Income and expenses under assignment agreements should be taken into account separately from income and expenses on other types of activities (clause 2 of Article 274 of the Tax Code of the Russian Federation).

Proceeds from the assignment of rights are income from the sale of property rights (clause 1 of Article 249 of the Tax Code of the Russian Federation). Costs associated with the assignment are included in costs associated with production and sales (clause 1, clause 1, article 253 of the Tax Code of the Russian Federation). If losses arise during the assignment, they should be taken into account in a special manner - on the basis of Article 279 of the Tax Code.

The tax accounting procedure for assignment depends on who made the assignment - the original creditor or the new one.

Accounting for losses upon assignment of the right of claim by the original creditor

The negative difference between the income from the sale of the right of claim and the cost of the goods (work, services) sold is a loss to the original creditor (clauses 1, 2 of Article 279 of the Tax Code of the Russian Federation).

If the assignment is made before the due date for payment under the main agreement, then when accounting for the loss, the original creditor must be guided by paragraph 1 of Article 279 of the Tax Code. According to it, until December 31, 2014, a loss that reduces taxable profit in this case cannot exceed the amount of interest that the taxpayer would have paid by borrowing an amount equal to the proceeds from the assignment of the claim. These percentages should be calculated according to the rules of Article 269 of the Tax Code for the period from the date of assignment of the right to the date of payment established by the main agreement.

The new version of paragraph 1 of Article 279 of the Tax Code, which comes into force on January 1, 2015, offers the taxpayer two options for calculating the loss from assignment taken into account for tax purposes:

- based on the maximum interest rate established for the corresponding type of currency by paragraph 1.2 of Article 269 of the Tax Code for a debt obligation equal to income from the assignment of the right of claim, for the period from the date of assignment to the date of payment under the sales agreement;

- based on the interest rate confirmed in accordance with the methods established by Section V.1 of the Tax Code for such debt obligation. Specific methods are enshrined in Article 105.7 of the Tax Code.

Your choice must be documented in your accounting policies.

Read about the rules for accounting for interest on debt obligations in the BErator PRIMERAO “Aktiv” shipped Vympel LLC on April 10 goods worth 118,000 rubles, including VAT 18,000 rubles. The deadline for payment for goods under the contract is April 30. On April 15, Aktiv JSC assigned the right to claim the debt to Passive LLC for 99,000 rubles. The loss of Aktiv JSC amounted to: RUB 118,000. – 99,000 rub. = 19,000 rubles. Let us assume that the refinancing rate in the period under review was 8%. The period for which the amount of interest that JSC Aktiv would pay if it borrowed 99,000 rubles should be calculated is 16 calendar days (from 15 to 30 April).Until December 31, 2014: The maximum amount of interest on debt obligations in rubles should be calculated based on a rate equal to 14.4% per annum: 8% × 1.8 = 14.4% Calculate the amount of interest: (99,000 rubles × 14.4% / 365 days) × 16 days = 580 rubles. A loss in this amount can be taken into account when taxing profits. A loss that cannot be taken into account will be: 19,000 rubles. – 580 rub. = 18,420 rubles. From January 1, 2015: JSC Aktiv established in its accounting policy that it will determine the loss from the assignment based on the maximum interest rate established for the corresponding type of currency, clause 1.2 of Art. 269 of the Tax Code of the Russian Federation. For 2015, it will be: 8 × 180% = 14.4% Further calculations will be similar to those given for an agreement concluded before December 31, 2014. The procedure for accounting for losses upon assignment after the due date for payment under the main agreement is established by paragraph 2 of Article 279 of the Tax Code. In this case, the loss can be taken into account in non-operating expenses in full. Until December 31, 2015, 50% of the loss amount is taken into account on the date of assignment of the right, and the remaining 50% after 45 calendar days. Starting from January 1, 2015, this loss can be taken into account as a lump sum.

When accounting for income and expenses using the accrual method, the date of assignment of the right of claim is determined as the day the parties sign the act of assignment of the right of claim (clause 5 of Article 271 of the Tax Code of the Russian Federation).

EXAMPLE Let's use the conditions of the previous example. Let’s assume that Vympel LLC did not pay for the goods within the period established by the contract. JSC Aktiv ceded its right of claim on May 15. The loss, which can be taken into account as part of non-operating expenses, will be: 118,000 rubles. – 99,000 rub. = 19,000 rubles. Until December 31, 2014: On May 15, the following will be taken into account as expenses: 19,000 rubles. × 50% = 9,500 rubles. After 45 calendar days - June 29 - the following will be taken into account as expenses: 19,000 rubles. × 50% = 9,500 rubles. From January 1, 2015: On May 15, the entire amount of the loss will be taken into account as expenses - 19,000 rubles.

Taxation of assignment agreement

For example, under the contract, the supplier company shipped agricultural products to the buyer. Having fulfilled its obligations, it has the right to demand payment from the other party. In accordance with civil law, such debt represents a property right owned by the supplier as a creditor, which can be assigned to another person.

