What is account 70 used for in accounting?

Account 70 “settlements with personnel for wages” is used according to the Chart of Accounts to reflect on it all wage settlements for both employees carrying out activities under employment contracts, and under contracts for the provision of services with individuals.

This account accumulates information on salary calculation in all its components:

- salary payment;

- bonuses;

- additional payments;

- vacations;

- compensation;

- payment of benefits and financial assistance, etc.

With the help of this information, the administration can make the necessary decisions on labor costs. This account summarizes the salaries of employees in all departments of the company. On the other hand, depending on the corresponding account, it is possible to establish labor costs for each structural unit.

This reflects information about the existence of existing debts, both of the employee for overpaid wages, and of the enterprise itself for wages that were not paid on time.

Attention! Account 70 also reflects settlements with the founders, who are also employees of the company, for dividends accrued to them.

Account characteristics

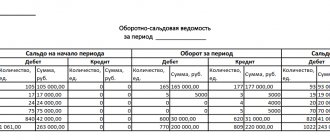

To record payroll calculations, account 70 is used. When asked which account 70 is active or passive, you can clearly answer that it is an active-passive account.

Depending on the situation, it can have two balances at once. The debit balance reflects the debt of persons working at the enterprise for the wages paid to them by the enterprise. The loan balance, on the contrary, reflects the employer’s debt to the employees working in the company.

When determining the final account balance, it matters which side the balance is on. If by debit, then the debit turnover reflects the increase in debt, and the credit turnover reflects its repayment.

The opening balance is added to the debit turnover, after which the resulting result must be compared with the credit balance. If the final value of the difference with the loan turnover turns out to be positive, then the final balance is a debit.

When the initial balance of account 70 is on credit, then the increase in debt is reflected on the credit side, and its repayment on the debit side. If the difference between the amount of the opening balance and the turnover on the credit account with the debit turnover is positive, then the ending balance is in credit. Otherwise, at the end of the period, a debit balance of account 70 is obtained.

Attention! The turnover sheet for account 70 can reflect two balances at once. This is due to the fact that subaccounts within it can be either debit or credit, and the synthetic account has a folded double balance.

In the balance sheet, account 70 balances are reflected as follows:

- In the asset as part of current assets on line 1230 as accounts receivable.

- In liabilities as part of short-term liabilities on line 1520 as accounts payable.

You might be interested in:

Chart of accounts for 2021 with explanations and entries

Example of business transactions

To better understand what transactions can be made using account 70, you should familiarize yourself with several examples.

| D70/K50 | Issuance of wages (in cash) to personnel in accordance with relevant documentation |

| D70/K52 | Salaries have been credited to employees' bank accounts (based on statements) |

| D70/K55 | Transferring salaries from special bank accounts |

| D70/K73 | Repayment of the cost of workwear by the employee according to the application |

| D70/K10.9 | Issuance of branded clothing to staff |

| D70/K68 Personal income tax | Operation of income tax withholding from organization personnel |

| D70/K91.1 | Free transfer of workwear to the company’s courier |

| D70/K72.2 | Reflection of deductions from the salaries of guilty citizens |

| D70/K70 | No arrears in wages and account closure |

What subaccounts are used?

Analytical accounting for account 70 is built for each employee separately. As a rule, information on people is combined into higher subaccounts, which are created for each department in the company.

The Chart of Accounts does not establish subaccounts recommended for opening, therefore it is customary to independently create subaccounts of a higher order with the following grouping:

- Settlements with staff members.

- Calculations under contract agreements.

- Settlements with part-time workers.

- Settlements with disabled personnel.

Attention! The enterprise must approve the Working Chart of Accounts when putting the Accounting Policy into effect.

Corresponds with accounts

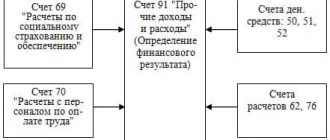

Account 70 can correspond with the following accounts:

From the debit of account 70 to the credit of accounts:

- Account 50 - when paying wages in cash from the cash register;

- Account 51 – when paying wages by transfer from a current account;

- Account 52 – when paying wages by transfer from a foreign currency account;

- Account 55 – when paying wages by transfer from a special account;

- Account 68 - regarding tax withholding from wages;

- Account 69 - when withholding funds not covered by the social insurance fund (for example, when paying for a voucher);

- Account 71 - when withholding unpaid accountable amounts;

- Account 73 - when withholding funds in favor of the company (for example, when covering damage or defects);

- Account 76 - when depositing unpaid wages, or deductions under writs of execution;

- Account 79 - for settlements between the parent company and the branch;

- Account 94 - for a one-time recovery of the deficiency from the guilty person.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - regarding the calculation of wages to employees involved in the creation or preparation for operation of a non-current asset;

- Account 20 - when calculating wages to the main employees of the workshop;

- Account 23 – when calculating wages for employees of the auxiliary workshop;

- Account 25 – when calculating salaries for managerial or technical personnel;

- Account 26 - when calculating salaries for administrative staff;

- Account 28 - when calculating wages for employees who are constantly engaged in correcting defects;

- Account 29 – when calculating wages to employees of service farms;

- Account 44 - when calculating wages for employees engaged in trade;

- Account 69 - when calculating payments made from social funds;

- Account 76 - when calculating payments from third parties in favor of a specific employee;

- Account 79 – for settlements between the parent company and the branch;

- Account 84 - when accruing income based on the results of activities to the founders, members of the company, etc.;

- Account 91 - when calculating wages to employees who are not engaged in their main activities;

- Account 96 - in case of accrual of payments made at the expense of a previously created reserve;

- Account 97 - when calculating payments that will actually be taken into account in the following periods;

- Account 99 - when calculating payment for work to eliminate the consequences of force majeure.

