary document must contain the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Source: www.26-2.ru

What are the features of tax accounting for loans and borrowings?

Received credit or borrowed funds are not income for the purpose of calculating income tax for their recipient due to the provisions of sub. 10 p. 1 art. 251 Tax Code of the Russian Federation. Also, the funds issued are not an expense, taking into account the provisions of clause 12 of Art. 270 Tax Code of the Russian Federation. Likewise, funds received and paid to repay a loan or loan are not considered income or expenses.

In this case, the amounts of accrued and paid interest are fully recognized as non-operating expenses in accordance with subparagraph. 2 p. 1 art. 265 Tax Code of the Russian Federation. The moment of reflection of interest amounts in expenses is determined in accordance with clause 8 of Art. 272 Tax Code of the Russian Federation:

- at the end of each month,

- on the date of repayment of the loan or loan (if they are fully repaid).

The amount of interest in the presence of controlled debt is included in non-operating expenses in the amount provided for in Art. 269 of the Tax Code of the Russian Federation.

Interest received under agreements on the issuance of loans and borrowings relates to non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

It should be noted that differences in accounting and tax recognition of accrued interest expenses for an investment loan or in the presence of controlled debt give rise to temporary differences accounted for in accordance with PBU 18/02 “Accounting for corporate income tax calculations.”

Situation:

How is the receipt and repayment of an interest-bearing loan reflected in the organization's accounting if, according to the agreement, interest on the loan is paid at a time on the date of repayment of the loan?

On January 12, 2015, the organization received an interest-bearing loan in the amount of 600,000 rubles from another legal entity. The loan repayment deadline is May 12, 2015. According to the loan agreement, interest on the loan is accrued at a rate of 25% per annum on a monthly basis, based on the number of days the agreement is valid in the current month, from the day following the day the loan was provided until the day the loan is repaid inclusive.

Borrowed funds were used to pay wages to employees of the organization. The loan amount and interest on it were transferred to the lender on May 12, 2015.

Interim financial statements are prepared by the organization on a monthly basis.

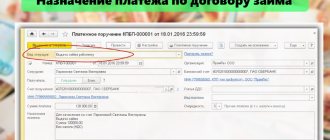

Example of postings for a loan from a legal entity

The company was provided with a cash loan for a period of months at a rate of 12% per annum in the amount of 350,000 rubles.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 66 | Cash loan received | 350 000 | Loan agreement Bank statement | |

| 91.2 | 66 | Interest accrued under the loan agreement | 38 500 | Accounting information |

| 66 | Interest transferred | 38 500 | Payment order | |

| 66 | Loan repaid | 350 000 | Payment order |

If the lender is an individual, on the amount of interest paid to him: 13% for residents and 35% for non-residents. This operation is documented by posting: Debit 73 (76) Credit 68 Personal Income Tax. Transfer of interest to an individual is carried out by recording Debit 66 (67) Credit (50).