The absence of payment received from the buyer for the goods (work, services) sold to him for the simplified means the absence of revenue. As a result of the sale of the buyer's debt, the simplifier-assignor receives income in the amount received from the assignee under the DC, and expenses include the cost of goods (work, services) sold to the buyer.

The transfer of property rights is considered an independent object for the calculation of VAT and is a normal implementation, with the provision of an invoice by the assignor. But the assignor cannot deduct VAT; this is regulated by the procedure for determining the VAT base the next time the assignee exercises the right to property.

Tax accounting upon assignment of the right of claim by a new creditor

The new creditor may make another assignment of the claim. For income tax purposes, such a transaction will be considered as the sale of financial services (clause 3 of Article 279 of the Tax Code of the Russian Federation). This means that when determining the tax base for it, it is necessary to take into account the provisions of Article 268 of the Tax Code.

The tax base for a subsequent assignment will be determined as follows:

| The tax base | = | Value of property due upon subsequent assignment or termination of obligation | – | Expenses for acquiring the right to claim |

If the new creditor takes into account income and expenses on an accrual basis, then the receipt of income should be reflected on the date of the subsequent assignment or on the date of fulfillment of the claim by the debtor (clause 5 of Article 271 of the Tax Code of the Russian Federation).

If the costs of acquiring the right of claim exceeded the income from its sale, such a loss can be taken into account when taxing profits (clause 2 of Article 268 of the Tax Code of the Russian Federation).

Documentary proof of loss

The loss that a taxpayer-creditor received when exercising the right to claim (assign) a debt to a third party must be confirmed by documents certifying the existence of the debt, the right to claim which was exercised. If there are no such documents, the loss is not accepted as an expense when determining the tax base for income tax (letter of the Federal Tax Service of Russia dated December 1, 2015 No. SD-4-3 / [email protected] ).

Paragraph 3 of Article 385 of the Civil Code of the Russian Federation requires a creditor who has assigned a claim to another person to transfer to him documents certifying the right (claim) and provide information relevant for the exercise of this right (claim). The claim passes to the assignee at the moment of concluding an agreement for the assignment of the right of claim, unless otherwise provided by law or agreement (clause 2 of Article 389.1 of the Civil Code of the Russian Federation).

In some cases, the new creditor may insist on the transfer of the originals, for example, in order to transfer it to the new acquirer upon further assignment or to present it to court in the event of a dispute with the debtor.

In addition, if in the assignment agreement in the section on the transfer of documents there is a general wording “supporting documents”, then the originals will have to be given by force of law (clause 2 of Article 385 of the Civil Code of the Russian Federation).

If it does happen that the assignor is forced to give the assignee the originals, he must make sure that he himself has copies of the documents that will not cause criticism from the inspectors.

Keep in mind that the Tax Code does not oblige you to confirm expenses exclusively with original documents. It only requires that supporting documents be drawn up in accordance with Russian legislation (business customs applied in the foreign country where the expenses were incurred) (Clause 1 of Article 252 of the Tax Code of the Russian Federation). Therefore, if instead of the originals you are left with their properly certified copies, then there is nothing to be afraid of. Copies must be certified by the manager’s signature and, if available, a seal.

When transferring documents, a transfer and acceptance certificate must be drawn up. It should indicate, among other things, whether these are copies or originals and the number of pages.

And in order to prevent disagreements with inspectors, it is better to specify in the assignment agreement which documents, within what time frame and in what form (originals or copies) the assignor transfers to the assignee.

Let us recall that the parties to the transaction on the assignment of the right to claim a debt, which is called an assignment, are the assignor (the first creditor) and the assignee (the new creditor).

The receivables, which are sold under the assignment agreement, are repaid from the assignor. As a result of the transaction, he incurs income and expenses, and may also incur losses.

The cost of assignment of the claim is recognized as part of other income on the date of transfer of the right of claim to the new creditor (clause 7 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of the Russian Federation dated 05/06/1999 No. 32n). At the same time, the amounts of written off receivables are recognized as other expenses (clause 11, 14.1 of PBU 10/99 “Organization’s expenses”, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n).

If the difference between the income from the sale of the right to claim a debt and the cost of goods (work, services) sold is negative, then a loss occurs.

The order in which this loss is taken into account when calculating income tax is established in Article 279 of the Tax Code of the Russian Federation. At the same time, their own rules have been established for two situations in which losses may arise from the assignment of rights: before the payment deadline (clause 1 of Article 279 of the Tax Code of the Russian Federation) and after the maturity of payment (clause 2 of Article 279 of the Tax Code of the Russian Federation).

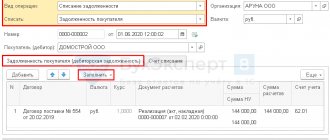

Postings for writing off debt with VAT

Since the amount that is payable to a person is reflected in the credit of the current account, it must contain an analysis of who the obligations are paid to. If the creditor changes, the debtor must reflect the corresponding changes.

For example, if organization 1 purchased products subject to value added tax from company 2, entry DT41KT60 (organization 2) will be drawn up. Company 2 assigned the debt to company 3 under an assignment agreement.

Based on the notification to person 1 about the assignment of debt, an entry will be created to clarify the data on account 60 - DT60 (company 2) KT60 (company 3). Postings for this action will be reflected in accounting. The organization will need to repay the debt 3.

