Home / News and changes

Back

Published: 07/02/2019

Reading time: 7 min

5

496

An assignment agreement between individuals is an assignment of the right to claim a debt, secured by a written agreement. The assignment is regulated by Art. 382-390 Civil Code of the Russian Federation.

- In what cases is

- Parties to the agreement

- Types of agreements Compensatory agreement

- Free transfer of rights

- Tripartite Agreement

- Assignment by writ of execution

Contracts with a change of persons in the obligation

Type

Name

| Debt transfer agreement |

| Debt transfer agreement with the participation of the creditor |

| Assignment agreement (assignment of claims) |

The Latin word "cession" means assignment or transfer to another person of a right or claim belonging to the creditor. The parties to the assignment agreement are the assignor and the assignee. Another person involved in these legal relations will be the debtor.

An assignment agreement is also called a creditor substitution. The assignor under the agreement is the original creditor, and the assignee is the new creditor. As a result of this transaction, the assignor transfers his right of debt to the assignee, to whom the debtor becomes indebted.

The simplest example of an assignment agreement in real life is the sale by a bank of its client’s debt to a collection agency. The bank receives a certain amount (less than the client owes) for its right to demand repayment of the loan, but the collectors do not give any discount to the debtor. The methods of their work, which are often very cruel and violate not only civil, but even criminal legislation, are well known from sharp media reports. In 2012, the Supreme Court stood up for bank debtors, indicating that the transfer of debt by a bank to organizations that do not have a banking license (in this case, collection agencies) is allowed only with the consent of the debtor.

But let's return to the assignment agreement as such. In fact, this is a convenient tool that allows the creditor to immediately receive the funds he needs in a situation where the debtor is not going to pay him back. Yes, the amount that the creditor will receive from the person to whom he transferred his right of claim is in most cases less than the amount that is credited to the debtor, but this money will be received here and now. The difference in the amount will also be a payment for the risk that the debtor will not pay the bills, but this will already be a problem for the new creditor.

Registration of transactions with non-residents

Some companies working with import or export are faced with the need to enter into an assignment agreement with non-residents. A transaction by a legal entity with the status of a resident and a non-resident assignee, just like other foreign exchange transactions, must be accompanied by a transaction passport. If the foreign creditor changes to another non-resident, a new passport is opened.

The main thing is that all actions taken comply with the law “On Currency Regulation and Control”.

What rights can be transferred under an assignment agreement?

First of all, under an assignment agreement it is prohibited to transfer claims that are inextricably linked to the identity of the creditor . These are, for example, obligations such as alimony and claims for compensation for harm caused to life or health (Article 383 of the Civil Code of the Russian Federation). This also includes the right to demand compensation for moral damage, execution of a testamentary refusal, and the requirement of lifelong maintenance under an annuity agreement.

Usually, under an assignment agreement, a monetary claim - this can be accounts receivable or debt on a loan. Rights to securities can also be transferred under the assignment option.

An assignment agreement should not be confused with an agreement on the transfer of rights and obligations under an equity participation agreement in construction from one shareholder to another. The difference here is that under the assignment agreement only the rights of the creditor (to receive the debt) are transferred, and under the agreement of shareholders, responsibilities are also transferred, in particular, to continue making payments for housing under construction.

An agreement under which the creditor has a right of claim against the debtor (for example, a loan or supply agreement) may contain a clause prohibiting the replacement of the creditor. If there is no such clause, then the debtor’s consent to the transfer of the right of claim under the assignment agreement is not required (Article 382 of the Civil Code of the Russian Federation). A ban on the transfer of the right of claim in certain situations may be established by law.

Participants' rights

In accordance with Art. 384 of the Civil Code of Russia, the obligations and rights of the parties entering into this agreement remain unchanged. Relations between counterparties are carried out according to the same scheme as between previous parties to the agreement. Moreover, there are no differences between the assignor and the assignee. For example, the borrower also has every right to make claims against the new lender if they had any against the old one.

Upon conclusion of the contract, all obligations with rights are also transferred to the new owner

When comparing the previous and current documents, the differences between them, roughly speaking, should only be in the names of the parties. The purchaser of the debt obligation must inform the debtor about the re-conclusion of a new agreement, as well as tell about other important points regarding this procedure.

According to current legislation, the previous creditor is responsible for actions or violations committed by him earlier. The assignor should not be held liable for failure to fulfill obligations by the debtor.