You might be interested in:

An employee took a taxi on a business trip - is it possible to deduct these expenses?

Interaction with other accounts

Based on the extensive classification of payments and wage deductions, a large number of items of settlements with employees are distinguished. That is why account 70 corresponds with the vast majority of other accounts. We list the main ones:

- By loan — 20, 23, 25, 26, 28, 29, 44, 69, 84, 96;

- By debit — 50, 51, 52, 55, 68, 69, 71, 73, 76, 79, 94.

Receipt of wages by employees in kind is documented by posting to accounts 70 and 90. From the debit of account 70 to the credit of account 90 “Sales”, the amount of wages equal to the amount of goods issued is written off. And also from the debit of account 90 to the credit of account 43 “Finished products”, the transfer of goods (materials, products) to employees is registered.

|

|

What is reflected in debit and credit

The debit of account 70 shows:

- Amounts of paid salaries, bonuses, benefits, and other cash payments to the employee;

- Amounts of accrued taxes, fees, deductions under writs of execution, etc.

- Amounts of accrued but not paid wages on time.

The account credit reflects:

- The amount of salary that the employee earned for the specified period;

- Amounts of earnings that were accrued from reserves;

- Amounts of accrued benefits - sick leave, maternity leave, etc., paid from social insurance funds;

- Amounts of income from participation in the capital of the organization.

Examples of accounting entries for an account

All transactions listed below in 1c are generated automatically by completing the necessary documents.

Payroll

| Debit | Credit | Description |

| 08 | 70 | Salaries accrued to employees involved in preparing non-current assets for operation |

| 20 | 70 | Salaries accrued to employees of the main workshop |

| 23 | 70 | Salaries accrued to employees of the auxiliary workshop |

| 25 | 70 | Salaries accrued to general production employees |

| 26 | 70 | Administrative staff salaries accrued |

| 29 | 70 | Salaries accrued to maintenance department employees |

| 44 | 70 | Salaries accrued to employees who sell products |

| 97 | 70 | Vacation accrued for the future period |

Salary payments

| Debit | Credit | Description |

| 70 | 50 | Payment was made in cash from the cash register |

| 70 | 51 | Payment was made by transfer from the current account |

| 70 | 55 | Payment was made by transfer from a special account |

Accounting for payroll in the accounting of the parent company for the branch

| Debit | Credit | Description |

| 20 | 79/2 | The salaries of the employees of the main workshop of the branch were calculated |

| 26 | 79/2 | The salaries of the administrative staff of the branch were calculated |

| 79/2 | 51 | Funds transferred to pay salaries |

Payroll calculation in the branch

| Debit | Credit | Description |

| 20 | 70 | The salaries of the employees of the main workshop were calculated |

| 26 | 70 | Administrative employees were accrued |

| 79/2 | 20 | The calculation of wages for workshop employees is attributed to settlements with the parent company |

| 79/2 | 26 | Payroll for administrative personnel is included in settlements with the parent company |

| 51 | 79/2 | Received funds from the parent company to pay salaries |

| 50 | 51 | Funds received at the cash desk |

| 70 | 50 | Salaries were issued in cash from the cash register |

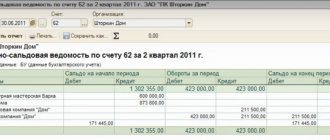

Calculation of salaries for employees of various departments

LLC "Rukodelnitsa" is engaged in the production of equipment for sewing workshops. Workers of Rukodelnitsa LLC are busy constructing a building that is planned to be used as a warehouse. Employees of Rukodelnitsa LLC have the opportunity to visit the swimming pool for free, which is listed on the company’s balance sheet.

In August 2015, a fire occurred in one of the production workshops of Rukodelnitsa LLC.

Based on the results of August 2015, employees of Rukodelnitsa LLC received the following salaries:

- workers of production workshops – 418,500 rubles;

- sales department employees – 212,300 rubles;

- workers involved in the construction of a building for a warehouse - 77,400 rubles;

- employees servicing the pool - 32,000 rubles;

- workers who eliminated the consequences of the fire - 88,200 rubles;

- employees of management departments – 133,800 rubles.

The accountant at Rukodelnitsa LLC reflected the salary calculation transactions with the following entries:

| Dt | CT | Description | Sum | Document |

| 20 | 70 | Reflects the calculation of wages for workers in production workshops | 418,500 rub. | Payroll |

| 44 | 70 | Reflects the calculation of salaries for sales department employees | 212,300 rub. | Payroll |

| 08 | 70 | Reflects the calculation of wages for workers involved in the construction of a building for a warehouse | 77,400 rub. | Payroll |

| 91.2 | 70 | The calculation of wages for workers who eliminated the consequences of the fire, as well as for employees servicing the pool (RUB 32,000 + RUB 88,200) is reflected. | 120,200 rub. | Payroll |

| 26 | 70 | Reflects the calculation of salaries for employees of management departments | RUB 133,800 | Payroll |