Before payment is due

The taxpayer has the right to take into account the resulting loss in an amount not exceeding the amount of interest that can be accrued on the amount of the assigned claim for the period from the moment of assignment until the expiration of the payment deadline for the assigned claim:

- based on the maximum interest rates applied when accounting for interest on controlled transactions as expenses (clause 1.2 of Article 269 of the Tax Code of the Russian Federation);

- based on rates, the value of which is confirmed by the taxpayer in accordance with the methods established by section V.1 of the Tax Code of the Russian Federation for the specified debt obligation.

One of these methods should be fixed in the accounting policy.

Clause 1.2 of Article 269 of the Tax Code of the Russian Federation establishes intervals for maximum interest rates on debt obligations depending on the type of currency of the debt.

In particular, for debt obligations issued in rubles, as a result of a transaction recognized as controlled in accordance with clause 2 of Art. 105.14 of the Tax Code of the Russian Federation, the maximum interest rate is set at 125% of the key rate of the Bank of Russia. For 2021, the key rate is set at 11% (Instruction of the Bank of Russia dated December 11, 2015 No. 3894-U).

For a debt obligation issued in euros - in the amount of the EURIBOR rate in euros, increased by 7 percentage points. For a debt issued in Chinese yuan, the Shanghai Interbank RMB SHIBOR rate in Chinese yuan increased by 7 percentage points.

For debt obligations issued in other currencies - in the amount of the LIBOR rate in US dollars, increased by 7 percentage points.

EXAMPLE Under a supply agreement in 2021, the seller shipped goods to the buyer in the amount of 1,180,000 rubles, including VAT of 180,000 rubles. The agreement establishes a deadline for payment of the transaction. 30 days before the payment deadline, the supplier (assignor) assigned the rights to demand fulfillment of the obligation by the buyer (debtor) to a third organization (assignee) for 1,000,000 rubles. The loss from this transaction amounted to 180,000 rubles. (RUB 1,180,000 – RUB 1,000,000). Let's calculate the amount of loss that can be taken into account when calculating income tax. The maximum interest rate on debt obligations in rubles established by clause 1.2 of Art. 269 of the Tax Code of the Russian Federation, is 125% of the key rate of the Bank of Russia, that is, 13.75% (11.00 × 125). Therefore, the amount of loss that an organization can take into account when calculating income tax in 2021 will be 11,302. 37 rub. (RUB 1,000,000 × 13.75%: 365 days × 30 days). In accounting, a loss of RUB 180,000. from the assignment of the right of claim is taken into account in other expenses. Due to differences in accounting, a constant difference is formed equal to RUB 168,697.63. (RUB 180,000 – RUB 11,302.37), which entails the formation of a permanent tax liability in the amount of RUB 33,739.53. (RUB 168,697.63 × 20%).

Difficulties of the second method

Using the second method to calculate losses may cause some inconvenience to the company.

In order to find the marginal interest rate, it is necessary to use those established in paragraph 1 of Art. 105.7 of the Tax Code of the Russian Federation methods, namely:

- method of comparable market prices;

- cost method;

- subsequent sale price method;

- comparable profitability method;

- distributed profit method.

It should be noted that the comparable market prices method is the main one in this list. Its use is regulated by Articles 105.5 - 105.7, 105.9 of the Tax Code of the Russian Federation and allows you to use data both for your own transactions and for transactions of third-party companies. Other methods are used if there are no comparable transactions or it is difficult to make a conclusion about the consistency of prices using market methods.

However, the Tax Code of the Russian Federation in section V.1 does not provide clear criteria for how to correctly determine the compliance of marginal interest rates with their market values. Usually the rules specified in Articles 105.5, 105.6, 105.9 of the Tax Code of the Russian Federation are applied. For example, in accordance with paragraph 11 of Article 105.5 of the Tax Code of the Russian Federation, to determine the comparability of the terms of a loan agreement, one should focus on the currency of the debt, the maturity date of the obligation, as well as other conditions affecting the interest rate.

A lot of difficulties are caused by comparing difficultly comparable factors - the result of the assignment of the right of claim and the price of using money on the market. In such circumstances, market rate debt obligations should be issued in an amount equal to the amount of the loss, in the same currencies as in the assignment agreement, and the period for providing obligations should be equal to the interval from the moment of assignment to the moment of payment under the agreement under which the right of claim is assigned . If there are additional criteria here, they are very difficult to predetermine.

After the company chooses a standardization procedure, its choice must be approved in the accounting policy.

After payment is due

Organizations using the accrual method can take into account the loss from the assignment of the right of claim, which was made to a third party after the payment deadline stipulated in the contract for the sale of goods (works, services), at a time on the date of this assignment (clause 2 of Article 279 of the Tax Code of the Russian Federation) .

The best solution for an accountant

Berator "Practical Encyclopedia of an Accountant" is an electronic publication that will find the best solution for any accounting problem. For each specific topic there is everything you need: a detailed algorithm of actions and postings, examples from the practice of real companies and samples of filling out documents e.berator.ru