Thus, no serious differences arise between the treaties and the rights of participants in a comparative comparison. Therefore, the conclusion of an assignment or transfer of debt does not have a special impact on the parties. Only in some cases the impact is radical.

Form of assignment agreement

The replacement of the creditor must be made in the same form as the agreement under which the creditor received the right of claim. If this agreement was concluded in notarial form, then the assignment of the right of claim must be registered by a notary. Failure to comply with the notarial form will result in the assignment agreement being declared invalid (void).

The same applies to the main agreement, which has undergone state registration - in this case, the assignment will also need to be registered. If this norm is violated, the assignment agreement will be considered not concluded.

Important information about taxation

Debt assignment is a paid procedure. The transaction value is the amount of debt obligations. In addition to the basic cost of the debt, additional services may be included in the transaction amount. But the parties can also agree on the gratuitous transfer of debt obligations. In this case, tax risks arise for the parties to the transaction. For example, for ordinary citizens this is a material benefit subject to personal income tax. And for entrepreneurs and organizations there are risks associated with the calculation of income tax and VAT.

For example, a transaction is subject to VAT upon assignment of the right to claim a debt (clause 1, clause 1, article 149 of the Tax Code of the Russian Federation). The taxation procedure depends on the following factors (clause 2 of article 153, clauses 1, 2, 4 of article 155 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated March 24, 2017 No. 03-07-11/17212, dated July 27, 2016 No. 03- 07-11/43845):

- the identity of the assignor;

- the difference between the amount of debt and the transaction amount;

- type of rights acquired.

But the transfer of rights under a credit agreement or loan agreement is not subject to VAT. Transactions involving the assignment of rights to collect advance payments to the original creditor are also considered non-taxable.

For income tax purposes, the amount of income from the assignment is recognized as sales proceeds. And the costs of the assignment and expenses associated with the sale can be taken into account when calculating corporate income tax.

Terms of the assignment agreement

The subject of the assignment agreement will be the transfer of the right of claim of the assignor to the assignee . It is necessary to describe in detail in the contract not only the content of the right of claim, but also the basis for its occurrence. This may be a court decision, an act of reconciliation of accounts, a writ of execution, or an agreement concluded between the original creditor and the debtor. It is also necessary to indicate the details of these documents. If it is not possible to unambiguously determine from the subject matter of the assignment agreement exactly under which obligation of the debtor the claim is being assigned, then this agreement may be recognized as not concluded.

To be able to transfer a claim under an assignment agreement, the following conditions must be met:

- the creditor's claim against the debtor exists at the time of assignment (here we mean that the debtor has not yet actually settled with the creditor);

- the original creditor has not previously transferred the corresponding right of claim to another person;

- the original creditor did not perform actions due to which the debtor’s obligation is considered fulfilled (for example, offset of claims).

The assignor is liable to the assignee only for the invalidity of the transferred claim. The assignor is not responsible for whether the debtor pays off with the new creditor, unless he has assumed guarantee for the debtor.

It is interesting that under an assignment agreement it is possible to transfer not only the existing claim of the creditor, but also the future, including under an agreement that has not yet been concluded (Article 388.1 of the Civil Code of the Russian Federation). The transfer of a future claim to the assignee is possible from the moment it arises, i.e. after the original creditor and debtor have signed an agreement giving rise to this claim. The parties to the assignment agreement may also agree on a later date for the transfer of the claim.

As for the volume of transferred claims , the assignee receives them in the same volumes and on the same conditions under which the assignor received them. If the subject of the assignment agreement is divisible (monetary obligation), then it can be transferred in whole or in part. In the case where, in addition to the amount of the principal debt, the debtor is obliged to pay a penalty or interest, the parties to the assignment agreement may agree whether these obligations are transferred to the new creditor.

An assignment agreement between commercial organizations must necessarily be for compensation, although the provisions of the Civil Code of the Russian Federation do not directly indicate this. The fact is that if the creditor transfers his right of claim free of charge, this will be qualified as a gift agreement, which is prohibited between such entities (Article 575 of the Civil Code of the Russian Federation). For an assigned claim, the assignee can pay the assignor not only with money, but also with other consideration, for example, the transfer of property or goods.

Another important nuance for the assignor and assignee, who are business entities, is a change in the tax base of the transferred obligation. In most cases, the assignor receives from the assignee less than what the debtor owed. The difference in amounts is classified as a loss for the assignor and is recorded accordingly. But for the new creditor, i.e. the assignee, this difference will be additional taxable income, because he bought the debt for less than he would receive from the debtor.

By the way, the original creditor should not transfer his right of claim significantly cheaper than he could receive from the debtor. Here there is a risk of receiving claims from tax authorities regarding the economic inexpediency of the assignment agreement. To avoid these claims, the assignor must be prepared to prove that the costs of collecting the debt are disproportionately high or that his financial condition requires the immediate receipt of at least some amount of money.

An important condition of the assignment agreement will be the agreement on the moment of transfer of the right of claim from the assignor to the assignee , from whom he already has the right to demand the debt from the debtor. It could be:

- date of conclusion of the contract;

- the date of transfer by the assignor to the assignee of documents confirming the claim;

- the date of full payment by the assignee of the assigned right.

Additionally, the parties can prescribe other usual contractual conditions: liability of the parties, conditions for termination of the contract, dispute resolution.

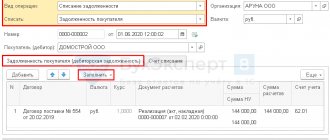

Reflection of the assignment in the company's balance sheet

Like other financial movements, the assignment is part of the assets of the enterprise, so the accounting department makes entries in accordance with all the rules. It is noted on account No. 91, where “Other income and expenses” are shown.

Such agreements must be reflected in accounting

The principal amount is listed on the 91st account, and the profit received from concluding this transaction is recorded on the 76th account. Thus, the following entries are noted in the BB:

- DZ 76 KZ 91.1.

- The right to claim has been fully exercised.

The cost of the assignment is indicated in the receivables on account 91. On the day the contract is concluded, the following entries should be made:

- DZ 91.2 KZ62 or 76, 58.

- Write-off of the price of the right of claim.

If any payments are received from the assignee, they must be entered into the accounting records as follows:

- DZ 51 (50) KZ 76.

- Payment accepted.

If the level of profit from concluding a transaction is higher than the amount that can be claimed, then VAT is charged. The assignor is obliged to pay it. If this is not done, serious problems with the tax authorities may arise.

Filling out reporting on accounting entries should only be done by a professional. Since this is a labor-intensive process that requires extreme care and great effort, errors can easily be made in the documentation if an amateur does the calculations.

Notification of the debtor about the replacement of the creditor

Although the debtor is not actually a party to the assignment agreement, he participates in legal relations during the transfer of the right of claim, and therefore he must be notified of the replacement of the creditor . The main risk for the debtor will be the fulfillment of the obligation by the former creditor, while the latter has already transferred its right of claim to another person.

The Civil Code regulates this issue as follows:

- the debtor must be notified in writing about the transfer of the right of claim against him to another person, and both the original creditor and the new creditor can inform about this;

- if the debtor has not received such notice, then the risk of failure to fulfill the obligation to the proper person is borne by the new creditor;

- the debtor has the right not to fulfill the obligation to the new creditor until he receives from him evidence of the transfer of the claim (in particular, an assignment agreement), however, if the corresponding notice was given by the original creditor, then the debtor does not have the right to demand documents from the assignee.

How to concede a claim

To concede a claim:

1) make sure that you can give it up . In particular, that the claim was not previously assigned to another person (clause 2 of Article 390 of the Civil Code of the Russian Federation). If necessary, obtain the debtor's consent to the assignment. We do not recommend violating the agreement between the debtor and the creditor to limit or prohibit the assignment. This may entail negative consequences for the assignor and (or) assignee (clauses 3, 4, Article 388 of the Civil Code of the Russian Federation);

2) enter into an assignment agreement in the same form as the agreement with the debtor (clause 1 of Article 389 of the Civil Code of the Russian Federation). Be sure to describe in it the claim being assigned and indicate other essential conditions (clause 1 of Article 432 of the Civil Code of the Russian Federation). Otherwise, the contract may be considered unconcluded. Register the assignment agreement if the agreement with the debtor has passed state registration and is not otherwise provided by law (clause 2 of Article 389 of the Civil Code of the Russian Federation);

Is it possible to conclude a preliminary agreement for the assignment of claims?

It’s possible, the law doesn’t prohibit it.

In such an agreement, describe the assigned claim in as much detail as possible and include in it the conditions that you or your counterparty must agree upon when concluding a preliminary agreement (clause 3 of Article 429 of the Civil Code of the Russian Federation). Otherwise, this agreement will not be considered concluded and you will not be able to require the counterparty to conclude the main agreement.

It is important to know! Agreement on the assignment of a future claim - sample

The remaining terms can be agreed upon later, when concluding the main assignment agreement.

Is it possible to conclude an assignment agreement under the condition that the debtor pays the debt to the assignee?

If we are talking about the possibility of the assignee paying the cost of the assignment after the debtor pays him the debt, then you can agree on a condition for this in the contract.

If you want the debtor to first pay the debt to the assignee and only after that the assignment agreement begins to be considered concluded, then this cannot be done for the following reasons. In this case, we are talking about an assignment agreement with a suspensive condition - payment of the debt by the debtor. But when a transaction is concluded under a suspensive condition, rights and obligations under it arise from the moment a certain circumstance occurs (clause 1 of Article 157 of the Civil Code of the Russian Federation). In the case of a cession, after the occurrence of the specified event (conditions), in particular:

- · the need to notify the debtor;

- · the right to demand performance from the notified debtor to the new creditor.

Accordingly, the debtor fulfills the obligation to the new creditor after the occurrence of the suspensive condition.

Thus, the fulfillment of an obligation by the debtor (payment of funds) cannot be a condition precedent for concluding an assignment agreement, since it cannot precede the moment when the assignee has the right to demand performance from the debtor.

3) provide the assignee with the necessary documents;

4) notify the debtor of the assignment . It is better for the assignor to do this. Otherwise, the debtor may not fulfill the obligation to the assignee until he receives evidence that the right has transferred to him (clause 1 of Article 385 of the Civil Code of the Russian Federation).

Please note: if the debtor has objections to the claim, he must inform the new creditor of them within a reasonable time after receiving the notice. Then he will be able to raise them against the new creditor, but provided that the grounds for objections arose before the debtor received notice of the transfer. For example, he must inform the assignee that he does not agree with the amount of the debt, since he has offset claims with the original creditor. The debtor is also obliged to give the new creditor the opportunity to become familiar with the grounds for objections. If he does not do this, then in the future he will not be able to refer to them (Article 386 of the Civil Code of the Russian Federation).

Replacement of debtor or transfer of debt

Sometimes another change of persons in an obligation is confused with an assignment agreement - the replacement of the debtor. Such a transaction is also called debt transfer (Article 391 of the Civil Code of the Russian Federation). When transferring a debt, you can transfer not only a monetary, but also another obligation. This may be the obligation to provide services, supply goods, or perform work.

The transfer of debt is formalized by another agreement, which is called a debt transfer agreement, and its subjects are the original debtor, the new debtor and the creditor. Transfer of debt from the original debtor to another person is possible only with the consent of the creditor, except in situations provided for by law. In particular, such consent is not required when reorganizing the debtor.

If obligations during the transfer of debt arose in business relations, then such an agreement can be concluded directly between the new debtor and the creditor. In this case, both debtors – the original and the new – bear liability to the creditor (joint and several or subsidiary).

The contract may provide that the original debtor is released from fulfilling the obligation. Before agreeing to such a condition, the creditor is recommended to verify the solvency of the new debtor, for which you can request documents from him about his financial condition and conduct a standard check of the future counterparty.

Since 2014, the Civil Code has provided another possibility for changing persons in obligations - the transfer of a contract (Article 392.3 of the Civil Code of the Russian Federation). In this case, one of the parties to the transaction transfers to the other person all its rights and obligations under this transaction. In this case, the provisions of the assignment agreement and the debt transfer agreement in the relevant part are applied simultaneously.

Features and conditions of debt transfer

Most often, such relationships arise in business between two counterparties; individuals are rarely parties to such agreements. For example, such a situation may arise when repaying a debt that arises in the balance sheet of a company that is a creditor of a third company.

Example. has a contractual contract in relation to enterprise “2” and a contractual contract in relation to organization “3”. Thus, the first of them can transfer its debt obligations to the third. If the amounts are equivalent to each other, then this assignment can be complete; in the case where the amounts of the creditor and debtor do not match, it can be partial.

The type of debt is not at all important when concluding such agreements. It is worth considering a number of conditions prescribed in the Civil Code of the Russian Federation:

- Permission to carry out the transfer of debt rights must be given by the creditor in writing.

- The essence and size of the monetary debt remains unchanged.

- If the old version of the contract had a notary seal, then it must be done for the new document.

- The new owner of the debt obligation has every right to demand or operate in court with evidence that was obtained by the previous creditor. For example, correspondence, audio recordings of telephone conversations, etc. can be used.

If at least one of the listed conditions is not met, the contract may be called into question and its replacement or refusal will be required.